23 September 2024: OUE REIT (OUEREIT SP), CMOC Group Ltd (3993 HK), Moody’s Corp (MCO US)

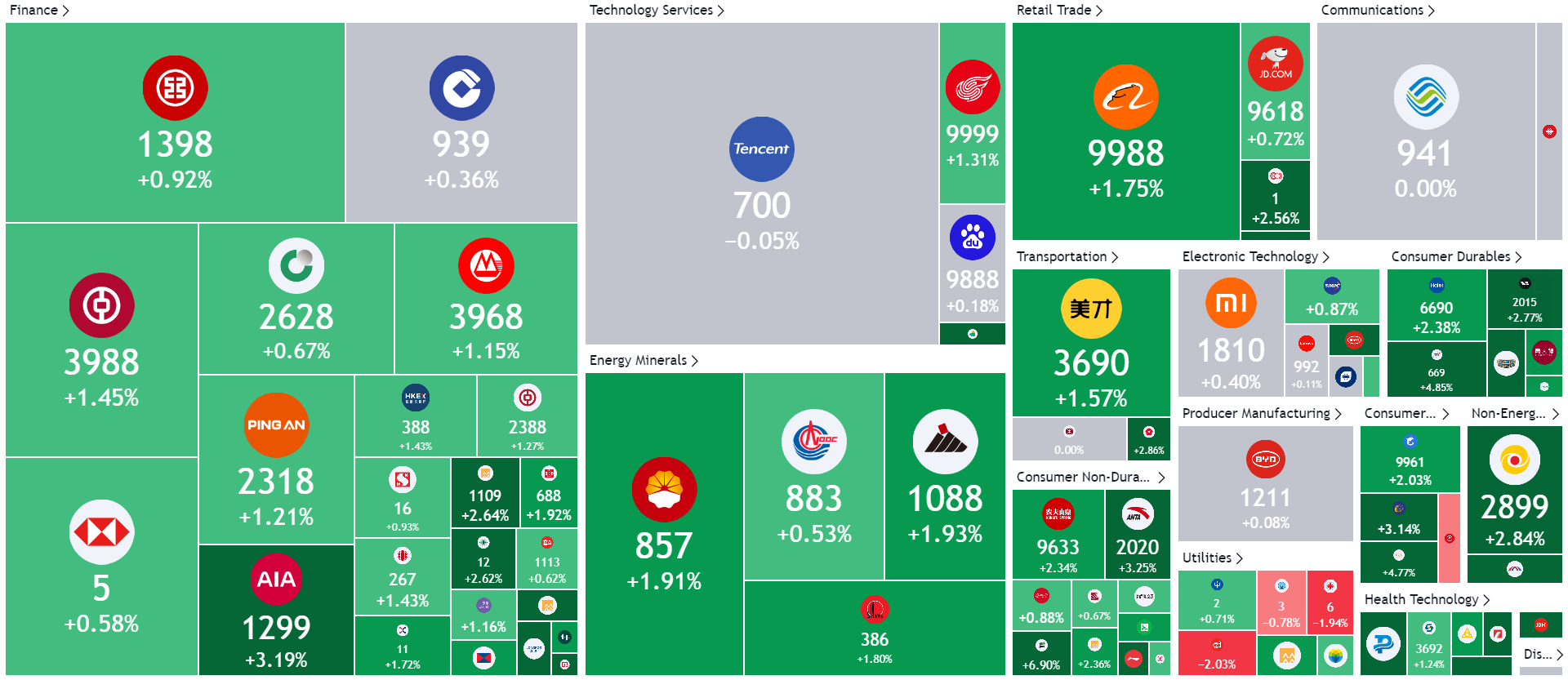

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

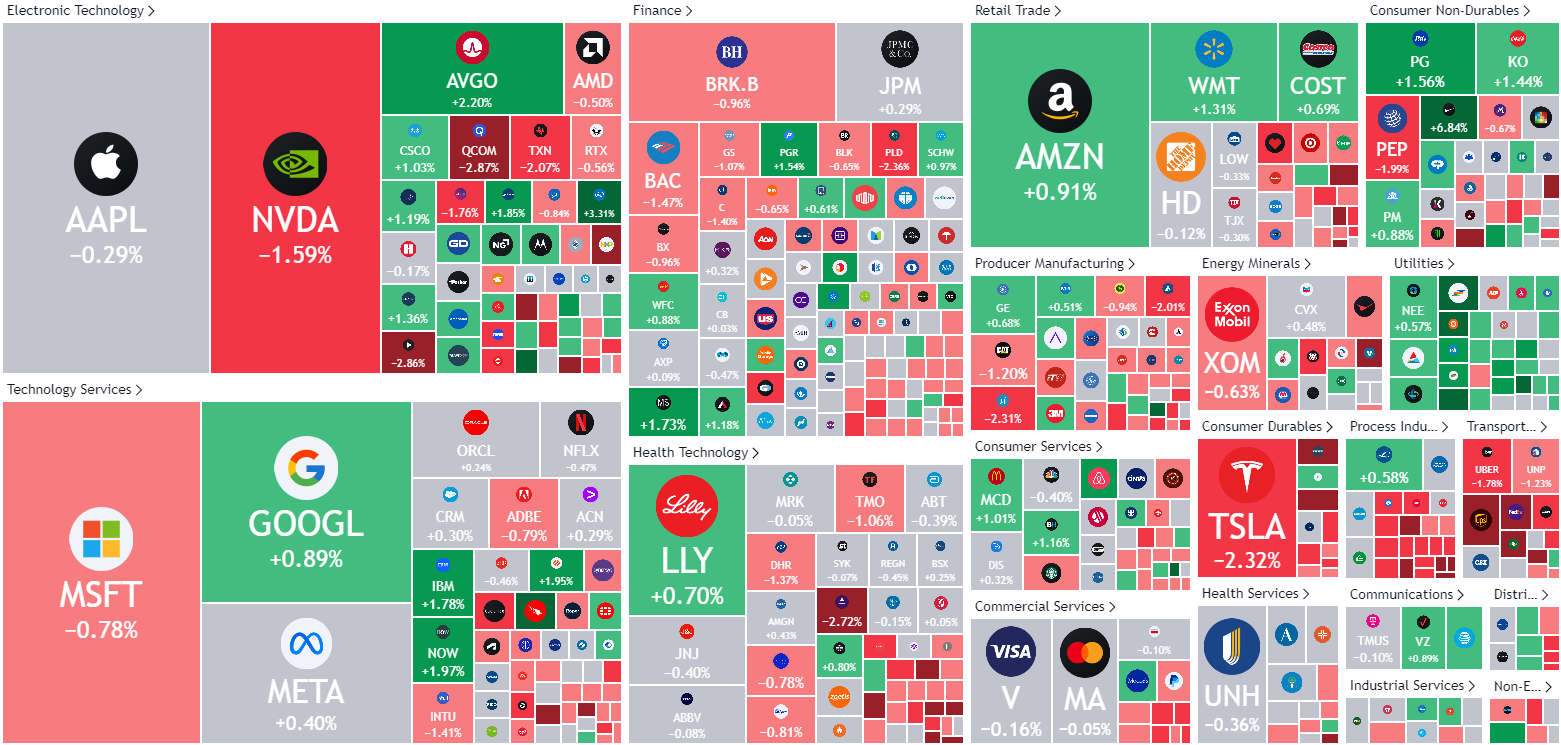

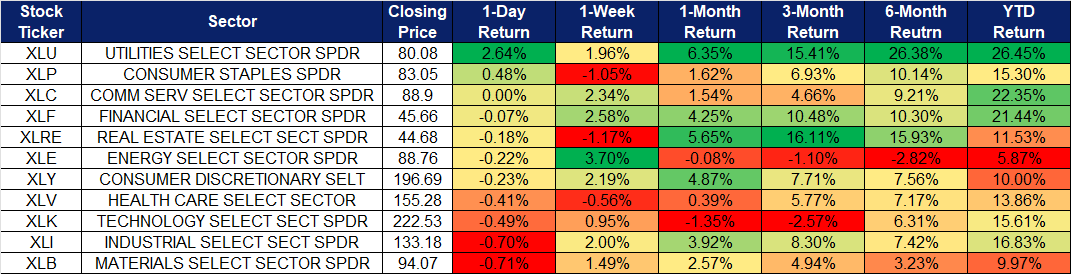

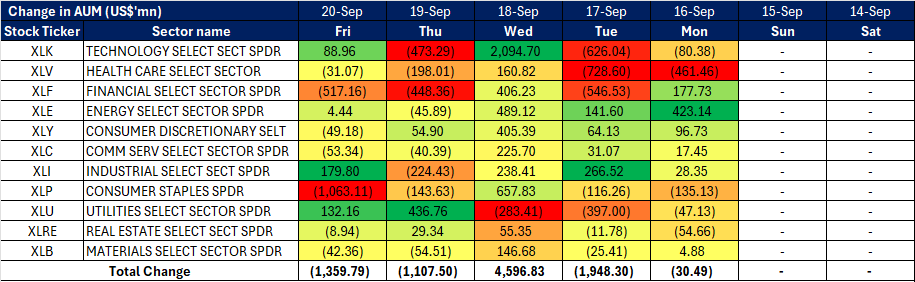

United States

Hong Kong

OUE REIT (OUEREIT SP): 50bps rate cut not priced in yet

- BUY Entry – 0.320 Target– 0.350 Stop Loss – 0.305

- OUE Real Estate Investment Trust (OUE REIT) provides real estate investment services. The Company invests in income-producing real estate used primarily for retail, hospitality, and office purposes in financial and business hubs, as well as real estate-related assets. OUE REIT serves customers in Singapore and China.

- Beginning of US Federal Interest rate cuts. The recent US Federal Reserve cut interest rates by 0.5%, aimed at combating slowing inflation and maintaining labour market strength. Projections suggest further rate cuts through 2026, with the benchmark rate expected to fall to 2.75% to 3%. While inflation risks remain, the Fed is prepared to adjust policy as needed to maintain stable prices and