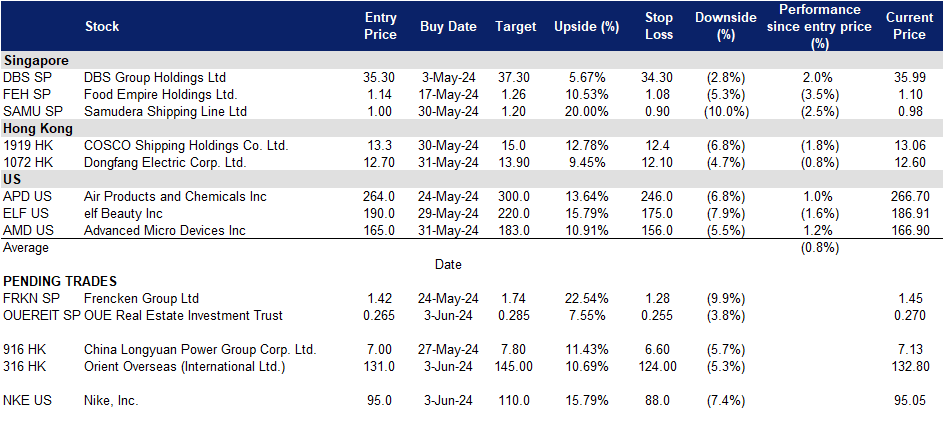

3 June 2024: OUE Real Estate Investment Trust (OUEREIT SP), Orient Overseas (International) Ltd. (316 HK), Advanced Micro Devices Inc (AMD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

