16 January 2025: Investment Product Ideas

Investing in the Pharmaceutical Industry. Targets pharmaceutical stocks, covering R&D, production, marketing, and sales Ideal for investors seeking tactical tilts or sector rotation without selecting individual stocks.

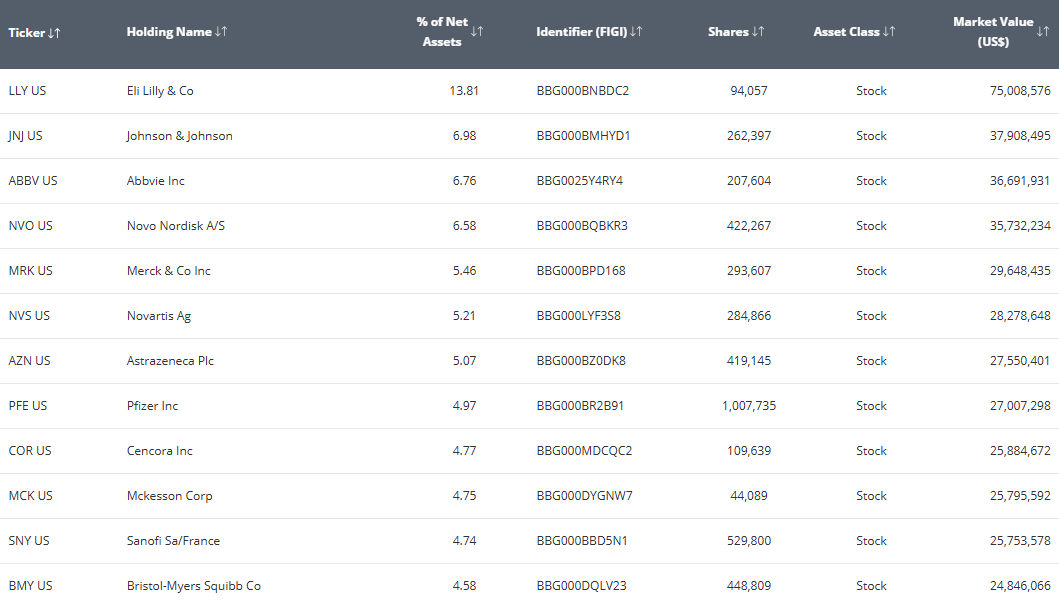

Top 10 Holdings Dominate the Portfolio. The portfolio holds stocks of major industry players, including Eli Lilly, Johnson Johnson, AbbVie, Novo Nordisk, and Merck. The top 10 holdings make up 63.7% of the portfolio.

Global Investment. This ETF invests globally in pharmaceutical companies, with 60.66% in the U.S. and exposure to Europe and Japan, offering diversified access to the global sector.

|

Fund Name (Ticker) |

VanEck Pharmaceutical ETF (PPH US) |

|

Description |

VanEck Pharmaceutical ETF (PPH®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Pharmaceutical 25 Index (MVPPHTR), which is intended to track the overall performance of companies involved in pharmaceuticals, including pharmaceutical research and development as well a production, marketing and sales of pharmaceuticals. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 14 Jan) |

153,857 |

|

Net Assets of Fund (as of 14 Jan) |

$536,100,000 |

|

12-Month Yield (as of 14 Jan) |

2.00% |

|

P/E Ratio (as of 31 Dec) |

27.14 |

|

P/B Ratio (as of 31 Dec) |

3.62 |

|

Expense Ratio (Annual) |

0.36% |

Top Holdings

(as of 13 January 2025)

(Source: Bloomberg)

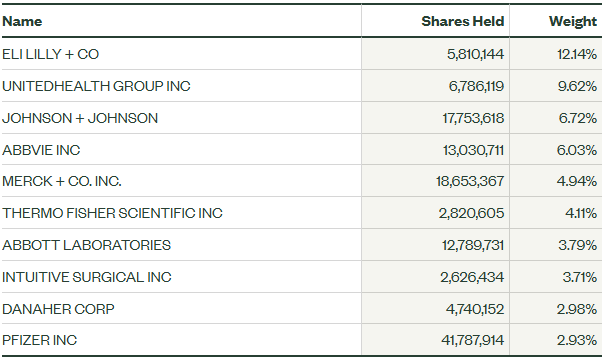

Largest U.S. Healthcare ETF. This ETF is the largest U S healthcare ETF by asset size, broadly investing in healthcare-related sectors within the S&P 500 including pharmaceuticals, medical devices and supplies, biotechnology, healthcare providers, and life sciences tools and services, with strong liquidity.

Diversified Investment. The pharmaceutical industry offers relatively stable demand, with growth potential fueled by an increasing focus on health and healthcare The tracked index covers multiple sectors, including pharmaceuticals, medical devices and supplies, healthcare services, and biotechnology.

Low Expense Ratio. This ETF has an expense ratio of 0.09% making it cost effective and helping investors reduce investment costs.

|

Fund Name (Ticker) |

Health Care Select Sector SPDR Fund (XLV US) |

|

Description |

The Health Care Select Sector SPDR® Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Health Care Select Sector Index (the “Index”). Seeks to provide precise exposure to companies in the pharmaceuticals; health care equipment and supplies; health care providers and services; biotechnology; life sciences tools and services; and health care technology industries. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 13 Jan) |

7,968,466 |

|

Net Assets of Fund (as of 13 Jan) |

$37,916,260,000 |

|

12-Month Yield (as of 13 Jan) |

1.62% |

|

P/E Ratio (as of 13 Jan) |

33.50 |

|

P/B Ratio (as of 13 Jan) |

4.66 |

|

Expense Ratio (Annual) |

0.09% |

Top 10 Holdings

(as of 13 January 2025)

=

(Source: Bloomberg)