maximum employment. The rate cuts are expected to benefit OUE REIT by reducing borrowing costs, enhancing financial flexibility, and aligning with the REIT’s growth strategy for increased profitability in the coming quarters.

- Refinancing at a lower rate. On 19 September, OUE REIT announced that it priced S$180mn in fixed-rate green notes, due in 2031, at an interest rate of 3.9%. The notes fall under OUE REIT’s S$2bn multicurrency debt issuance programme and are expected to be issued on 26 September 2024, with a maturity date of 26 September 2031. Rated “BBB-” by S&P Global Ratings, the net proceeds will be used to finance or refinance eligible green projects under the REIT’s green financing framework. OCBC serves as the sole global coordinator, with DBS and OCBC acting as joint lead managers and bookrunners. Despite the recent rate cuts by the US Federal Reserve, OUE REIT managed to secure a competitive rate of 3.9% for the loan, which is lower than current market rates. This favourable pricing reflects investor confidence in OUE REIT’s financial stability and strengthens its ability to drive profitability through lower financing costs while supporting its sustainability initiatives.

- Growth in rental reversion. Despite a market slowdown, OUE REIT’s management maintained a high committed occupancy rate of 95.2% for its Singapore office portfolio, with an average passing rent of S$10.57 per sq ft, marking a 0.7% QoQ increase. The REIT achieved rental reversion growth of 11.7%, supported by proactive lease renewal strategies that kept the weighted average lease expiry (WALE) at a comfortable 2.2 years by net lettable area (NLA) and 2.1 years by gross rental income (GRI). Enhancements to the tenant mix have further bolstered portfolio performance.

- 1H24 results review. Revenue for 1H24 increased by 5.7% YoY to S$146.7mn, compared to S$138.8mn in 1H23. Net property income rose by 1.6% YoY to S$117.1mn in 1H24, compared to S$115.3mn in 1H23, mainly driven by the recovery of Singapore’s tourism sector, benefiting the hospitality segment. However, due to the change in base management fees to be fully paid in cash, distribution per unit (DPU) declined by 11.4% YoY to 0.93 Scents, from 1.05 Scents in 1H23.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.309. Please read the full report here.

