25 February 2025: Futures Product Ideas

KGI Weekly Futures Update

SGX TSI Iron Ore CFR China (62% Fe Fines) Index Futures

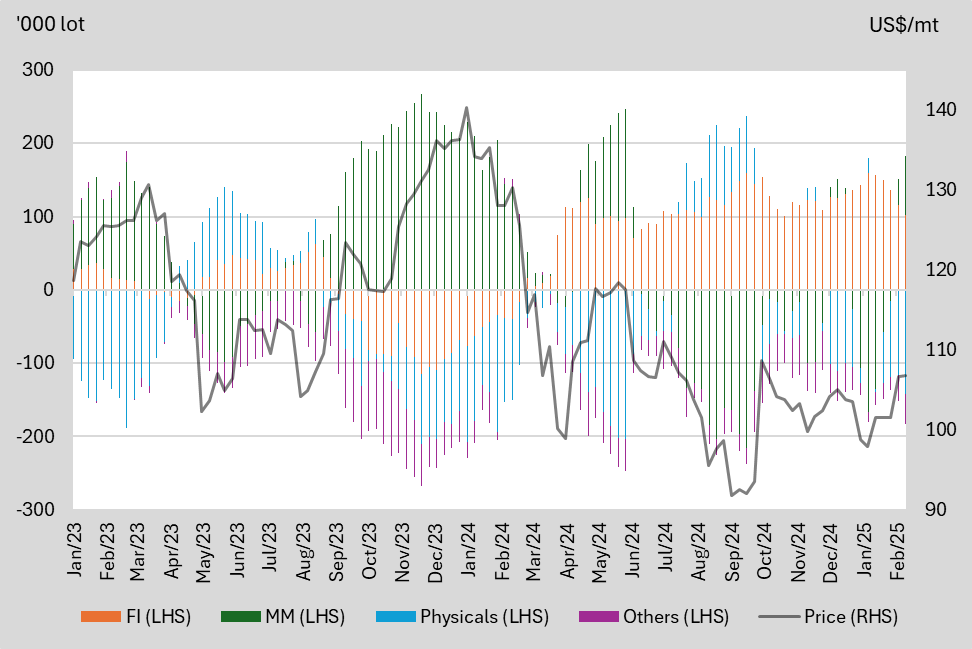

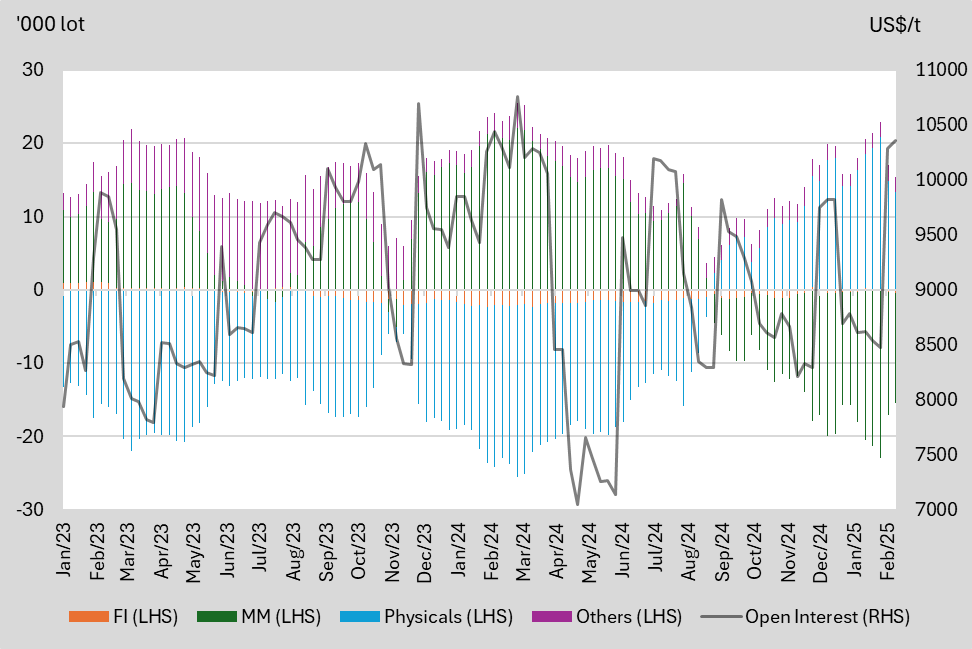

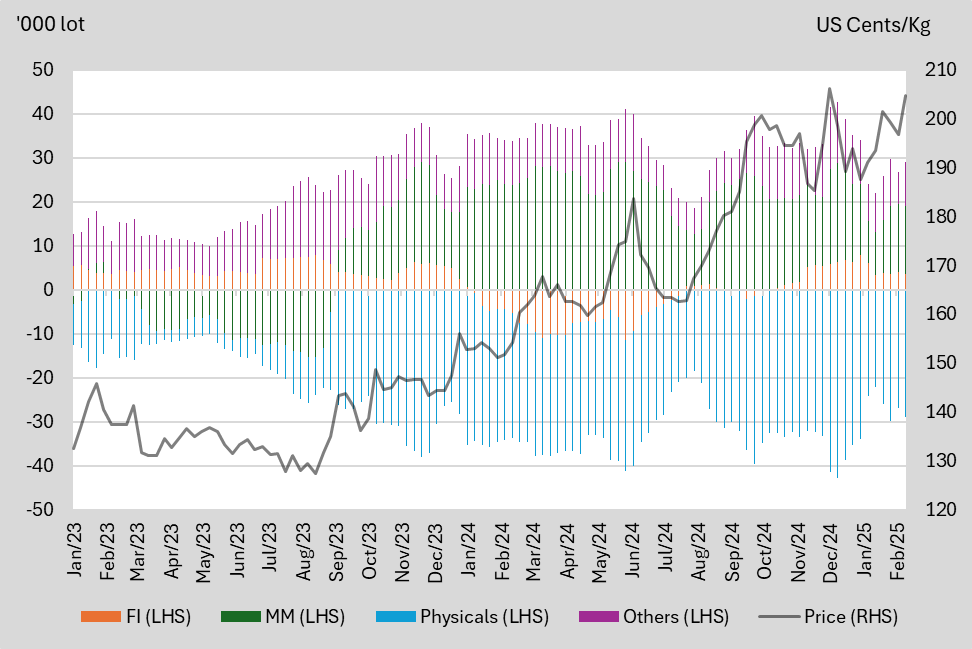

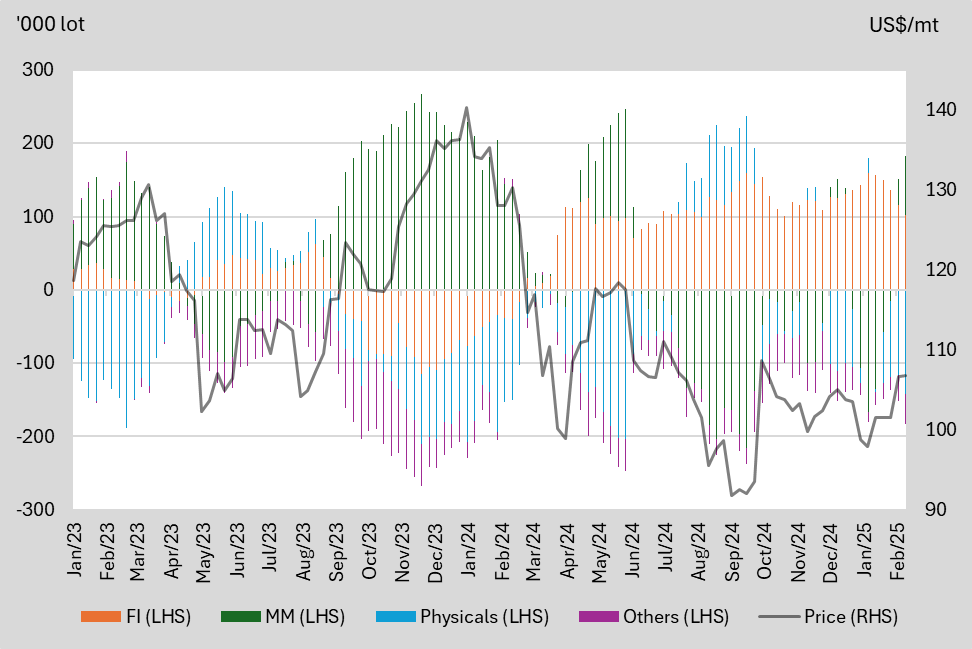

