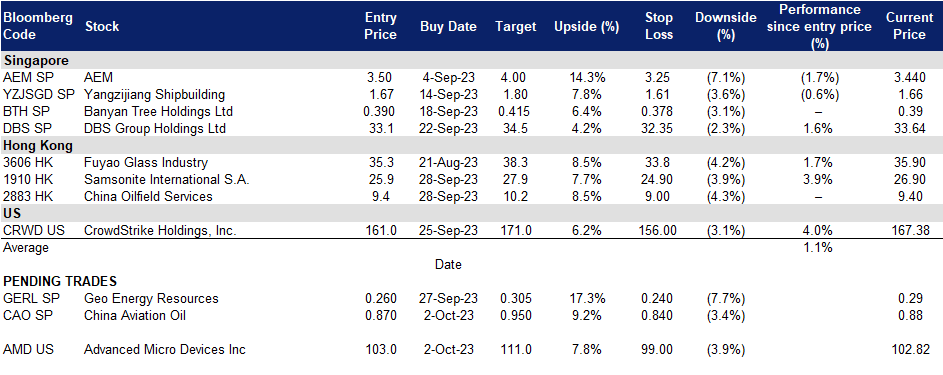

2 October 2023: China Aviation Oil Singapore Corp. Ltd. (CAO SP), China Oilfield Services (2883 HK), Advanced Micro Devices Inc (AMD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

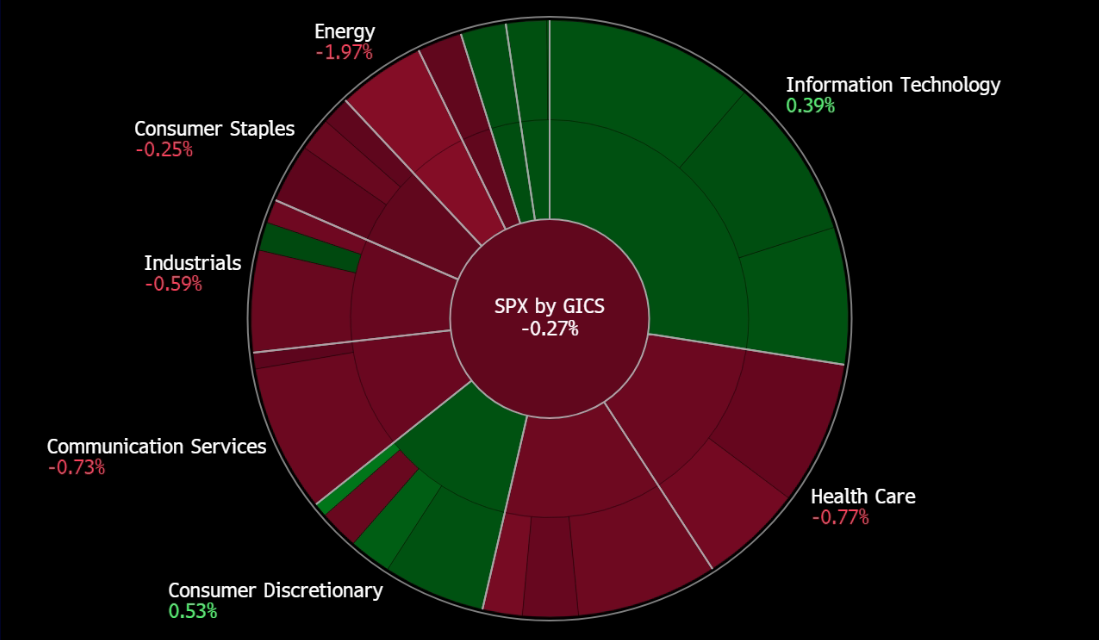

United States

Hong Kong

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Tourism outshines amidst gloomy economic recovery

- BUY Entry 0.87 – Target – 0.95 Stop Loss – 0.84

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, and petrochemical products, including physical and paper swaps, and futures trading.

