18 December 2024 : Winking Studios Ltd (WKS SP), Sinopharm Group Co Ltd (1099 HK), Toll Brothers Inc (TOL US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

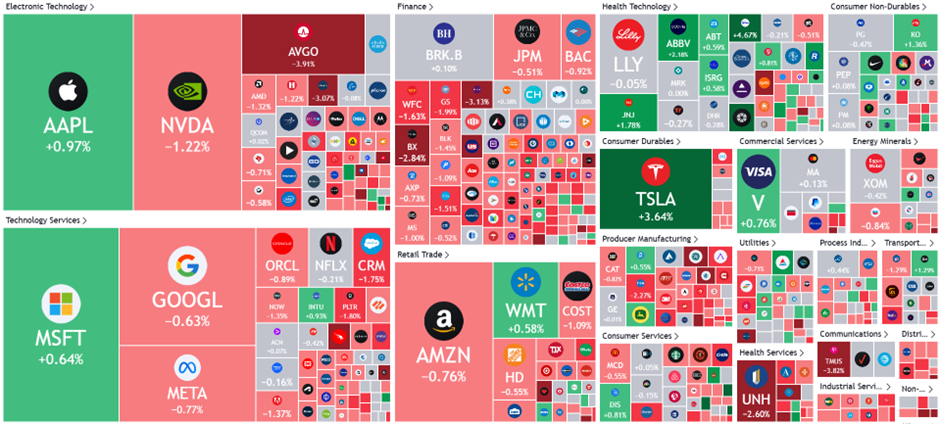

United States

Hong Kong

Winking Studios Ltd (WKS SP): SG shares at a discount

- BUY Entry – 0.29 Target– 0.33 Stop Loss – 0.27

- Winking Studios Limited operates as a game art outsourcing studio. The Company provides complete end-to-end art outsourcing and game development services across various platforms for the video games industry. Winking Studios serves customers worldwide.

- SGX price to play catch up. Winking Studios’ largest peer Keywords Studios was previously listed on AIM in 2013, valued at £49mn, with shares at £1.23. During its £2.1bn acquisition two months ago, shares reached £24.50, rewarding investors as the business grew 40-fold by providing services like music, art, and translation for video games. On 14 November, Winking listed on AIM at 15p per share and is currently trading at 23p, demonstrating early market interest. The company leverages key industry trends like art outsourcing and mobile gaming, attracting major clients like Ubisoft and EA. With a focus on high-quality, cost-effective services and a strong foundation with Acer as a major shareholder, Winking aims to replicate Keyword’s success. This includes organic growth, strategic acquisitions, and leveraging AI to enhance its offerings. As Winking Studios continues to execute its growth strategy and demonstrates increasing value, we anticipate its SGX share price to follow suit and expect continued strong performance and attractive returns for investors.

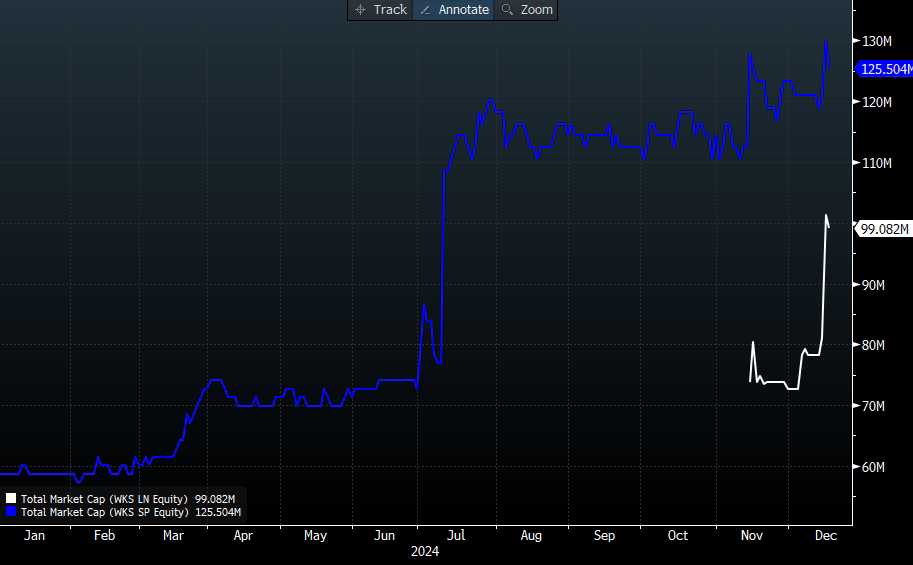

Market cap of Winking Studios LSE (£) vs SGX (S$)

