13 February 2025: Investment Product Ideas

High-Yield ETFs for Consistent Monthly Income

Monthly income streams. The JPMorgan Equity Premium Income ETF (JEPI) and NEOS S&P 500 High Income ETF (SPYI) generate consistent monthly income through a combination of option premiums and stock dividends. These ETFs offer high-yield potential, making them attractive to income-focused investors. The covered call strategy helps mitigate downside risk, reducing volatility compared to traditional equity ETFs like SPY. As a result, these funds are particularly appealing to investors seeking steady passive income, risk averse investors, and those seeking passive cash flow rather than pure capital appreciation.

Upside potential. Both funds invest in S&P 500 or similar blue-chip stocks, providing broad market exposure and diversification. While their covered call strategies cap potential gains, they still allow investors to capture a portion of the market’s upside when the S&P 500 rises.

Attractive yields. These funds offer significantly higher yields than traditional equity ETFs, bonds, and even high-yield fixed-income instruments. By leveraging covered call strategies, these funds generate enhanced income streams, potentially improving overall portfolio returns. As of the latest 12-month rolling period, JEPI yields 7.36%, while SPYI offers an even higher yield of 11.85%, making them compelling options for income-seeking investors.

|

Fund Name (Ticker) |

JPMorgan Equity Premium Income ETF (JEPI US) |

|

Description |

JPMorgan Equity Premium Income ETF is an exchange-traded fund incorporated in the USA. The fund seeks to provide current income while maintaining prospects for capital appreciation by delivering the majority of the returns of the S&P500 while exposing investors to lower risk through lower volatility and still offering incremental income. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 11 Feb) |

4,015,928 |

|

Net Assets of Fund (as 11 Feb) |

$39.09bn |

|

12-Month Yield (as of 11 Feb) |

7.36% |

|

P/E Ratio (as of 11 Feb) |

27.8x |

|

P/B Ratio (as of 11 Feb) |

5.82x |

|

Expense Ratio (Annual) |

0.35% |

Top Holdings

(as of 11 February 2025)

(Source: Bloomberg)

|

Fund Name (Ticker) |

NEOS S&P 500 High Income ETF (SPYI US) |

|

Description |

The NEOS S&P 500 High Income ETF is an exchange-traded fund incorporated in the USA. The ETF invests in a portfolio of stocks that make up the S&P 500 Index and a call options strategy, which consists of a mix of written (sold) call options and long (bought) call options on the S&P 500 Index. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 11 Feb) |

859,852 |

|

Net Assets of Fund (as of 10 Feb) |

$2,948,247,581 |

|

12-Month Yield (as of 11 Feb) |

11.85% |

|

P/E Ratio (as of 11 Feb) |

29.7x |

|

P/B Ratio (as of 11 Feb) |

5.22x |

|

Expense Ratio (Annual) |

0.68% |

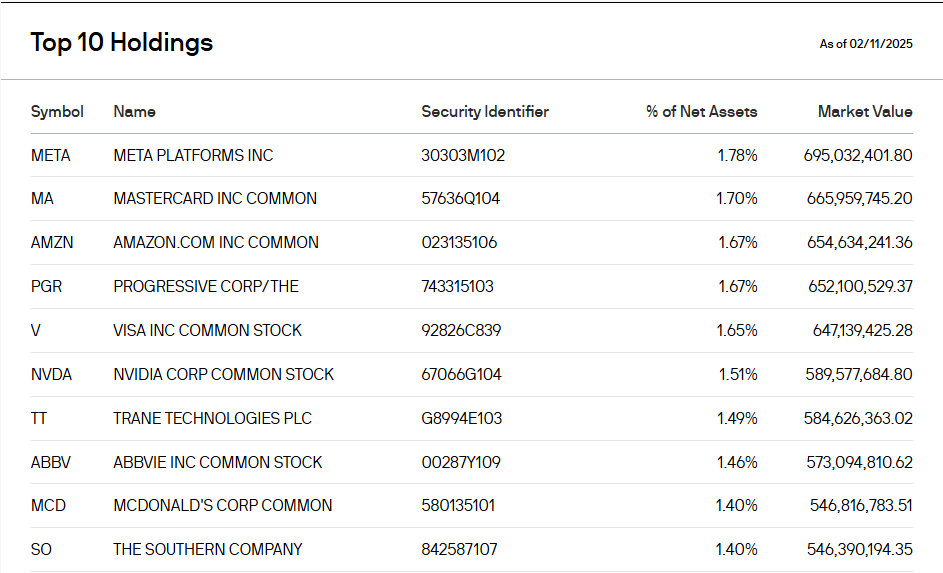

Top 10 Holdings

(as of 12 February 2025)

(Source: Bloomberg)