3 February 2025 : Oversea-Chinese Banking Corp Ltd. (OCBC SP), Alibaba Group Holdings Ltd. (9988 HK), Snowflake Inc (SNOW US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

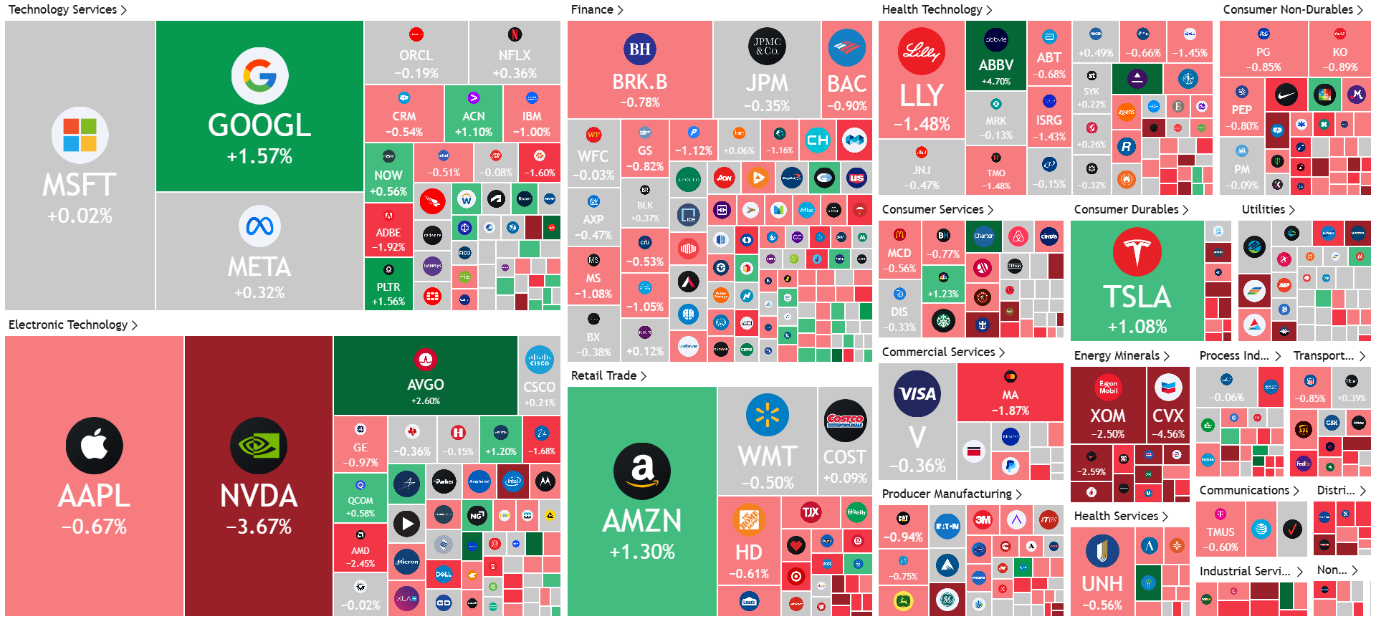

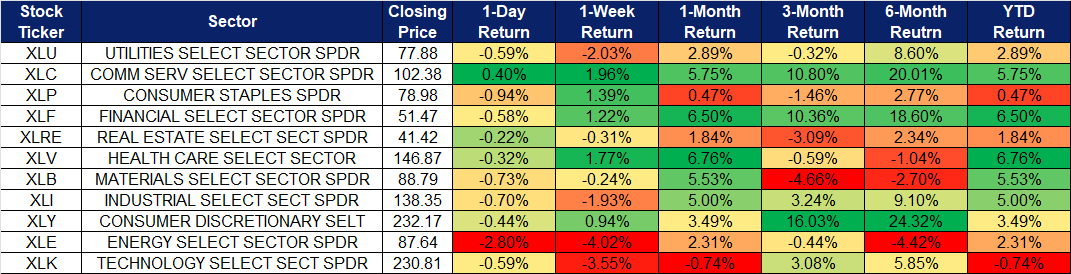

United States

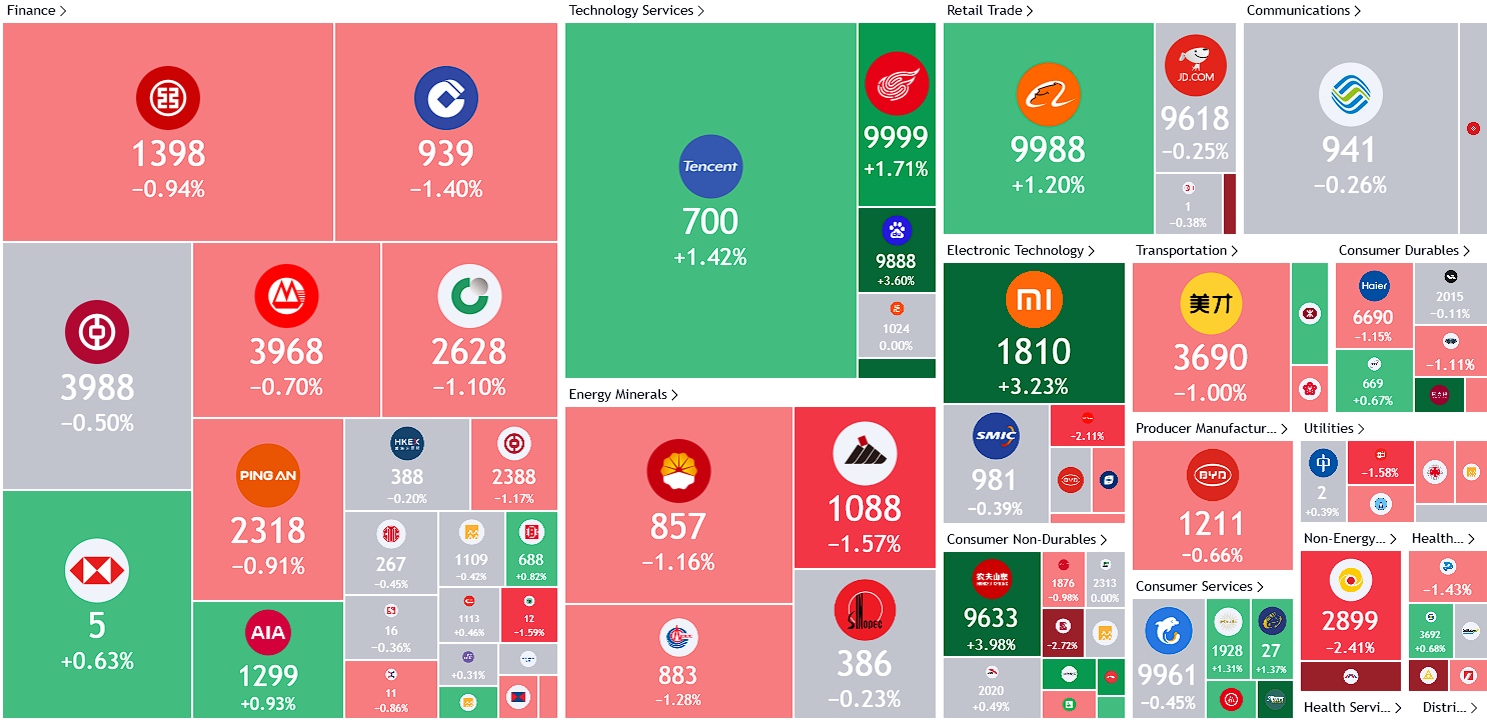

Hong Kong

Oversea-Chinese Banking Corp Ltd. (OCBC SP): Positive U.S. sentiments to extend into Singapore

- BUY Entry – 17.3 Target– 18.9 Stop Loss – 16.5

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Positive sentiment from the US banks. Despite the drag from declining interest rates on net interest income, U.S. banks posted strong FY24 results, driven by a rebound in Wall Street dealmaking. Investment banking revenue surged, with the largest banks reporting year-over-year increases of 25% or more. While interest rates remain elevated amid economic uncertainty, optimism around dealmaking persists. Major consulting firms, including PwC and EY, anticipate continued growth in U.S. M&A activity. EY-Parthenon’s macroeconomic outlook projects a 10% rise in M&A activity in 2025, building on an expected 13% increase in 2024. This momentum is expected to continue as election-related uncertainty fades, economic conditions remain strong, and interest rates trend lower. The heightened level of dealmaking is likely to benefit U.S. banks throughout 2025, with positive sentiment also extending to Singapore’s banking sector.