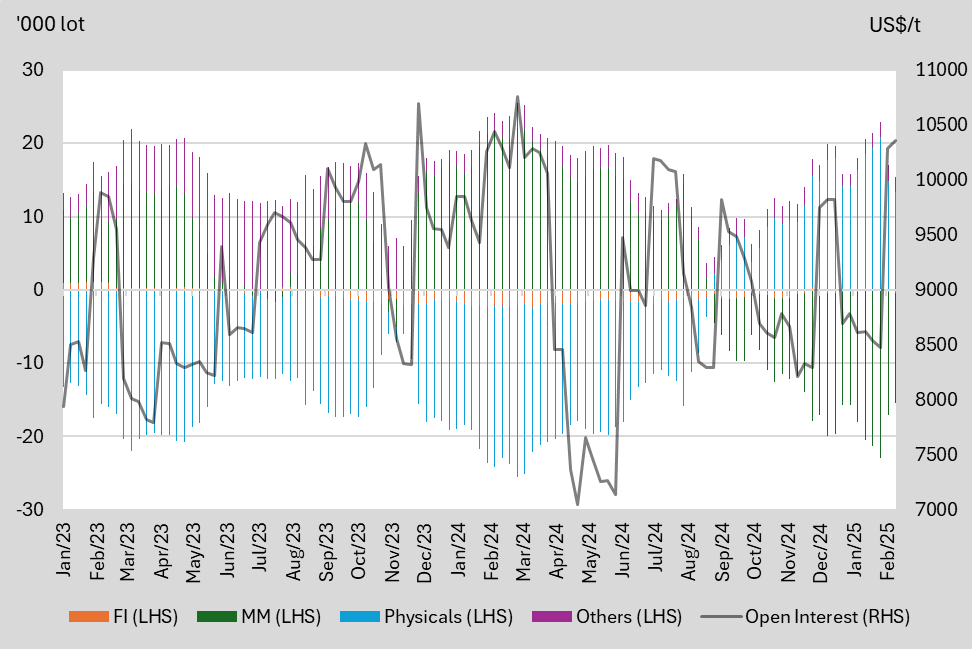

Net Long/Short and Price Comparison

We highlight the key price levels that each participant switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | Below US$118/mt | Above US$118/mt | Below US$100/mt | NA |

