23 December 2024 : Olam Group Ltd (OLG SP), East Buy Holding Ltd. (1797 HK), IonQ Inc (IONQ US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

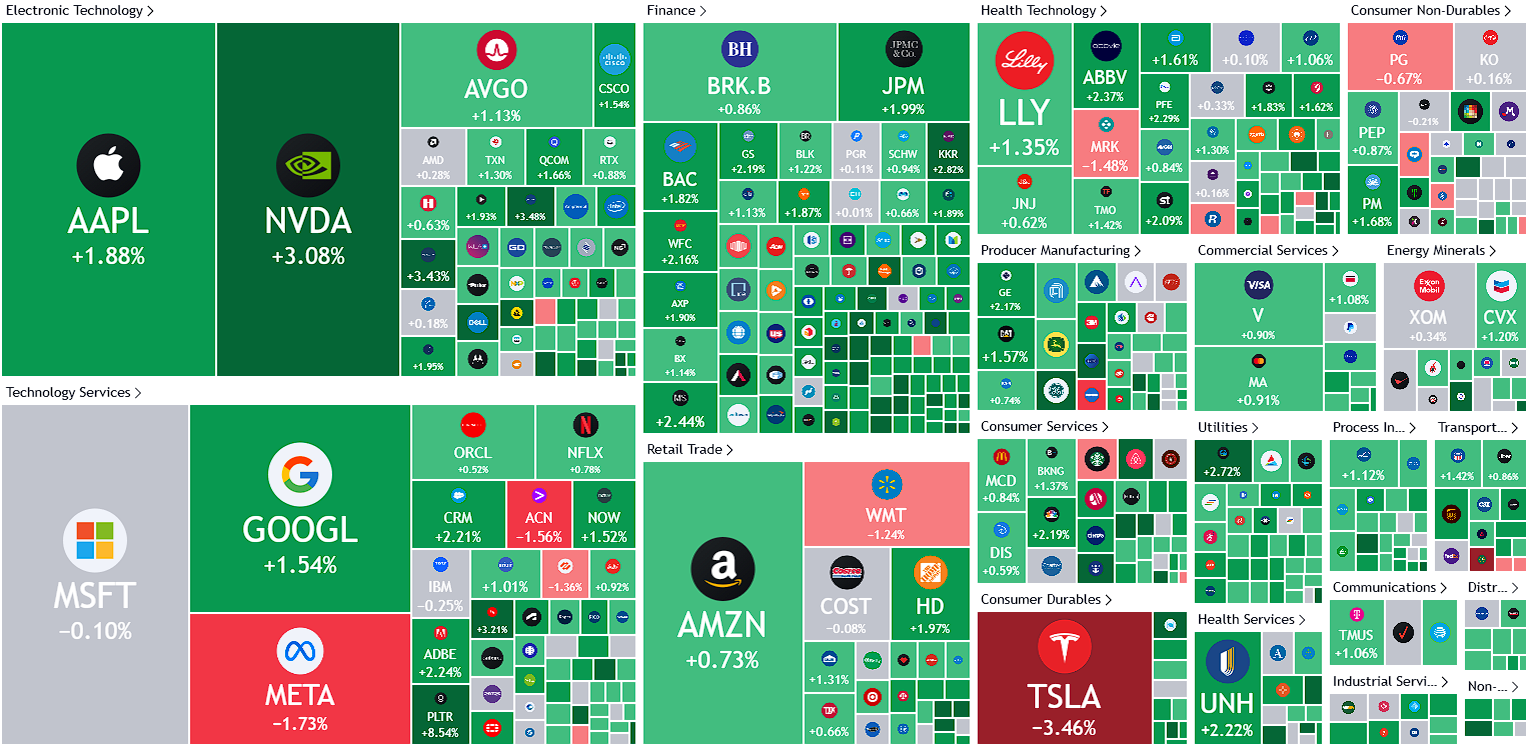

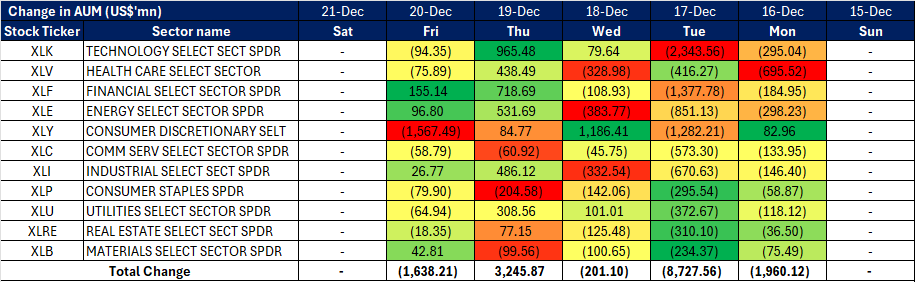

United States

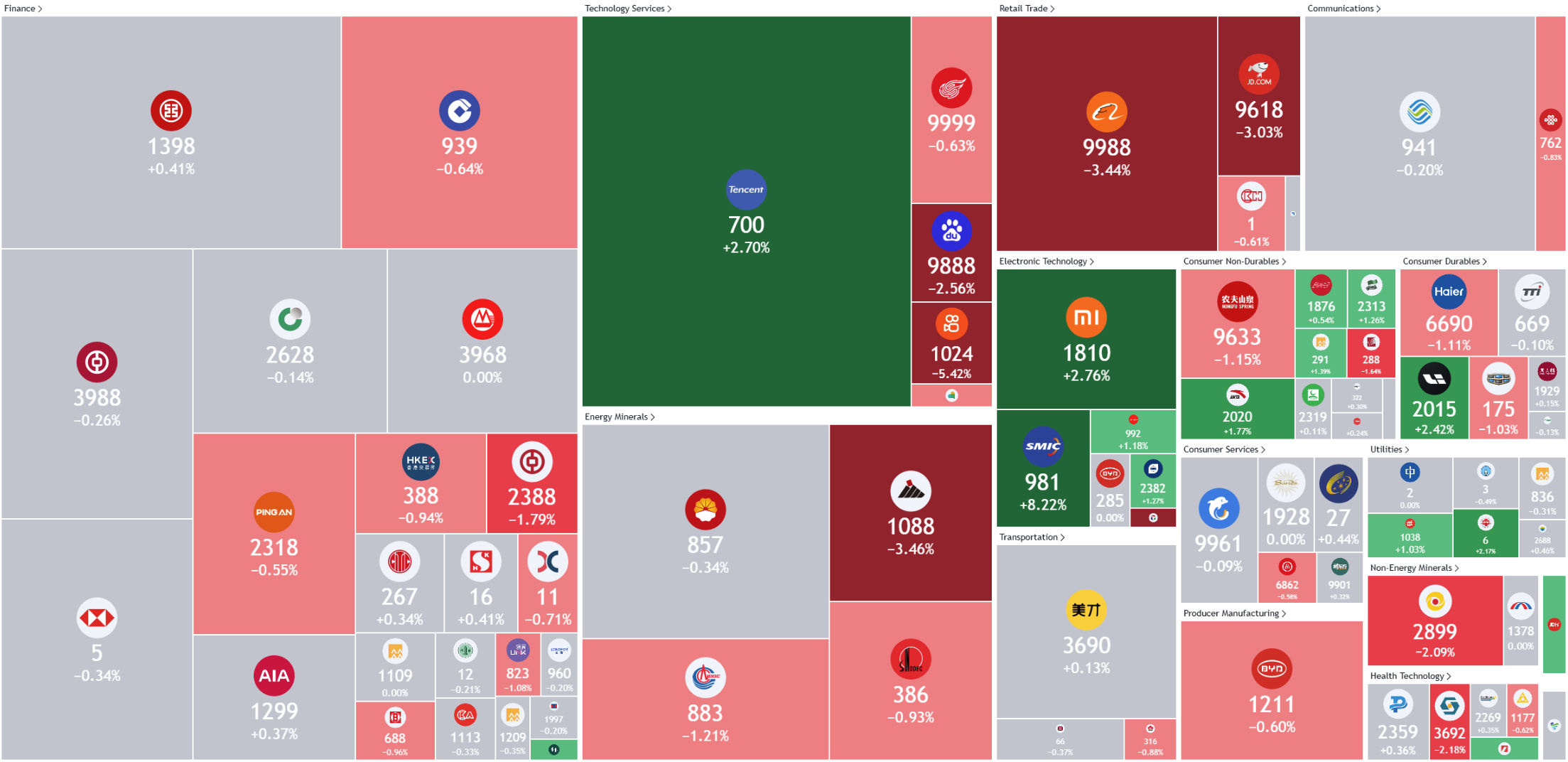

Hong Kong

Olam Group Ltd (OLG SP): Climate change driving agricultural product prices

- BUY Entry – 1.18 Target– 1.28 Stop Loss – 1.13

- Olam Group Ltd operates as a food and agri-business company. The Company supplies food ingredients, feed, fibre, and edible oil. Olam Group serves customers worldwide.

- Higher food ingredient prices. Coffee and cocoa prices recently climbed to a record high, with coffee rising to over US$3.24/lbs, while cocoa rose to over £9,600/ton. Coffee prices have soared this year due to major supply disruptions in key producers from Brazil to Vietnam, with the more budget-friendly robusta type that’s used in instant drinks recently hitting the highest since the 1970s. Concerns have also mounted that supplies from Brazil will slow after a long drought that hurt coffee trees, which may reduce next season’s output. On the other hand, adverse weather conditions and supply tightness