Trading Ideas 17 February 2025 : DBS Group Holding Ltd (DBS SP), Yidu Tech Inc. (2158 HK)), General Electric Co (GE US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

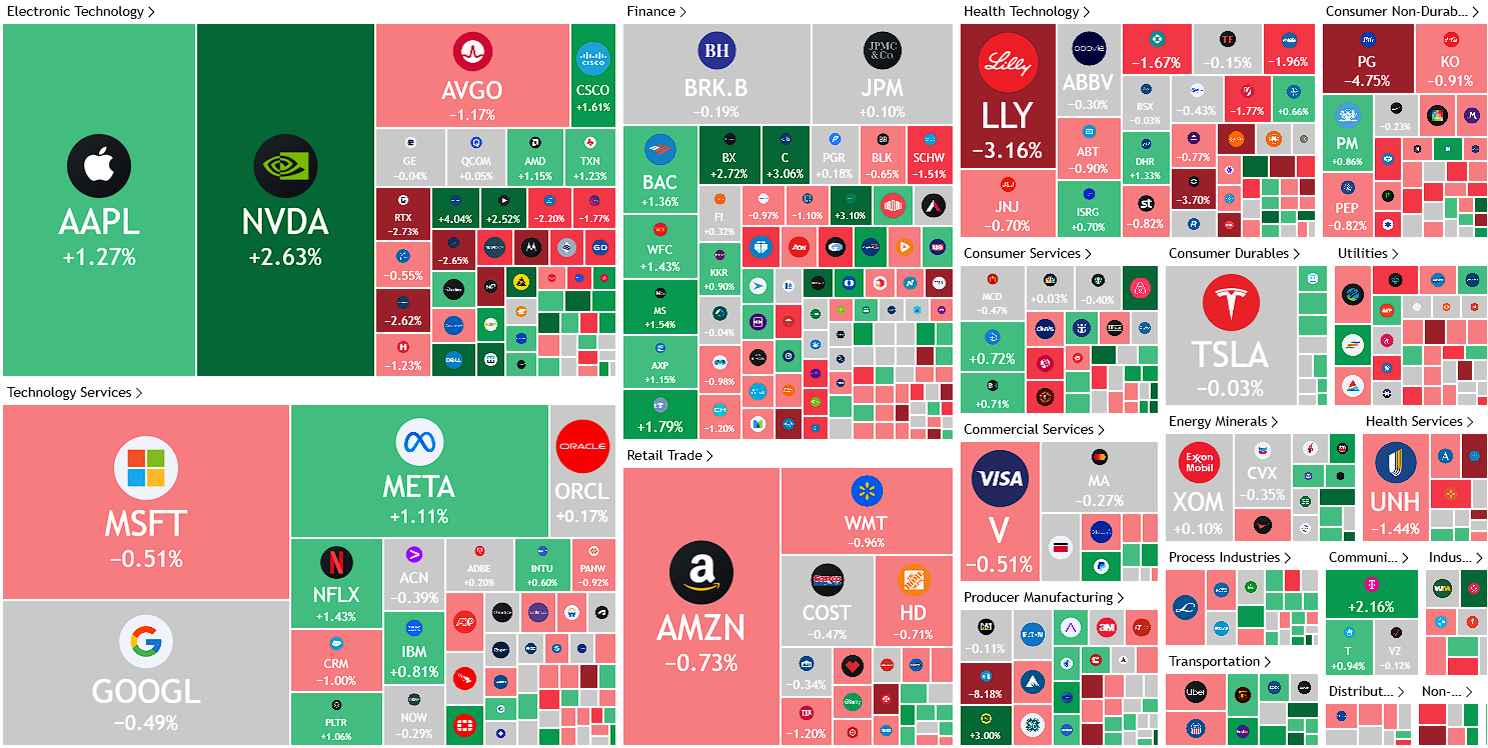

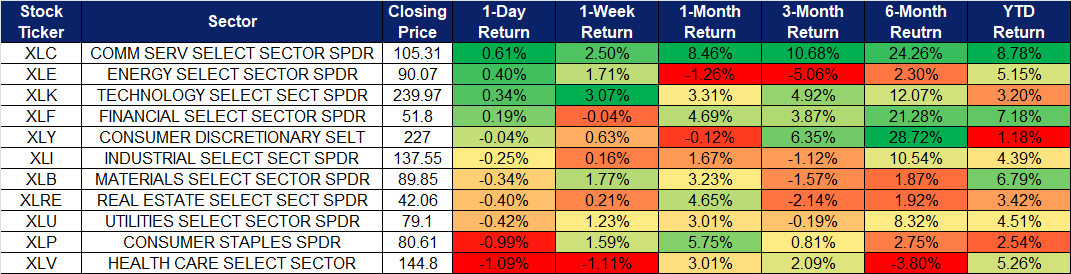

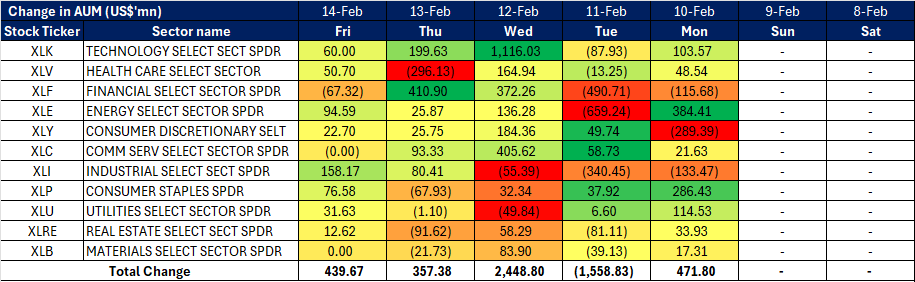

United States

Hong Kong

DBS Group Holding Ltd (DBS SP): Impeccable performance

- RE-ITERATE BUY Entry – 44 Target– 48 Stop Loss – 42

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage. DBS Group also acts as the primary dealer in Singapore government securities.

- Leadership changes ahead of CEO transition. DBS Bank has appointed Derrick Goh as its first Group Chief Operating Officer (COO), effective 1 April, overseeing operations and transformation. He will also join the bank’s executive committee. Koh Kar Siong will take over as head of audit and join the management committee. Additionally, Jimmy Ng, current head of operations, will retire on 1 July but continue as a senior adviser for AI until year-end. These changes come as Piyush Gupta prepares to step down as CEO on 28 March, with Tan Su Shan, deputy CEO since August 2024, set to succeed him. The leadership changes at DBS Bank signal a strategic transition aimed at sustaining growth and strengthening its operational and digital transformation efforts. DBS’ leadership changes reinforce its commitment to operational efficiency, and governance, ensuring continued growth amid evolving global banking trends. The bank is well-positioned for sustained profitability and market leadership under its new executive team.

- Special bonus and capital return amid record profits. DBS will distribute a one-time S$1,000 bonus to all staff except senior managers, totaling S$32 million, as a reward for their contribution to its record performance. This bonus will benefit 90-95% of employees. The bank also announced a capital return dividend of S$0.15 per share per quarter for FY25, with plans for similar distributions over the next two years. This is part of its strategy to reduce excess capital through dividends, special payouts, and share buybacks. For 4Q24, DBS reported a net profit of S$2.52 billion, 11% YoY increase, bringing its full-year net profit to a record S$11.29 billion, up 12% YoY. Despite macroeconomic uncertainty, interest rate trends and geopolitical risks, DBS managed to outperform expectations. We believe that the bank remains well-positioned for long-term growth, backed by record earnings, strong leadership succession, and continued investment in technology.

- 4Q24 results review. Total income for 4Q24 rose 11% to S$5.51bn and net profit rose 11% YoY to S$2.52bn, compared with S$2.27bn from the year-ago period. DBS’ full-year net profit was brought to a new record high of S$11.29bn, up 12% from the year-ago period. DBS declared Q4 dividend at S$0. 0.15 per share per quarter to be paid out over financial year 2025; it expects to pay out a similar amount of capital in the next two years.