Net Short | Above US$118/mt | Below US$115/mt | Above US$100/mt | NA |

Net-position WoW Change | Remarks | |

FI | -13.8 | Decrease for the last 5 consecutive weeks |

MM | +45.7 | Increase for the last 5 consecutive weeks |

Physicals | -25.8 | Decrease for the last 5 consecutive weeks |

Others | -6.1 | Decrease for the last 2 consecutive weeks |

Figure 1: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

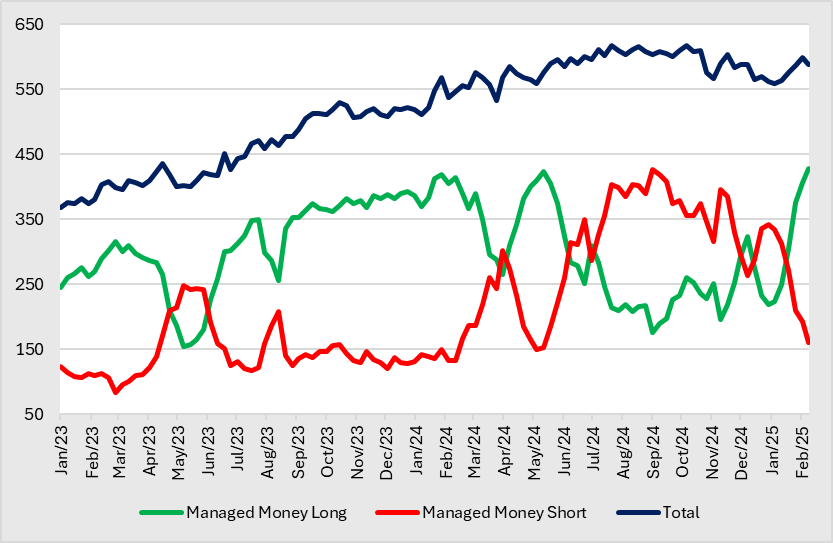

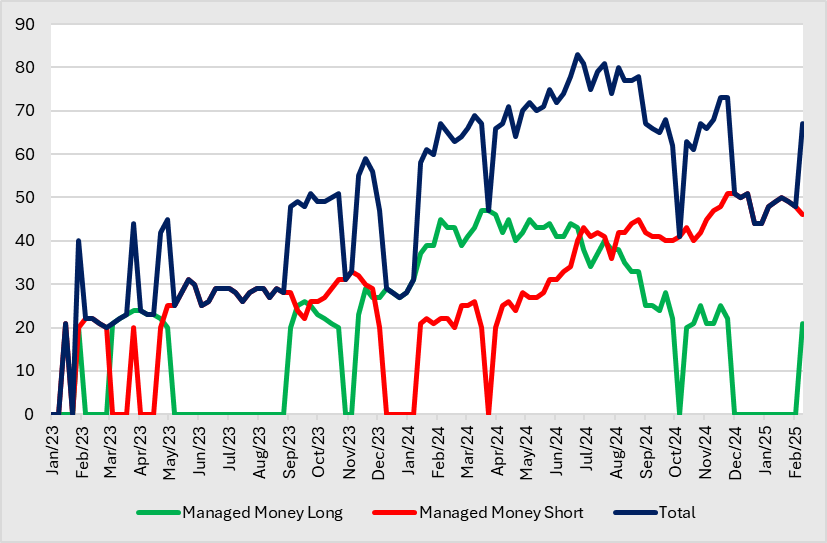

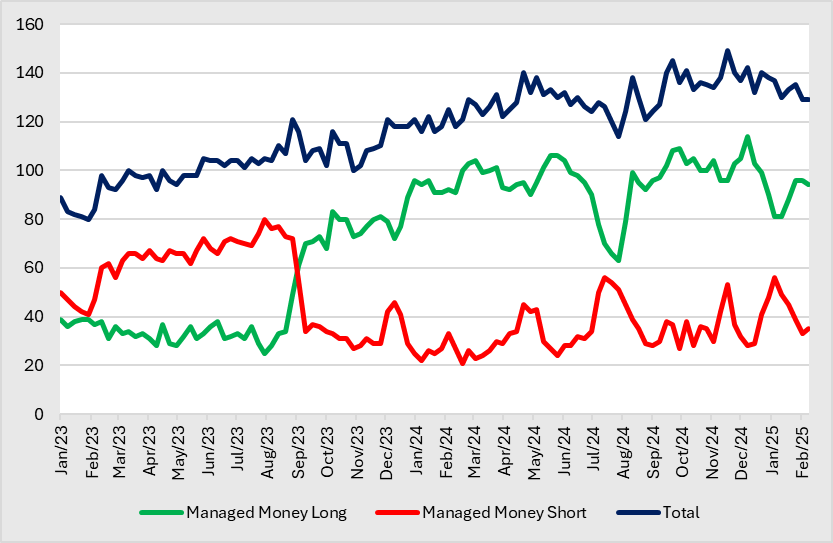

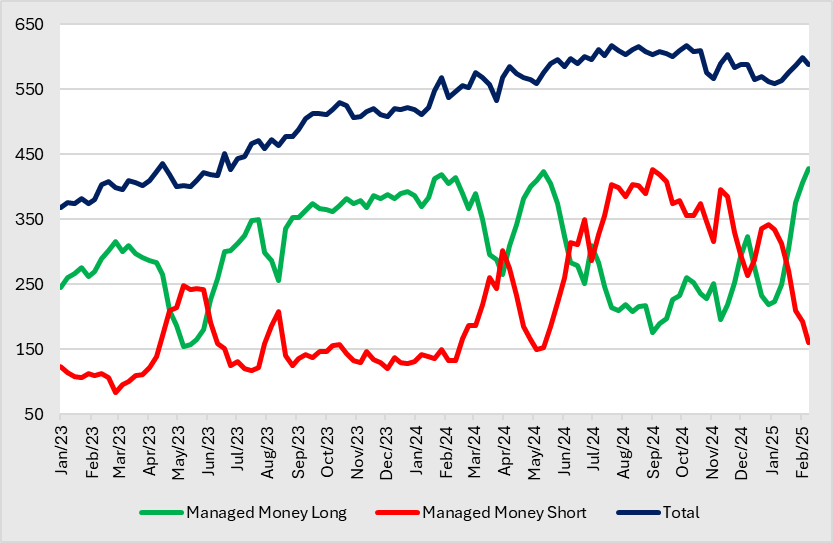

