12 December 2024: Wealth Product Ideas

Diversified Portfolio: Breaking Free from Single-Market Dependence

- The XMAG ETF offers investors a valuable diversification strategy. By excluding the “Magnificent Seven” tech giants, which exert significant influence on major market indexes, it helps investors reduce their dependence on the performance of a few dominant stocks. This diversification strategy mitigates the risk of significant losses if these tech giants underperform.

- By excluding the “Magnificent Seven,” the XMAG ETF provides exposure to other large-cap companies with strong growth potential across various sectors. This allows investors to capture broader market gains and potentially outperform the overall market if these other companies outperform the tech giants.

Fund Name (Ticker) | Defiance Large Cap Ex-Magnificent Seven ETF (XMAG US) |

Description | XMAG, the first ETF designed to provide investors with exposure to the S&P 500, excluding the “Magnificent 7” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla). XMAG offers a unique opportunity for investors to access the broader market while reducing concentration risk in these dominant tech stocks. |

Asset Class | Equity |

30-Day Average Volume (as of 10 Dec) | 19,930 |

Net Assets of Fund (as of 10 Dec) | $9,637,400 |

12-Month Yield | N/A |

P/E Ratio (as of 10 Dec) | 28.743 |

P/B Ratio (as of 10 Dec) | 4.196 |

Expense Ratio (Annual) | 0.35% |

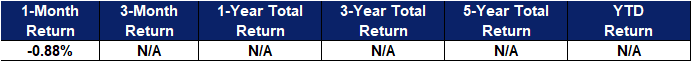

Top Holdings

(as of 11 December 2024)

(Source: Bloomberg)

Artificial Intelligence Innovation: Seizing Future Growth Opportunities

- The BAI ETF focuses on companies involved in artificial intelligence, a rapidly growing and transformative technology. Investing in this ETF allows investors to participate in the potential long-term growth of the AI sector and benefit from the innovations driving this industry forward.

- The AI sector is experiencing explosive growth driven by advancements in large language models, machine learning, and other AI technologies. This rapid growth is attracting significant investment from both public and private sectors, fuelling innovation and creating new market opportunities. By investing in the BAI ETF, investors can directly participate in this dynamic and rapidly expanding sector, potentially generating substantial returns as AI continues to revolutionize various industries.

Fund Name (Ticker) | iShares A.I. Innovation and Tech Active ETF (BAI US) |

Description | The iShares A.I. Innovation and Tech Active ETF seeks to maximize total return. |

Asset Class | Fixed income |

30-Day Average Volume (as of 9 Dec) | 43,401 |

Net Assets of Fund (as of 10 Dec) | $35,977,416 |

12-Month Yield | N/A |

P/E Ratio (as of 10 Dec) | 76.051 |

P/B Ratio (as of 10 Dec) | 11.327 |

Expense Ratio (Annual) | 0.55% |

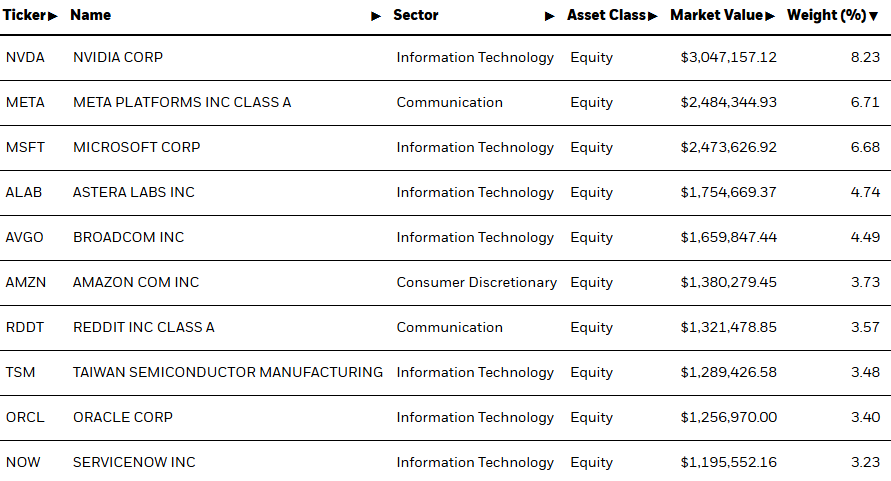

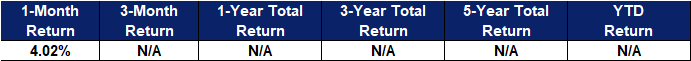

Top 10 Holdings

(as of 9 December 2024)

(Source: Bloomberg)