- Partnership with XTransfer. OCBC has partnered with XTransfer to offer SMEs engaged in international trade seamless, one-stop cross-border financial solutions. The collaboration will leverage OCBC China’s extensive regional network, targeting key markets such as Singapore, Hong Kong SAR, Malaysia, and Indonesia. Through this partnership, SMEs will gain access to integrated services, including payment solutions, foreign exchange (FX), risk management, and wealth management. By expanding available payment methods and currencies, the initiative aims to facilitate cross-border trade and support SME growth in the global marketplace. This strategic alliance is expected to drive higher transaction volumes while strengthening OCBC’s regional presence.

- Collaboration with Disney. OCBC and Disney have announced a five-year strategic partnership across Singapore, Malaysia, and Indonesia, aimed at significantly increasing OCBC’s new customer base in Southeast Asia by 2029. The collaboration includes the launch of the OCBC MyOwn Account for children aged 7-15, allowing them to manage their own accounts under parental supervision via the OCBC app. The partnership will also feature Disney-themed bank cards, financial literacy materials with Disney characters, and related merchandise by mid-2025. OCBC highlighted that the partnership will help attract new customers by offering unique, non-price-based products and services.

- 3Q24 results review. Total income for 3Q24 increased by 10.8% YoY to S$3.80bn, driven by robust non-interest income growth and lower allowances, compared to S$3.43bn in 3Q23. Net interest income fell by 0.9% YoY and non-interest income rose by 40.7% YoY. Increased wealth management activities lifted fee and trading income, with insurance income higher as well. Net profit increased by 9.1% YoY to S$1.97bn in 3Q24, compared to S$1.81bn in 3Q23.

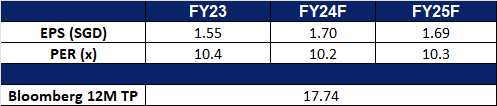

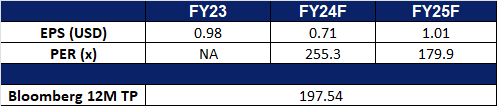

- Market Consensus.

(Source: Bloomberg)

Singapore Telecommunications Ltd. (ST SP): Further integration of AI

- RE-ITERATE BUY Entry – 3.24 Target– 3.50 Stop Loss – 3.11

- Singapore Telecommunications Limited wireless telecommunication services. The Company offers diverse range of services including fixed, mobile, data, internet, TV, and digital solutions. Singapore Telecommunications serves customers worldwide.

- Expanding AI Integration. Singtel has introduced free access to Perplexity Pro as part of a strategic initiative to democratize AI tools and enhance customer engagement. The year-long subscription, typically valued at SGD 270, is available to all Singtel broadband, mobile, and TV subscribers. This move positions Singtel as a gateway for mainstream AI adoption, particularly targeting users curious about generative AI but hesitant to integrate it into their daily lives. While early adopters may already use ChatGPT or Claude, many remain reluctant to try standalone AI applications. By bundling Perplexity Pro, Singtel eliminates barriers and provides a risk-free opportunity for users to explore AI’s potential. This partnership underscores Singtel’s focus on leveraging AI as a unique value proposition to deepen customer loyalty and enhance its service offering.

- Strengthening Local Connections Through Marketing. Singtel has released a new film celebrating the evolution of technology and its role in enriching lives, highlighting the power of its 10Gbps broadband service. Titled The Corridor, the 90-second film takes viewers on a nostalgic journey from the era of dial-up modems and pagers to today’s ultra-fast broadband. It showcases how Singtel has consistently bridged distances and strengthened bonds among families and communities. Featuring relatable personalities, the film emphasizes how technology empowers everyone—from small business owners to vulnerable groups—while aligning with Singtel’s festive Chinese New Year campaign. The campaign also promotes special deals on its 10Gbps plans, Singapore’s fastest home broadband service, reinforcing Singtel’s position as a trusted technology partner in everyday life.