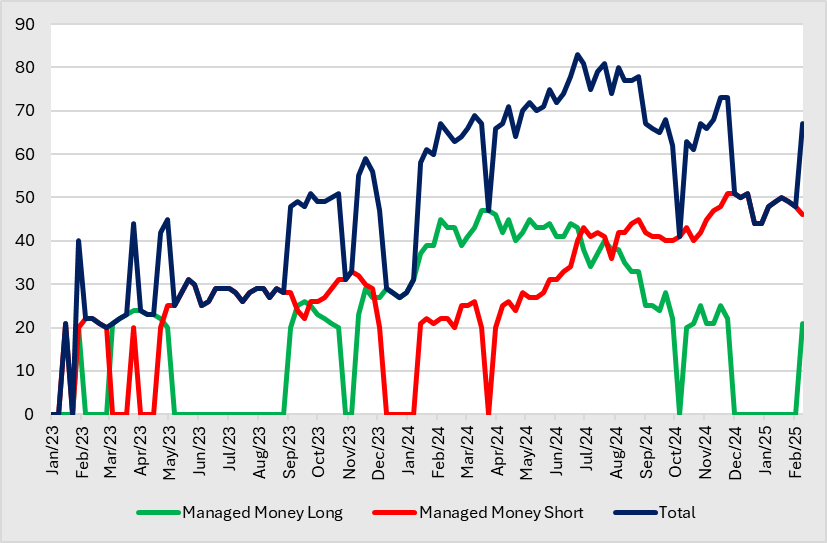

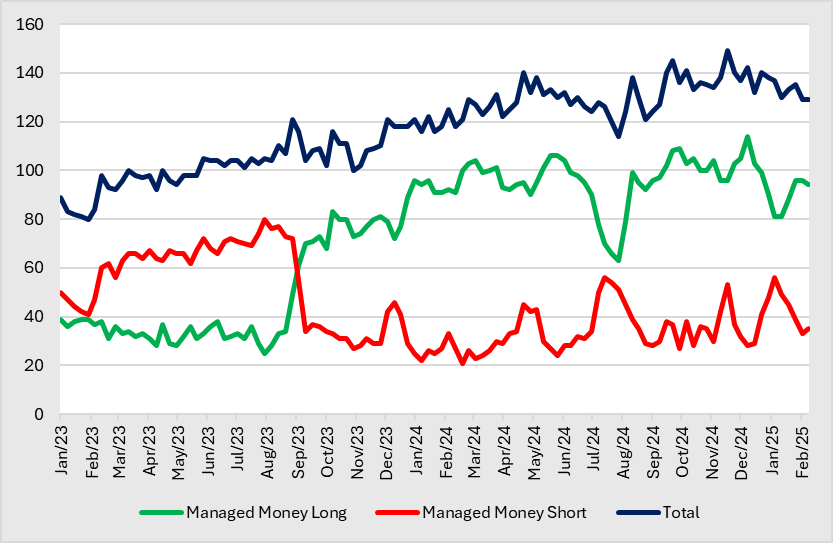

Long/Short Traders Snapshot

- Managed Money. The number of MM with long positions increased for 6 consecutive weeks to 428, since a low of 219 at the start of the year. Accordingly, the number of MM with short positions decreases further to 160, representing a decline for 6 weeks consecutively. Seasonally, More MMs are prone to long in 1HQ4 and 2HQ2, and there are more MMs with short positions in 1HQ2 and 1HQ3.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 423 | 427 | 393 | 248 |

