Trading Ideas 14 February 2025 : IFast Corp Ltd. (IFast SP), Horizon Robotics (9660 HK), Kratos Defense & Security Solutions Inc (KTOS US)

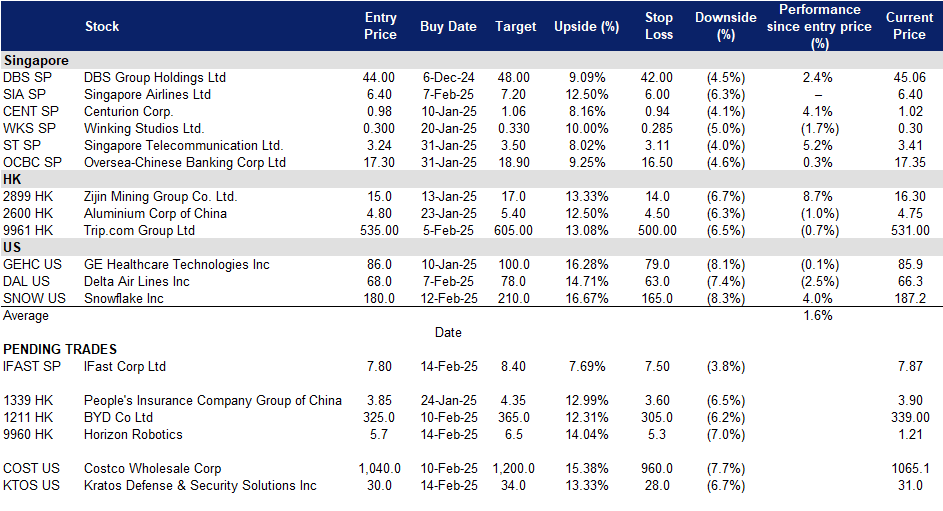

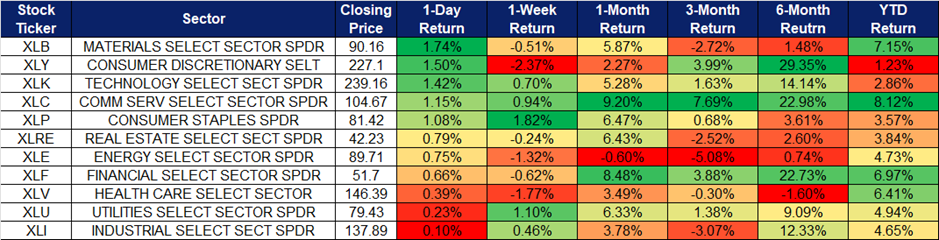

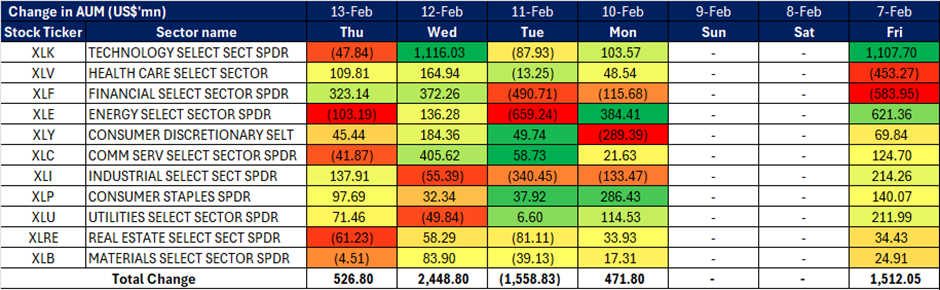

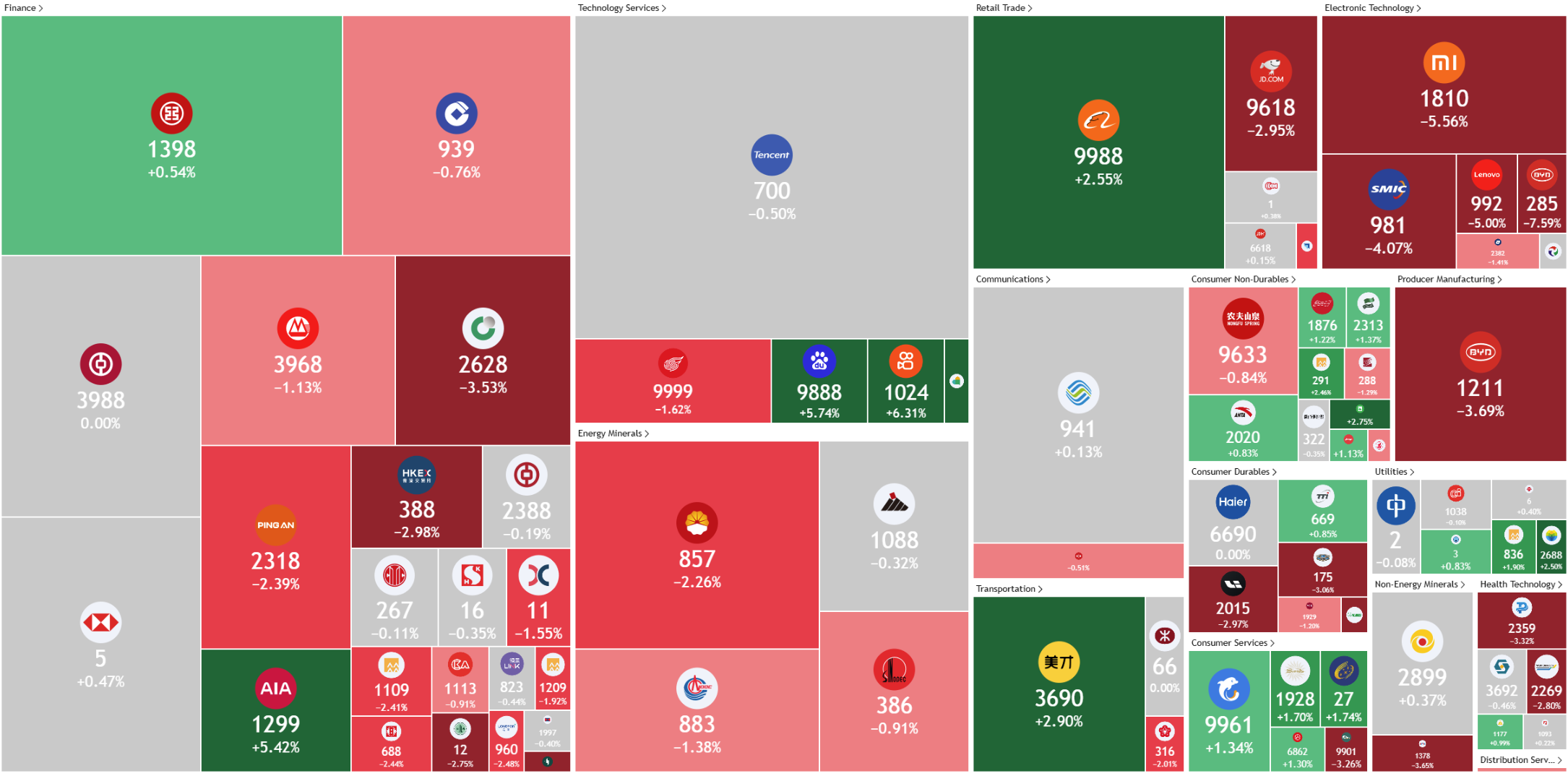

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

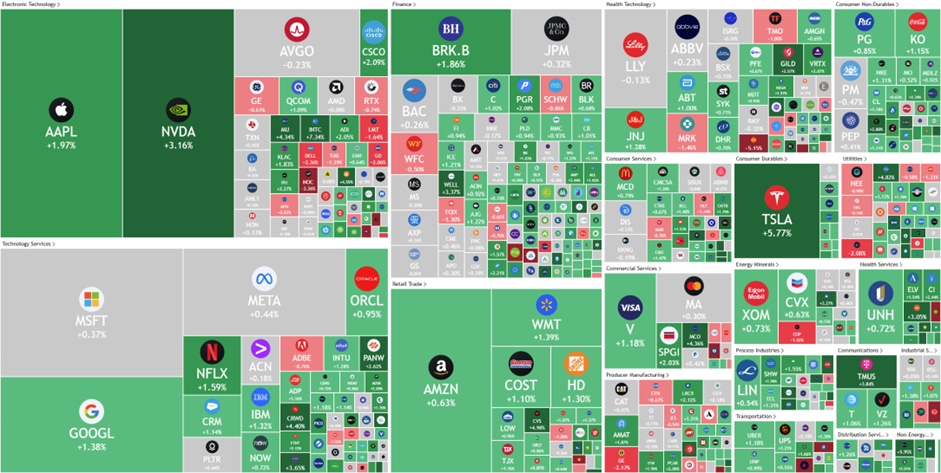

United States

Hong Kong

IFast Corp Ltd. (IFast SP): Impressive results shows growth

- BUY Entry – 7.80 Target– 8.40 Stop Loss – 7.50

- iFast Corporation Ltd. operates a funds and investments distribution platform in the Asia Pacific region.

- Strong Growth in 4Q24 Results. iFast delivered robust 4Q24 results, with net profit surging 46.3% year-over-year to S$19.3 million, up from S$13.2 million in 4Q23. Revenue grew 16.4% to S$90 million, driven by strong performance in its core wealth management platform and a turnaround in iFast Global Bank (iGB). Notably, iGB became profitable for the first time, posting a S$0.3 million profit in 4Q24 compared to a S$2.57 