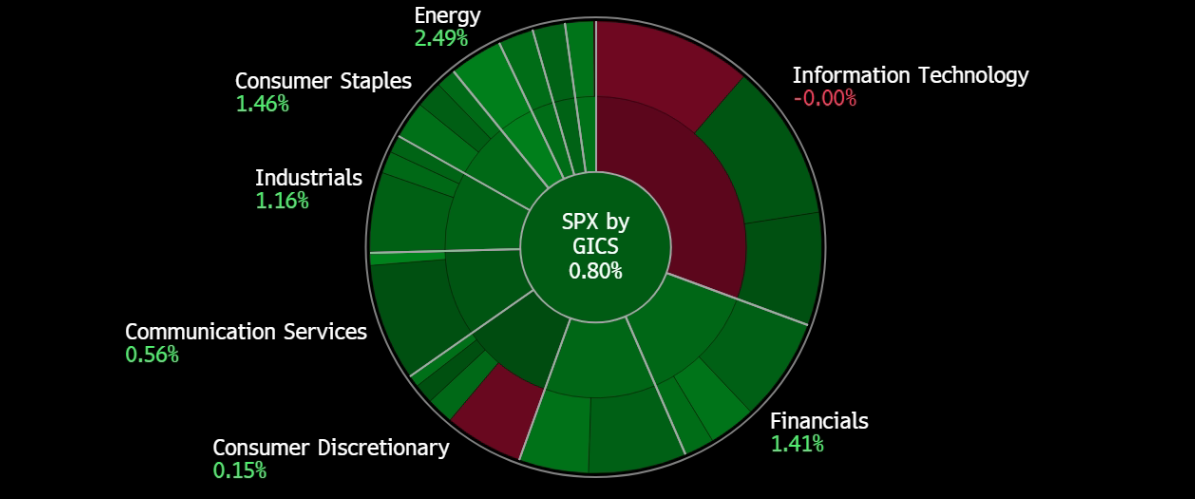

United States

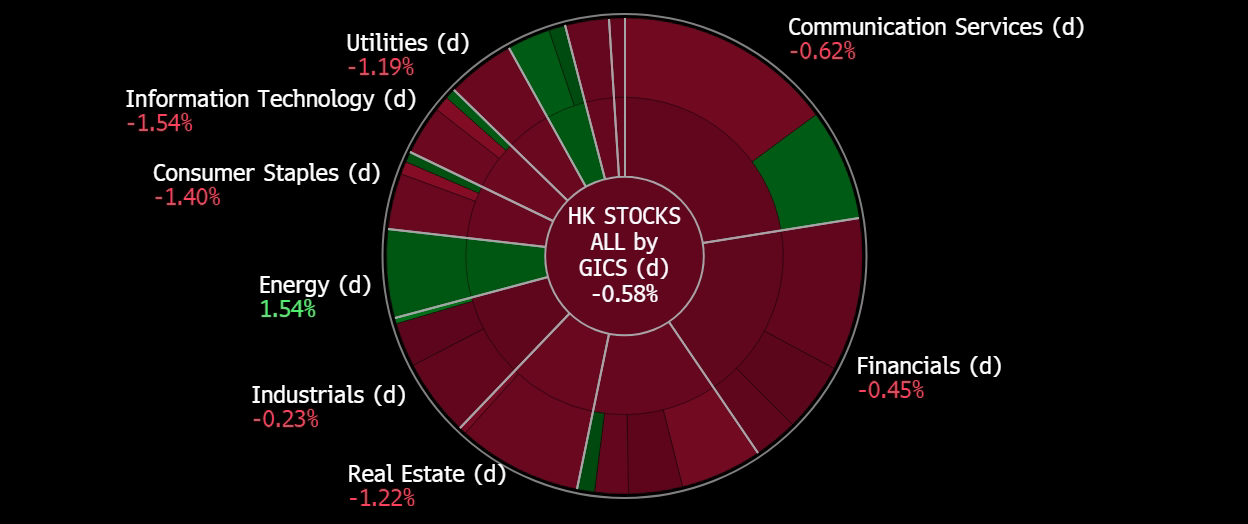

Hong Kong

OUE Real Estate Investment Trust (OUEREIT SP): Resilience amidst challenging market conditions

- BUY Entry – 0.265 Target– 0.285 Stop Loss – 0.255

- OUE Real Estate Investment Trust (OUE REIT) provides real estate investment services. The Company invests in income-producing real estate used primarily for retail, hospitality, and office purposes in financial and business hubs, as well as real estate-related assets. OUE REIT serves customers in Singapore and China.

- Increased topline growth and stable occupancy surpassing pre-pandemic levels. For 1Q24, OUE REIT reported revenue of S$74.9mn, a 9.5% YoY growth. It delivered net property income of S$60.5mn, a 6.9% YoY growth. It also secured positive rental reversion of 12.6% in its Singapore offices and achieved high committed occupancy of 97.6% in Mandarin Gallery, showcasing its stability and competitiveness in the market.

- Positioned for a tourism boom. Singapore’s thriving tourism industry presents a significant opportunity for OUE REIT’s hospitality segment. Anticipating a surge in tourist arrivals driven by a lineup of exciting events and attractions, including concerts and meetings, incentives, conferences and exhibitions (MICE) events, the REIT has strategically completed asset enhancement initiatives (AEIs) for its hotels. This proactive approach has already yielded promising results, with a remarkable 22.7% YoY revenue growth to S$26.9 million in the hospitality segment. Notably, the surge in revenue per available room (RevPAR) by 23.3% YoY to S$280 reflects the REIT’s ability to capitalize on higher room rates amid strong demand from event attendees and tourists.

- Beneficiary of Rate Cuts. Market expectations for a rate cut by the Federal Reserve present a favourable outlook for OUE REIT. With the anticipated rate reduction of 25 basis points in 2024 and the ensuing rate cuts, the REIT stands to benefit from lower borrowing costs, enhancing its financial flexibility and potentially driving higher investor interest. This favourable interest rate path aligns with the REIT’s growth strategy, positioning it for enhanced profitability and value creation in the coming quarters. (Assuming a 25 basis points decrease in interest rates, DPU would increase 0.04 Scents per unit).