Low | 176 | 131 | 154 | 83 |

Figure 2: Number of position holders iron ore futures

Source: SGX, KGI Research

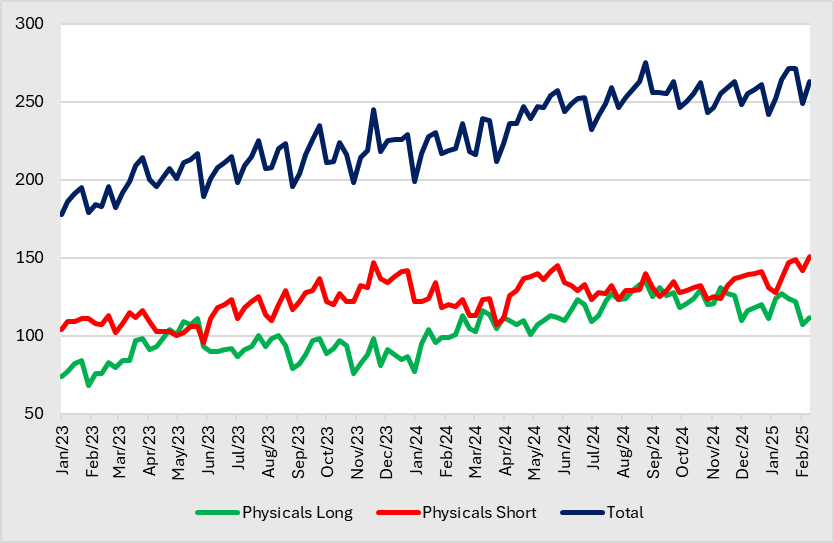

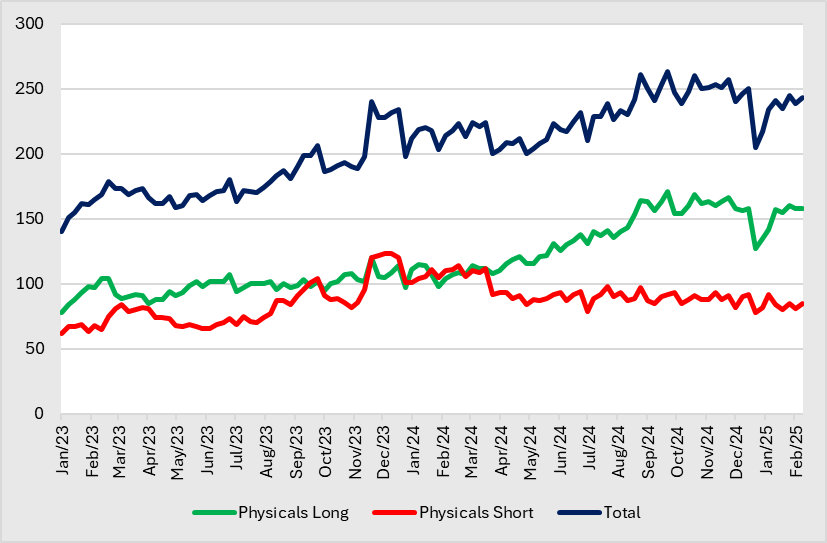

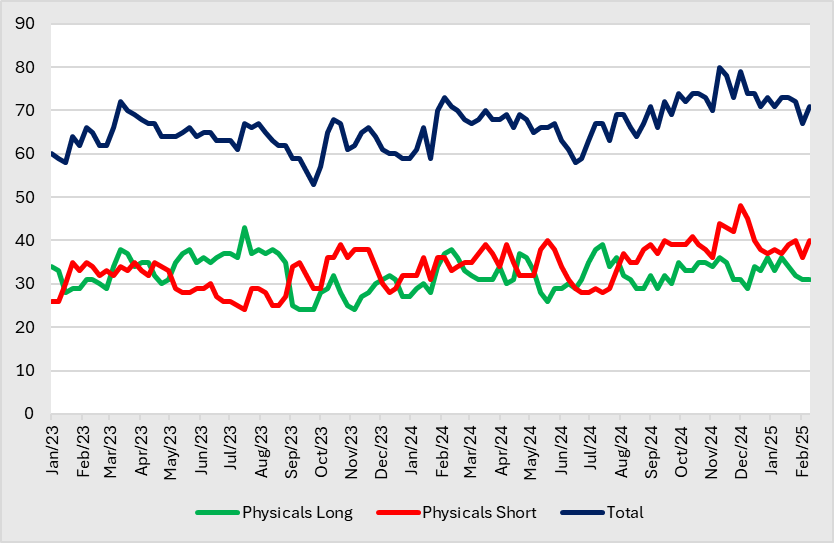

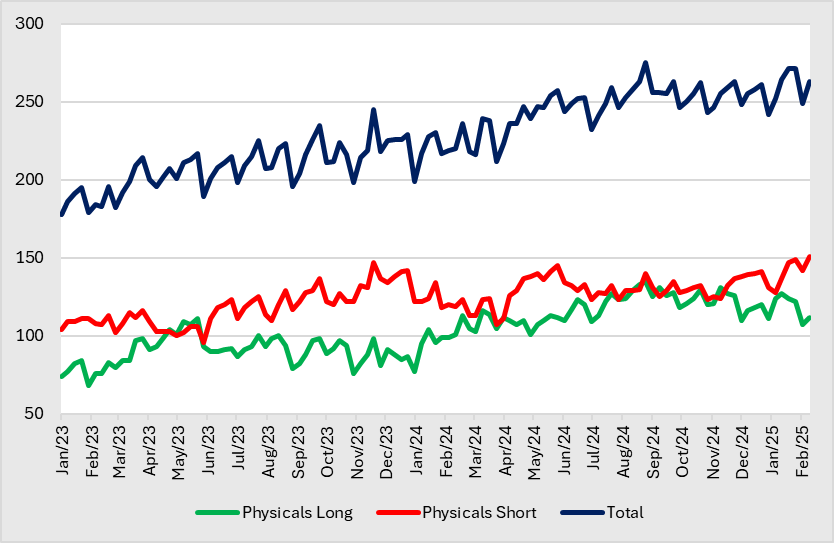

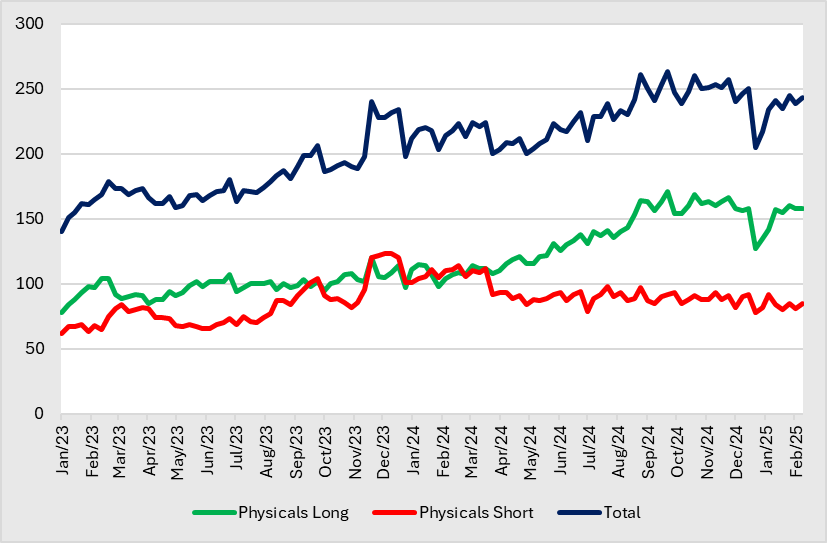

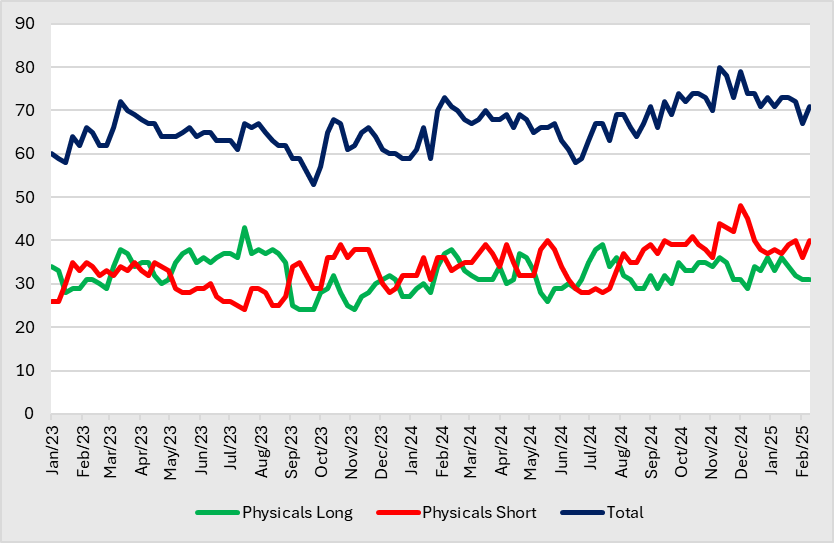

- Physicals. The number of physicals with long positions rebound to 112 after 3 consecutive weeks of decline. Accordingly, the number of physical with short positions continue to increase to 151 after a pullback a week ago, and represents a high in over 2 years. Seasonally, more physicals are prone to being long in 1Q, and there are more physicals with short positions in Q4.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 135 | 145 | 111 | 147 |