million loss a year ago. Looking ahead to 2025, iFast expects continued growth across its business segments, with further expansion in assets under administration (AUA) for its wealth management platform and full-year profitability at iGB. iFast remains confident in achieving robust revenue and profitability growth in 2025, barring unforeseen circumstances.

- Expanding into China. In December 2024, iFAST Global Markets (iGM) Singapore launched a China Desk to enhance its ability to serve Chinese clients both within and outside Singapore. The unit aims to support investors looking to access the Chinese market, with initial operations in Singapore and Hong Kong. The China Desk is part of iFast’s broader strategy to expand its global business footprint, offering tailored advisory services to investors who prefer professional guidance over self-directed investing. Management sees this as a meaningful step toward deepening iFast’s engagement with Chinese investors and strengthening its international presence.

- Introducing Cross-Currency Transfers. iFAST Global Bank (iGB) launched EzRemit in September 2024, a service designed to streamline cross-currency transfers for its Digital Personal Banking (DPB) customers. With EzRemit, users can transfer money quickly and affordably to over 50 countries in more than 25 currencies. The EzWallet feature further enhances convenience by enabling transfers to international banks and over 50 e-wallets, including Malaysia’s TNG, the Philippines’ GCash, and Pakistan’s Easypaisa. By eliminating reliance on local financial players, iGB’s enhanced cross-border capabilities are expected to attract more customers and strengthen its competitive positioning in the digital banking space.

- 4Q24 results review. Revenue increased by 26.7% YoY to S$104.1mn in 4Q24 compared with S$82.2mn in 4Q23, driven by improvement in the group’s core wealth management platform business and turnaround of its banking business, iFast Global Bank (iGB). Net profit rose by 46.3% YoY to S$19.3mn in 4Q24 compared with S$13.2mn in 4Q23. Basis EPS rose to 6.47 Scents in 4Q24, compared to 4.46 Scents in 4Q23.