in West Africa, which is home to around three-quarters of the world’s cocoa production, contributed to a rally in cocoa prices. As a major trader and processor of these commodities, the rally in prices of coffee and cocoa could lead to increased revenues for Olam.

- Expanding Presence. OLAM Agri, a subsidiary of the Olam Group, has reinforced its commitment to advancing agriculture in Nigeria by enhancing soybean production in Kwara State. The company recently donated soybean threshing machines to farmers in the Baruten Local Government Area, marking a significant step in its partnership with the Kwara State Government. This initiative aims to boost soybean yields by improving both the quantity and quality of production while also supporting the livelihoods of local farmers. Through this collaboration, OLAM Agri continues to play a pivotal role in fostering agricultural development and economic growth in the region.

- 1H24 results review. Total revenue rose to S$26.9bn in 1H24, +9.1% YoY, compared to S$24.7bn in 1H23. Net profit declined to S$67.2mn in 1H24, compared to S$116.7mn in 1H23. Diluted EPS remained flat at 0.84 S cents in 1H24, compared to 1H23.

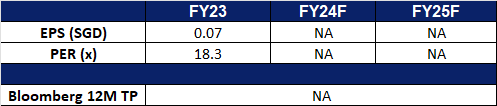

- Market Consensus.

(Source: Bloomberg)

Singapore Airlines Ltd (SIA SP): Winter travel demand

- RE-ITERATE BUY Entry – 6.4 Target– 7.2 Stop Loss – 6.0

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

- Year-end travel demand. In October 2024, Asia Pacific airlines experienced strong travel demand, with international passenger numbers rising by 19.0% YoY, reaching 31 million. Passenger demand, measured by Revenue Passenger Kilometres (RPK), grew by 19.7%, while capacity expanded by 18.6%, resulting in a 0.8 percentage point increase in load factor to 81.2%. Air cargo also saw robust growth, with international demand rising by 10.9%, driven by businesses restocking inventories for the holiday season and online sales events. Freight capacity increased by 10.6%, leading to a slight increase in the load factor to 61.6%. The total number of international passengers carried in the first 10 months of the year rose by 33%, and air freight volumes grew by 14%. The holiday season is expected to drive further demand for air travel, with higher ticket prices and lower jet fuel costs likely benefiting airlines like Singapore Airlines by improving their operating margins.