Low | 77 | 107 | 68 | 96 |

Figure 3: Number of position holders iron ore futures

Source: SGX, KGI Research

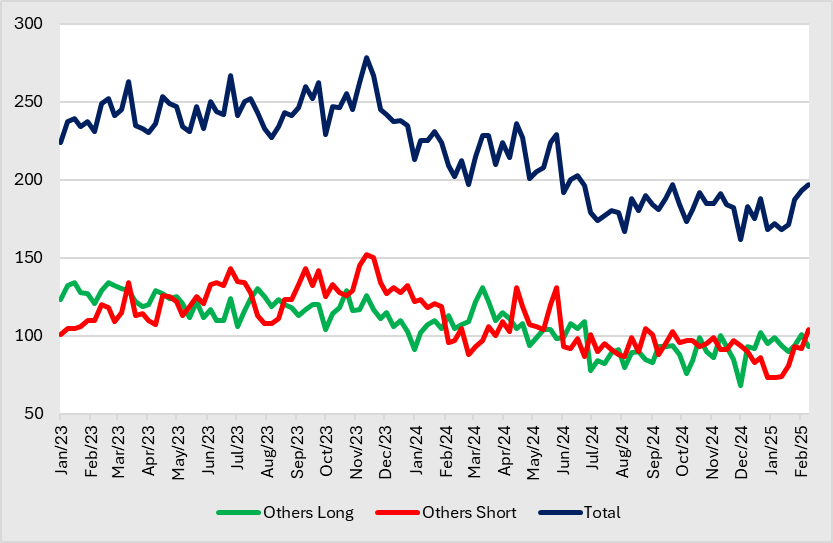

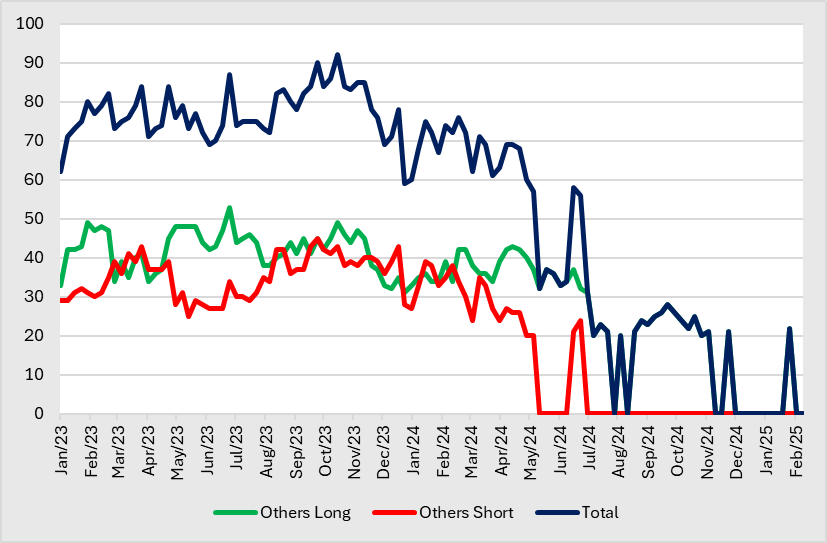

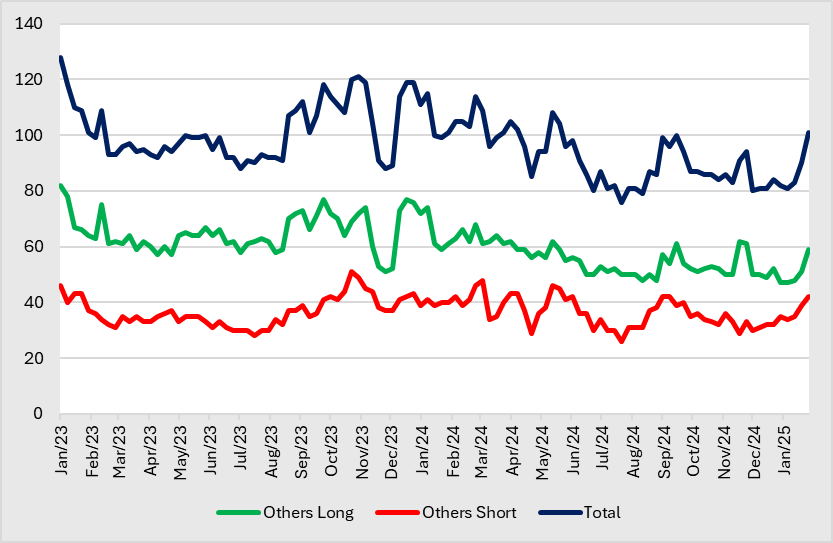

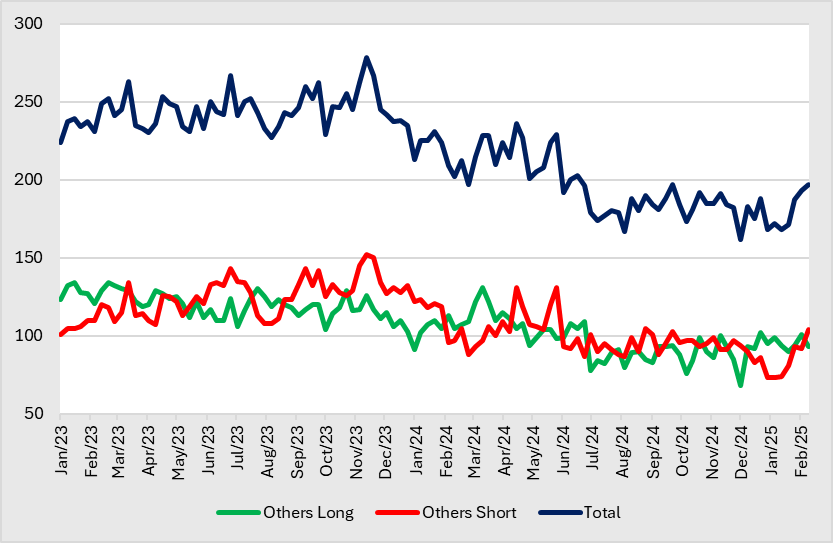

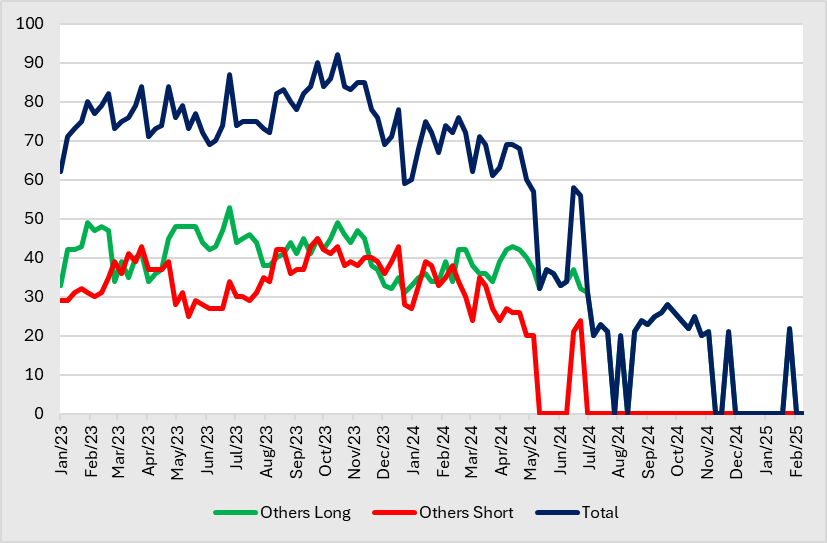

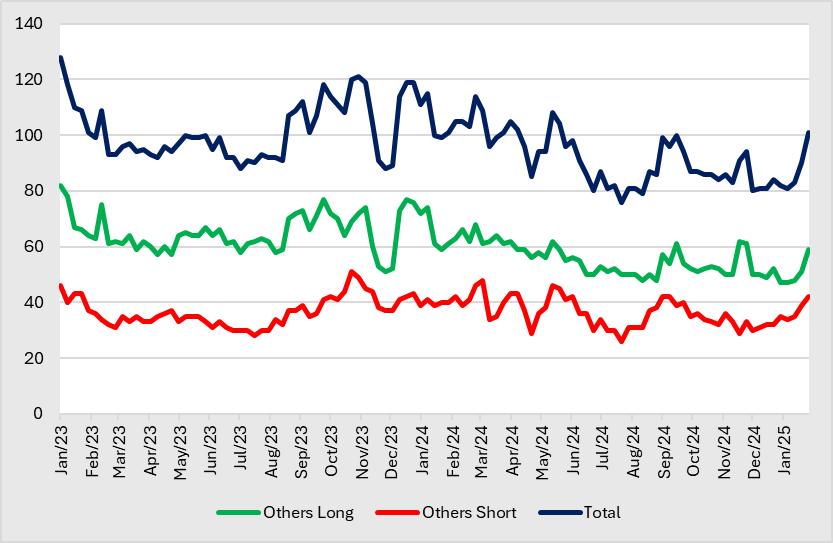

- Others. The number of others with long positions retreated to 93 after 2 consecutive weeks of increase, while the number of others with short positions continued to increase to its current level at 104, representing a high since August 2024 and after a slight pullback a week ago.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 131 | 131 | 134 | 152 |