(Source: Bloomberg)

- Joint AI development project. Winking Studios recently entered a supplementary agreement with Acer for the second phase of their joint AI project to develop GenMotion.AI, a 3D animation generation tool. Acer will contribute US$200,000, with Winking providing resources. Both companies will share intellectual property 50/50 for any new inventions. GenMotion.AI converts text input into detailed 3D animations, enhancing efficiency and creativity for animators. GenMotion.AI leverages Winking’s proprietary, traceable training data, aiming to lead the way in AI adoption for digital art. The tool is expected to revolutionize workflows by improving visual quality, production speed, and ultimately, revenue per worker. This collaboration strengthens Winking’s position to handle more projects with tighter deadlines or larger projects, without the need for more manpower, unlocking significant growth potential.

- Dual listed. On 14 November, Winking Studios Limited successfully dual-listed on the London Stock Exchange’s AIM market, raising £7.9mn and achieving a market capitalization of £66mn. The proceeds will support expansion into Western markets and operational enhancements. Winking Studios has collaborated with major developers like Ubisoft and EA, contributing to titles such as FIFA and Call of Duty. The listing followed shareholder approval to issue 130 million shares, with 52.6 million shares placed at a discounted price of 15 pence or $S0.26 with the full consideration at S$13.5mn.

- 1H24 results review. Total revenue for 1H24 increased by 7.1% YoY to US$15.23mn driven by strong growth in the Art Outsourcing Segment and Game Development segment, which saw a 6.6% and 8.1% rise respectively.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.35. Please read the full report here.

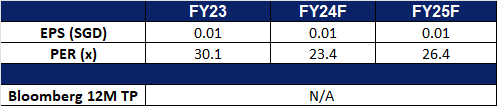

- Market Consensus.

(Source: Bloomberg)

Singapore Airlines Ltd (SIA SP): Winter travel demand

- RE-ITERATE BUY Entry – 6.4 Target– 7.2 Stop Loss – 6.0

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

- Year-end travel demand. In October 2024, Asia Pacific airlines experienced strong travel demand, with international passenger numbers rising by 19.0% YoY, reaching 31 million. Passenger demand, measured by Revenue Passenger Kilometres (RPK), grew by 19.7%, while capacity expanded by 18.6%, resulting in a 0.8 percentage point increase in load factor to 81.2%. Air cargo also saw robust growth, with international demand rising by 10.9%, driven by businesses restocking inventories for the holiday season and online sales events. Freight capacity increased by 10.6%, leading to a slight increase in the load factor to 61.6%. The total number of international passengers carried in the first 10 months of the year rose by 33%, and air freight volumes grew by 14%. The holiday season is expected to drive further demand for air travel, with higher ticket prices and lower jet fuel costs likely benefiting airlines like Singapore Airlines by improving their operating margins.

- Participation in turbulence network. Singapore Airlines has joined the International Air Transport Association’s (IATA) Turbulence Aware platform, a global system for real-time turbulence data exchange, following a fatal turbulence incident in May 2024. SIA and its budget arm, Scoot, signed up alongside Asiana Airlines and British Airways on 10 December, joining a growing network of over 25 carriers using the platform. Turbulence Aware, launched in 2019, provides instant turbulence reports to help pilots avoid turbulent areas, complementing traditional tools like weather maps. SIA began using the platform on 1 November, enhancing its weather management capabilities. The platform has collected over 180 million turbulence reports, improving global coverage as participation increases.

- 1H24 results review. Revenue rose S$335 million, a 3.7% YoY increase to S$9,497 million, with passenger flown revenue up S$118 million and cargo flown revenue higher by S$42 million. Increased competition and higher passenger capacity in key markets exerted pressure on yields, which fell 5.6%. On the cargo front, yield was 13.4% lower amid the continued recovery in bellyhold capacity. The demand for air travel remained healthy in the first six months, with SIA and Scoot carrying 19.2 million passengers, a 10.8% YoY increase. However, passenger traffic growth of 7.9% trailed the SIA Group’s passenger capacity expansion of 11.0%, resulting in a 2.4 percentage point decline in Group passenger load factor (PLF) to 86.4%. SIA and Scoot achieved PLFs of 85.7% and 88.6% respectively. The Group posted a net profit of S$742 million, a 48.5% YoY decline, primarily due to the weaker operating performance.