- Participation in turbulence network. Singapore Airlines has joined the International Air Transport Association’s (IATA) Turbulence Aware platform, a global system for real-time turbulence data exchange, following a fatal turbulence incident in May 2024. SIA and its budget arm, Scoot, signed up alongside Asiana Airlines and British Airways on 10 December, joining a growing network of over 25 carriers using the platform. Turbulence Aware, launched in 2019, provides instant turbulence reports to help pilots avoid turbulent areas, complementing traditional tools like weather maps. SIA began using the platform on 1 November, enhancing its weather management capabilities. The platform has collected over 180 million turbulence reports, improving global coverage as participation increases.

- 1H24 results review. Revenue rose S$335 million, a 3.7% YoY increase to S$9,497 million, with passenger flown revenue up S$118 million and cargo flown revenue higher by S$42 million. Increased competition and higher passenger capacity in key markets exerted pressure on yields, which fell 5.6%. On the cargo front, yield was 13.4% lower amid the continued recovery in bellyhold capacity. The demand for air travel remained healthy in the first six months, with SIA and Scoot carrying 19.2 million passengers, a 10.8% YoY increase. However, passenger traffic growth of 7.9% trailed the SIA Group’s passenger capacity expansion of 11.0%, resulting in a 2.4 percentage point decline in Group passenger load factor (PLF) to 86.4%. SIA and Scoot achieved PLFs of 85.7% and 88.6% respectively. The Group posted a net profit of S$742 million, a 48.5% YoY decline, primarily due to the weaker operating performance.

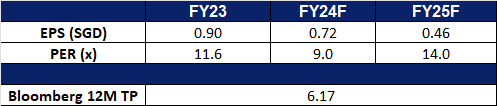

- Market Consensus.

(Source: Bloomberg)

East Buy Holding Ltd. (1797 HK): To boost domestic consumption

- BUY Entry – 15.80 Target – 17.80 Stop Loss – 14.80

- East Buy Holding Limited operates livestreaming platform businesses. The Company provides private label products including agricultural products, food, books, and household goods. East Buy Holding also conducts college education businesses.

- Expecting more sales from WeChat Store. WeChat has introduced a new feature that allows users to send physical gifts purchased through its shop section directly to their friends. This feature enables users to select products priced under CNY 10,000 from approved merchants with a single click, streamlining the gifting process. East Buy Holding, a prominent live-streaming e-commerce platform known for its high-quality, cost-effective products and strong brand endorsements, stands to benefit significantly from this feature. With the festive season approaching—including Christmas, New Year, and Chinese New Year—gift demand is expected to rise, potentially driving growth in WeChat’s e-commerce ecosystem and boosting sales for key players like East Buy Holding.

- Expectations to boost domestic consumption. China plans to implement targeted measures to boost consumption and deliver tangible benefits to its population, following a policy shift emphasizing domestic demand amid external uncertainties. This direction was outlined during the recent Central Economic Work Conference, where the “vigorous promotion of consumption” was identified as the top priority for the country’s 2025 economic agenda. East Buy Holding is well-positioned to benefit from this increased focus on consumption. As policies aimed at spurring domestic demand take effect, the company is likely to see heightened opportunities for growth in the world’s second-largest economy.

- FY24 earnings. Revenue increased by 56.8% to RMB7.07bn in FY24, compared with RMB4.51bn in FY23. Net profit rose to RMB1.72bn in FY24, compared to RMB971.3mn in FY23. Basic EPS rose to RMB 1.68 in FY24, compared with RMB0.97 in FY23.

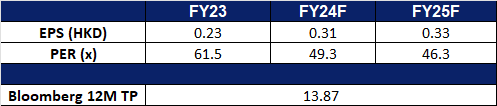

- Market consensus.