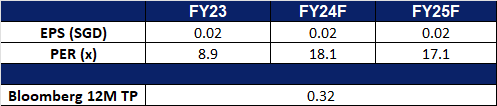

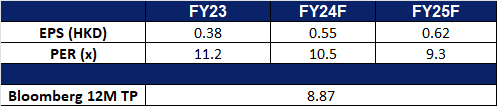

- Market Consensus.

(Source: Bloomberg)

United Hampshire US REIT (UHU SP): More rate cuts to come

- RE-ITERATE BUY Entry – 0.49 Target– 0.53 Stop Loss – 0.47

- United Hampshire US REIT operates as a real estate investment trust. The Company owns and operates shopping, storage, grocery, and necessity-based retail properties.

- Optimism surrounding US Federal Interest rate cuts. The US Federal Reserve cut interest rates by 0.5% on 18 September, marking its first reduction in over four years, ahead of the November presidential election. Fed Chairman Jerome Powell cited slowing inflation and the need to maintain labour market strength as key reasons for the cut. The Fed aims to prevent a significant economic slowdown, particularly as unemployment has slightly increased. Projections indicate further rate cuts through 2026, with the benchmark rate expected to drop to 2.75% to 3%. While there were concerns over reigniting inflation, the Fed emphasized its readiness to adjust policy if needed to meet its goals of stable prices and maximum employment. Economic growth is projected to remain steady, with inflation approaching the Fed’s 2% target by 2025. These further rate reductions are poised to benefit United Hampshire US REIT by lowering borrowing costs, enhancing financial flexibility, and potentially attracting higher investor interest. This favourable interest rate environment aligns with the REIT’s growth strategy, positioning it for increased profitability and value creation in the upcoming quarters.

- Organic growth to drive upside in profitability. United Hampshire US REIT expects organic growth to drive profitability, leveraging built-in rental escalation in the majority of long-term tenant contracts and shorter-term leases in prime self-storage properties. These factors contribute to potential revenue growth and enhanced operational performance.

- Better positioning for active management. If the Federal Reserve implements rate cuts, United Hampshire US REIT stands to benefit in the coming year, enabling proactive portfolio management through strategic acquisitions and divestments. This flexibility underscores the REIT’s capability to adapt to changing market conditions and optimize its asset base.

- 1H24 results review. Revenue for 1H24 increased by 2.4% YoY to US$36.8mn, compared to US$36.0mn in 1H23. Net profit declined by 25.4% YoY to US$9.67mn in 1H24, compared to US$12.96mn in 1H23, mainly due to high interest rates. It also divested a Freestanding Lowe’s and Freestanding Sam’s Club Property within Hudson Valley Plaza for a divestment consideration of US$36.5mn.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.60. Please read the full report here.

- Market Consensus.

(Source: Bloomberg)

CMOC Group Ltd (3993 HK): Benefitting from interest rate cut cycle

- BUY Entry – 6.30 Target 7.10 Stop Loss – 5.90

- CMOC Group Ltd, formerly China Molybdenum Co Ltd, is a China-based company mainly engaged in the mining, smelting, processing and trading of molybdenum, tungsten, copper and other metals. The Company operates through six segments. The Molybdenum and Tungsten Related Products segment is engaged in the mining of molybdenum and tungsten ore. The Copper and Gold Related Products segment is engaged in the mining of copper and gold. The Niobium and Phosphate Related Products segment is mainly engaged in the production of niobium and phosphate fertilizers. The Copper and Cobalt Related Products segment is engaged in the production of copper and cobalt. The Metals Trading segment is principally engaged in the sales of metals. The Other segment is mainly engaged in mining support business.

- Copper price rally. Copper prices surged to a two-month high, bolstered by the Federal Reserve’s half-point rate cut. Base metals have climbed alongside other global risk assets as Fed Chair Jerome Powell initiated the central bank’s easing cycle. In China, the metals market shows signs of recovery, with premiums on imported copper reaching their highest levels since early 2024, and a decline in inventories on the Shanghai Futures Exchange. Investors are also anticipating potential economic support from China, the world’s largest copper consumer, following disappointing industrial output, retail sales, and fixed-asset investment figures, which highlighted the manufacturing sector’s slowdown in the absence of further stimulus. On the supply side, energy shortages in Zambia have constrained output from one of the key global copper ore producers. A continued rally in copper prices is expected to positively impact CMOC’s revenue.