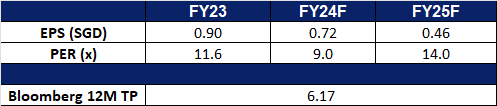

- Market Consensus.

(Source: Bloomberg)

Sinopharm Group Co Ltd (1099 HK): Advanced pharmaceutical developments underway

- RE-ITERATE BUY Entry – 21.5 Target 23.7 Stop Loss – 20.4

- Sinopharm Group Co Ltd is a China-based company principally engaged in pharmaceutical and medical devices distribution business. The Company operates its business through four segments. Pharmaceutical Distribution segment is engaged in the distribution of pharmaceutical products to hospitals, other distributors, retail pharmacy stores and clinics. Medical Devices segment is engaged in the distribution of medical devices, as well as provides installation and maintenance services. Retail Pharmacy segment is engaged in the operation of chain pharmacy stores. Other Business segment is engaged in the distribution of laboratory supplies, manufacture and distribution of chemical reagents, production and sale of pharmaceutical products.

- Clinical trial for Mpox vaccine underway. China’s top drug regulator has approved clinical trials for a domestically developed mpox vaccine by Sinopharm, marking progress in China’s efforts to create a homegrown solution for the disease. The vaccine, created by the Beijing Institute of Biological Products and the National Institute for Viral Disease Control and Prevention, has shown safety and effectiveness in preclinical trials with animal models. Sinopharm emphasized that the vaccine is independently developed with proprietary intellectual property and is expected to play a key role in mpox prevention.

- Pharmaceutical collaboration. Pharmaceutical dealmaking between China and the West has emerged as a rare area of collaboration. In 2023-24, Western pharmaceutical companies spent over US$3.15 billion acquiring or licensing Chinese drug molecules, attracted by China’s growing innovation in biotech. Companies like Pfizer, Roche, and AstraZeneca have invested heavily in partnerships, local incubators, and exploratory efforts to tap into China’s burgeoning biotech sector, which has tripled its contribution to global licensing deals over six years. China’s regulatory reforms under the “Made in China 2025” initiative and venture capital inflows have fostered a biotech ecosystem driven by returning scientists with global expertise. Despite China’s limited track record of FDA-approved drugs, the quality of its emerging therapies is reshaping the global pharmaceutical landscape. As China’s pharmaceutical innovation gains global recognition, Sinopharm is well-positioned to capitalize on this momentum by expanding its international presence and distributing its innovative products to a broader global market.

- 3Q24 earnings. Sinopharm Group’s revenue increased by 2.65% YoY to RMB18.680 billion in 3Q24 from RMB18.198 billion in 3Q23 and a net profit attributable to shareholders of the listed company of RMB322 million, representing a YoY decrease of 10.39%. Basic earnings per share for the quarter declined 10.77% YoY to RMB0.58 from RMB0.65. For 9M24, the company achieved revenue of RMB56.466 billion, representing a YoY decrease of 0.21%; a net profit attributable to shareholders of the listed company of RMB1.066 billion, representing a YoY decrease of 10.43%. As a result, the basic earnings per share decreased by 10.75% YoY and the weighted average return on net assets decreased by 1.19 percentage points YoY.

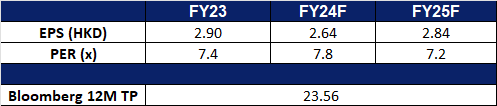

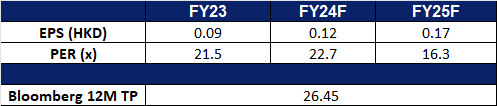

- Market consensus.