(Source: Bloomberg)

Sunny Optical Technology Group Co Ltd (2382 HK): Positive growth trajectory

- RE-ITERATE BUY Entry – 70 Target – 78 Stop Loss – 66

- Sunny Optical Technology Group Co Ltd is an investment holding company principally engaged in the design, research and development, manufacture and sale of optical and optical related products and scientific instruments. The Company operates its business through three segments: Optical Components segment, Optoelectronic Products segment and Optical Instruments segment. The Company’s main products include mobile phone lenses, automotive lenses, high-pixel lens lights, camera modules and others. The Company’s products are sold in China and overseas markets.

- Continued growth of China’s smartphone market. According to data from International Data Corporation (IDC), China’s smartphone shipments grew 3.2% year-over-year to 68.8 million units in Q3 2024, marking the fourth consecutive quarter of expansion. This growth was driven by sustained pent-up demand as consumers, motivated by the need for upgrades, continued purchasing new devices after a three-year slowdown. Chinese OEMs—vivo, Huawei, and Xiaomi—led a 3.8% increase in the Android market, each achieving robust double-digit growth. Apple also re-entered the Top 5 smartphone brands, ranking second with the launch of its iPhone 16 series. Initial sales were comparable to its predecessor, and the company expects upcoming promotions and the anticipated release of Apple Intelligence to drive further demand. IDC forecasts continued growth in the fourth quarter, supported by early flagship model launches from leading brands and the advanced start of the Singles Day shopping festival. Sunny Optical, a key supplier to major Chinese OEMs like Huawei and Xiaomi, as well as global brands such as Apple, is well-positioned to benefit from the sustained growth in China’s smartphone market.

- Apple to roll out AI features in China. Apple is reportedly in early-stage discussions with Tencent and ByteDance to integrate their artificial intelligence (AI) models into iPhones sold in China. With ChatGPT unavailable in the country and regulatory requirements mandating government approval for generative AI services, Apple is seeking local partnerships to enhance its AI capabilities while addressing compliance challenges. These efforts come as Apple faces declining market share in China. If Apple successfully integrates local AI models into its iPhones, it could significantly boost demand for its devices in the region. Such a development would also indirectly benefit suppliers like Sunny Optical, which counts Apple among its key clients.

- iPhone 18 Camera Upgrades to Boost Sunny Optical’s Revenue. Sunny Optical Technology, a key player in the optical industry, is poised for robust growth over the next two years, driven by its deepening integration into Apple’s supply chain. Industry sources indicate that Sunny Optical is expected to secure 15–20% of Apple’s lens orders in 2025, supported by the anticipated launch of the iPhone 17. This next-generation iPhone is expected to feature an ultra-slim design and advanced Apple Intelligence, both of which are likely to drive higher iPhone shipments. Beyond 2025, Sunny Optical is set to capitalize on significant advancements in Apple’s camera technology. The 2026 iPhone 18 is expected to introduce a variable aperture lens for the wide camera, marking a major upgrade. Sources suggest that Sunny Optical will serve as the primary supplier of variable aperture shutters and the second-largest supplier of variable aperture lenses for the iPhone 18. This strategic role in supplying both shutters and lenses, combined with the high average selling price (ASP) of these cutting-edge components, is expected to significantly boost Sunny Optical’s long-term revenue, solidifying its position as a critical partner in Apple’s supply chain.

- 1H24 earnings. Revenue increased by 32.1% to RMB18.9bn in 1H24, compared with RMB14.3bn in 1H23. Net profit rose to RMB1.11bn in 1H24, compared to RMB459.4mn in 1H23. Basic EPS rose to 99.1 RMB cents in 1H24, compared with 39.99 RMB cents in 1H23.

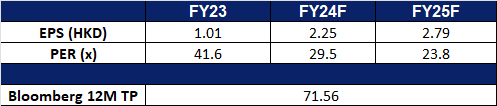

- Market consensus.

