18 February 2025: Futures Product Ideas

KGI Weekly Futures Update

SGX TSI Iron Ore CFR China (62% Fe Fines) Index Futures

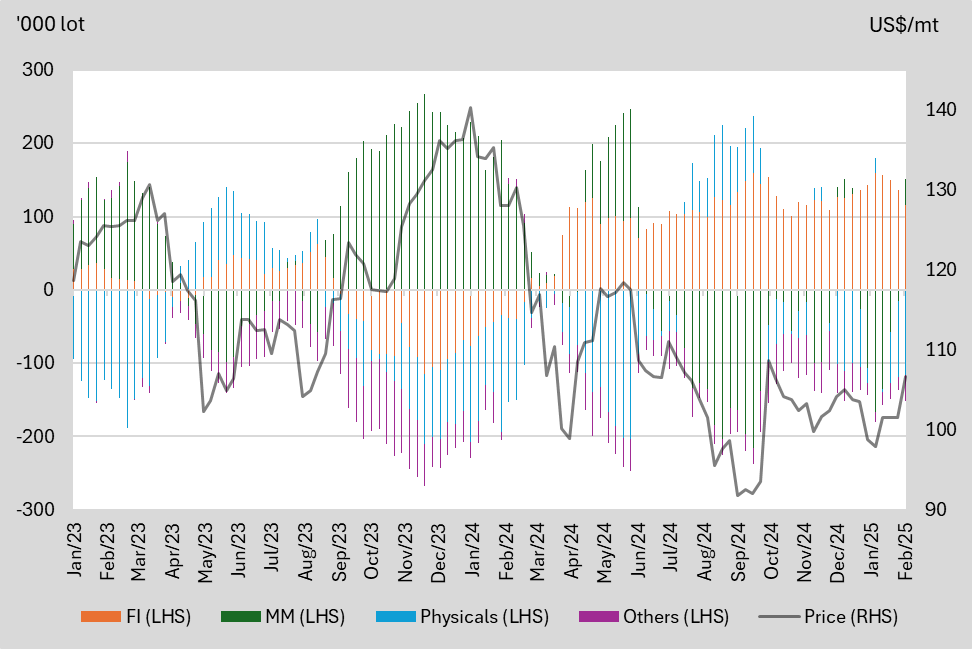

Net Long/Short and Price Comparison

We highlight the key price levels that each participant switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | Below US$118/mt | Above US$118/mt | Below US$100/mt | NA |

Net Short | Above US$118/mt | Below US$115/mt | Above US$100/mt | NA |

Net-position WoW Change | Remarks | |

FI | -21.3 | Decrease for the last 4 consecutive weeks |

MM | +51.3 | Increase for the last 4 consecutive weeks |

Physicals | -13.3 | Decrease for the last 4 consecutive weeks |

Others | -16.7 | Decrease for 1-week, the largest decrease since the end of September 2024 |