(Source: Bloomberg)

Sands China Ltd (1928 HK): Tourism recovery

- RE-ITERATE BUY Entry – 21.5 Target 24.5 Stop Loss – 20.0

- Sands China Ltd. is an investment holding company principally engaged in the development and operation of integrated resorts in Macao. The Company operates many places, including gaming areas, meeting space, convention and exhibition halls, retail and dining areas and entertainment venues. The Company operates its business through six segments: The Venetian Macao, Sands Cotai Central, The Plaza Macao, Sands Macao, Ferry and Other Operations and The Parisian Macao. Through its subsidiaries, the Company is also engaged in the provision of high speed ferry transportation services. The Company’s subsidiaries include Cotai Ferry Company Limited, Hotel (Macau) Limited and Development Limited.

- Visitor arrivals exceed expectations. Macao Government Tourism Office (MGTO) announced that visitor numbers to Macau are expected to surpass 33 million this year, meeting the government’s target set at the beginning of 2023. As of 10 November, over 30 million visitors had already arrived, averaging about 95,000 daily. This increase was partly influenced by the recent Macao Grand Prix and the approaching peak season in December. The Census and Statistics Department (DSEC) recorded approximately 1.68 million foreign visitors, with foreign arrivals making up 6.5% of the total in the first three quarters and an average of 2.88 million arrivals per month. This year’s target reflects a notable rise from 28.2 million visitors in 2023. The ongoing recovery in visitor levels is expected to boost tourism spending in Macau, benefiting Sands China.

- Partnership with NBA. Sands China recently entered into a multi-year partnership with the National Basketball Association (NBA) to bring basketball events to Macau. This partnership will see two NBA preseason games hosted annually at the Venetian Arena for the next five years, which began with the Brooklyn Nets and Phoenix Suns in October 2024. By hosting these globally recognized games, Sands China aims to enhance Macau’s tourism appeal, attracting international visitors and solidifying the city’s reputation as a premier destination for sports and entertainment. These events are expected to drive increased tourism revenue for Macau and boost Sands China’s guest traffic and revenue during the preseason game period.

- 1H24 earnings. Sands China’s revenue increased by 22.7% YoY to US$3.55 billion (HK$27.73 billion) for 1H24 from US$2.90 billion (HK$22.69 billion) in 1H23, with net revenues increasing across all business segments mainly driven by continued recovery in visitation and tourism spending in Macao. The group’s profit was US$541 million (HK$4.22 billion) in 1H24 an increase of 209.1% YoY, compared to US$175 million (HK$1.37 billion) in 1H23. Basic earnings per share rose to US 6.69 cents (HK52.24 cents) in 1H24, compared to US2.16 cents (HK16.93 cents) in 1H23.

- Market consensus.

(Source: Bloomberg)

Toll Brothers Inc (TOL US): Luxury home demand

- RE-ITERATE BUY Entry – 133 Target – 150 Stop Loss – 123

- Toll Brothers, Inc. builds luxury homes, serving both move-up and empty nester buyers in several regions of the United States. The Company builds customized single and attached homes, primarily on land that it develops and improves. Toll Brothers also operates its own architectural, engineering, mortgage, title, security, landscape, insurance brokerage, and manufacturing operations.

- Booming high-end property market. According to a December report by Douglas Elliman, the volume of high-end residential transactions in affluent US areas surged in November. For instance, sales of properties exceeding US$5 million in Manhattan, Miami, and Palm Beach saw significant year-on-year growth. The report attributes this trend primarily to the prosperity of financial markets, with high-net-worth individuals treating luxury real estate as a financial investment rather than a residential necessity. As the wealth effect from a strong stock market persists, demand for luxury properties is expected to remain robust.

- Indirect investment exposure to US luxury homes. Toll Brothers serves as a barometer for the US luxury housing market, offering investors indirect exposure. Strong demand for luxury properties drives the company’s sales and strengthens its pricing power, allowing it to maintain high profit margins. Consequently, Toll Brothers’ performance and stock price closely reflect the trends and health of the US luxury real estate sector.

- 4Q24 results. The company announced its fourth-quarter results on 9 December. Revenue reached US$3.33 billion, a YoY increase of 10.3%, exceeding market expectations by US$160 million. Non-GAAP earnings per share were US$4.63, beating expectations by US$0.29. In the fourth quarter, the company had 2,658 newly signed residential properties, a YoY increase of 30%, and the total value was US$2.66 billion, a YoY increase of 32%.

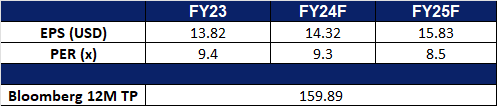

- Market consensus.