Low | 68 | 83 | 103 | 101 |

Figure 4: Number of position holders iron ore futures

Source: SGX, KGI Research

SGX Baltic Panamax Time Charter Average Futures

We highlight the key price levels that each participants switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | NA | Above US$9,000/t | Below US$8,500/t | NA |

Net Short | NA | Below US$9,000/t | Above US$9,500/t | NA |

Net-position WoW Change | Remarks | |

FI | -0.16 | Decrease for 2 consecutive weeks |

MM | +1.81 | Increase for 2 consecutive weeks |

Physicals | -1.52 | Decline for 2 consecutive weeks |

Others | -0.14 | Decrease for a week after 4 consecutive weeks of increase |

Figure 5: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

Long/Short Traders Snapshot

- Managed Money. The number of MM with long positions remained stable at 21 at mid-February. On the other hand, the number of MM with short positions declined for 3 consecutive weeks to its current level at 46. Seasonally, More MM are prone to long in 1H, and there are more MM with short positions in 2H.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 47 | 51 | 29 | 33 |

Low | 20 | 20 | 20 | 20 |

Figure 6: Number of position holders freight futures

Source: SGX, KGI Research

- Physicals. The number of physicals with long positions remained stable for a week at 158. Accordingly, the number of physical with short positions rebounded slightly to 85 after retreating a week ago. The number of physicals has been on a general upward trend since 2Q, while physicals with short positions generally saw a downtrend since 2Q.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 171 | 114 | 120 | 123 |

Low | 98 | 78 | 78 | 62 |

Figure 7: Number of position holders freight futures

Source: SGX, KGI Research

- Others. The number of others with long positions remain stable at 22 in 2025, while the number of others with short positions continues to remain stable around 24 each at the end of June 2024.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 43 | 39 | 53 | 45 |

Low | 20 | 20 | 31 | 25 |

Figure 8: Number of position holders freight futures

Source: SGX, KGI Research

SGX SICOM Rubber Futures – TSR20

Net Long/Short and Price Comparison

We highlight the key price levels that each participants switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | Below US$1.90/kg | NA | NA | NA |

Net Short | Above US$1.60/kg | NA | NA | NA |

Net-position WoW Change | Remarks | |

FI | -0.39 | Decrease from previous week |

MM | -0.15 | Decrease for the first time in 4 weeks |

Physicals | -2.19 | Reverted to a downward trajectory from previous incline |

Others | +2.72 | Trend has reverted to an upward trajectory after temporary downward deviation |

Figure 9: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

Long/Short Traders Snapshot

- Managed Money. The number of MM with long positions retreated marginally to 94 after being on a general uptrend since the start of 2025. Accordingly, the number of MM with short positions rebounded slightly to 35 after declining for 4 consecutive weeks, but is still on a general downtrend since the start of 2025.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 114 | 56 | 89 | 80 |

Low | 63 | 21 | 25 | 27 |

Figure 10: Number of position holders rubber futures

Source: SGX, KGI Research

- Physicals. The number of physicals with long positions remained stable at 31 after 3 consecutive weeks of decline, representing a low since mid-December 2024. Accordingly, the number of physicals with short positions rebounded back to 40 after a pullback a week ago. Seasonally, more physicals are prone to long in early Q3, and there are more physicals with short positions in Q4.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 39 | 48 | 43 | 39 |

Low | 26 | 28 | 24 | 24 |

Figure 11: Number of position holders rubber futures

Source: SGX, KGI Research

- Others. The number of long holders increased for 3 consecutive weeks to its current level at 59, representing a high since December 2024. On the other hand, the number of short holders increased for 3 consecutive weeks to 42, representing a high since September 2024.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 77 | 48 | 82 | 51 |

Low | 48 | 26 | 51 | 28 |

Figure 12: Number of position holders rubber futures

Source: SGX, KGI Research

Participant Category | Description |

Financial Institutions | An entity, such as a broker trading desk, bank trading desk or swap dealer, that uses the futures markets to manage or hedge the risk. |

Managed Money | An entity that is engaged in organized futures trading on behalf of funds or other special investment purpose vehicles such as Pension Funds, Asset Managers, Hedge Funds, Proprietary Trading Groups, Family Offices, etc. |

Physicals | An entity that predominantly engages in the physical markets and uses the futures markets to manage or hedge risks associated with the conduct of those activities. Such activities could include the production, processing, trading, packing or handling of a physical commodity, or the provision of transportation, warehousing or distribution services. |

Others | Every other trader that is not placed into one of the other three categories. E.g., Broker Agency, Bank Agency, Inter-Dealer Brokers, etc. |

凯基证券期货周报 – 2 月 25 日

SGX TSI 铁矿石 CFR 中国(62% 铁粉)指数期货

净多头/空头和价格比较

我们根据2024年数据,突出了每个参与者在净多头和净空头之间切换仓位的关键价格水平。

2024 | 金融机构 (FI) | 管理资金 (MM) | 实物交易(Physicals) | 其他 (Others) |

净多头 | 低于 118 美元/吨 | 118 美元/吨以上 | 低于 100 美元/吨 | 无 |

净空头 | 118 美元/吨以上 | 低于 115 美元/吨 | 100 美元/吨以上 | 无 |

净仓位按周变化 | 备注 | |

金融机构 | -13.8 | 过去连续 5 周下降 |

管理资金 | +45.7 | 过去连续 5 周 增加 |

实物交易 | -25.8 | 过去连续 5 周下降 |

其他 | -6.1 | 最近连续 2 周下降 |

图 1:按参与者细分的净持仓和价格比较

资料来源: 新交所、凯基研究

多头/空头交易简报

- 管理资金。 持有多头仓位的管理资金数量连续6周增加至428,自年初的219低点以来持续上升。相应地,持有空头仓位的管理资金数量进一步减少至160,连续6周下降。季节性来看,更多管理资金倾向于在第四季上半季和第二季下半季持有多头,而在第二季上半季和第三季上半季则更多持有空头。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 423 | 427 | 393 | 248 |