Figure 1: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

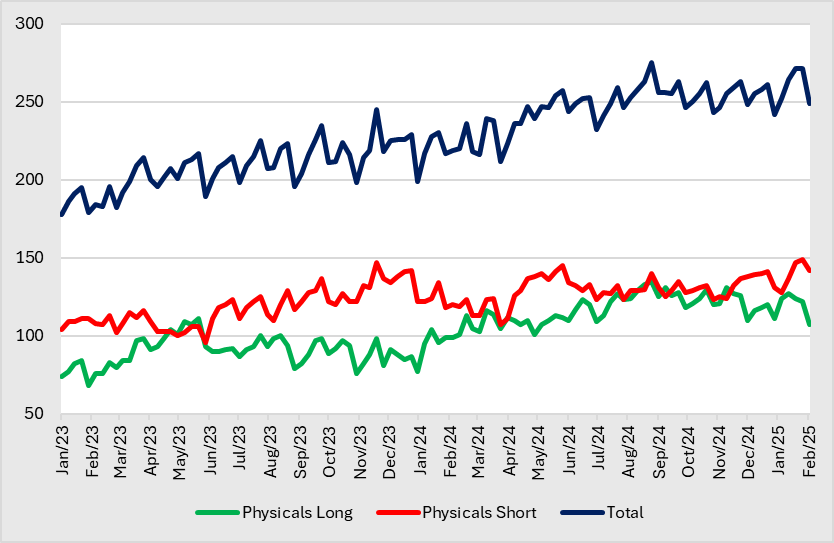

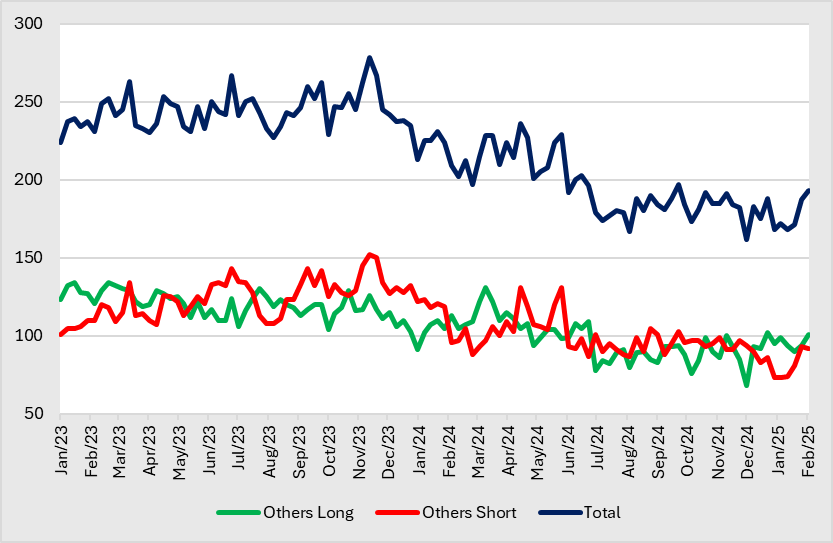

Long/Short Traders Snapshot

- Managed Money. The number of MM with long positions increased for 5 consecutive weeks to 406, since a low of 219 at the start of the year. Accordingly, the number of MM with short positions decreases further to 193, representing a decline for 5 weeks consecutively. Seasonally, More MMs are prone to long in 1HQ4 and 2HQ2, and there are more MMs with short positions in 1HQ2 and 1HQ3.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 423 | 427 | 393 | 248 |

Low | 176 | 131 | 154 | 83 |

Figure 2: Number of position holders iron ore futures

Source: SGX, KGI Research

- Physicals. The number of physicals with long positions decreased for 3 weeks to 107. Accordingly, the number of physical with short positions retreated slightly to 142 after 3 consecutive weeks of increase. Seasonally, more physicals are prone to being long in 1Q, and there are more physicals with short positions in Q4.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 135 | 145 | 111 | 147 |

Low | 77 | 107 | 68 | 96 |

Figure 3: Number of position holders iron ore futures

Source: SGX, KGI Research

- Others. The number of others with long positions increased for 2 consecutive weeks to 101, representing a high YTD, while the number of others with short positions retreated marginally to 92 after 3 consecutive weeks of increase.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 131 | 131 | 134 | 152 |