- Hot tourism during the Golden Week holiday. According to the Ministry of Culture and Tourism, the number of domestic tourism trips during the Mid-Autumn Festival and National Day holiday is expected to reach 896 million, up 86% YoY, and revenue from domestic tourism is expected to be RMB782.5bn, up 138% year-on-year. During the eight-day holiday, the cultural tourism market in the Yangtze River Delta and Pearl River Delta regions such as Shanghai, Suzhou, Chengdu and other popular tourist cities is extremely hot, and the bookings of hotels and air tickets have increased at least 5 times over the same period last year.

- Air traffic to surge in Shanghai airports. Shanghai Pudong Airport and Hongqiao Airport are expected to handle 17,000 flights (including 11,000 flights in Pudong Airport and 6,000 flights in Hongqiao Airport), with an average daily flight takeoff and landing of 2,161 flights, an increase of 71.6% YoY. The passenger traffic is expected to be 2.602 mn (including 1.585 mn in Pudong Airport and 1.017 mn Hongqiao Airport), and the average daily passenger flow was 325,000 people, an increase of 131.7% YoY. Cities such as Guangzhou, Shenzhen, Beijing, Xi ‘an and Chengdu are expected to become popular travel destinations in China. Internationally, Thailand, Japan and South Korea are expected to be popular destinations. Flights from Shanghai to Northeast Asia, Southeast Asia, the Middle East and other regional directions will further increase.

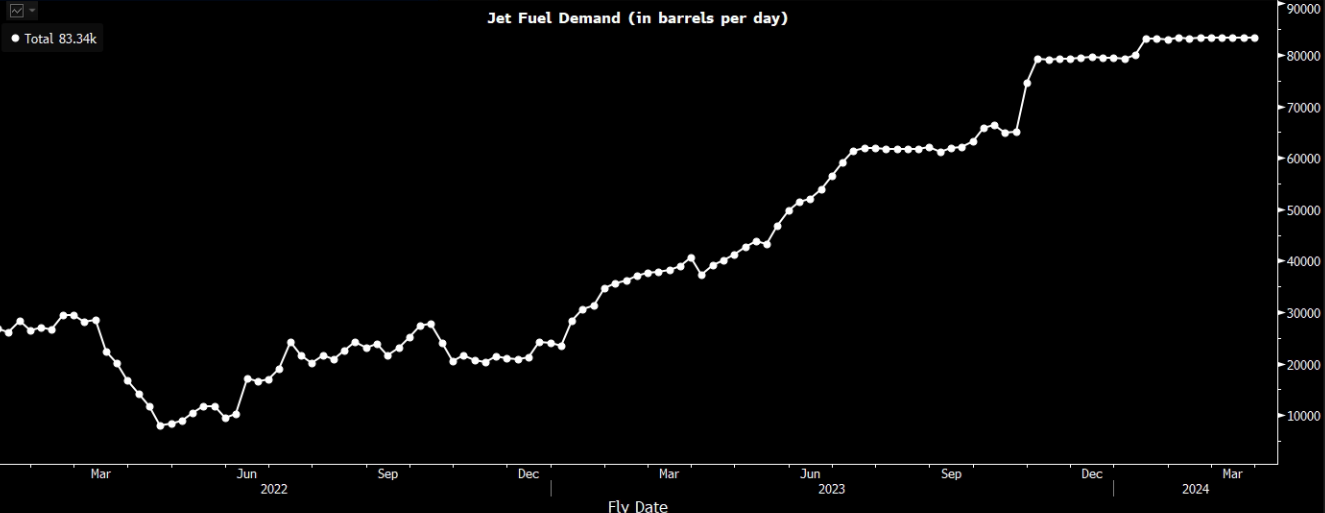

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

- 1H23 results review. 1H23 revenue plunged by 32.4% to US$6.3bn. Gross profit plunged by 50.6% YoY to US$10.6mn. Total supply and trading volume decreased by 16.1% YoY to 9.5mn tonnes. Net profit decreased by 1.07% YoY to US$19.4mn.