China Shanghai copper spot price (RMB/tonne)

(Source: Bloomberg)

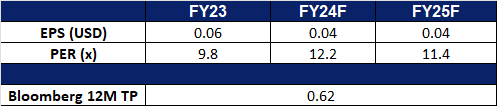

- China increasing gold reserves. While China has paused its gold purchases since May due to surging Gold prices, the country has been ramping up on its gold reserves over the last 2 years. This brings China’s gold reserves now a total of 2,264 tonnes at the end of August, compared to around 1950 tonnes of gold just 2 years ago, according to the World Gold Council. These purchases increase the country’s already sizable holdings as part of a strategy to reduce its reliance on the US dollar. Gold now makes up 4.9% of China’s foreign exchange reserves in US dollars, the highest level ever recorded. The central bank’s gold buying spree, combined with weak performances of Chinese assets such as equities and properties, has sparked retail investors’ interest in gold. It also contributed to a surge in local gold investment demand during 2024 and could continue to support the sector’s growth. We expect gold investment demand to continue increase as the rate cut cycle commenced.

PBOC Gold Reserves

(Source: PBoC, World Gold Council)

(Source: PBoC, World Gold Council)

- Commencement of interest rate cut cycle. The Federal Reserve began its interest rate cut cycle in September, reducing the key overnight borrowing rate by 50bps amid signs of moderating inflation and a softening labor market. The Fed noted increased confidence that inflation is on a sustainable path toward the 2% target, and believes the risks to its employment and inflation objectives are now more balanced. Markets currently anticipate two additional rate cuts by year-end, totaling a potential 75bps. The ongoing rate cuts are expected to support gold prices, benefitting CMOC Group Ltd.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

- 1H24 earnings. Total operating revenue rose 18.56% YoY to RMB102.8bn in 1H24, compared to RMB86.7bn in 1H23. Net profit attributable to shareholders increased 4.13% YoY to RMB62.0bn in 1H24, compared to RMB59.5bn in 1H23. Basic earnings per share was RMB0.25 in 1H24, compared to RMB0.03 in 1H23.