最低值 | 176 | 131 | 154 | 83 |

图 2:铁矿石期货持仓者数量

资料来源: 新交所、凯基研究

- 实物交易者。 持有多头仓位的实物交易者数量在连续3周下降后反弹至112。相应地,持有空头仓位的实物交易者数量在一周前回落后继续增加至151,创下两年多来的新高。季节性来看,更多实物交易者倾向于在一季度持有多头,而在四季度则更多持有空头。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 135 | 145 | 111 | 147 |

最低值 | 77 | 107 | 68 | 96 |

图 3:铁矿石期货持仓者数量

资料来源: 新交所、凯基研究

- 其他。 持有多头仓位的其他交易者数量在连续2周增加后回落至93,而持有空头仓位的其他交易者数量继续增加至104,创下自2024年8月以来的新高,且在一周前略有回落。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 131 | 131 | 134 | 152 |

最低值 | 68 | 83 | 103 | 101 |

图 4:铁矿石期货持仓者数量

资料来源: 新交所、凯基研究

SGX 波罗的海巴拿马型船平均期租期货

我们根据2024年数据,突出了每个参与者在净多头和净空头之间切换仓位的关键价格水平。

2024 | 金融机构 (FI) | 管理资金 (MM) | 实物交易(Physicals) | 其他 (Others) |

净多头 | 无 | 9,000 美元/吨以上 | 低于 8,500 美元/吨 | 无 |

净空头 | 无 | 低于 9,000 美元/吨 | 9,500 美元/吨以上 | 无 |

净仓位按周变化 | 备注 | |

金融机构 | -0.16 | 连续 2 周下降 |

管理资金 | +1.81 | 连续 2 周增加 |

实物交易 | -1.52 | 连续 2 周下跌 |

其他 | -0.14 | 连续 4 周增加后下降一周 |

图 5:按参与者类别划分的净仓位及价格比较

资料来源: 新交所、凯基研究

多头/空头交易者快照

- 管理资金。 持有多头仓位的管理资金数量在2月中旬保持稳定在21。另一方面,持有空头仓位的管理资金数量连续3周下降至46。季节性来看,更多管理资金倾向于在上半年持有多头,而在下半年则更多持有空头。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 47 | 51 | 29 | 33 |

最低值 | 20 | 20 | 20 | 20 |

图 6: 运费期货持仓者数量

资料来源: 新交所、凯基研究

- 实物交易者。 持有多头仓位的实物交易者数量在一周内保持稳定在158。相应地,持有空头仓位的实物交易者数量在一周前回落后小幅反弹至85。自第二季季度以来,实物交易者数量总体呈上升趋势,而持有空头仓位的实物交易者数量自第二季度以来总体呈下降趋势。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 171 | 114 | 120 | 123 |

最低值 | 98 | 78 | 78 | 62 |

图 7: 运费期货持仓者数量

资料来源: 新交所、凯基研究

- 其他。 持有多头仓位的其他交易者数量在2025年保持稳定在22,而持有空头仓位的其他交易者数量在2024年6月底保持稳定在24左右。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 43 | 39 | 53 | 45 |

最低值 | 20 | 20 | 31 | 25 |

图 8: 运费期货持仓者数量

资料来源: 新交所、凯基研究

SGX SICOM 橡胶期货 – TSR20

净多头/空头及价格比较

我们根据2024年数据,突出了每个参与者在净多头和净空头之间切换仓位的关键价格水平。

2024 | 金融机构 (FI) | 管理资金 (MM) | 实物交易(Physicals) | 其他 (Others) |

净多头 | 低于 1.90 美元/公斤 | 无 | 无 | 无 |

净空头 | 1.60 美元/公斤以上 | 无 | 无 | 无 |

净仓位按周变化 | 备注 | |

金融机构 | -0.39 | 较上周减少 |

管理资金 | -0.15 | 4 周内首次下降 |

实物交易 | -2.19 | 从之前的斜坡恢复到向下的轨迹 |

其他 | +2.72 | 趋势在短暂的向下偏离后恢复为上升轨迹 |

图 9:按参与者类别划分的净仓位及价格比较

资料来源: 新交所、凯基研究

多头/空头交易者快照

- 管理资金。 持有多头仓位的管理资金数量在自2025年初以来的总体上升趋势中微幅回落至94。相应地,持有空头仓位的管理资金数量在连续4周下降后小幅反弹至35,但仍处于自2025年初以来的总体下降趋势中。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 114 | 56 | 89 | 80 |

最低值 | 63 | 21 | 25 | 27 |

图 10:橡胶期货持仓者数量

资料来源:新交所、凯基研究

- 实物交易者。 持有多头仓位的实物交易者数量在连续3周下降后保持稳定在31,创下自2024年12月中旬以来的新低。相应地,持有空头仓位的实物交易者数量在一周前回落后反弹至40。季节性来看,更多实物交易者倾向于在第三季度初持有多头,而在第四季度则更多持有空头。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 39 | 48 | 43 | 39 |

最低值 | 26 | 28 | 24 | 24 |

图11:橡胶期货持仓者数量

资料来源:新交所、凯基研究

- 其他。 持有多头仓位的其他交易者数量连续3周增加至59,创下自2024年12月以来的新高。另一方面,持有空头仓位的其他交易者数量连续3周增加至42,创下自2024年9月以来的新高。

2024 | 2023 | |||

看多 | 看空 | 看多 | 看空 | |

最高值 | 77 | 48 | 82 | 51 |

最低值 | 48 | 26 | 51 | 28 |

图 12:持仓橡胶期货数量

资料来源:新交所、凯基研究

参与者类别 | 描述 |

金融机构 | 使用期货市场管理或对冲风险的实体,如经纪商交易台、银行交易台或互换交易商。 |

管理资金 | 代表基金或其他特殊投资目的工具(如养老基金、资产管理公司、对冲基金、自营交易集团、家族办公室等)从事有组织的期货交易的实体。 |

实物交易 | 主要从事实物市场并使用期货市场管理或对冲与这些活动相关风险的实体。这些活动可能包括生产、加工、贸易、包装或处理实物商品,或提供运输、仓储或分销服务。 |

其他 | 未归类到上述三类中的其他交易者,例如经纪代理、银行代理、交易商间经纪商等。 |