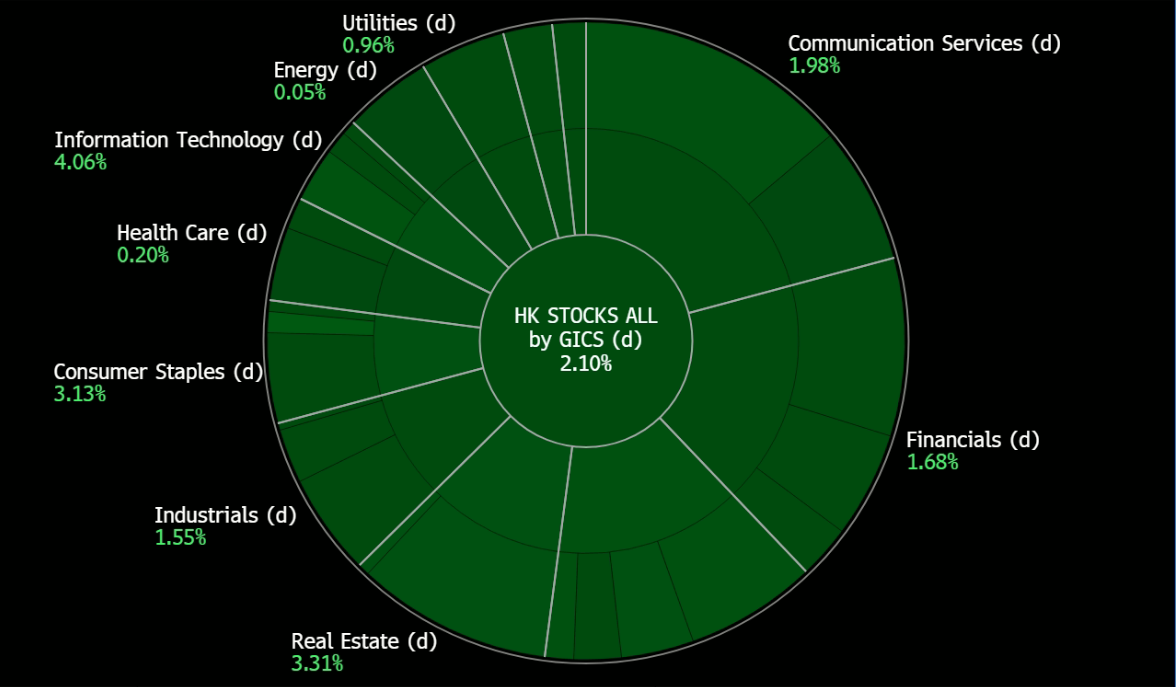

- Market consensus.

(Source: Bloomberg)

Geo Energy Resources Limited (GERL SP): Profit off from seasonality

- RE-ITERATE BUY Entry 0.260 – Target – 0.305 Stop Loss – 0.240

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third-party mine owners, and sells coal to coal traders and export companies.

- War chest secured. The company announced that it has secured US$200mn term loan facilities with an 8.5% p.a. Interest rate and tenor of up to 5 years from Bank Mandiri. The loan is used for potential acquisitions, working capital and other expenditures.

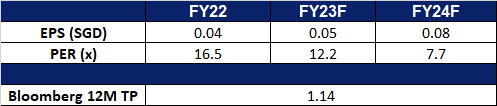

- Re-stocking season coming. China’s economic recovery has been lukewarm since its reopening in 4Q22. However, its coal demand remains resilient as higher electricity consumption is driven by the recovery in the service sectors. Meanwhile, the increasing penetration of electric vehicles also drives power demand higher. Seasonally, 4Q is the peak season of both electricity and coal demand, and hence, power companies start restocking their coal inventories for the coming winter. Accordingly, coal prices are expected to edge up higher.