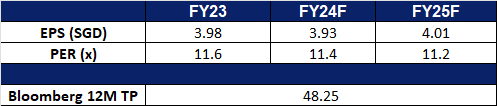

- Market Consensus.

(Source: Bloomberg)

IFast Corp Ltd. (IFast SP): Impressive results shows growth

- RE-ITERATE BUY Entry – 7.80 Target– 8.40 Stop Loss – 7.50

- iFast Corporation Ltd. operates a funds and investments distribution platform in the Asia Pacific region.

- Strong Growth in 4Q24 Results. iFast delivered robust 4Q24 results, with net profit surging 46.3% year-over-year to S$19.3 million, up from S$13.2 million in 4Q23. Revenue grew 16.4% to S$90 million, driven by strong performance in its core wealth management platform and a turnaround in iFast Global Bank (iGB). Notably, iGB became profitable for the first time, posting a S$0.3 million profit in 4Q24 compared to a S$2.57 million loss a year ago. Looking ahead to 2025, iFast expects continued growth across its business segments, with further expansion in assets under administration (AUA) for its wealth management platform and full-year profitability at iGB. iFast remains confident in achieving robust revenue and profitability growth in 2025, barring unforeseen circumstances.

- Expanding into China. In December 2024, iFAST Global Markets (iGM) Singapore launched a China Desk to enhance its ability to serve Chinese clients both within and outside Singapore. The unit aims to support investors looking to access the Chinese market, with initial operations in Singapore and Hong Kong. The China Desk is part of iFast’s broader strategy to expand its global business footprint, offering tailored advisory services to investors who prefer professional guidance over self-directed investing. Management sees this as a meaningful step toward deepening iFast’s engagement with Chinese investors and strengthening its international presence.

- Introducing Cross-Currency Transfers. iFAST Global Bank (iGB) launched EzRemit in September 2024, a service designed to streamline cross-currency transfers for its Digital Personal Banking (DPB) customers. With EzRemit, users can transfer money quickly and affordably to over 50 countries in more than 25 currencies. The EzWallet feature further enhances convenience by enabling transfers to international banks and over 50 e-wallets, including Malaysia’s TNG, the Philippines’ GCash, and Pakistan’s Easypaisa. By eliminating reliance on local financial players, iGB’s enhanced cross-border capabilities are expected to attract more customers and strengthen its competitive positioning in the digital banking space.

- 4Q24 results review. Revenue increased by 26.7% YoY to S$104.1mn in 4Q24 compared with S$82.2mn in 4Q23, driven by improvement in the group’s core wealth management platform business and turnaround of its banking business, iFast Global Bank (iGB). Net profit rose by 46.3% YoY to S$19.3mn in 4Q24 compared with S$13.2mn in 4Q23. Basis EPS rose to 6.47 Scents in 4Q24, compared to 4.46 Scents in 4Q23.

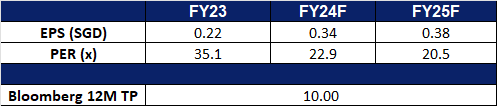

- Market Consensus.

(Source: Bloomberg)

Yidu Tech Inc. (2158 HK): AI in Healthcare

- BUY Entry – 7.70 Target – 8.70 Stop Loss – 7.20

- Yidu Tech Inc is an investment holding company primarily engaged in providing healthcare solutions built on big data and artificial intelligence (AI) technologies. The Company mainly operates its business through three segments. The Big Data Platform and Solutions segment is engaged in providing data intelligence platform and data analytics-driven solutions. The Life Sciences Solutions segment is engaged in supporting the full life-cycle management of pharmaceuticals and medical devices, which covers all phases from clinical development to post-market commercialization. The Health Management Platform and Solutions segment is engaged in providing AI-enabled health management solutions. The Company conducts its business in the domestic and overseas markets.