(Source: Bloomberg)

IonQ Inc (IONQ US): Pure quantum computing play

- BUY Entry – 42 Target – 50 Stop Loss – 38

- IonQ, Inc. operates as a computing hardware and software company. The Company develops a general-purpose trapped ion quantum computer and software to generate, optimize, and execute quantum circuits. IonQ serves customers worldwide.

- Pure play quantum computing investment. Quantum computing has gained significant attention recently, especially following Google’s unveiling of its latest Willow Quantum Chip, which has sparked heightened investor interest in the field. While Google’s advancements have captured widespread attention, IonQ emerges as a compelling pure-play investment opportunity, uniquely positioned to benefit from the rapid growth of quantum computing as classical computing struggles to address increasingly complex problems. Unlike Google’s Willow chip, which features superconducting qubits that support large-scale integration but are challenging to manufacture, and other competitors like IBM who are facing challenges such as inconsistencies and short operational lifespan, IonQ offers notable advantages, including superior qubit consistency and a fully connected architecture, leveraging stable atomic properties for greater precision and extended performance times. With ongoing progress in hardware, networking, and software, IonQ is well-prepared to tackle the next generation of computational challenges.

- New Enterprise-Grade Quantum OS and Hybrid Services Suite. IonQ recently unveiled its newly branded quantum operating system, IonQ Quantum OS, alongside the IonQ Hybrid Services suite, a collection of innovative capabilities. The IonQ Hybrid Services suite is designed to streamline the development and deployment of hybrid workloads by seamlessly integrating IonQ quantum computers with high-performance classical computing resources via the cloud. These advancements significantly enhance the speed, performance, and usability of quantum workloads, marking a major step forward in the practical application of quantum computing. Together, these technologies are poised to transform quantum computing performance and utility, particularly for enterprise customers.

- 3Q24 results. The company’s revenue grew by 102.1% to US$12.4mn in 3Q24, compared to US$6.14mn in 3Q23. Net loss increased slightly by 17.1% to US$52.5mn in 3Q24, compared to US$44.8mn net loss in 3Q23. Basic and diluted net loss per share increased to US$0.24 in 3Q24, compared to US$0.22 in 3Q23.

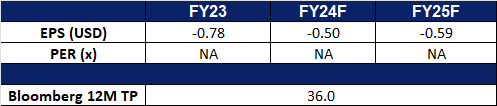

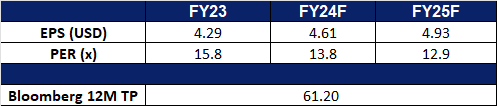

- Market consensus.

(Source: Bloomberg)

Tapestry Inc (TPR US): Deals and steals

- RE-ITERATE BUY Entry – 60 Target – 68 Stop Loss – 56

- Tapestry, Inc. designs and markets clothes and accessories. The Company offers handbags, leather goods, footwear, fragrance, jewelry, outer wear, ready-to-wear, scarves, sunwear, travel accessories, and watches. Tapestry serves customers worldwide.