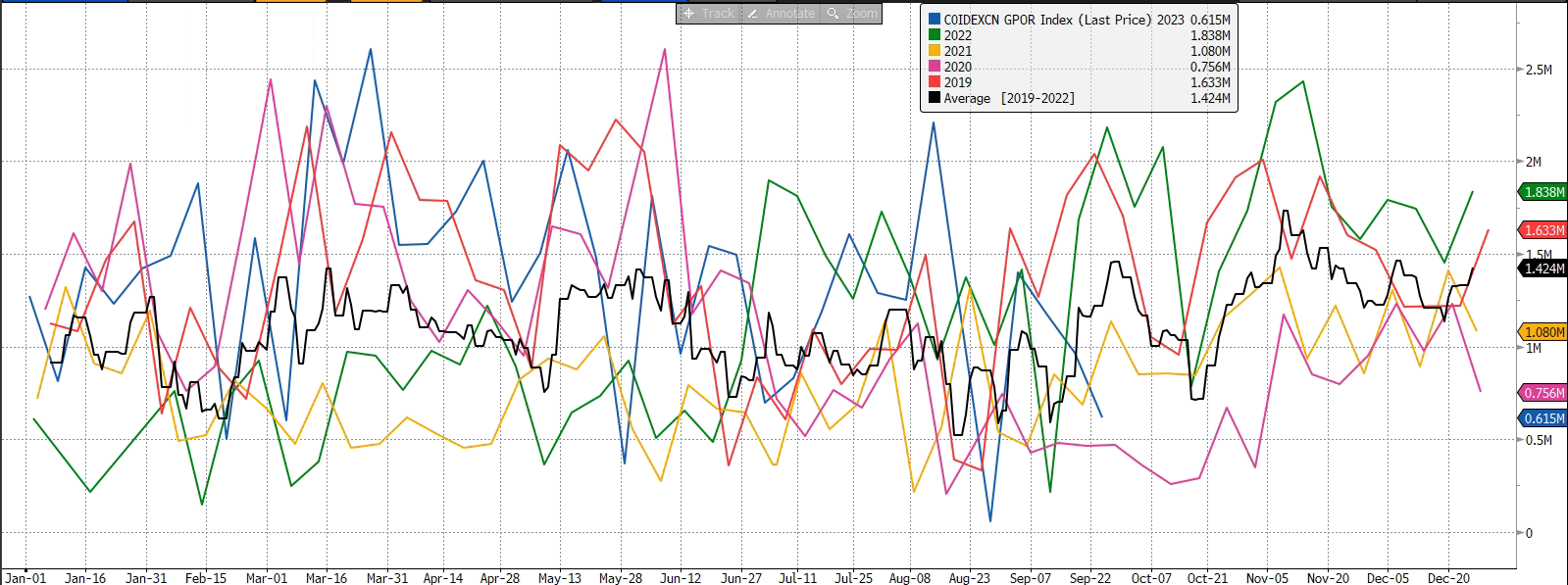

Indonesia’s coal exports to China seasonality

(Source: Bloomberg)

China port coal stocks

(Source: Bloomberg)

Indonesia 4,200 GAR coal futures

(Source: Bloomberg)

- Attractive dividend yield. Geo Energy has been paying consistent quarterly dividends. The current trailing 12M dividend yield is 24%.

China Oilfield Services (2883 HK): Capturing Oil Demand

- RE-ITERATE BUY Entry – 9.40 Target – 10.20 Stop Loss – 9.00

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- New Drilling Rig Service Contracts. China Oilfield Services recently announced that its wholly owned subsidiary, COSL Drilling Europe, has entered into multiple drilling rig service agreements with two multinational oil firms in Norway, each with a set term and an option to extend for up to five years. The total value of the contracts with fixed terms is around 4.7 billion RMB.