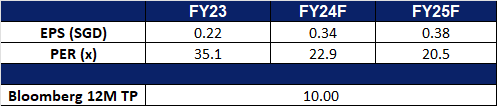

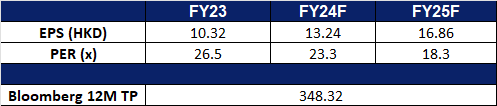

- Market Consensus.

(Source: Bloomberg)

Singapore Telecommunications Ltd. (ST SP): Further integration of AI

- RE-ITERATE BUY Entry – 3.24 Target– 3.50 Stop Loss – 3.11

- Singapore Telecommunications Limited wireless telecommunication services. The Company offers diverse range of services including fixed, mobile, data, internet, TV, and digital solutions. Singapore Telecommunications serves customers worldwide.

- Expanding AI Integration. Singtel has introduced free access to Perplexity Pro as part of a strategic initiative to democratize AI tools and enhance customer engagement. The year-long subscription, typically valued at SGD 270, is available to all Singtel broadband, mobile, and TV subscribers. This move positions Singtel as a gateway for mainstream AI adoption, particularly targeting users curious about generative AI but hesitant to integrate it into their daily lives. While early adopters may already use ChatGPT or Claude, many remain reluctant to try standalone AI applications. By bundling Perplexity Pro, Singtel eliminates barriers and provides a risk-free opportunity for users to explore AI’s potential. This partnership underscores Singtel’s focus on leveraging AI as a unique value proposition to deepen customer loyalty and enhance its service offering.

- Strengthening Local Connections Through Marketing. Singtel has released a new film celebrating the evolution of technology and its role in enriching lives, highlighting the power of its 10Gbps broadband service. Titled The Corridor, the 90-second film takes viewers on a nostalgic journey from the era of dial-up modems and pagers to today’s ultra-fast broadband. It showcases how Singtel has consistently bridged distances and strengthened bonds among families and communities. Featuring relatable personalities, the film emphasizes how technology empowers everyone—from small business owners to vulnerable groups—while aligning with Singtel’s festive Chinese New Year campaign. The campaign also promotes special deals on its 10Gbps plans, Singapore’s fastest home broadband service, reinforcing Singtel’s position as a trusted technology partner in everyday life.

- Partnership with DSTA and HTX. Singtel has announced a collaboration with Singapore’s Defence Science and Technology Agency (DSTA) and the Home Team Science and Technology Agency (HTX) to implement 5G network slicing technology, aimed at enhancing the nation’s defence and security capabilities. This customised solution leverages Singtel’s 5G network to deliver high-speed connectivity, low latency, and dedicated bandwidth, enabling the deployment of autonomous vehicles, robotics, and artificial intelligence (AI). It also supports the secure and efficient analysis of large data volumes, empowering first responders to make faster, more informed decisions and respond swiftly. This partnership builds on the successful trial conducted in July 2024 on Sentosa Island, where 5G was used for video-intensive transmissions and the autonomous control of unmanned vehicles and drones.

- 1H24 results review. Revenue fell by 0.5% YoY to S$6.99bn in 1H25, compared with S$7.03bn in 1H24. Net profit fell by 42.4% to S$1.23bn in 1H25, compared to S$2.14bn in 1H24, due to an exceptional gain from the issuance of Telkomsel shares to integrate IndiHome in the corresponding period last year. EBIT excluding associates contribution rose by 27.3% to S$738mn in 1H25, compared to S$580mn in 1H24, mainly driven by Optus and NCS.

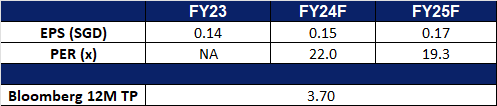

- Market Consensus.