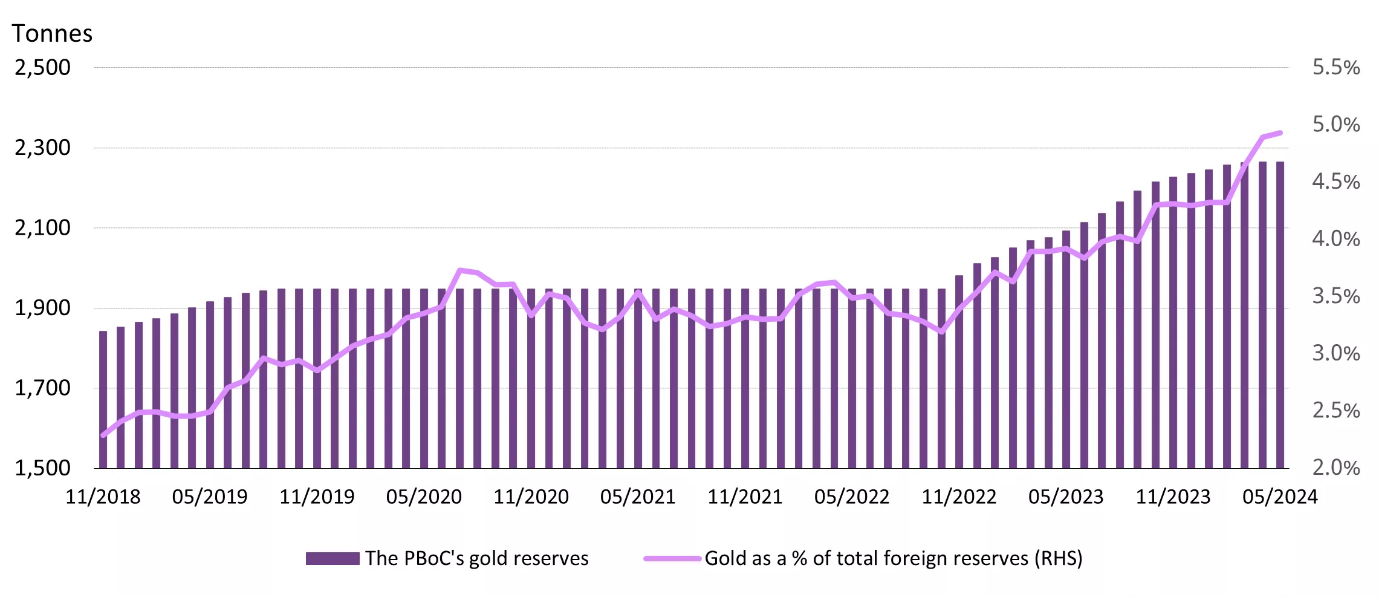

- Market consensus.

(Source: Bloomberg)

Hong Kong Exchanges and Clearing Ltd (388 HK): Expecting more fund inflows

- RE-ITERATE BUY Entry – 236 Target 266 Stop Loss – 221

- Hong Kong Exchanges and Clearing Limited (HKEX) is principally engaged in the operation of stock exchanges. The Company operates through five business segments. The Cash segment includes various equity products traded on the Cash Market platforms, the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The Equity and Financial Derivatives segment includes derivatives products traded on Hong Kong Futures Exchange Limited (HKFE) and the Stock Exchange of Hong Kong Limited (SEHK) and other related activities. The Commodities segment includes the operations of the London Metal Exchange (LME). The Clearing segment includes the operations of various clearing houses, such as Hong Kong Securities Clearing Company Limited, the SEHK Options Clearing House Limited, HKFE Clearing Corporation Limited, over the counter (OTC) Clearing Hong Kong Limited and LME Clear Limited. The Platform and Infrastructure segment provides users with access to the platform and infrastructure of the Company.

- Lower interest rates to drive fund flow. Hong Kong’s central bank lowered its interest rate by 50 basis points to 5.25% yesterday, mirroring the U.S. Federal Reserve’s move. This rate cut is expected to boost business confidence and stimulate consumer spending in Hong Kong. Lower rates are also likely to encourage a shift of funds from safe assets into the stock market, enhancing market liquidity and trading volumes. As a result, HKEX is well-positioned to benefit from increased capital inflows into the stock market.

- To benefit from increasing IPO activities. Hong Kong’s IPO market is poised for growth, with positive signals suggesting more mega deals on the horizon. According to Chan, CEO of HKEX, the market expects increased IPO activity and sustained momentum. Medea’s recent IPO on the HKEX raised HK$31.01 billion, marking the city’s largest listing in over three years. So far this year, Hong Kong has raised approximately HK$51 billion through 45 IPOs and is expected to see continued robust activity through year-end. Alongside IPOs, the city’s secondary fundraising market is also gaining traction, with over US$20 billion raised through follow-on offerings to date. This surge in IPO and fundraising activity is set to significantly benefit HKEX.

- 1H24 earnings. Revenue rose marginally by 0.4% YoY to HK$10.6bn in 1H24, compared to HK$10.8bn in 1H23. Net profit fell by 3.0% YoY to HK$6.12bn in 1H24, from HK6.31bn in 1H23. Basic and diluted earnings per share was HK$4.84 in 1H24, compared to HK$4.99 in 1H23.

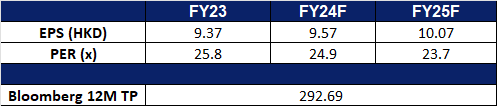

- Market consensus.

(Source: Bloomberg)

Moody’s Corp (MCO US): Bond market recovery

- BUY Entry – 490 Target – 550 Stop Loss – 460

- Moody’s Corporation is a credit rating, research, and risk analysis firm. The Company provides credit ratings and related research, data and analytical tools, quantitative credit risk measures, risk scoring software, and credit portfolio management solutions and securities pricing software and valuation models.