- Demand for oil to outgrow supply. World oil demand is surging to record levels, with growth being driven by a number of factors, including a rebound in air travel, increased oil use in power generation, and strong demand from China’s petrochemical industry. Demand is expected to rise by 2.2 mb/d in 2023, reaching 102.2 mb/d. China is expected to account for more than 70% of this growth. Additionally, major oil-producing countries, including Saudi Arabia, also recently announced that they would be extending the voluntary oil cuts to year-end, putting more constraints on oil supply, and driving up oil prices in the near term. Saudi Arabia will be extending its voluntary oil cut of 1mn barrels per day to the end of 2023, and Moscos will be extending its voluntary oil cut of 300,000 barrels per day to end of 2023, with both countries to still review the cuts monthly. Consequently, the cost of oil is anticipated to increase within the market.

- 1H23 earnings. Revenue rose by 24.1% YoY to RMB18.9bn, compared to RMB15.2bn in 1H22. Net profit rose 31.0% YoY to RMB1.46bn, compared to RMB1.11bn in 1H22. Basic EPS rose by 21.1% YoY to RMB28.06, compared to RMB23.17 in 1H22.

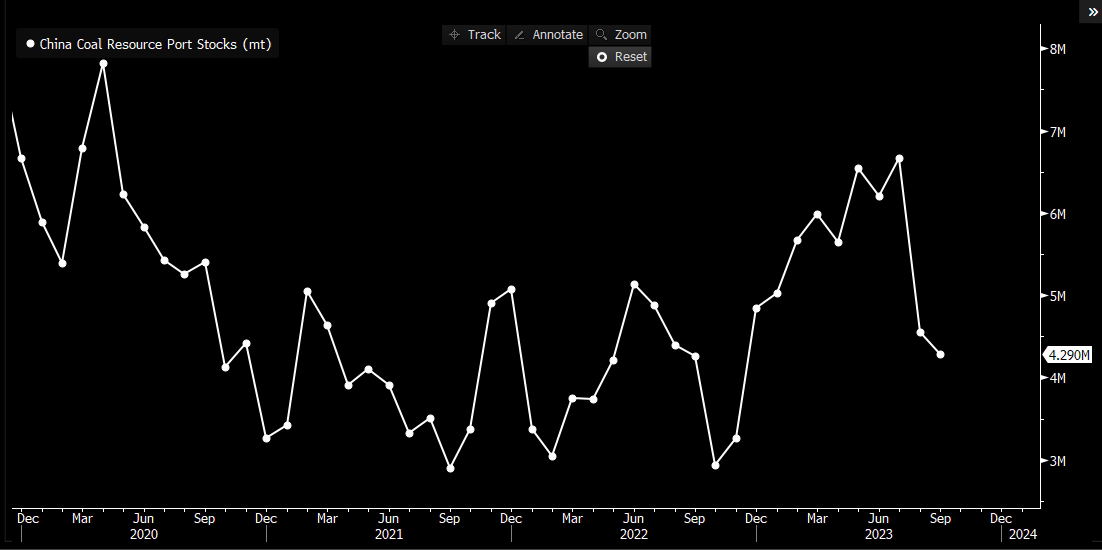

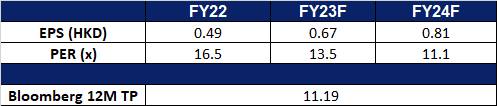

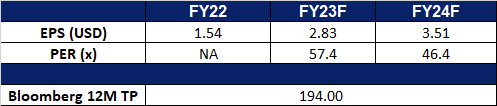

- Market Consensus.

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

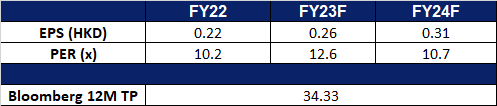

Samsonite International S.A. (1910 HK): Travelling with Style

- RE-ITERATE BUY Entry – 25.90 Target – 27.90 Stop Loss – 24.90

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- New partnership with Hugo Boss. Samsonite recently announced that the company has entered into a collaboration with Hugo Boss on an exclusive aluminium capsule collection, which aims to showcase a shared passion for premium quality, innovation, and timeless design with a distinctive twist. This collection would appeal to those consumers who have a passion for travelling and exploration but refuse to compromise on style. This collection will be a limited edition and will start to be on sales in selected BOSS and Samsonite stores, as well as on the brands’ respective websites from October 2023 onwards. This partnership helps to promote Samsonite’s brand name indirectly, as well as showcasing the premium quality that Samsonite’s luggage is able to provide to its consumers.