(Source: Bloomberg)

Horizon Robotics (9660 HK): Strong growth in smart driving in 2025

- BUY Entry – 5.70 Target – 6.50 Stop Loss – 5.30

- Horizon Robotics is an investment holding company principally engaged in the provision of advanced driver assistance systems (ADAS) and autonomous driving (AD) solutions for passenger cars. The Company operates primarily through two segments. The Automotive Solutions segment is principally engaged in the provision of product solutions and license and services. The Company’s solutions mainly include Horizon Mono, Horizon Pilot, Horizon SuperDrive, and automotive in-cabin solution for the passenger vehicle. The Non-Automotive Solutions segment enables device manufacturers to design and manufacture devices and appliances, such as lawn mowers, fitness mirrors, and air purifiers. The Company mainly conducts its businesses in the domestic market.

- Launch of Journey 6 on BYD DiPilot C. BYD recently unveiled its National Smart Driving Strategy and introduced the Tri-camera Edition of DiPilot C, marking the global debut and road deployment of Horizon Robotics’ Journey 6 intelligent computing platform. With the official delivery of BYD models equipped with DiPilot C, Journey 6 has now entered large-scale mass production as of February. Leveraging its extensive experience in mass production and engineering implementation, Horizon Robotics aims to accelerate the adoption of advanced intelligent driving, creating the world’s largest smart driving user ecosystem. Given BYD’s dominant market share in China, this partnership is expected to drive substantial growth for Horizon Robotics.

- Advancements in Smart Driving Solutions. At its “Beyond the Horizon – Smart Driving Experience Day” in Shanghai, Horizon Robotics showcased its latest SuperDrive full-scenario smart driving solution. Designed to deliver a human-like, highly efficient, and intuitive driving experience, SuperDrive demonstrated advanced capabilities such as seamless U-turn execution and roaming mode support. Management emphasized that by 2025, Horizon’s smart driving solutions are expected to surpass 10 million units in mass production, reinforcing its leadership in China’s intelligent driving sector. Additionally, the SuperDrive solution is set to enter mass production within the year, further expanding Horizon’s market presence.

- Strategic Partnership with iMotion. Horizon Robotics has signed a strategic cooperation agreement with iMotion, focusing on automotive intelligence technologies and smart driving solutions. The partnership aims to deliver high-quality, innovative smart driving systems to both Chinese and international automakers, strengthening Horizon’s footprint in global markets. The collaboration centers on mass production projects leveraging Horizon’s Journey 6 platform, with iMotion successfully deploying advanced algorithms on the system. iMotion is also working with Horizon Continental Technology Shanghai Co., Ltd., a joint venture with Continental, to develop lightweight urban smart driving solutions. By 2H2025, iMotion’s advanced driving domain controllers, powered by Journey 6, will be deployed in two flagship models from a leading Chinese automaker and introduced to global markets, marking a key milestone in Horizon’s expansion.

- 1H24 earnings. Horizon Robotics recorded a loss of 5.1bn in the first six months of 2024, compared with a loss of 1.9bn yuan in the same period a year earlier as research costs grew, according to prospectus. Revenue rose by 152% to 935mn yuan in 1H24. In October 2024, Horizon Robotics raised HK$5.4 billion in its initial public offering (IPO) in Hong Kong. This was the largest IPO in Hong Kong in 2024.

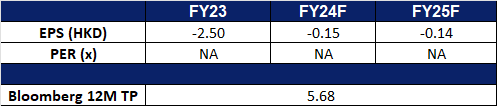

- Market consensus.

(Source: Bloomberg)

BYD Co. Ltd. (1211 HK): Upcoming smart-car strategy

- RE-ITERATE BUY Entry – 325 Target – 365 Stop Loss – 305

- BYD Company Limited is a China-based company principally engaged in the manufacture and sales of transportation equipment. The Company is also engaged in the manufacture and sales of electronic parts and components and electronic devices for daily use. The Company’s products include rechargeable batteries and photovoltaic products, mobile phone parts and assembly, and automobiles and related products. The Company mainly conducts its businesses in China, the United States and Europe.