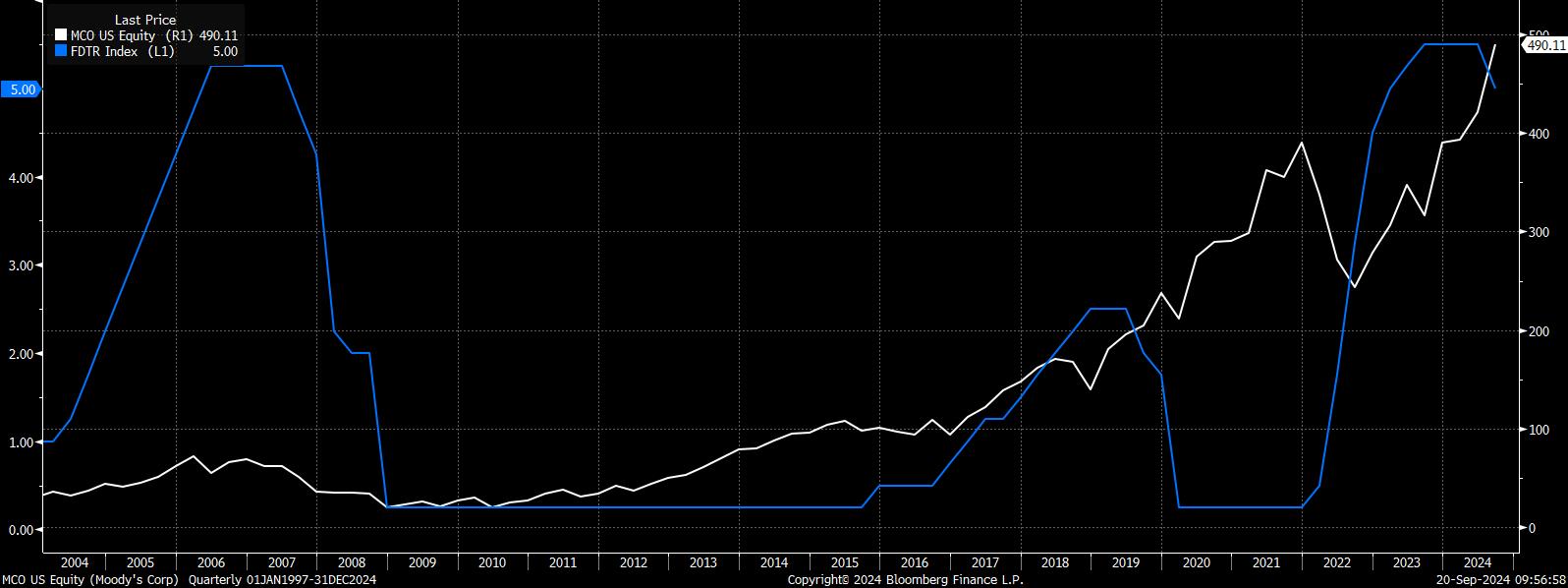

- During the interest rate cut cycle, the bond market recovers. The global bond market has experienced a bear market for more than two years due to the high-interest rate environment. As central banks around the world start their interest rate cut cycle, bond prices gradually recover. In the rising cycle, government and corporate bond issuance and market demand increase simultaneously, thereby increasing Moody’s ratings business revenue.

Company share price and Fed Fund rate cycle

(Source: Bloomberg)

- Funds rotated from defensive sectors to cyclical sectors. As the Federal Reserve begins to cut interest rates, the market expects interest rate cuts to reach 200 basis points in the next year. Some funds began to rotate from defensive stocks to cyclical stocks. Moody’s business has strong cyclical attributes, especially during periods of cyclical changes in interest rates

- 2Q24 earnings review. Revenue increased by 20.8% year-on-year to US$1.8 billion, exceeding expectations by US$80 million. Non-GAAP earnings per share were US$3.28, exceeding expectations by US$0.26.

- Market consensus.