- Integration of DeepSeek. Yidu Technology has integrated the DeepSeek AI model into its proprietary “AI Medical Brain,” YiduCore, further accelerating the large-scale application of AI in healthcare. This integration enhances YiduCore’s ability to extract deeper insights from medical data, improving disease analysis, diagnosis, and public health applications. By breaking down data silos and enhancing decision-making, the AI-driven platform aims to reduce healthcare costs, improve efficiency across the industry’s supply chain, and drive operational growth for Yidu Tech.

- Expanding Digital Health Market in China. China’s rapid advancements in AI, showcased by the recent launch of Qwen2.5-Max, Kimi k1.5, and DeepSeek-V3, underscore the country’s commitment to technological self-sufficiency. These AI models enable enhanced diagnostics, personalized treatment recommendations, and improved patient-provider communication, fueling the expansion of the digital health sector. According to GlobalData, China accounted for 20% of the Asia-Pacific digital health market in 2024, reflecting rising demand for AI-driven healthcare innovations. As a key player in China’s digital health space, Yidu Tech stands to benefit significantly from the country’s AI-driven growth.

- Strengthening Global Presence. Yidu Tech’s global reach continues to expand, as Founder and Chairwoman Ms. Gong Rujing represented China’s AI-powered healthcare sector at the World Economic Forum Annual Meeting 2025 in Switzerland. She highlighted the company’s impact, including 240+ scientific publications, a 40% increase in clinical trial efficiency, and health insurance solutions benefiting 34 million policyholders. Yidu Tech is actively expanding into Southeast Asia and the U.S., with plans to further establish its presence in Japan, Europe, and other key markets. This growing international footprint positions Yidu Tech as a leading force in AI-powered healthcare innovation.

- 1H24 earnings. Revenue fell by 7.6% YoY to RMB329.4mn in 1H24 compared with RMB356.5mn in 1H23. Net loss of RMB56.4mn in 1H24 compared with a net loss of RMB79.6mn in 1H23. Net loss per share was RMB0.04 in 1H24, compared to net loss per share of RMB0.07 in 1H23.

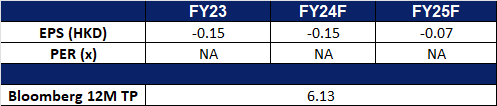

- Market consensus.

(Source: Bloomberg)

Horizon Robotics (9660 HK): Strong growth in smart driving in 2025

- BUY Entry – 6.60 Target – 7.60 Stop Loss – 6.10

- Horizon Robotics is an investment holding company principally engaged in the provision of advanced driver assistance systems (ADAS) and autonomous driving (AD) solutions for passenger cars. The Company operates primarily through two segments. The Automotive Solutions segment is principally engaged in the provision of product solutions and license and services. The Company’s solutions mainly include Horizon Mono, Horizon Pilot, Horizon SuperDrive, and automotive in-cabin solution for the passenger vehicle. The Non-Automotive Solutions segment enables device manufacturers to design and manufacture devices and appliances, such as lawn mowers, fitness mirrors, and air purifiers. The Company mainly conducts its businesses in the domestic market.

- Launch of Journey 6 on BYD DiPilot C. BYD recently unveiled its National Smart Driving Strategy and introduced the Tri-camera Edition of DiPilot C, marking the global debut and road deployment of Horizon Robotics’ Journey 6 intelligent computing platform. With the official delivery of BYD models equipped with DiPilot C, Journey 6 has now entered large-scale mass production as of February. Leveraging its extensive experience in mass production and engineering implementation, Horizon Robotics aims to accelerate the adoption of advanced intelligent driving, creating the world’s largest smart driving user ecosystem. Given BYD’s dominant market share in China, this partnership is expected to drive substantial growth for Horizon Robotics.

- Advancements in Smart Driving Solutions. At its “Beyond the Horizon – Smart Driving Experience Day” in Shanghai, Horizon Robotics showcased its latest SuperDrive full-scenario smart driving solution. Designed to deliver a human-like, highly efficient, and intuitive driving experience, SuperDrive demonstrated advanced capabilities such as seamless U-turn execution and roaming mode support. Management emphasized that by 2025, Horizon’s smart driving solutions are expected to surpass 10 million units in mass production, reinforcing its leadership in China’s intelligent driving sector. Additionally, the SuperDrive solution is set to enter mass production within the year, further expanding Horizon’s market presence.