- BYD to Unveil Smart-Car Strategy. BYD is set to reveal its vehicle intelligence strategy on February 10, 2025, with market expectations that the company will integrate autonomous-driving technology into its more affordable models. The event invitation, which emphasizes “making advanced autonomous-driving technology affordable for everyone,” suggests that BYD aims to democratize self-driving capabilities in China’s increasingly competitive autonomous vehicle market. The company is expected to expand the number of models equipped with autonomous-driving features, reinforcing its position in the sector.

- Strong January Sales Despite Holiday Impact. BYD sold 300,538 electric vehicles in January, marking a 47.5% YoY increase. Exports surged to 66,336 units, up 83.3% YoY, setting a new monthly record. The company also produced 327,864 vehicles, up 49.1% YoY, and installed 15.511 GWh of battery capacity into EVs. While MoM sales declined, the drop was attributed to the Chinese New Year holiday (January 27–February 4), which limited domestic sales activity in the final week of January. BYD also ranked as the top automobile brand in China’s passenger car market by sales revenue in 2024, highlighting its continued dominance, a trend expected to persist in 2025.

- BYD Expands Southeast Asia Presence via Grab Partnership. BYD has partnered with Grab to provide up to 50,000 BYD electric vehicles to Grab’s driver-partners across Southeast Asia, increasing the availability of green vehicles for ride-hailing users. High upfront costs remain a key barrier to EV adoption in the region, and this partnership aims to accelerate transportation electrification by offering Grab’s fleet and driver-partners access to BYD EVs at competitive rates with extended battery warranties. The collaboration will also integrate IoT connectivity between BYD’s vehicles and Grab’s platform, enhancing operational efficiency. This move strengthens BYD’s brand presence in Southeast Asia, a fast-growing EV market with significant long-term potential.

- 3Q24 earnings. Operating revenue increased by 24.0% to RMB201.1bn in 3Q24, compared with RMB162.2bn in 3Q23. Net profit rose by 11.5% to RMB11.6bn in 3Q24, compared to RMB10.4bn in 3Q23. Basic EPS rose to RMB4.00 in 3Q24, compared with RMB3.58 in 3Q23.

- Market consensus.

(Source: Bloomberg)

Kratos Defense & Security Solutions Inc (KTOS US): Capitalizing on rising global defence spending

- BUY Entry – 30 Target – 34 Stop Loss – 28

- Kratos Defense & Security Solutions, Inc. operates as a defense contractor and security systems integrator for the federal government and for state and local agencies. The Company offers services in weapon systems lifecycle support, military weapon range, security and surveillance systems, and IT engineering.

- Benefit from defence industry. Kratos Defense & Security Solutions is strategically positioned to benefit from rising U.S. defense expenditures fuelled by geopolitical tensions and ongoing government initiatives. With the Pentagon’s budget nearing US$1tn and an increasing commitment to defense spending, demand for Kratos’ high-performance technologies, especially within its Government Services and Unmanned Systems divisions, is expected to grow. Kratos’ cost-efficient, advanced unmanned systems and hypersonic technologies are well-aligned with the government’s push for budget optimization and military innovation. As defense budgets rise, Kratos is poised to secure new contracts, driving sustained growth and reinforcing its leadership in national security initiatives.

- Rise in global defense expenditure. In 2024, global defense spending rose to US$2.46tn, a 7.4% increase driven by geopolitical tensions and security concerns, with significant budget expansions in Europe, Asia, and MENA. Europe’s spending grew by 11.7%, with Russia’s budget surging by 41.9%. While the U.S. defense budget remained constrained, other regions increased investments in advanced defense capabilities, particularly unmanned systems and hypersonic technologies. Despite potential budgetary revisions, Kratos Defense & Security Solutions is poised to benefit from rising military budgets, with increased demand for its unmanned aerial systems, hypersonic weapons, and C5ISR solutions, areas where Kratos excels. Its vertical integration and expertise make it a strong contender for long-term contracts in the growing global defense market.