(Source: Bloomberg)

Reddit Inc (RDDT US): Small and mid-cap upcycle kick starts

Reddit Inc (RDDT US): Small and mid-cap upcycle kick starts

- RE-ITERATE BUY Entry – 61 Target – 69 Stop Loss – 57

- Reddit, Inc. operates as a network of communities. The Company offers a social networking platform where anyone can join a community to learn from one another, engage in authentic conversations, explore passions, research new hobbies, exchange goods and services, create new communities, and find belonging. Reddit serves customers worldwide.

- More rate cuts in the pipeline. Following the Federal Reserve’s 50-basis point rate cut in September, small and mid-cap stocks are poised to significantly benefit. With anticipated continued rate reductions of 50 basis points in the remainder of 2024, 100 basis points in 2025, and an additional 50 basis points in 2026, small and mid-cap companies will enjoy lower financing costs. This, combined with increased fund volume in the market due to lower interest rates, will provide a favourable environment for these companies. Moreover, the rate cuts signal the Fed’s confidence in the global economy, which bodes well for the advertising space and, consequently, Reddit’s revenue growth.

- Growth in advertising revenue, narrowing losses. Reddit’s strategic partnerships with major sports leagues such as NFL, NBA, MLB, NASCAR, and PGA Tour, and OpenAI have significantly bolstered its position in the digital advertising market. By leveraging these collaborations, Reddit has not only enhanced its ad offerings but has also fostered stronger community dynamics, driving substantial growth in ad revenue. This is exemplified by the impressive 41% YoY increase in ad revenue, coupled with a 51% surge in daily active users. Reddit’s commitment to refining its advertising technology and expanding its market reach positions it for continued success and sustained growth in the digital advertising landscape. Moreover, the company’s ongoing development of dynamic product ads (DPA) demonstrates its dedication to delivering highly personalized ad experiences to users, which is expected to further contribute to revenue growth in the future.

- 2Q24 earnings review. Revenue rose by 53.6% YoY to US$281.2mn, beating estimates by US$27.32M. GAAP EPS was -US$0.06, beating estimates by US$0.24. In Q3 revenue is expected to be range between US$290mn to US$310mn vs US$282.34mn consensus and adjusted EBITDA in the range of US$40mn to US$60mn.

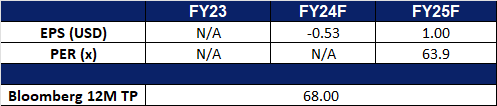

- Market consensus.

(Source: Bloomberg)

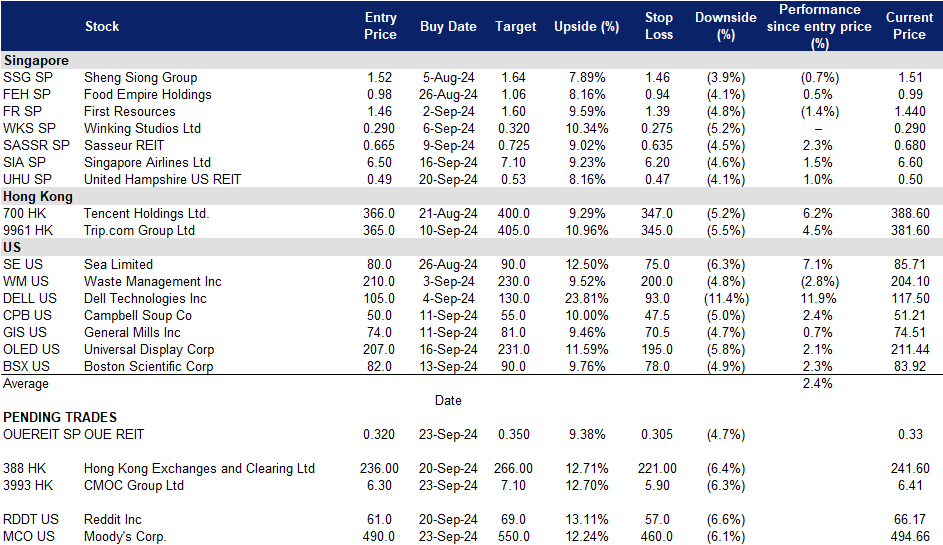

Trading Dashboard Update: Add United Hampshire US REIT (UHU SP) at S$0.49.