- Strategic Partnership with iMotion. Horizon Robotics has signed a strategic cooperation agreement with iMotion, focusing on automotive intelligence technologies and smart driving solutions. The partnership aims to deliver high-quality, innovative smart driving systems to both Chinese and international automakers, strengthening Horizon’s footprint in global markets. The collaboration centers on mass production projects leveraging Horizon’s Journey 6 platform, with iMotion successfully deploying advanced algorithms on the system. iMotion is also working with Horizon Continental Technology Shanghai Co., Ltd., a joint venture with Continental, to develop lightweight urban smart driving solutions. By 2H2025, iMotion’s advanced driving domain controllers, powered by Journey 6, will be deployed in two flagship models from a leading Chinese automaker and introduced to global markets, marking a key milestone in Horizon’s expansion.

- 1H24 earnings. Horizon Robotics recorded a loss of 5.1bn in the first six months of 2024, compared with a loss of 1.9bn yuan in the same period a year earlier as research costs grew, according to prospectus. Revenue rose by 152% to 935mn yuan in 1H24. In October 2024, Horizon Robotics raised HK$5.4 billion in its initial public offering (IPO) in Hong Kong. This was the largest IPO in Hong Kong in 2024.

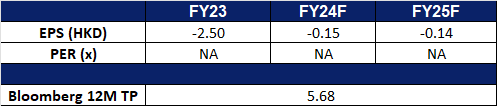

- Market consensus.

(Source: Bloomberg)

General Electric Co (GE US): Driving innovation in aviation and defence

- BUY Entry – 205 Target – 225 Stop Loss – 195

- GE Electric Co (doing business as GE Aerospace) operates as an aircraft engine supplier company. The Company provides jet and turboprop engines, as well as integrated systems for commercial, military, business, and general aviation aircraft. GE Aerospace serves customers worldwide.

- Expected steady growth in the global aviation industry. The global aviation market is projected to grow at an annual rate of 4%–5% from 2024 to 2030, driven primarily by demand for commercial aviation and air cargo. Increasing demand for new, more efficient, and lower-emission aircraft engines is expected to benefit GE Aerospace.

- Growth in military and defense business. Strong demand for military aerospace equipment from the U.S. and other countries, particularly in fighter jets, drones, and other defense applications, is driving growth. GE Aerospace’s F110 and F414 military engines are already in service across multiple armed forces, and as geopolitical uncertainties rise, demand for advanced defense technologies is expected to continue growing.

- 4Q24 results. Adjusted revenue grew 16% YoY to US$9.88bn, beating expectations by US$410mn. Non-GAAP EPS of US$1.32, exceeding estimates by US$0.28. Total orders increased 46% YoY to US$15.5bn. The company announced a 30% dividend increase and a US$7bn share repurchase program.

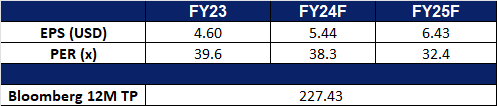

- Market consensus

(Source: Bloomberg)

Kratos Defense & Security Solutions Inc (KTOS US): Capitalizing on rising global defence spending

- BUY Entry – 26.6 Target – 30.6 Stop Loss – 24.6

- Kratos Defense & Security Solutions, Inc. operates as a defense contractor and security systems integrator for the federal government and for state and local agencies. The Company offers services in weapon systems lifecycle support, military weapon range, security and surveillance systems, and IT engineering.

- Benefit from defence industry. Kratos Defense & Security Solutions is strategically positioned to benefit from rising U.S. defense expenditures fuelled by geopolitical tensions and ongoing government initiatives. With the Pentagon’s budget nearing US$1tn and an increasing commitment to defense spending, demand for Kratos’ high-performance technologies, especially within its Government Services and Unmanned Systems divisions, is expected to grow. Kratos’ cost-efficient, advanced unmanned systems and hypersonic technologies are well-aligned with the government’s push for budget optimization and military innovation. As defense budgets rise, Kratos is poised to secure new contracts, driving sustained growth and reinforcing its leadership in national security initiatives.