- Secured multiple contracts and revenue streams. Kratos has recently secured multiple high-value contracts, reinforcing its position as a leader in defense innovation. A US$34.9mn contract with the U.S. Marine Corps to advance the XQ-58A Valkyrie unmanned aerial system positions Kratos at the forefront of next-generation warfare strategies, where unmanned systems will complement manned aircraft for enhanced battlefield effectiveness. Additionally, a hypersonic systems contract with a total potential value of US$100mn, along with an initial US$15mn in funding, underscores Kratos’ critical role in advancing hypersonic technologies for modern defense. These contracts present Kratos’ expertise while also ensure recurring revenue and long-term government partnerships, setting the stage for continued growth in key defense sectors.

- 3Q24 results. Kratos Defense & Security Solutions Inc’s revenue increased by 0.5% YoY to US$275.9mn in 3Q24, below estimates by US$1.32mn. It delivered non-GAAP EPS of US$0.11, above estimates by US$0.03. The company projected a 10% YoY revenue growth for 2025.

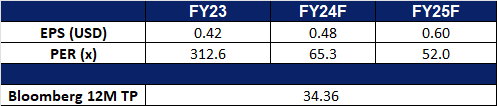

- Market consensus

(Source: Bloomberg)

Costco Wholesale Corp (COST US): Beneficiary of tariffs

- RE-ITERATE BUY Entry – 1,040 Target – 1,200 Stop Loss – 960

- Costco Wholesale Corporation is a membership warehouse club The Company sells all kinds of food, automotive supplies, toys, hardware, sporting goods, jewelry, electronics, apparel, health, and beauty aids, as well as other goods. Costco Wholesale serves customers worldwide.

- Tariff policies drive potential inflationary pressure. In 2024, the US trade deficit reached US$918.4bn, increasing by 17% YoY. The US-China trade deficit accounted for US$295.4bn of this total. The Trump administration has begun using tariff policies to pressure major US trading partners. While tariffs on Canada and Mexico have been temporarily paused, the administration has maintained a 10% tariff increase on Chinese goods. The market expects the next round of tariffs to target high-value-added products from Taiwan, South Korea, and Japan. As a result, inflationary pressure in the US is expected to rise, leading to increased capital inflows into inflation-related sectors.

- Defensive and growth attributes. Unlike traditional large supermarkets that rely on low-margin, high-volume sales, Costco maintains ultra-low wholesale prices, with its primary source of profit coming from membership fees. Membership growth and fee increases serve as long-term growth drivers. As of December 2024, the number of paid household members reached 77.4 million, an 8% YoY increase, with a total of 138.8 million cardholders. The global membership renewal rate stood at 90.4%. Additionally, since 1 September 2024, Costco has raised membership fees in the US and Canada, increasing the standard membership fee from US$60 to US$65 and the executive membership fee from US$120 to US$130. In South Korea, membership fees will increase by 7.5% to 15.2% in May 2025. Currently, the company operates 897 warehouses across 13 countries and plans to open 29 new warehouses in 2025, with 12 located outside the US

- 1Q25 results. Costco Wholesale Corp’s revenue increased by 7.5% YoY to US$62.15bn in 1Q25, above estimates by US$150mn. It delivered non-GAAP EPS of US$3.82, above estimates by US$0.03. The company reported strong sales performance for January 2025, with net sales reaching US$19.51bn, marking a 9.2% increase from US$17.87bn in the previous year. The company’s 22-week net sales grew 8.2% to US$113.55bn. It declared a of $1.16/share quarterly dividend, in line with previous, payable on 21 February for shareholders of record 7 February.

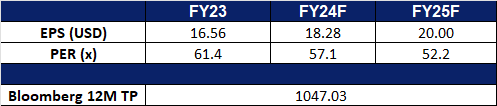

- Market consensus

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Seatrium Ltd (STM SP) at S$2.43, Alibaba Group Holdings Ltd (9988 HK) at HK$110 and Lenovo Group Ltd (992 HK) at HK$12.7. Add Snowflake Inc (SNOW US) at US$180. Cut loss on Banco Marco SA (BMA US) at US$90.