- 1Q24 results review. 1Q24 revenue rose by 9.5% to S$74.9mn and net property income grew 6.9% YoY to S$60.5mn, attributed to higher contributions from Hilton Singapore Orchard and the resilient performance of commercial properties in Singapore.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.309. Please read the full report here.

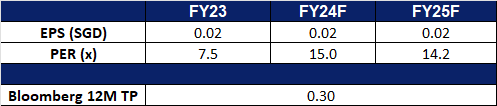

- Market Consensus

(Source: Bloomberg)

Samudera Shipping Line Ltd (SAMU SP): Freight rates going back upwards

- RE-ITERATE BUY Entry – 1.00 Target– 1.20 Stop Loss – 0.90

- Samudera Shipping Line Limited owns and operates ocean-going ships and provides containerized feeder shipping services. Through its subsidiaries, the Company also owns and charters vessels, provides sea and air freight forwarding, and operates shipping agency and container freight station services.

- Intra-Asia freight rates at 30-month high. Port congestion in Asia, diversions in the Red Sea, and increasing exports from Southeast Asia are driving intra-Asia freight rates to 30-month highs on some routes from China. Carriers and forwarders report rising intra-Asia volumes as long-haul ocean carriers redeploy vessels and skip regional trades to support mainline east-west services. High charter rates and a shortage of feeder vessels are preventing carriers from leasing additional ships to address the capacity shortfall.

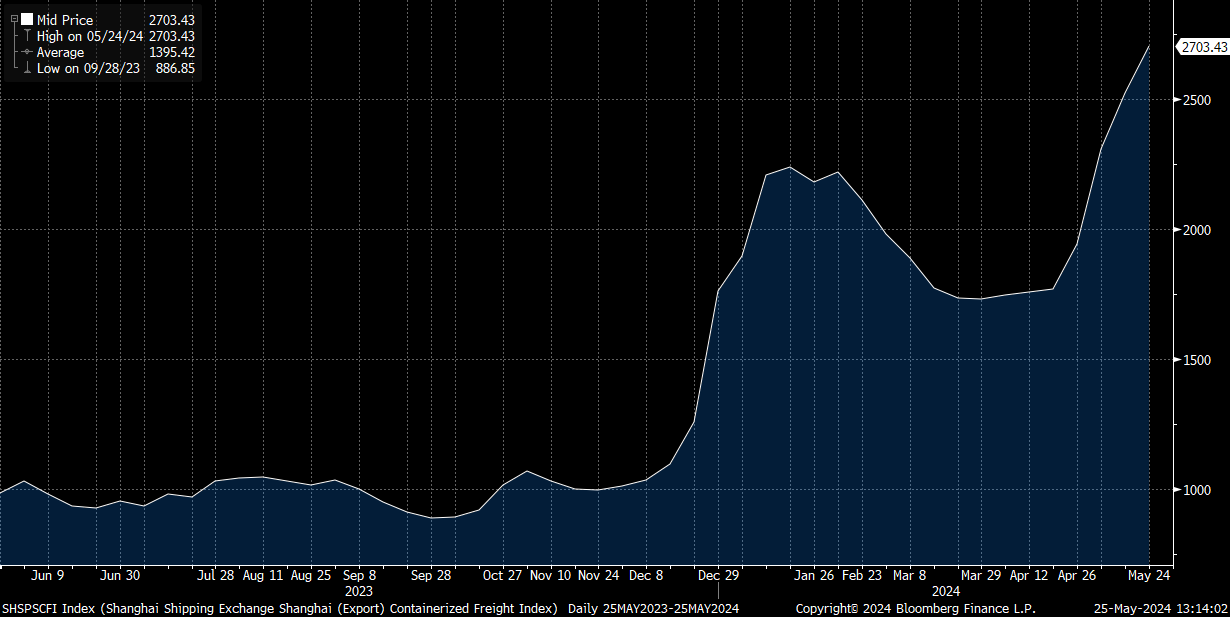

Shanghai Shipping Exchange (Export) Containerized Freight Index

(Source: Bloomberg)