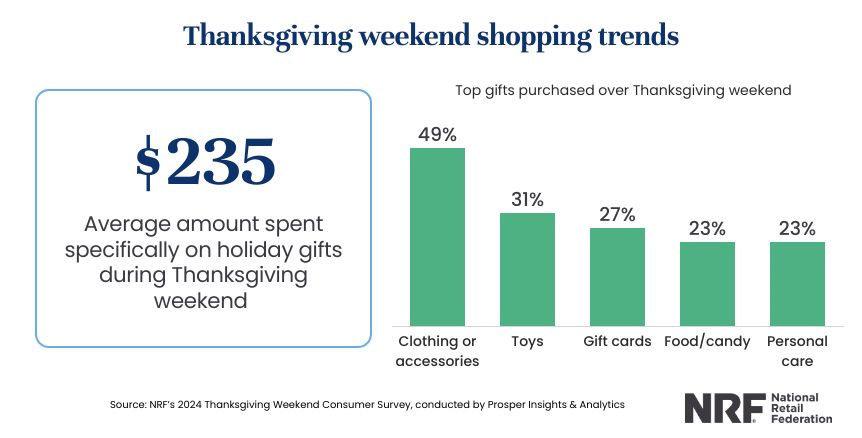

- Shopping for discounts. According to the National Retail Federation (NRF) the Thanksgiving holiday shopping weekend saw robust consumer activity, with 197 million people shopping from Thanksgiving to Cyber Monday, slightly fewer than the 2023 record of 200 million but surpassing the NRF’s expectations of 183 million. Shoppers spent more overall, with online spending up nearly 15% on Black Friday and total sales rising 3.4%, driven by discounts and deals. In-store traffic grew modestly by 0.7%. The NRF reported that consumers spent an average of US$235, up US$8 from last year, primarily on clothing and accessories. Retailers noted that shoppers were selective due to inflation, focusing on value and early sales promotions. Black Friday remained the peak shopping day for both in-store and online activity. The NRF expects holiday sales to grow up to 3.5% this year, slower than recent years but consistent with pre-pandemic trends. Retail executives described consumers as becoming more resourceful, with early holiday deals and budget-conscious behaviour shaping spending patterns. Tapestry Inc is well-positioned to benefit from the increased consumer demand for discounts during the holiday season. As shoppers prioritize value, the company’s promotions and competitive pricing will likely drive strong sales, capitalizing on consumers’ desire for good deals.

Thanksgiving weekend shopping trends (five-day holiday weekend from Thanksgiving through Cyber Monday)

(Source: National Retail Federation)