- Expected rising air travel demand. The upcoming Golden Week holiday in China is expected to provide a boost to travel demand. The upcoming holiday, which would be from Sept 29 to Oct 6 encompasses both the Mid-Autumn Festival and the National Day break, providing consumers with an 8-day break to travel. It is expected that more than 21mn people in China will be taking flights over the course of this upcoming holiday period. Domestic travel in China would also surge over the holiday, with an expected 14,000 domestic flights per day. The higher demand for travelling leading up to the Golden Week holiday also lifted China’s air passenger traffic to record highs for two consecutive months in July and August.

- Plans for expansion. The brand is extending its sales locations in the country using an innovative format already successful in Asia and Europe. This fresh brand concept arrives in Peru, situated within Mall de Salaverry. This year, the company aims to remodel its flagship store at Jockey Plaza, which houses multiple brands. Plans also include launching new stores in Lima and provinces next year, with a target of achieving 25% growth compared to the prior year and 30% growth relative to pre-pandemic 2019. Furthermore, the company also has a plan to expand its warehouse in an attempt to enhance market reach as well as to ramp up its production capacity.

- 1H23 results. Net sales improved to US$1.78bn, up 39.8% YoY, compared to US$1.27bn in 1H22. Net profit rose to US$170.9mn in 1H23, up 104.9% YoY, compared to US$83.3mn in 1H22. Basic EPS was US$0.106 cents in 1H23, compared to US$0.039 in 1H22.

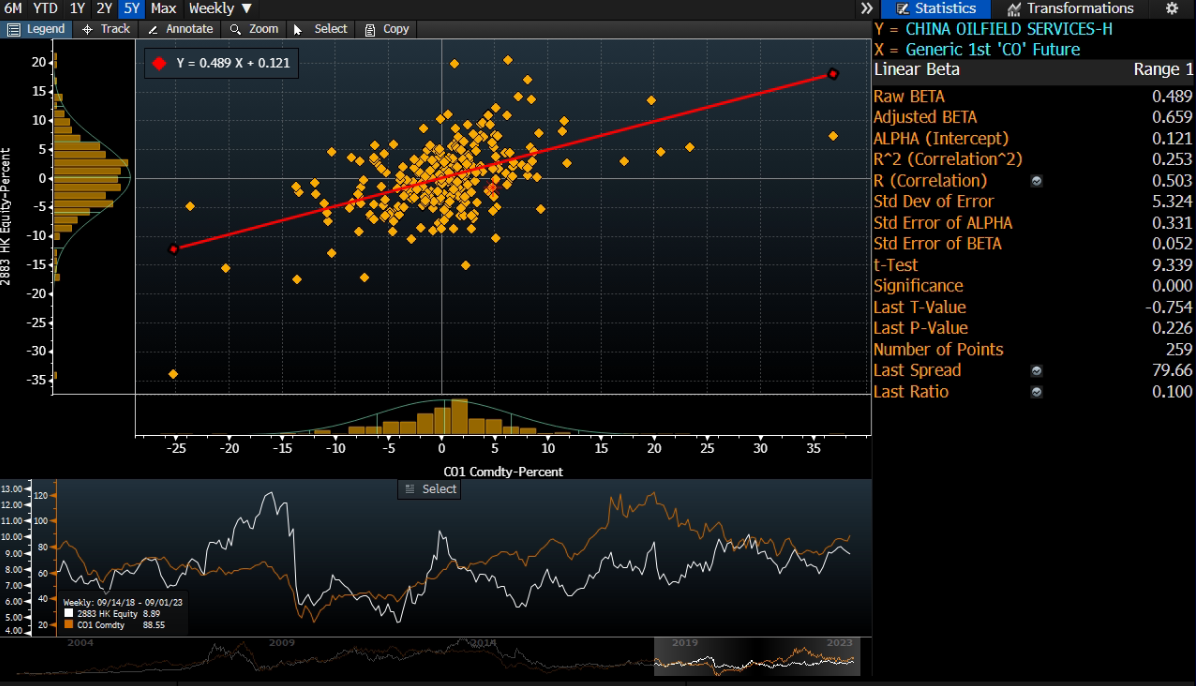

- Market Consensus.