- Global shipping rates surge. A sudden container capacity crunch is causing global ocean freight rates to soar, with rates increasing by about 30% recently and expected to rise further, impacting consumer prices. This surge is driven by the peak shipping season, longer transit routes to avoid the Red Sea, and bad weather in Asia, leading carriers to skip ports and reduce time at ports, exacerbating supply chain issues. Spot rates have spiked by as much as US$1,500 on US routes, with container shortages severe due to high demand and delayed returns of empty containers. This situation is reminiscent of the Covid-19 pandemic, with logistics experts now facing shortages in trade lanes from Asia to Latin America, Europe, and the US West Coast. The ongoing congestion and higher rates are expected to persist, especially with an early start to the peak shipping season to avoid potential labour disruptions at East Coast and Gulf ports in the fall. Shipping companies are increasing rates and adding surcharges, with MSC announcing rates of US$8,000 to US$10,000 for 40-foot containers to the US West Coast. The higher rates are expected to benefit Samudera, enabling it to boost its revenue in response to the increased demand despite the higher prices.

- Reaping the benefits of its new additions. On 27 December, Samudera Shipping announced that it signed a memorandum of understanding to acquire two ethylene gas vessels for US$12.6mn, to be renamed Sinar Ternate and Sinar Tidore. Built in 2009 and 2010 and flagged in the Bahamas, the acquisition will be funded through bank borrowings and internal resources. This purchase aims to expand Samudera’s fleet and secure more charter contracts, capitalizing on the growing ethylene market in Indonesia, where ethylene is extensively used as a feedstock in petrochemical plants. It announced that the second vessel, Sinar Tidore was delivered on 24 April 2024. This will enable it to take on more charter contracts contributing to an increase in its revenue.

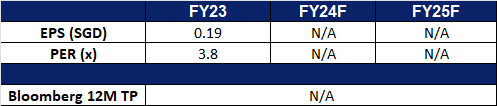

- FY23 results review. FY23 revenue fell by 41.2% to US$582.9mn and net profit decreased 68.6% YoY to USS$101.2mn. The decline was attributed to lower freight rates in the container shipping segment, despite a slight increase in container volume. In 1Q24, its container volume remained relatively stable, whereas freight rates declined to US$244 from US$371 per TEU. Its fleet size increased to 7 vessels. Additionally, both storage capacity and volume handled rose YoY, attributed to securing more management contracts and higher demand for storage capacity.

- Market Consensus

(Source: Bloomberg)

Orient Overseas (International) Ltd. (316 HK): Surging freight rates

- BUY Entry – 131 Target 145 Stop Loss – 124

- Orient Overseas (International) Limited is an investment holding company principally engaged in container transport and logistics businesses. Along with subsidiaries, the Company operates its business through two segments: the Container Transport and Logistics segment, as well as the Others segment. The Container Transport and Logistics segment is engaged in the provision of global containerised shipping services in major trade lanes, covering Trans-Pacific, Trans-Atlantic, Asia/Europe, Asia/Australia and Intra-Asia trades. In addition, it also provides integrated services over the management and control of effective storage and flow of goods. The Others segment is involved in the commercial properties.