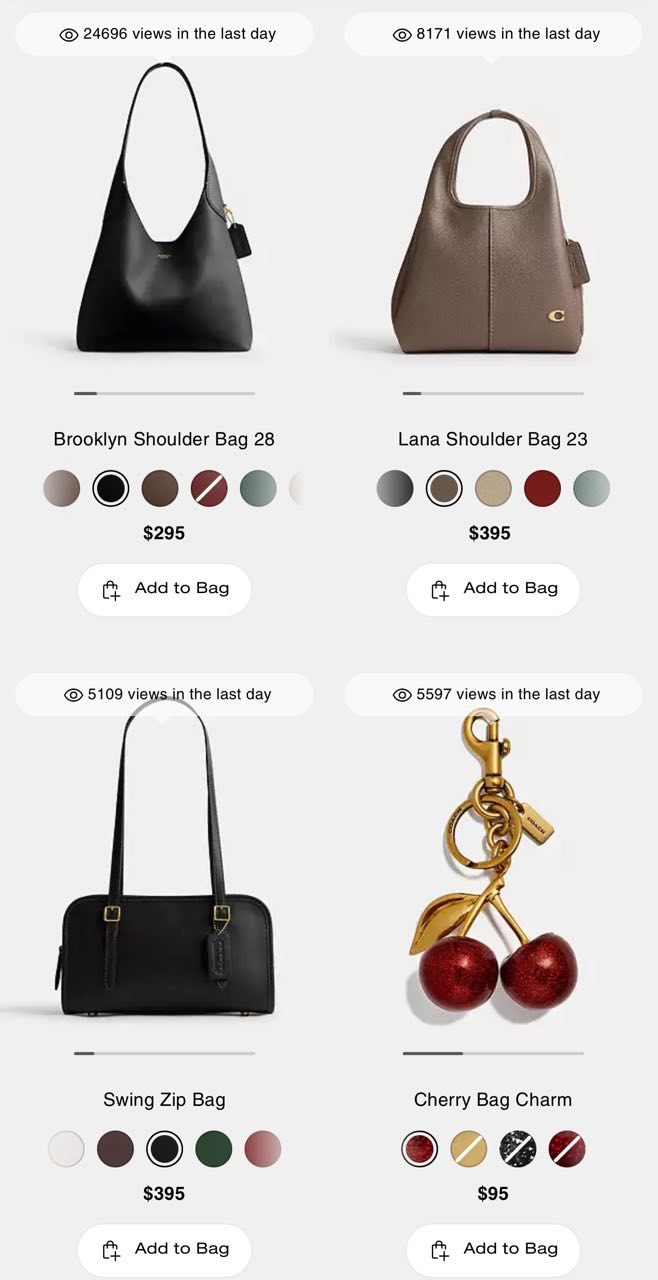

- Banking on Coach’s popularity. Coach has experienced a resurgence in popularity, fuelled by social media and the revival of Y2K nostalgia. As a more affordable luxury brand, Coach’s quality and stylish designs have resonated with Gen-Z and millennial consumers. This growth is evident in Tapestry Inc.’s first-quarter results, with Coach driving handbag revenue and AUR gains. The brand’s success was driven by strong demand for its Coach Tabby bags, which boosted full-price sales in 4Q24. Other designs, like the Brooklyn bag, have also gained traction on social media, selling out quickly. Celebrity endorsements, such as Bella Hadid carrying Coach bags, have further enhanced its appeal to Gen-Z. With its targeted social media marketing and vintage-inspired designs, Coach is poised to maintain strong revenue and profitability growth during this holiday season, which would benefit Tapestry’s top lines.

Bestsellers on Coach US website (prices listed in US$)

(Source: Coach)

- 1Q25 results. Revenue was US$1.51 billion, flat YoY, exceeding market expectations by US$40 million. Non-GAAP EPS was US$1.02, beating expectations by US$0.07. The company raised FY25 revenue expectations to over US$6.75 billion an increase of approximately 1% to 2% YoY, from the previous forecast of about 1% YoY growth, slightly above analysts’ consensus of US$6.706 billion. On an adjusted basis, Tapestry now expects earnings of US$4.50 to US$4.55 a share, compared to its prior guidance of US$4.45 to US$4.50 a share, above analysts’ estimates of $4.49. For Q1, it declared a quarterly dividend of US$0.35 per share, in line with the previous. Tapestry also announced plans for a US$2 billion accelerated share repurchase program.

- Market consensus.

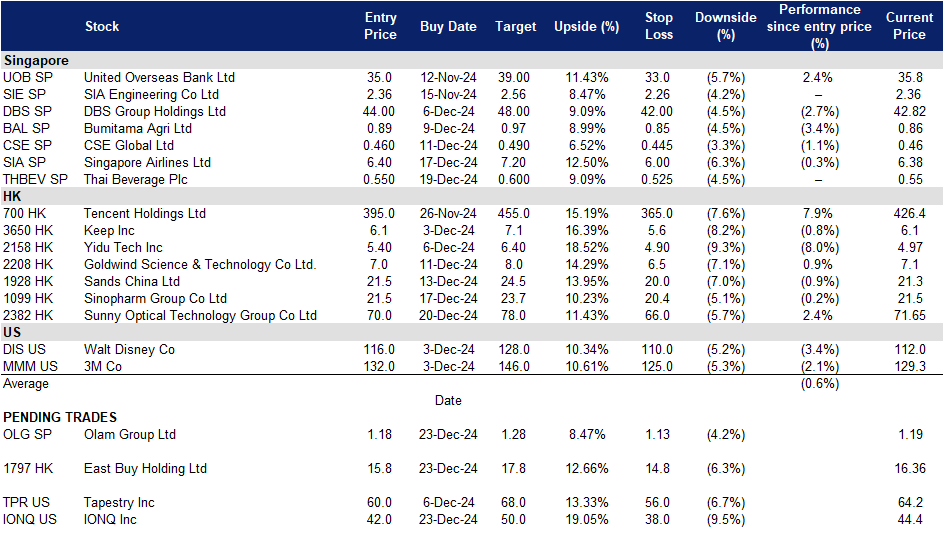

Trading Dashboard Update: Add Sunny Optical Technology Group Ltd (2382 HK) at HK$70.0. Cut loss on Winking Studios Ltd. (WKS SP) at S$0.27, Zillow Group Inc (Z US) at US$75.0, and Toll Brothers Inc. (TOL US) at US$123.0.