Low | 68 | 83 | 103 | 101 |

Figure 4: Number of position holders iron ore futures

Source: SGX, KGI Research

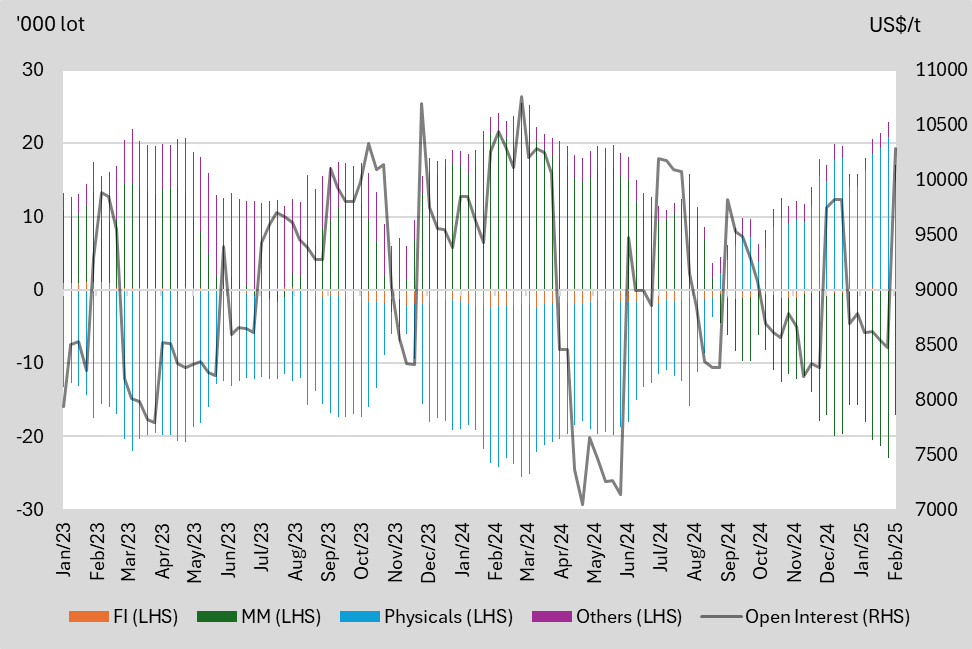

SGX Baltic Panamax Time Charter Average Futures

We highlight the key price levels that each participants switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | NA | Above US$9,000/t | Below US$8,500/t | NA |

Net Short | NA | Below US$9,000/t | Above US$9,500/t | NA |

Net-position WoW Change | Remarks | |

FI | -0.30 | Retreated for 1 week |

MM | +6.09 | Rebounded after 5 consecutive weeks of decline; represents the largest increase since the end of 2023 |

Physicals | -5.99 | Retreated after 4 consecutive weeks of increase; represents the largest decrease since the end of 2023 |

Others | +0.20 | Increase for the last 4 consecutive weeks |

Figure 5: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

Long/Short Traders Snapshot

- Managed Money. The number of MM with long positions remained stable at 22 at the end of November. On the other hand, the number of MM with short positions declined marginally for 2 consecutive weeks but still remained relatively stable at its current level at 48. Seasonally, More MM are prone to long in 1H, and there are more MM with short positions in 2H.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 47 | 51 | 29 | 33 |

Low | 20 | 20 | 20 | 20 |

Figure 6: Number of position holders freight futures

Source: SGX, KGI Research

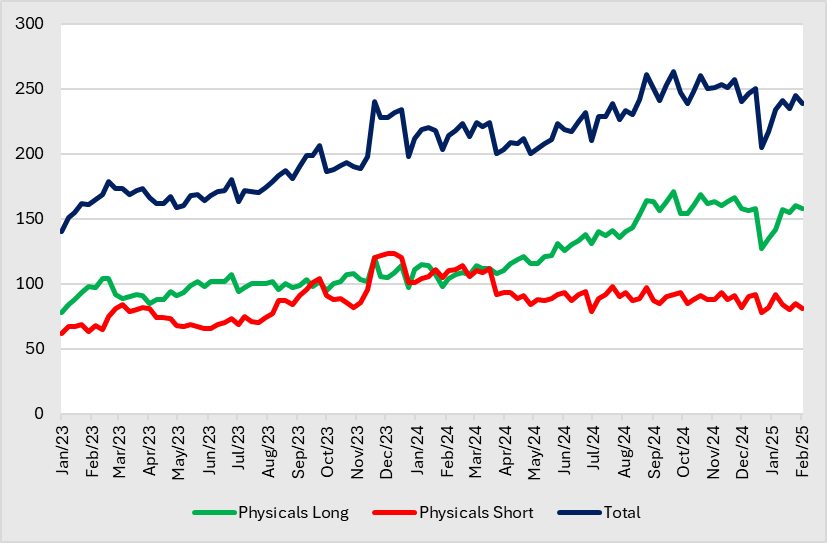

- Physicals. The number of physicals with long positions retreated marginally to 158, after reaching a high since the end of November 2024 a week ago. Accordingly, the number of physical with short positions continues to retreat to its current level of 81 after a short rebound a week ago. The number of physicals has been on a general upward trend since 2Q, while physicals with short positions generally saw a downtrend since 2Q.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 171 | 114 | 120 | 123 |

Low | 98 | 78 | 78 | 62 |

Figure 7: Number of position holders freight futures

Source: SGX, KGI Research

- Others. The number of others with long positions remain stable at 22 in 2025, while the number of others with short positions continues to remain stable around 24 each at the end of June 2024.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 43 | 39 | 53 | 45 |

