5 June 2025: Investment Product Ideas

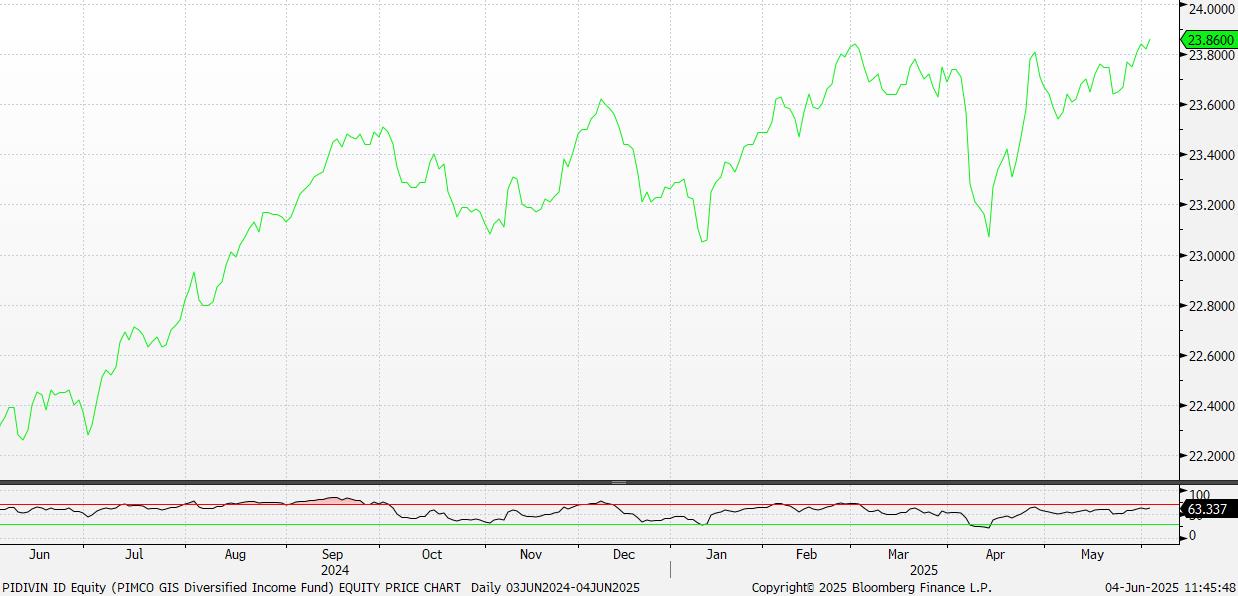

PIMCO GIS Diversified Income Fund

- Global Diversified Allocation. The fund adopts a globally diversified allocation strategy, covering investment-grade bonds, high-yield bonds, emerging market debt, and mortgage-backed securities. This approach helps mitigate risk and capture return opportunities across various markets, providing stable and diversified sources of return.

- Experienced Management Team. Actively managed by a professional team of PIMCO (one of the world’s largest bond asset management companies), the portfolio is flexibly adjusted according to market conditions, demonstrating relatively stable long-term performance.

- Morningstar 4-Star Rating. The fund has a large asset base, an average credit rating of AA and a 4-star rating from Morningstar, earning the trust of investors worldwide.

Fund Name (Ticker) | PIMCO GIS Diversified Income Fund |

Description | PIMCO GIS Diversified Income Fund is an open-end fund incorporated in Ireland. The objective is total return. The Fund invests at least two-thirds of its assets in a diversified portfolio of fixed-income securities of varying maturities. The average portfolio duration of this Fund normally varies within a three-to-eight-year time frame based on the investment. |

Asset Class | Fixed Income |

30-Day Average Volume | N.A. |

Net Assets of Fund (as of 30 April) | US$9.5bn |

Yield-to-maturity (as of 30 April) | 7.35% |

Average Duration (as of 30 April) | 5.29yrs |

Expense Ratio (Annual) | 1.59% |

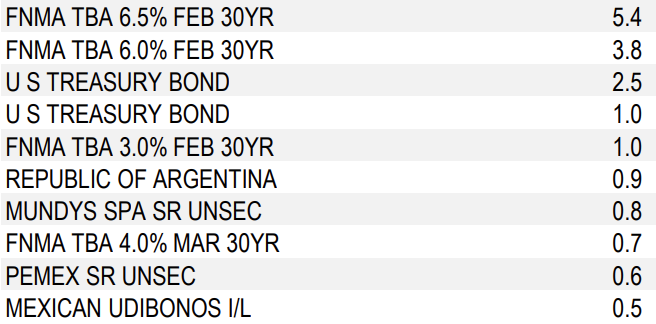

Top Holdings

(as of 31 December 2024)

(Source: Bloomberg)

Fidelity Funds – US Dollar Bond Fund

- Focused on High Quality, Investment Grade Bonds. The fund primarily invests in U S dollar-denominated bonds, with approximately 95% of the portfolio allocated to investment-grade securities. The average credit rating is AA-, offering a relatively stable portfolio for investors amid uncertain market conditions.

- Flexible Active Management. With over 30 years of history, the fund adopts a dynamic allocation strategy, investing in sovereign and corporate bonds across multiple countries. It adjusts bond allocations flexibly based on market conditions, allowing for agile responses to interest rate shifts or credit market volatility. The contrarian investment approach further enhances the fund’s return potential.

- Monthly Distribution Share Class Available. The fund aims to provide stable income and offers a monthly distribution share class, making it suitable for conservative investors seeking consistent income.

Fund Name (Ticker) | Fidelity Funds – US Dollar Bond Fund |

Description | Fidelity Funds – US Dollar Bond Fund is an open-end Fund incorporated in Luxembourg. The Fund aims to provide investors with relatively high income with the possibility of capital gains. The Fund primarily invests in American dollar-denominated bonds. At least 50% of the Fund’s net assets will be invested with ESG criteria. |

Asset Class | Fixed Income |

30-Day Average Volume | N.A. |

Net Assets of Fund (as of 30 April) | US$5.281bn |

Yield-to-maturity (as of 30 April) | 4.42% |

Average Duration (as of 30 April) | 6.4yrs |

Expense Ratio (Annual) | 0.75% |

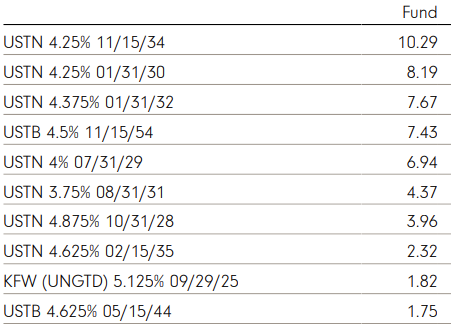

Top Holdings

(as of 30 April 2025)

(Source: Bloomberg)