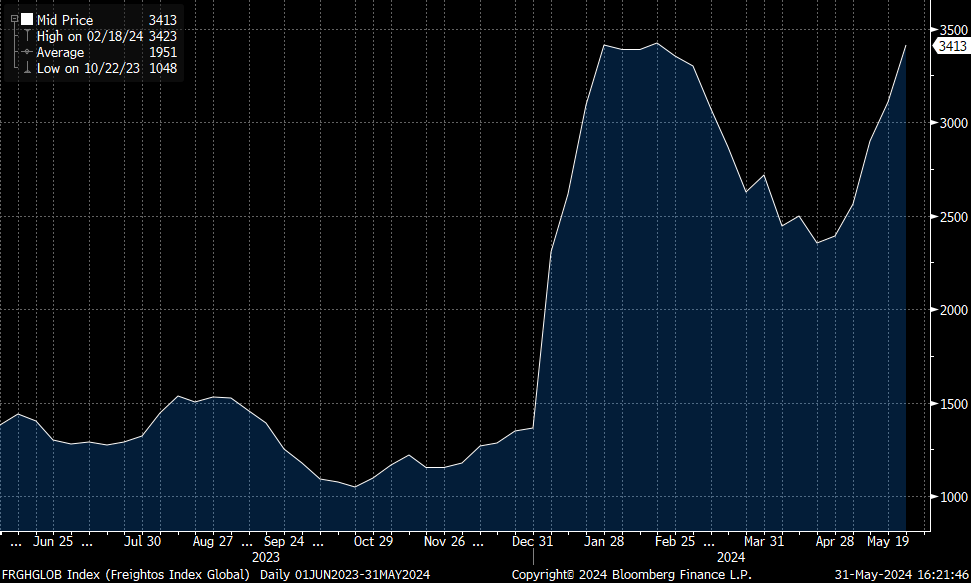

- Surge in ocean container freight rate. Global freight spot rates have surged over 30% in the past month, reaching levels expected to surpass those seen during the Red Sea crisis earlier this year. This increase is driven by peak shipping season, longer transit routes to avoid the Red Sea, and adverse weather in Asia, causing carriers to skip ports and reduce port times, worsening supply chain issues. On US routes, spot rates have spiked by up to $1,500, with severe container shortages due to high demand and delayed returns of empty containers. Orient Overseas International is bound to benefit from the increase in freight rates.

Global Freightos Index

(Source: Bloomberg)

- Continued Supply chain headwinds. Ongoing attacks on ships in the Red Sea are straining shipping routes, forcing vessels to reroute around the Cape of Good Hope and thereby increasing transit times from Asia to the Middle East. Additionally, U.S. tariffs on Chinese goods are prompting Chinese exporters to accelerate shipments, further driving up demand for containers amidst tight supply. The combination of increased global exports and longer sailing periods has led to congestion at several key ports worldwide. This surge in shipping demand at the onset of the peak season is expected to continue driving freight rates higher in the near term.

- Increasing sea routes. Orient Overseas Container Line (OOCL), a subsidiary of Orient Overseas International, has announced the expansion of its Asia-Latin America network with a new service connecting China, Japan, and Korea to Mexican ports. This route will provide direct links between China, South Korea, and Mexico, featuring sailing times of 15 days from Qingdao to Ensenada and 20 days to Manzanillo. The service will employ eight ships with capacities ranging from 4,000 to 6,000 twenty-foot equivalent units. Additionally, OOCL has launched a new maritime service between Saudi Arabia and Jubail Commercial Port, enhancing connectivity between the Kingdom’s ports and those in the UAE, Kuwait, and other Gulf countries. These new shipping routes are expected to boost Orient Overseas International’s revenue.

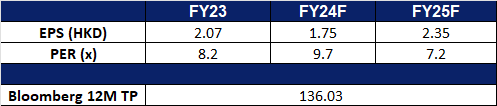

- FY23 earnings. Revenue fell to US$8.34bn in FY23, compared to US$19.8bn in FY22. Net profit fell to US$1.37bn in FY23, compared to US$9.97bn in FY22. Basic EPS fell to US$2.07 in FY23, compared to US$15.09 in FY22.

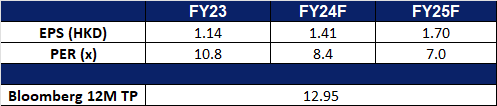

- Market consensus.

(Source: Bloomberg)

Dongfang Electric Corp. Ltd. (1072 HK): Boom in renewable energy

- RE-ITERATE BUY Entry – 12.70 Target 13.90 Stop Loss – 12.10

- Dongfang Electric Corp Ltd is a China-based company mainly engaged in the manufacturing and sales of power generation equipment. The Company operates five major reporting segments: Clean and High-Efficiency Energy Equipment segment, Renewable Energy Equipment segment, Engineering and Trade segment, Modern Manufacturing Service Industry segment, and Emerging Growth Industry segment. The Company’s main products include water turbine generator sets, steam turbine generators, wind turbine generator sets, power station steam turbines and power station boilers as well as gas turbines. The Company distributes its products within the domestic market and to overseas market.

