26 September 2024: Wealth Product Ideas

The Smartphone Revolution

- AI Integration: The upcoming iPhone 16 is expected to feature advanced AI capabilities, potentially setting a new standard for the industry and inspiring widespread innovation among competitors.

- Market Growth: Global smartphone shipments are projected to increase by 5.8% in 2024, indicating a robust and expanding market.

- Consumer Demand: Despite technological advancements, prices are not expected to rise significantly. This suggests that manufacturers and component suppliers may maintain healthy profit margins while meeting increased consumer demand.

- Ecosystem Opportunity: The combination of cutting-edge technology and market growth creates a favorable environment for investing in various aspects of the smartphone ecosystem, including hardware manufacturers, software developers, and component suppliers.

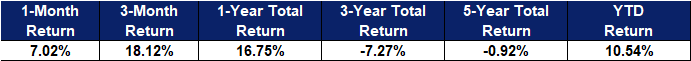

Fund Name (Ticker) | iShares U.S. Telecommunications ETF (IYZ US) |

Description | The iShares U.S. Telecommunications ETF seeks to track the investment results of an index composed of U.S. equities in the telecommunications sector. |

Asset Class | Equity |

30-Day Average Volume (as of 23 Sep) | 675,660 |

Net Assets of Fund (as of 24 Sep) | $243,861,822 |

12-Month Yield (as of 31 Aug) | 2.18% |

P/E Ratio (as of 23 Sep) | 19.18 |

P/B Ratio (as of 23 Sep) | 2.23 |

Expense Ratio (Annual) | 0.40% |

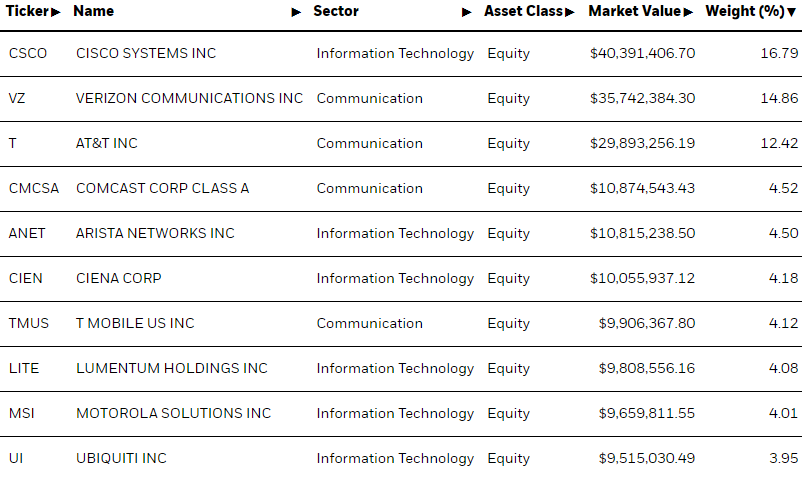

Top 10 Holdings

(as of 23 September 2024)

(Source: Bloomberg)

- Increasing Power Demands: The proliferation of AI applications and data centers is putting unprecedented strain on existing power infrastructure, necessitating significant upgrades.

- Aging Infrastructure: Approximately 70% of the US power grid is over two decades old, highlighting the urgent need for modernization to ensure reliability and efficiency.

- Massive Investment: Projections indicate that more than $600 billion will be invested in upgrading the US grid between 2023 and 2030, representing a substantial market opportunity.

- Renewable Energy Integration: The transition to clean energy sources requires more sophisticated and intelligent grid systems, further driving the need for advanced technologies and infrastructure improvements.

- Multi-faceted Opportunity: This theme encompasses various investment opportunities, including utility companies, technology providers for smart grid solutions, and manufacturers of advanced grid components.

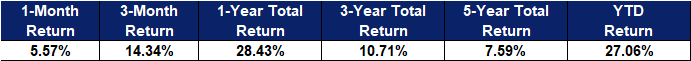

Fund Name (Ticker) | iShares U.S. Utilities ETF (IDU US) |

Description | The iShares U.S. Utilities ETF seeks to track the investment results of an index composed of U.S. equities in the utilities sector. |

Asset Class | Equity |

30-Day Average Volume (as of 23 Sep) | 115,899 |

Net Assets of Fund (as of 24 Sep) | $1,507,364,981 |

12-Month Yield (as of 31 Aug) | 2.24% |

P/E Ratio (as of 23 Sep) | 24.40 |

P/B Ratio (as of 23 Sep) | 2.58 |

Expense Ratio (Annual) | 0.39% |

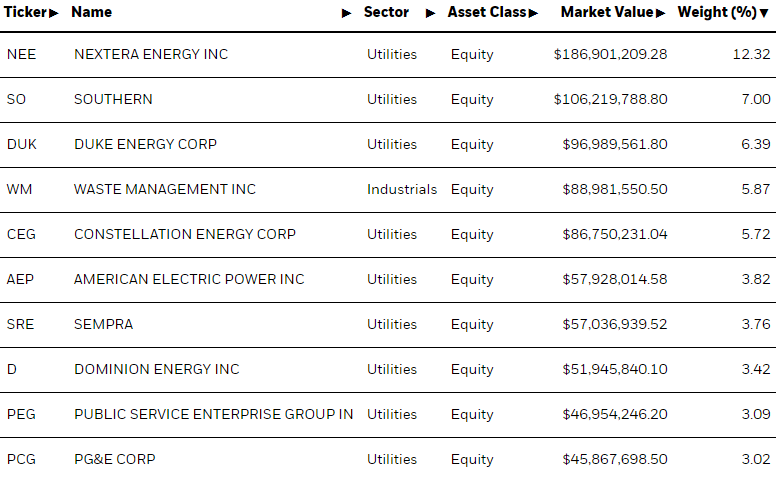

Top 10 Holdings

(as of 23 September 2024)

(Source: Bloomberg)