8 May 2025: Investment Product Ideas

Vanguard FTSE Developed Markets ETF (VEA US)

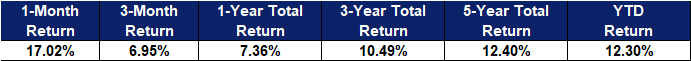

- Focused Exposure to Developed Markets Outside the U.S. The tracked index includes large-, mid- and small-cap stocks across developed markets, ex. the U.S. This ETF is well suited for investors seeking to broaden their regional exposure beyond the U S and into other developed economies.

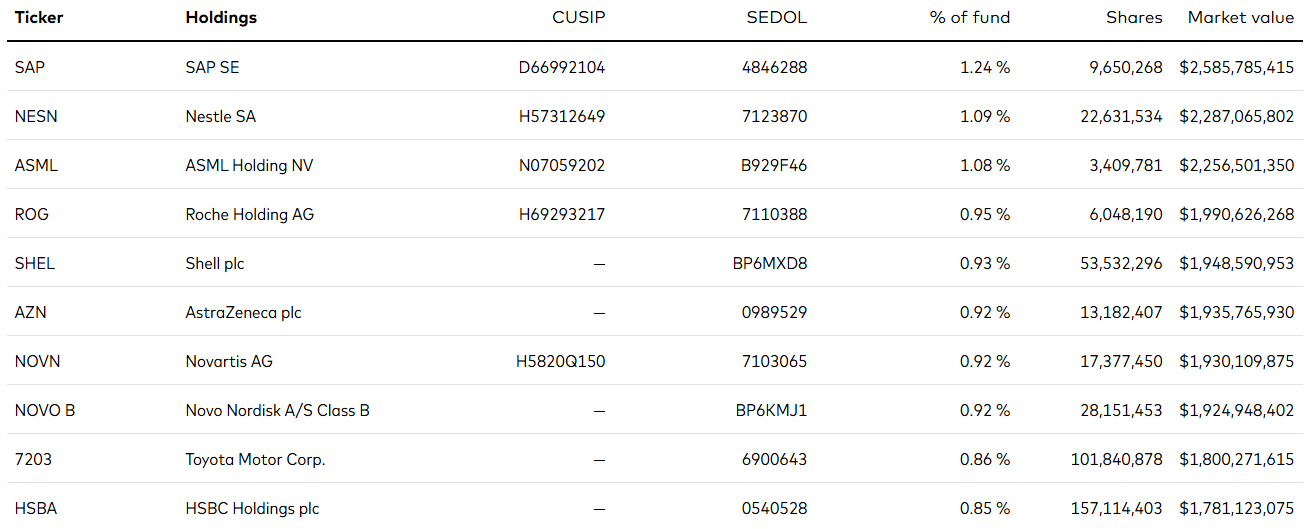

- Diversified Holdings. This ETF holds nearly 3,900 stocks, with its largest position, SAP, accounting for approximately 1.25% of the portfolio. The top 10 holdings collectively make up less than 10% of total assets, offering broad diversification and reducing single stock concentration risk, which helps lower overall portfolio volatility.

- Low Expense Ratio. The ETF carries an expense ratio of 0.03% placing it among the most cost effective options in its category This low fee structure helps investors reduce overall investment costs and improve long term net returns.

Fund Name (Ticker) | Vanguard FTSE Developed Markets ETF (VEA US) |

Description | This ETF tracks the FTSE Developed All Cap ex US Index, aiming to replicate the performance of the index constituents and deliver investment returns that correspond closely to that of the benchmark. The ETF provides a convenient way to match the performance of a diversified group of stocks of large-, mid-, and small-cap companies located in Canada and the major markets of Europe and the Pacific region, and follows a passively managed full-replication approach. |