- Expectations of higher electricity demand. China is projected to experience accelerated growth in electricity demand this year, with an anticipated increase of 8.3%, according to the National Energy Administration (NEA). The NEA forecasts power consumption to reach 9.96 trillion kilowatt-hours in 2024, up from a 6.7% growth rate in 2023. In April, China’s electricity consumption saw robust expansion, rising 7% year-over-year to 741.2 billion kilowatt-hours, driven by significant growth in industrial power generation. On the renewables end, solar power output soared by 21.4% year-over-year, while hydropower output increased by 21%. The NEA also expects solar and wind energy to contribute at least 17% of China’s electricity in 2024, up from 12% in 2023, following substantial expansion in renewable capacity over the past year.

- Surge in new-energy power generation. China’s installed capacity for power generation from clean energy sources surged in Q1 2024, driven by growing domestic demand as the country pursues high-quality and green development. According to the National Energy Administration (NEA), solar power installations reached approximately 660 million kilowatts in Q1 2024, a 55% year-over-year increase. Wind power installations grew by 21.5% year-over-year, totaling around 460 million kilowatts. As China’s economy continues to recover, energy demand is expected to rise. The demand for renewable energy and products in China is projected to remain strong as the country aims to expand its renewable capabilities and reduce CO2 emissions in 2024.

- Renewable energy collaboration. The 2024 Hungary Renewable Energy Business Investment Summit, which convened industry leaders from Hungary and China, highlights promising prospects for collaboration in renewable energy initiatives. In 2023, Hungary attracted a record-breaking 13 billion euros (approximately 14.1 billion U.S. dollars) in foreign direct investment, with Chinese investors contributing 7.6 billion euros. Recognizing the significance of strong partnerships with China in advancing their energy and climate objectives, Hungary stands to gain substantial benefits. This alliance is poised to particularly benefit power generation equipment manufacturers like Dongfang Electric.

- 1Q24 earnings. Operating revenue rose by 2.28% YoY to RMB15.1bn in 1Q24, compared to RMB14.7bn in 1Q23. Net profit fell by 11.12% YoY to RMB905.8mn in 1Q24, compared to RMB1.02bn in 1Q23. Basic EPS fell to RMB0.29 in 1Q24, compared to RMB0.33 in 1Q23.

- Market consensus.

(Source: Bloomberg)

Advanced Micro Devices Inc (AMD US): Exciting new products

- RE-ITERATE BUY Entry – 165 Target –183 Stop Loss – 156

- Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

- Unveiling the next generation of high-performance PC. At the upcoming Computex event, taking place from 4 June to 7 June, in Taiwan, AMD is expected to reveal its next-generation Zen 5 Ryzen 9000 series desktop processors. According to online sources, the launch is targeted for July, earlier than anticipated. The Ryzen 9000 series is expected to maintain the same core counts as previous generations, with six, eight, 12, and 16 core parts, and will not adopt a hybrid core architecture like Intel’s recent CPUs. AMD’s new processors will rely on the Zen 5 architecture for performance improvements. Additionally, AMD is rumoured to skip the 700-series naming for its motherboards, opting for the 800-series, aligning with Intel’s expected 800-series chipset release. The Ryzen 9000 CPUs will be compatible with existing AM5 motherboards with a BIOS update, while Intel’s upcoming processors will require a new socket and support only DDR5 memory, making upgrades more expensive for Intel users. This exciting new launch is highly anticipated at the event as it will bring about new developments in the PC world.