Low | 20 | 20 | 31 | 25 |

Figure 8: Number of position holders freight futures

Source: SGX, KGI Research

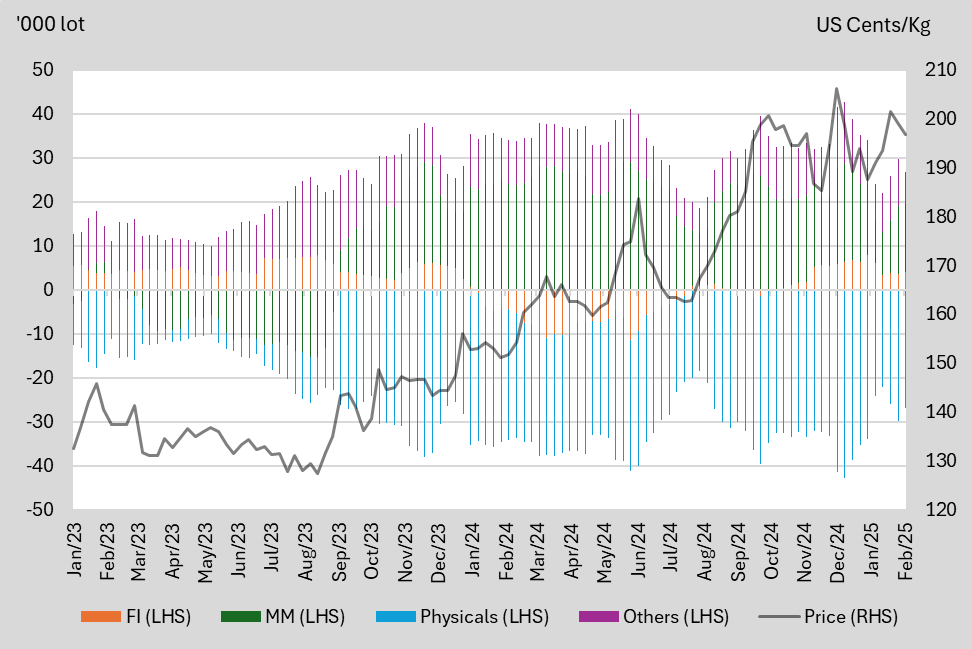

SGX SICOM Rubber Futures – TSR20

Net Long/Short and Price Comparison

We highlight the key price levels that each participants switches their positions between net long and net short based on 2024 data.