- Partnership with DSTA and HTX. Singtel has announced a collaboration with Singapore’s Defence Science and Technology Agency (DSTA) and the Home Team Science and Technology Agency (HTX) to implement 5G network slicing technology, aimed at enhancing the nation’s defence and security capabilities. This customised solution leverages Singtel’s 5G network to deliver high-speed connectivity, low latency, and dedicated bandwidth, enabling the deployment of autonomous vehicles, robotics, and artificial intelligence (AI). It also supports the secure and efficient analysis of large data volumes, empowering first responders to make faster, more informed decisions and respond swiftly. This partnership builds on the successful trial conducted in July 2024 on Sentosa Island, where 5G was used for video-intensive transmissions and the autonomous control of unmanned vehicles and drones.

- 1H24 results review. Revenue fell by 0.5% YoY to S$6.99bn in 1H25, compared with S$7.03bn in 1H24. Net profit fell by 42.4% to S$1.23bn in 1H25, compared to S$2.14bn in 1H24, due to an exceptional gain from the issuance of Telkomsel shares to integrate IndiHome in the corresponding period last year. EBIT excluding associates contribution rose by 27.3% to S$738mn in 1H25, compared to S$580mn in 1H24, mainly driven by Optus and NCS.

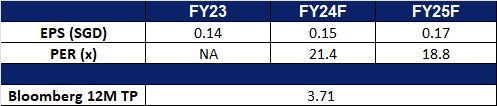

- Market Consensus.

(Source: Bloomberg)

Alibaba Group Holdings Ltd. (9988 HK): Entering the AI race

- BUY STOP Entry – 98.0 Target – 110.0 Stop Loss – 92.0

- Alibaba Group Holding Ltd provides technology infrastructure and marketing platforms. The Company operates through seven segments. China Commerce segment includes China retail commerce businesses such as Taobao, Tmall and Freshippo, among others, and wholesale business. International Commerce segment includes international retail and wholesale commerce businesses such as Lazada and AliExpress. Local Consumer Services segment includes location-based businesses such as Ele.me, Amap, Fliggy and others. Cainiao segment includes domestic and international one-stop-shop logistics services and supply chain management solutions. Cloud segment provides public and hybrid cloud services like Alibaba Cloud and DingTalk for domestic and foreign enterprises. Digital Media and Entertainment segment includes Youku, Quark and Alibaba Pictures, other content and distribution platforms and online games business. Innovation Initiatives and Others segment include Damo Academy, Tmall Genie and others.

- New artificial intelligence model. Alibaba recently unveiled Qwen 2.5-Max, the latest iteration of its AI model, claiming it outperforms the widely regarded DeepSeek-V3 on multiple benchmarks. The company stated that Qwen2.5 Max “achieves competitive performance against top-tier models,” including recent releases from OpenAI and Meta Platforms. Alibaba highlighted that its base models have demonstrated significant strengths across most benchmarks and expressed confidence that advancements in post-training techniques will further enhance future iterations of Qwen2.5 Max. With DeepSeek revealing that it trained V3 for just $5.6 million, investor focus is likely to shift toward China’s growing AI landscape, including Alibaba’s Qwen.

- Overseas push. Alibaba Cloud, the cloud computing and AI arm of Alibaba Group, has expanded its suite of proprietary large language models (LLMs) and development tools for global developers, reinforcing its push into international markets. The company announced that its latest Tongyi Qianwen LLMs, including the Qwen 2.5 series, as well as multimodal AI models like the Qwen-VL series and the visual generation-focused Tongyi Wanxiang, are now accessible via APIs on its generative AI development platform, Model Studio. This move aligns with Alibaba Cloud’s broader strategy to accelerate overseas investments and expand its cloud infrastructure in key global markets.