- Pending partnership with Samsung. According to the Korea Economic Daily, Samsung and AMD are set to deepen their partnership to produce next-generation chips using 3-nanometer (nm) process technology. While currently limited to Apple’s Mac lineup via Taiwan’s TSMC, Samsung’s 3nm technology features gate all around (GAAFET) transistors, an upgrade over FinFET transistors, allowing for improved electrical flow. GAAFET transistors use either nanowires or nanosheets, each with different trade-offs in efficiency and current flow. AMD CEO has indicated plans to mass-produce AMD’s future products with this technology, highlighting the performance and efficiency benefits of GAAFET. This partnership positions Samsung and AMD against TSMC in the competitive semiconductor fabrication industry. Samsung aims to leverage its early adoption of GAAFET transistors to gain market share, while TSMC plans to transition to nanosheet transistors with its 2nm process.

- Aim to establish new R&D facilities in Taiwan. The Taiwanese government aims to support both AMD and NVIDIA in establishing R&D centres in Taiwan to maintain a balanced relationship. AMD is planning to invest 5bn yuan to set up its facility in Taiwan, and cities like Tainan and Kaohsiung are being considered as potential locations. This decision came after Team Red applied for Taiwan’s subsidy program, and local governments collaborated with the firm to make it happen. AMD’s CEO is scheduled to visit Taiwan next week to confirm the plans for the R&D centre and to be involved in other developments related to the supply chain. The establishment of new R&D facilities in Taiwan aims to further advance the development of next-generation AI and semiconductors.

- 1Q24 earnings review. Revenue rose by 2.2% YoY to US$5.47bn, exceeding estimates by US$20mn. Non-GAAP EPS was US$0.63, beating estimates by US$0.01. 2Q24 sales revenue is expected to be approximately US$5.7bn, plus or minus US$300mn vs. US$5.69bn consensus. Non-GAAP gross margin is expected to be approximately 53%.

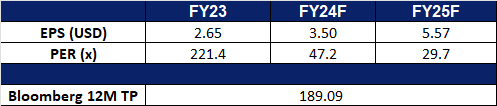

- Market consensus.

(Source: Bloomberg)

NIKE, Inc. (NKE US): To shine in the Olympics

- BUY Entry – 95 Target – 110 Stop Loss – 88

- NIKE, Inc. designs, develops, and markets athletic footwear, apparel, equipment, and accessory products for men, women, and children. The Company sells its products to retail stores, through its own stores, subsidiaries, and distributors. NIKE serves customers worldwide.

- Potential turnaround in the upcoming Olympics. In April, Nike unveiled the Olympic products for athletes in the Paris Olympic kits unveiling event. The market fightback plan is via a reinvention of the Nike Air sneaker. The new design includes an AI-generated interpretation of Air tech which is also co-created with athletes. Amidst rising global geopolitical tensions, the Olympics attracts more than ever spectators as contentions among athletes are considered as a form of competition of national power. Fan support will spur the consumption of related sports kits.

- Cyclical upswing. During the COVID period, working from home stimulated the consumption of sports gear. However, the surge in demand resulted in the ensuing high inventory as sales normalised soon after the reopening. Nike suffered from high inventories over the past two years, and it announced a US$2bn cost optimisation plan last year. Nike’s days in inventory turnover maintain at 105 days currently after 2 years of de-stocking. Recent guidance from the Dicks Sporting Goods showed that the sales of sports gear have bottomed out and are embracing an upswing cyclical growth.

- 3Q24 earnings review. Revenue rose slightly by 0.3% YoY to US$12.43bn, exceeding estimates by US$130mn. Non-GAAP EPS was US$0.98, beating estimates by US$0.23.

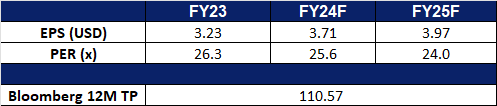

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Dongfang Electric (1072 HK) at HK$12.7 and Advanced Micro Devices (AMD US) at US$165. Cut loss on Yanlord Land (YLLG SP) at S$0.46 and Meta platform (META US) at US$457.