20 February 2025: Investment Product Ideas

Rising defense spending expected to boost defense stocks

Global defense spending surged to US$2.46 trillion in 2024, a 7.4% increase fuelled by escalating geopolitical tensions and security concerns. Significant budget expansions were seen across Europe, Asia, and the Middle East and North Africa (MENA) region. Europe led the charge with an 11.7% rise, including a dramatic 41.9% surge in Russia’s defense budget. This sector is poised to capitalize on rising U.S. defense expenditures, driven by both geopolitical instability and ongoing government initiatives. With the Pentagon’s budget approaching US$1 trillion and a sustained commitment to defense spending, demand for defense technologies is projected to grow. Going forward, Trump is likely to urge other nations to increase defense spending, and military stocks are expected to see sustained growth. Investors can tap into this trend through ETFs.

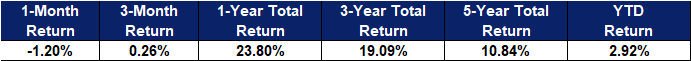

Invesco Aerospace & Defense ETF (PPA US)

- Focus on Specific Industries

This ETF invests in U.S. defense, homeland security, and aerospace companies, suitable for investors focused on these sectors.

- Diversified Holdings

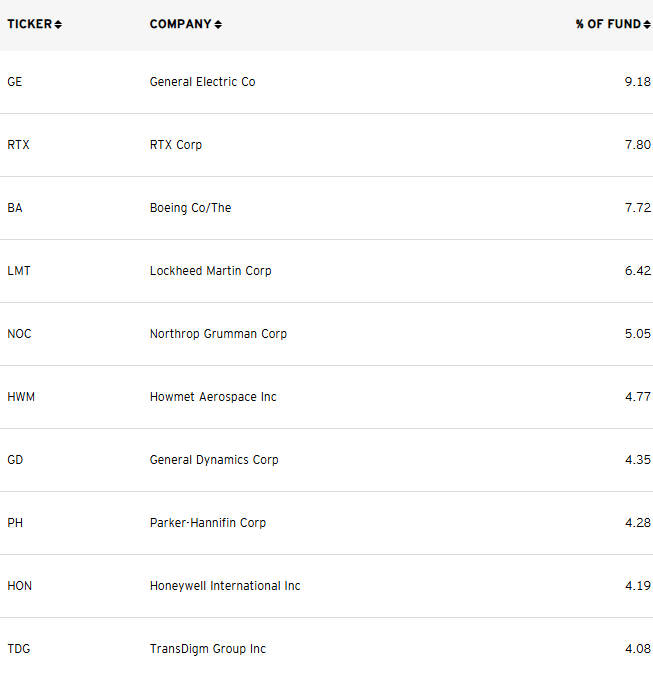

This ETF has 54 holdings, with none above 10%. Top names include GE, Raytheon, Boeing, Lockheed Martin, and Northrop Grumman, making up 57.93% of the portfolio.

- Countries’ Policies

Boosted by global defense spending, this sector thrives on high technical barriers, industry giants, and strong government funding.

|

Fund Name (Ticker) |

Invesco Aerospace & Defense ETF (PPA US) |

|

Description |

The Invesco Aerospace & Defense ETF (Fund) is based on the SPADE™ Defense Index (Index). The Fund will normally invest at least 90% of its total assets in common stocks that comprise the Index. The Index is designed to identify a group of companies involved in the development, manufacturing, operations and support of US defense, homeland security and aerospace operations. The Fund and the Index are rebalanced and reconstituted quarterly. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 18 Feb) |

229,708 |

|

Net Assets of Fund (as 18 Feb) |

$$4,777.8mn |

|

12-Month Yield (as of 18 Feb) |

0.59% |

|

P/E Ratio (as of 18 Feb) |

48.25x |

|

P/B Ratio (as of 18 Feb) |

5.42x |

|

Expense Ratio (Annual) |

0.57% |

Top Holdings

(as of 14 February 2025)

(Source: Bloomberg)

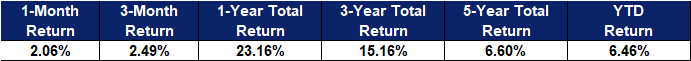

iShares U.S. Aerospace & Defense ETF (ITA US)

- Focused on Aerospace & Defense

This ETF tracks the Dow Jones U.S. Select Aerospace & Defense Index, covering U.S. manufacturers, suppliers, and service providers in the sector.

- Concentrated Holdings

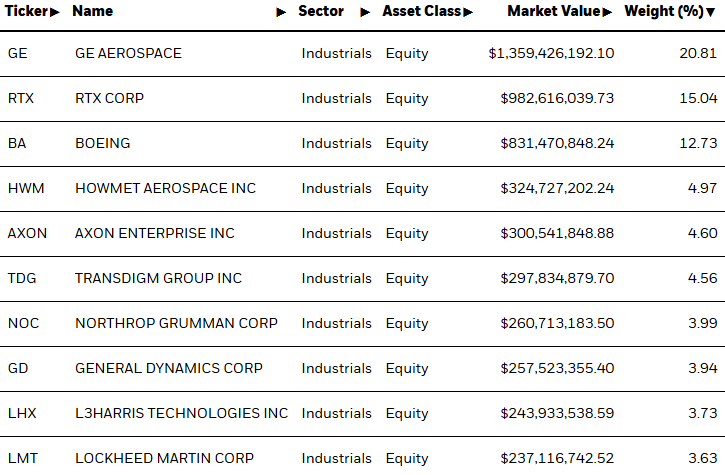

This ETF holds about 35 stocks, mainly mid- and large-cap names like GE, Raytheon, Boeing, Howmet Aerospace, and TransDigm. The top 10 holdings account for 77.83%.

- Low Expense Ratio

This ETF has a 0.4% expense ratio, making it relatively low among peers. Its cost efficiency helps investors reduce expenses.

|

Fund Name (Ticker) |

iShares U.S. Aerospace & Defense ETF (ITA US) |

|

Description |

The iShares U.S. Aerospace & Defense ETF seeks to track the investment results of an index composed of U.S. equities in the aerospace and defense sector. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 14 Feb) |

551,515 |

|

Net Assets of Fund (as of 18 Feb) |

$6,585,526,056 |

|

12-Month Yield (as of 31 Jan) |

0.78% |

|

P/E Ratio (as of 14 Feb) |

32.01x |

|

P/B Ratio (as of 14 Feb) |

4.65x |

|

Expense Ratio (Annual) |

0.40% |

Top 10 Holdings

(as of 14 February 2025)

(Source: Bloomberg)