- New gifting experiences. Alibaba has revamped its gift-giving feature on the Taobao marketplace, simplifying the process for buyers just days after rival Tencent enhanced a similar function on its WeChat super app. Previously, Taobao’s gifting option only allowed users to purchase an extra unit at checkout, with gift cards shareable only within the platform. The new system now enables users to send gifts across various online shopping and social platforms, including WeChat. To encourage adoption, Taobao is offering a 15% discount on select gift purchases. This update is expected to boost user engagement and drive traffic to the marketplace.

- 3Q24 results review. Revenue increased 5.21% YoY to RMB236.5bn in 3Q24, compared with RMB224.8bn in 3Q23. Net profit rose by 63.1% to RMB43.5bn in 3Q24, compared to RMB26.7bn in 3Q23. Diluted earnings per share increased to RMB2.27 in 3Q24, compared to RMB1.35 in 3Q23.

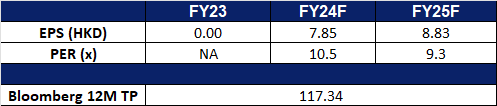

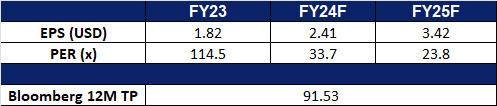

- Market consensus.

(Source: Bloomberg)

Trip.com Group Ltd. (9961 HK): Surge in Chinese New Year Travellers

- RE-ITERATE BUY Entry – 535 Target – 605 Stop Loss – 500

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Surge in Chinese New Year travelers. Train stations and airports across China experienced a surge in travelers on January 25, as millions returned home ahead of Chinese New Year. This annual migration, anticipated to break records, marks a significant cultural tradition as families reunite to celebrate. The holiday season officially begins on January 29, 2025, with eight consecutive public holidays offering opportunities to share festive meals, attend traditional performances, and enjoy firecrackers and fireworks. During the traditional 40-day travel period surrounding the holidays, an estimated nine billion interprovincial passenger trips are expected across all modes of transport. The Ministry of Transport projects approximately 510 million train journeys and 90 million air trips during this time. This massive travel wave presents a significant opportunity for Trip.com, which stands to benefit from the heightened demand for transportation bookings and travel-related services, solidifying its position as a key player in facilitating seamless travel experiences during peak seasons.

- New experiences. Zhangjiajie, one of China’s most iconic and breathtaking natural destinations, has partnered with Trip.com Group to offer international travelers captivating experiences in 2025. Announced during the “Fairyland Zhangjiajie, Enchanting the World” event in early January, this strategic collaboration marks a significant step in advancing the region’s tourism development. Co-hosted by the Zhangjiajie Municipal Bureau of Culture, Sports, Tourism, Radio & Television and Trip.com Group, the event welcomed global travel influencers from 12 countries and regions, including the UK, South Korea, Japan, Spain, Australia, Canada, Belarus, South Africa, Colombia, Nepal, Ukraine, and Hong Kong. These influencers experienced Zhangjiajie’s breathtaking landscapes, vibrant culture, and unique offerings firsthand. By showcasing its natural beauty and cultural richness to an international audience, Zhangjiajie aims to establish itself as a must-visit destination for 2025, driving an anticipated surge in inbound travel to China.

- Free layover tour to attract more travelers. Trip.com Group has introduced a complimentary half-day tour of Beijing for international transit passengers with layovers of eight hours or more. This initiative aims to attract and serve global travelers by showcasing Beijing’s beauty and offering a glimpse into Chinese culture. The tour includes free shuttle services, multilingual guides, attraction tickets, and complimentary internet access, ensuring a seamless and enjoyable experience for passengers. The service is available at the designated gathering point in Terminal 3 of Beijing Capital International Airport and has already been embraced by travelers from nearly 50 countries, including Australia, the United Kingdom, Germany, France, and Singapore. This initiative not only enhances the travel experience for transit passengers but also strengthens Trip.com Group’s brand as a leader in customer-centric travel solutions. By introducing travelers to Beijing’s attractions, the company builds goodwill, fosters brand loyalty, and positions itself to convert transit passengers into future customers, potentially increasing bookings for more extended stays or broader travel itineraries across China.

