28 January 2025: Investment Product Ideas

Navigating a Potentially Overvalued Market: The Covered Call Approach

The current S&P 500 forward price-to-earnings ratio is at levels seen during the pandemic and the 2000 dot-com bubble, suggesting potential increased market risk. Strategically, in addition to diversifying into defensive and low-volatility stocks, the covered call strategy can also help reduce portfolio volatility and increase the distribution yield.

The core of the strategy involves forgoing some potential upside gains in exchange for option premiums as income. It is most suitable for market conditions lacking strong upside catalysts but not requiring a bearish outlook. Furthermore, the strategy’s distribution yield is higher than that of the underlying assets, making income generation another reason for consideration. When market volatility increases, option premium income is also expected to rise. However, when the market outlook is pessimistic, the strategy’s downside protection is limited to the option premiums received.

As the strategy is not restricted by sector, it can also be applied to low-dividend-yielding technology stocks. There are also covered call ETFs available in the market that apply the strategy to single stocks. The number of options sold can control the portfolio’s balance between potential income and growth.

Global X Nasdaq 100 Covered Call ETF (QYLD US)

- The Global X Nasdaq 100 Covered Call ETF (QYLD) is a fully covered buy-write strategy that uses the Nasdaq 100 as its reference asset. Providing a potential stream of premium income, the fund acts as a competitive total return solution that may boost a portfolio’s current yield.

- Covered call investment strategies can bring visibility, a variety of diversification benefits, and risk mitigation potential to a portfolio.

|

Fund Name (Ticker) |

Global X Nasdaq 100 Covered Call ETF (QYLD US) |

|

Description |

The Global X Nasdaq 100 Covered Call ETF (QYLD) follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Nasdaq 100 Index and “writes” or “sells” corresponding call options on the same index. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 27 Jan) |

5,219,114 |

|

Net Assets of Fund (as of 24 Jan) |

$8,720,000,000 |

|

12-Month Yield (as of 27 Jan) |

13.49% |

|

P/E Ratio (as of 27 Jan) |

42.09 |

|

P/B Ratio (as of 27 Jan) |

8.67 |

|

Expense Ratio (Annual) |

0.61% |

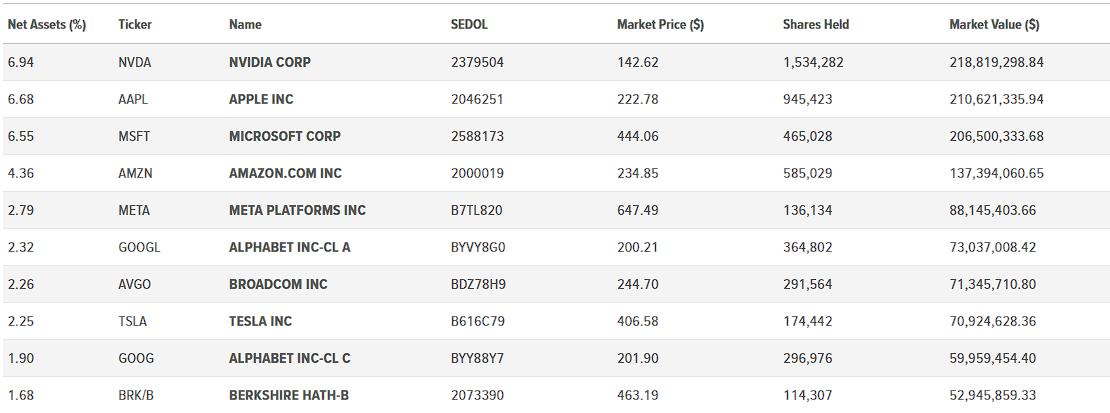

Top Holdings

(as of 24 January 2025)

(Source: Bloomberg)

Global X S&P 500 Covered Call ETF

- The Global X S&P 500 Covered Call ETF (XYLD) uses a buy/write strategy in an effort to generate income. By selling call options on the S&P 500 Index, XYLD may produce a competitive yield that can prove accretive to a variety of investor accounts.

- Spreading exposures across an array of companies and industries, the diversification potential provided by particular index funds might help improve the risk-adjusted returns associated with a broader portfolio. Covered call funds like XYLD can add a supplemental layer of diversification by writing call options.

|

Fund Name (Ticker) |

Global X S&P 500 Covered Call ETF (XYLD US) |

|

Description |

The Global X S&P 500 Covered Call ETF (XYLD) follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the S&P 500 Index and “writes” or “sells” corresponding call options on the same index. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 27 Jan) |

547,624 |

|

Net Assets of Fund (as of 24 Jan) |

$3.16bn |

|

12-Month Yield (as of 27 Jan) |

12.3% |

|

P/E Ratio (as of 27 Jan) |

30.7 |

|

P/B Ratio (as of 27 Jan) |

5.46 |

|

Expense Ratio (Annual) |

0.60% |

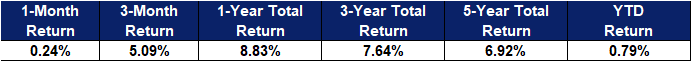

Top 10 Holdings

(as of 24 January 2025)

(Source: Bloomberg)