Asset Class | Equity |

30-Day Average Volume (as of 6 May) | 16,348,142 |

Net Assets of Fund (as of 31 Mar) | $205.0 B |

12-Month Yield (as of 6 May) | 2.90% |

PE Ratio (as of 6 May) | 17.0x |

PB Ratio (as of 6 May) | 1.74x |

Expense Ratio (Annual) | 0.03% |

Top Holdings

(as of 31 March 2025)

(Source: Bloomberg)

iShares MSCI Core EAFE ETF (IEFA US)

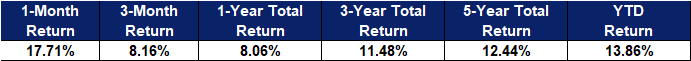

- Global Diversification Strategy. The underlying index follows a globally diversified allocation in accordance with MSCI standards, covering developed markets in Europe, Australia, and the Far East, ex. the U.S. and Canada, with South Korea classified as an emerging market. This ETF is suitable for long-term investors seeking exposure to developed markets outside of North America.

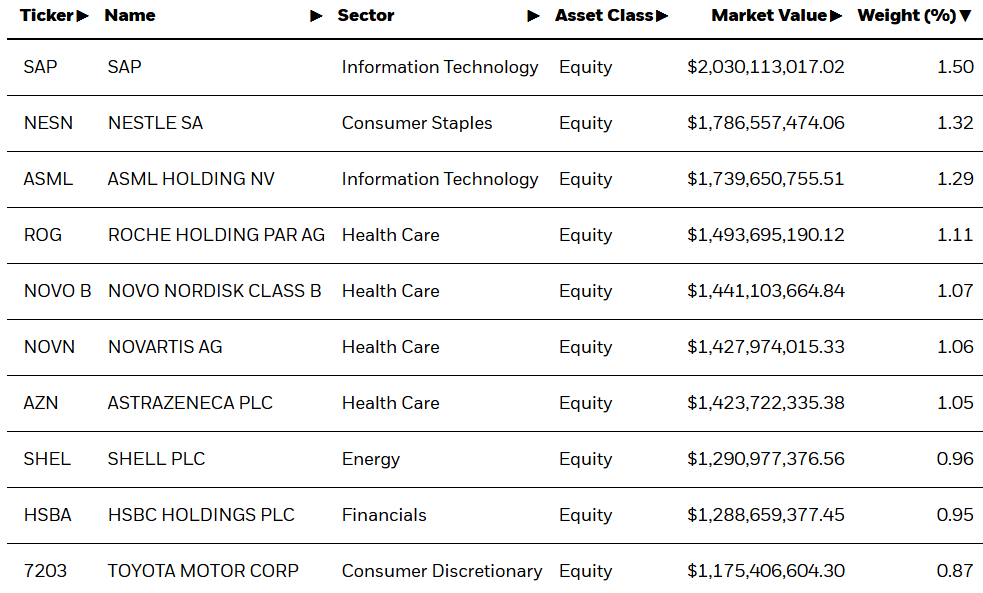

- Diversified Investment. It holds approximately 2,600 stocks, spanning large-, mid-, and small-cap companies. The top 10 holdings account for about 11.09% of total assets, with the largest position, SAP, representing roughly 1.46% of the portfolio, indicating low exposure to any single stock.

- High Liquidity. This ETF has over $130 billion in assets under management, offering high liquidity and tight index tracking. It is well suited for long-term investors.

Fund Name (Ticker) | iShares MSCI Core EAFE ETF (IEFA US) |

Description | The iShares Core MSCI EAFE ETF seeks to track the investment results of an index composed of large-, mid- and small-capitalization developed market equities, excluding the U.S. and Canada. |

Asset Class | Equity |

30-Day Average Volume (as of 5 May) | 15,681,332.0 |

Net Assets of Fund (as of 6 May) | $134,869,721,106 |

12-Month Yield (as of 6 May) | 3.05% |

P/E Ratio (as of 5 May) | 16.60x |

P/B Ratio (as of 5 May) | 1.80x |

Expense Ratio (Annual) | 0.07% |

Top Holdings

(as of 5 May 2025)

(Source: Bloomberg)