- 3Q24 results review. Revenue increased 15.6% YoY to RMB15.9bn in 3Q24, compared with RMB13.8bn in 3Q23. Net profit rose by 47.1% to RMB6.82bn in 3Q24, compared to RMB4.63bn in 3Q23. Basic earnings per share increased to RMB10.37 in 3Q24, compared to RMB7.05in 3Q23.

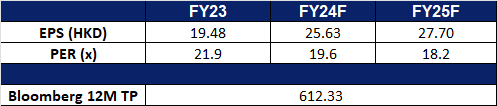

- Market consensus.

(Source: Bloomberg)

Snowflake Inc (SNOW US): AI expansion strategy

- BUY Entry – 180 Target – 210 Stop Loss – 165

- Snowflake Inc. provides software solutions. The Company develops database architecture, data warehouses, query optimization, and parallelization solutions. Snowflake serves customers worldwide.

- Potential acquisition. Snowflake Inc is reportedly in talks to acquire data analytics startup Redpanda, a move that could enhance its AI and data software capabilities while strengthening its position against competitors like Databricks and Confluent. Redpanda provides streaming data analytics software that is API-compatible with Apache Kafka, allowing seamless integration with Kafka-based applications without requiring code changes. This API compatibility could accelerate Snowflake’s integration speed, improving its ability to process and analyze real-time data while making its platform more interoperable. With major clients like Cisco, Activision Blizzard, and Vodafone, and recent AI integrations with OpenAI, Vertex AI, AWS Bedrock, and vector databases like Pinecone and Qdrant, Redpanda could significantly bolster Snowflake’s AI-driven and real-time data capabilities. The acquisition would help Snowflake compete more aggressively with Confluent, the leader in streaming data analytics, while also positioning it for greater adoption in AI-driven applications. Redpanda was reportedly seeking a valuation of around US$1.5 billion, though Snowflake’s potential offer remains undisclosed.

- Benefitting from DeepSeek popularity. Snowflake has been largely unaffected by the broader tech sell-off following the release of China’s AI model, DeepSeek, and could actually benefit from its cost-efficient approach, which reduces hardware dependency and drives wider AI adoption. Unlike AI semiconductor companies, Snowflake provides cloud-based data storage and analytics rather than computing capacity, meaning more efficient AI models could lower its infrastructure costs and improve profit margins. The company recently integrated DeepSeek models into its AI marketplace in response to strong customer demand, reinforcing its position in AI-driven data analytics. With over 1,000 generative AI use cases and 3,200 AI-focused customers, Snowflake is well-positioned to capitalize on growing AI adoption, as lower AI costs may increase demand for its data storage and processing services. Additionally, by offering DeepSeek models, Snowflake differentiates itself from competitors like Databricks and Google Cloud while strengthening its AI partner ecosystem, attracting more model providers, and further accelerating enterprise AI usage. Snowflake is well-positioned to capitalize on growing AI adoption, as lower AI costs may increase demand for its data storage and processing services.

- 3Q25 results. Snowflake Inc’s revenue increased by 28.3% YoY to US$942.1mn in 3Q25 from US$734.2mn in 3Q24, above estimates by US$43.6mn. It delivered non-GAAP EPS of US$0.20, above estimates by US$0.05. For the fourth quarter, the company expects to deliver US$906 – US$911mn in product revenue.

- Market consensus

(Source: Bloomberg)

Ciena Corporation (CIEN US): Dominating the optical networking space

- RE-ITERATE BUY Entry – 80 Target – 90 Stop Loss – 75

- Ciena Corporation develops and markets communications network platforms, software, and offers professional services. The Company’s broadband access, data and optical networking platforms, software tools, and global network services support worldwide telecom and cable/MSO services providers, and enterprise, and government networks.