(Source: Bloomberg)

Advanced Micro Devices Inc (AMD US): Darkhorse

- BUY Entry – 103 Target – 111 Stop Loss – 99

- Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

- Microsoft‘s demand for AMD AI chips. Microsoft’s Chief Technology Officer, Kevin Scott’s, stated that AMD is strengthening its position in artificial intelligence (AI), an area currently dominated by Nvidia. There is currently a growing demand for powerful chips to support large language models like OpenAI’s ChatGPT. While Nvidia’s GPUs have been handling much of this workload, AMD announced plans to sample its MI300X chip tailored for AI models. Microsoft, a long-time partner of AMD, has a vested interest in diversifying high-powered chip options. Scott’s comments at the Code Conference also hinted at potential collaboration between Microsoft and AMD on AI-related silicon, which could impact Nvidia’s role in the AI chip market. These had led to an increase in AMD’s share price.

- First to ship AI chips for PC. AMD has been shipping its AI-enabled x86 CPU chip for PCs, the Ryzen 7040 Series, since May, with plans to expand AI technology to more desktop and laptop Ryzen CPUs next year. AMD integrated AI technology from the Xilinx Versal adaptive SoC into the Ryzen 7040, becoming the first company to deliver AI on-PC processing. While AMD has not provided specific AI benchmarks, it highlights the benefits of dedicated performance, improved security, and cost-effectiveness. The Ryzen AI platform includes software tools for running AI models on select laptops, optimising performance at low power. AMD’s quick integration of Xilinx assets demonstrates its commitment to AI.

- 2Q23 results. Revenue rose to US$5.36bn, down 18.2% YoY, beating expectations by US$40mn. Non-GAAP EPS beat estimates by US$0.01 at US$0.58.

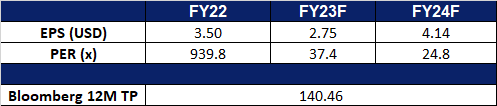

- Market consensus.

(Source: Bloomberg)

CrowdStrike Holdings, Inc. (CRWD US): New products to drive sales

- RE-ITERATE BUY Entry – 161 Target – 171 Stop Loss – 156

- CrowdStrike Holdings, Inc. provides cybersecurity products and services to stop breaches. The Company offers cloud-delivered protection across endpoints, cloud workloads, identity and data, and leading threat intelligence, managed security services, IT operations management, threat hunting, Zero Trust identity protection, and log management. CrowdStrike serves customers worldwide.

- Acquisition of cyber startup Bionic. The company recently announced that it would be acquiring cyber startup Bioni, which is a startup offering technology in the emerging category of application security posture management, for US$350mn. The company aims to incorporate the startup’s capabilities into its fast-growing cloud-native application protection platform (CNAPP).

- New products unveiled. The company recently unveiled several new products at Fal. Con 2023, including CrowdStrike Raptor, Falcon Foundry, Falcon Data Protection, and several more. These products integrate the company’s current product with the addition of generative AI features and also aim to provide the company’s clients with a single agent, single console and single data backend.

- 2Q24 results. Revenue rose to US$731.6mn, up 37% YoY, compared to US$535.2bn in 2Q23. Net profit rose to US$8.5mn, compared to a loss of US$49.3mn in 2Q23. Non-GAAP EPS rose to US$0.74, compared to US$0.36 in 2Q23.

- Market consensus.

Trading Dashboard Update: Add China Aviation Oil (2883 HK) at HK$9.4.

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)