(Source: Bloomberg)

Home Depot Inc (HD US): Robust housing and related spending

- RE-ITERATE BUY Entry – 420 Target – 460 Stop Loss – 400

- The Home Depot, Inc. is a home improvement retailer. The Company offers wide range of building materials, home improvement, lawn, and garden products, as well as provides DIY ideas, installation, repair, and other services. Home Depot serves customers worldwide.

- Wealth effect. The current bullish trend in the US equities market could encourage investors to capitalize on their gains by diversifying into real estate. This increased investor confidence in the property market is likely to translate into higher demand for homes. As a result, we can expect an uptick in home-building activity, leading to increased demand for home improvement materials, which would benefit Home Depot as a leading supplier in this sector.

- Strong performance to continue. The National Retail Federation (NRF) reported an estimated 197 million shoppers during the Thanksgiving holiday weekend. Furthermore, the NRF forecasts record holiday season spending between 1 November and 31 December, with an expected growth of 2.5% to 3.5% over 2023, reaching a total of US$979.5 billion to US$989 billion. Despite the holiday shopping surge, consumers still have ample time to complete their holiday shopping lists. Home Depot is poised to benefit from continued demand for hurricane recovery materials as affected homeowners undertake repairs. Additionally, the holiday season traditionally sees a surge in demand for holiday decorations, further bolstering Home Depot’s revenue growth.

- 3Q24 results. Revenue reached US$40.2 billion, a YoY increase of 6.6%, exceeding market expectations by US$980 million. Non-GAAP earnings per share were US$3.78, beating expectations by US$0.13. The company raised its fourth-quarter guidance for total sales to rise about 4% and a comparable sales decline of 2.5% YoY, compared to its previous forecast of 2.5% to 3.5% and a decline of 3% to 4% respectively. It also revised its adjusted earnings per share guidance to a 1% decline from the prior forecast of a 1% to 3% drop. It declared a quarterly dividend of US$2.25 in line with the previous.

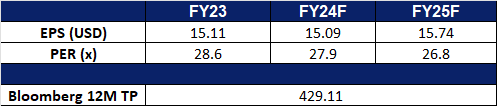

- Market consensus.

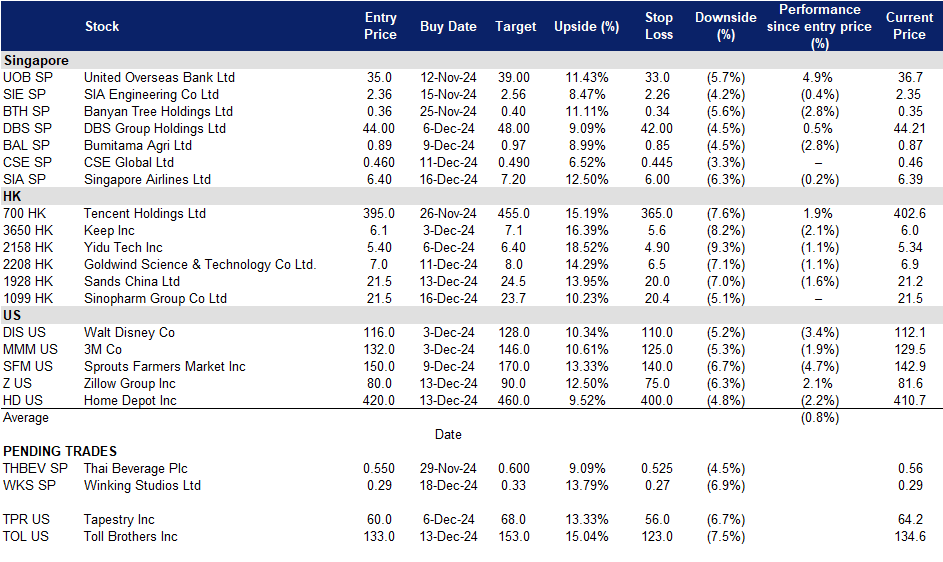

Trading Dashboard Update: Add Singapore Airlines Ltd (SIA SP) at S$6.40 and Sinopharm Group Co Ltd. (1099 HK) at HK$21.5. Cut loss on HongKong Land Holdings Ltd. (HKL SP) at S$4.40.