2024 | Financial Institution (FI) | Manage Money (MM) | Physicals | Others |

Net Long | Below US$1.90/kg | NA | NA | NA |

Net Short | Above US$1.60/kg | NA | NA | NA |

Net-position WoW Change | Remarks | |

FI | +0.41 | Increase from previous week |

MM | +0.07 | Continued increase YTD |

Physicals | +3.02 | Reduction in decline from the previous week |

Others | -3.50 | Decrease for the first time in 3 weeks |

Figure 9: Net-positions by participant segment and price comparison

Source: SGX, KGI Research

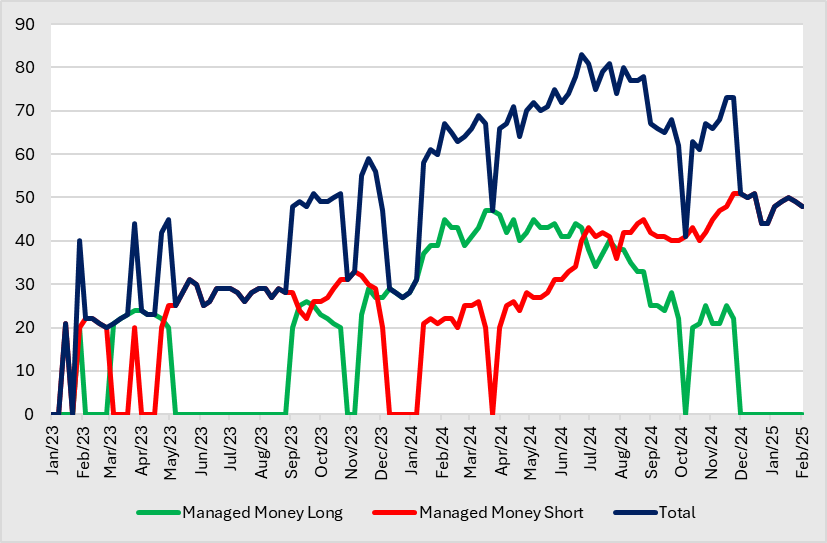

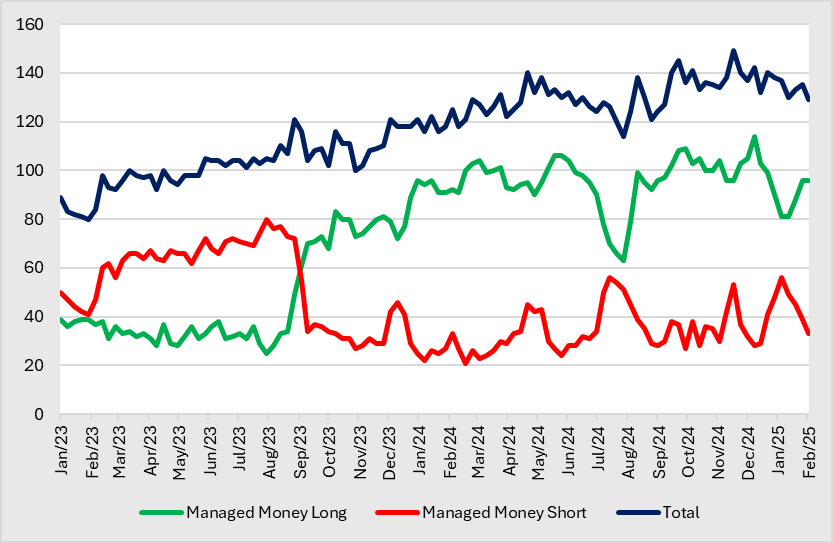

Long/Short Traders Snapshot

- Managed Money. The number of MM with long positions rebounded for 3 consecutive weeks to 96, representing a high since the start of the year. Accordingly, the number of MM with short positions fell for 4 consecutive weeks to 33, representing a low since the start of 2025.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 114 | 56 | 89 | 80 |

Low | 63 | 21 | 25 | 27 |

Figure 10: Number of position holders rubber futures

Source: SGX, KGI Research

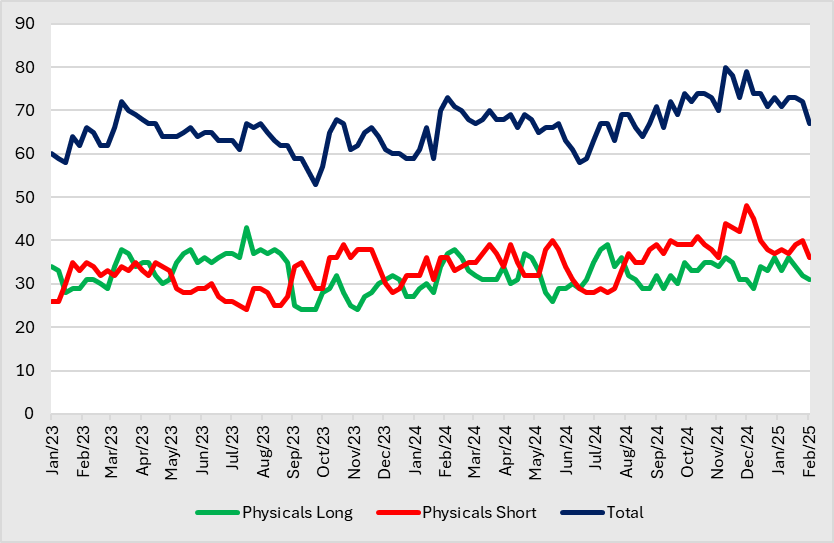

- Physicals. The number of physicals with long positions declined for 3 consecutive weeks to 31, representing a low since mid-December 2024. Accordingly, the number of physicals with short positions retreated to 36 after 2 consecutive weeks of increase. Seasonally, more physicals are prone to long in early Q3, and there are more physicals with short positions in Q4.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 39 | 48 | 43 | 39 |