- Cloud and AI driven traffic. The company’s fourth-quarter earnings exceeded Wall Street expectations, with robust revenue and strong order flow highlighting the growing demand for cloud and AI-driven bandwidth across networks. As AI remains a central focus in the coming year, Ciena Corp. is well-positioned to capitalize on this trend, driving accelerated revenue growth and market share expansion. As a leading provider of networking systems and software services, Ciena stands to benefit significantly from the anticipated surge in AI-related traffic. Its expertise in optical networking, enabling high-speed data transmission over long distances, will be a key differentiator in modern telecommunications, where speed and reliability are critical. Additionally, Ciena’s advanced 1.6 Tb/s and 800G coherent Coherent-Lite pluggable solutions are designed to help cloud and data center providers manage the exponential growth in cloud, machine learning, and AI traffic. With major projects like the Stargate AI data center and other large-scale data center initiatives underway, Ciena is poised to see increased demand for its optical networking equipment and inventory management solutions, streamlining operations for its customers. Supported by substantial investments from cloud customers and telecom operators, Ciena’s growth prospects remain strong, solidifying its position as a key player in the AI and cloud infrastructure landscape.

- Secured new term loan. Ciena Corporation refinanced its existing senior secured term loan with a US$1.16bn loan maturing in October 2030. Proceeds from the new loan, along with cash, were used to fully repay the previous loan. The loan features quarterly amortization payments, a SOFR-based interest rate, and early repayment options. This refinancing aims to optimize Ciena’s capital structure and enhance financial flexibility while maintaining consistent terms with the prior agreement.

- Connectivity milestone achieved. Southern Cross Cable Limited has achieved a significant milestone by implementing the world’s first 1 Tb/s single-carrier wavelength across its 13,500 km transpacific network, utilizing Ciena’s cutting-edge WaveLogic 6 Extreme (WL6e) coherent optics. This groundbreaking achievement underscores the exceptional performance and scalability of Ciena’s technology in meeting the surging demands of today’s digital world. By leveraging WL6e, Southern Cross enhances its network capacity and efficiency, enabling it to deliver high-bandwidth services critical for AI, cloud computing, and video applications. This deployment demonstrates the power of Ciena’s technology to support the growing bandwidth needs of global connectivity.

- 4Q24 results. Ciena Corporation’s revenue declined slightly by 0.9% YoY to US$1.12bn in 4Q24 from US$1.13bn in 4Q23, above estimates by US$20mn. It delivered non-GAAP EPS of US$0.54, below estimates by US$0.11. The company repurchased approximately 2.1mn shares of common stock for the aggregate price of US$132mn during the quarter. The company maintains a long-term revenue growth target of 6-8% CAGR, driven by webscale and cloud provider market growth.

- Market consensus

(Source: Bloomberg)

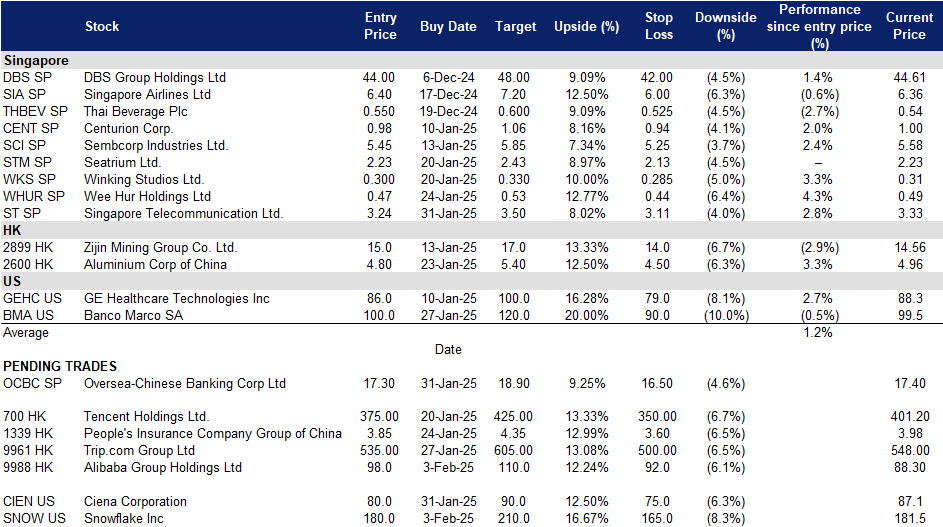

Trading Dashboard Update: Add Singapore Telecommunication Ltd (ST SP) at S$3.24.