- Rise in global defense expenditure. In 2024, global defense spending rose to US$2.46tn, a 7.4% increase driven by geopolitical tensions and security concerns, with significant budget expansions in Europe, Asia, and MENA. Europe’s spending grew by 11.7%, with Russia’s budget surging by 41.9%. While the U.S. defense budget remained constrained, other regions increased investments in advanced defense capabilities, particularly unmanned systems and hypersonic technologies. Despite potential budgetary revisions, Kratos Defense & Security Solutions is poised to benefit from rising military budgets, with increased demand for its unmanned aerial systems, hypersonic weapons, and C5ISR solutions, areas where Kratos excels. Its vertical integration and expertise make it a strong contender for long-term contracts in the growing global defense market.

- Secured multiple contracts and revenue streams. Kratos has recently secured multiple high-value contracts, reinforcing its position as a leader in defense innovation. A US$34.9mn contract with the U.S. Marine Corps to advance the XQ-58A Valkyrie unmanned aerial system positions Kratos at the forefront of next-generation warfare strategies, where unmanned systems will complement manned aircraft for enhanced battlefield effectiveness. Additionally, a hypersonic systems contract with a total potential value of US$100mn, along with an initial US$15mn in funding, underscores Kratos’ critical role in advancing hypersonic technologies for modern defense. These contracts present Kratos’ expertise while also ensure recurring revenue and long-term government partnerships, setting the stage for continued growth in key defense sectors.

- 3Q24 results. Kratos Defense & Security Solutions Inc’s revenue increased by 0.5% YoY to US$275.9mn in 3Q24, below estimates by US$1.32mn. It delivered non-GAAP EPS of US$0.11, above estimates by US$0.03. The company projected a 10% YoY revenue growth for 2025.

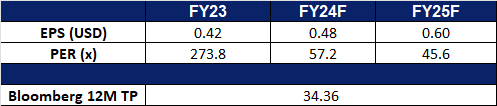

- Market consensus

(Source: Bloomberg)

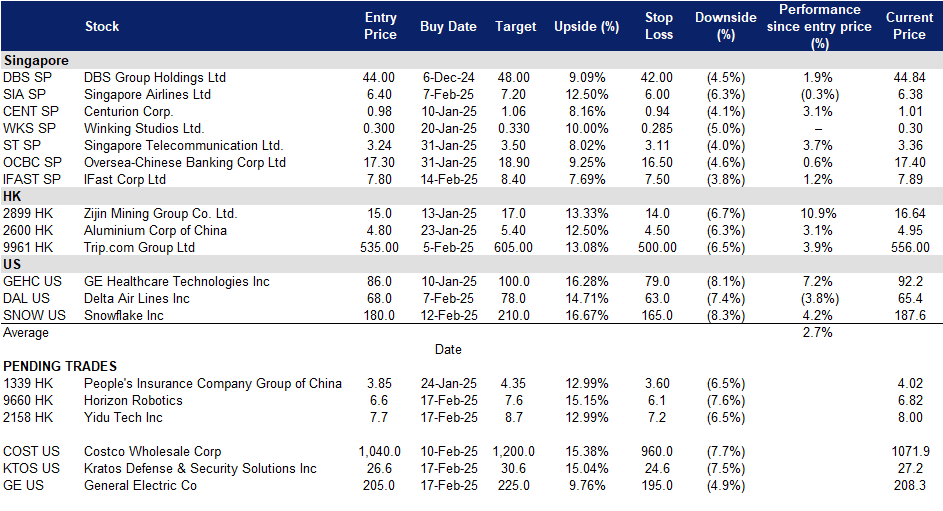

Trading Dashboard Update: Add iFast Corp Ltd. (IFAST US) at S$17.30.