Low | 26 | 28 | 24 | 24 |

Figure 11: Number of position holders rubber futures

Source: SGX, KGI Research

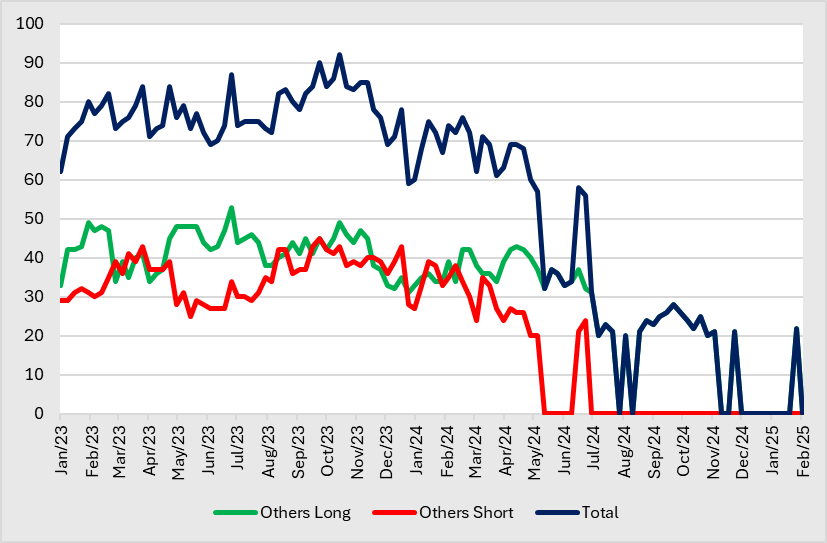

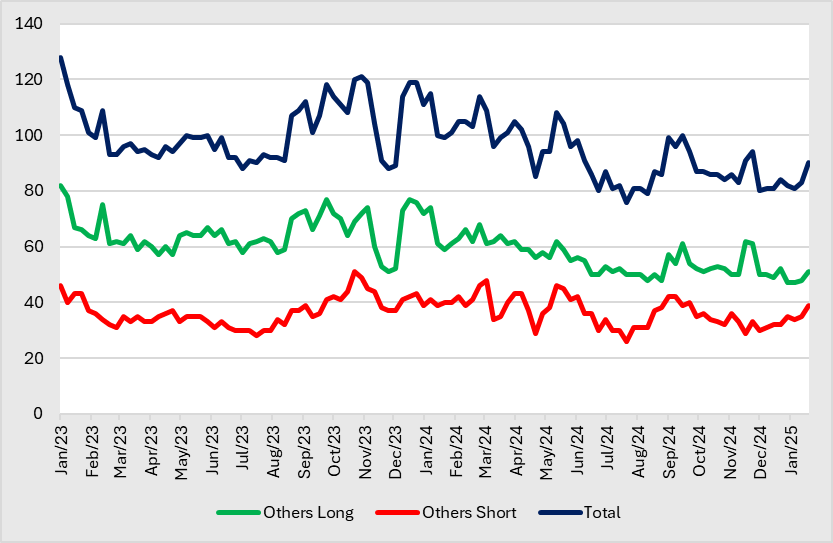

- Others. The number of long holders rebounded for 2 consecutive weeks to its current level at 51, but still hovers near a low since 2023. On the other hand, the number of short holders increased for 2 consecutive weeks to its current level at 39.

2024 | 2023 | |||

Long | Short | Long | Short | |

High | 77 | 48 | 82 | 51 |

Low | 48 | 26 | 51 | 28 |

Figure 12: Number of position holders rubber futures

Source: SGX, KGI Research

Participant Category | Description |

Financial Institutions | An entity, such as a broker trading desk, bank trading desk or swap dealer, that uses the futures markets to manage or hedge the risk. |

Managed Money | An entity that is engaged in organized futures trading on behalf of funds or other special investment purpose vehicles such as Pension Funds, Asset Managers, Hedge Funds, Proprietary Trading Groups, Family Offices, etc. |

Physicals | An entity that predominantly engages in the physical markets and uses the futures markets to manage or hedge risks associated with the conduct of those activities. Such activities could include the production, processing, trading, packing or handling of a physical commodity, or the provision of transportation, warehousing or distribution services. |

Others | Every other trader that is not placed into one of the other three categories. E.g., Broker Agency, Bank Agency, Inter-Dealer Brokers, etc. |