16 September 2024: Singapore Airlines Ltd (SIA SP), Laopu Gold Co Ltd (6181 HK), Universal Display (OLED US)

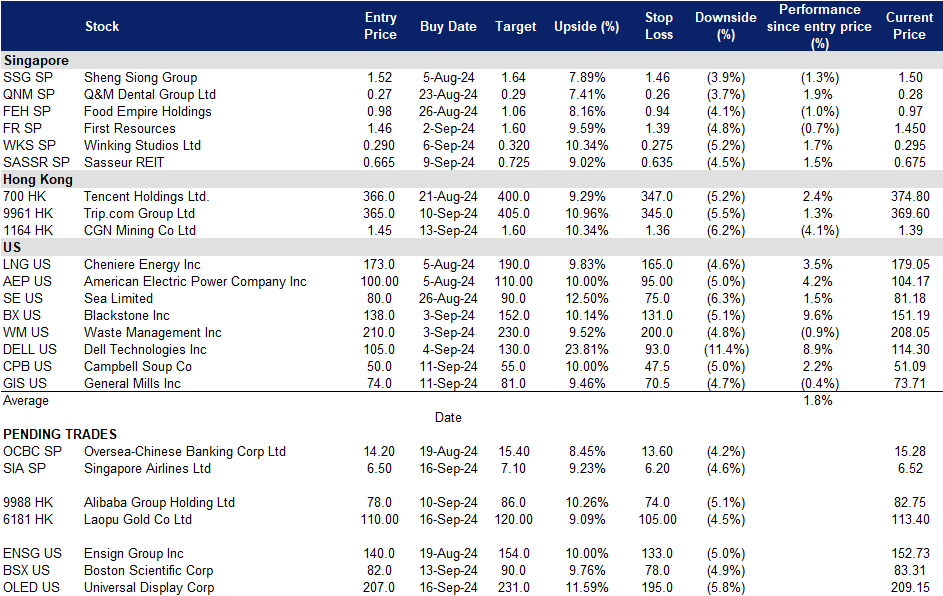

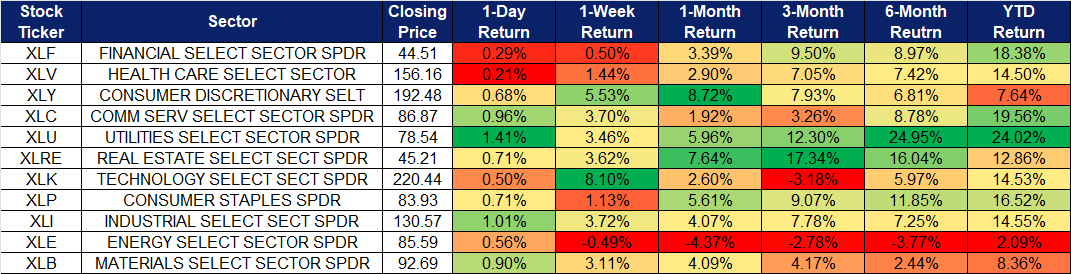

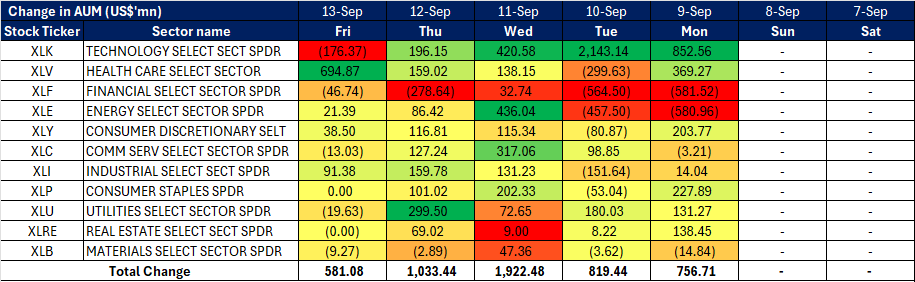

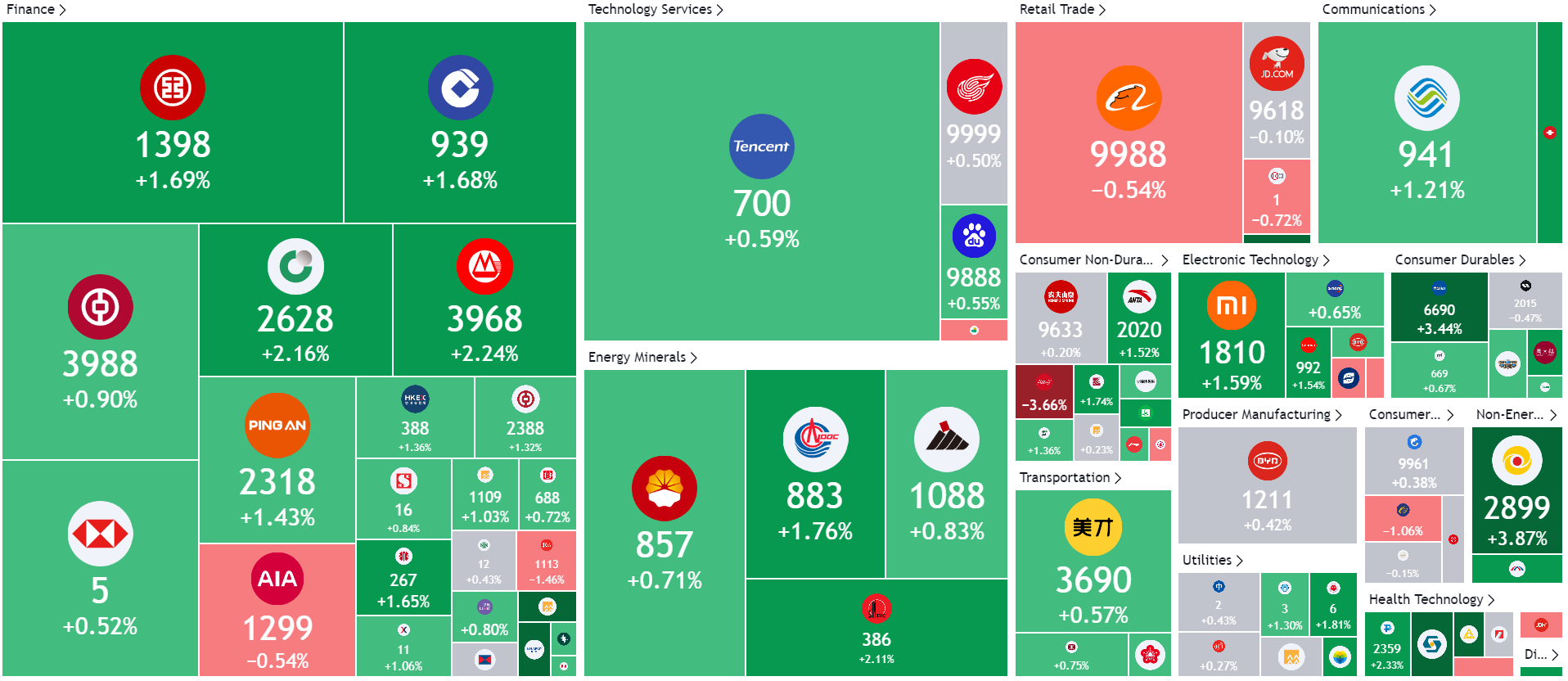

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

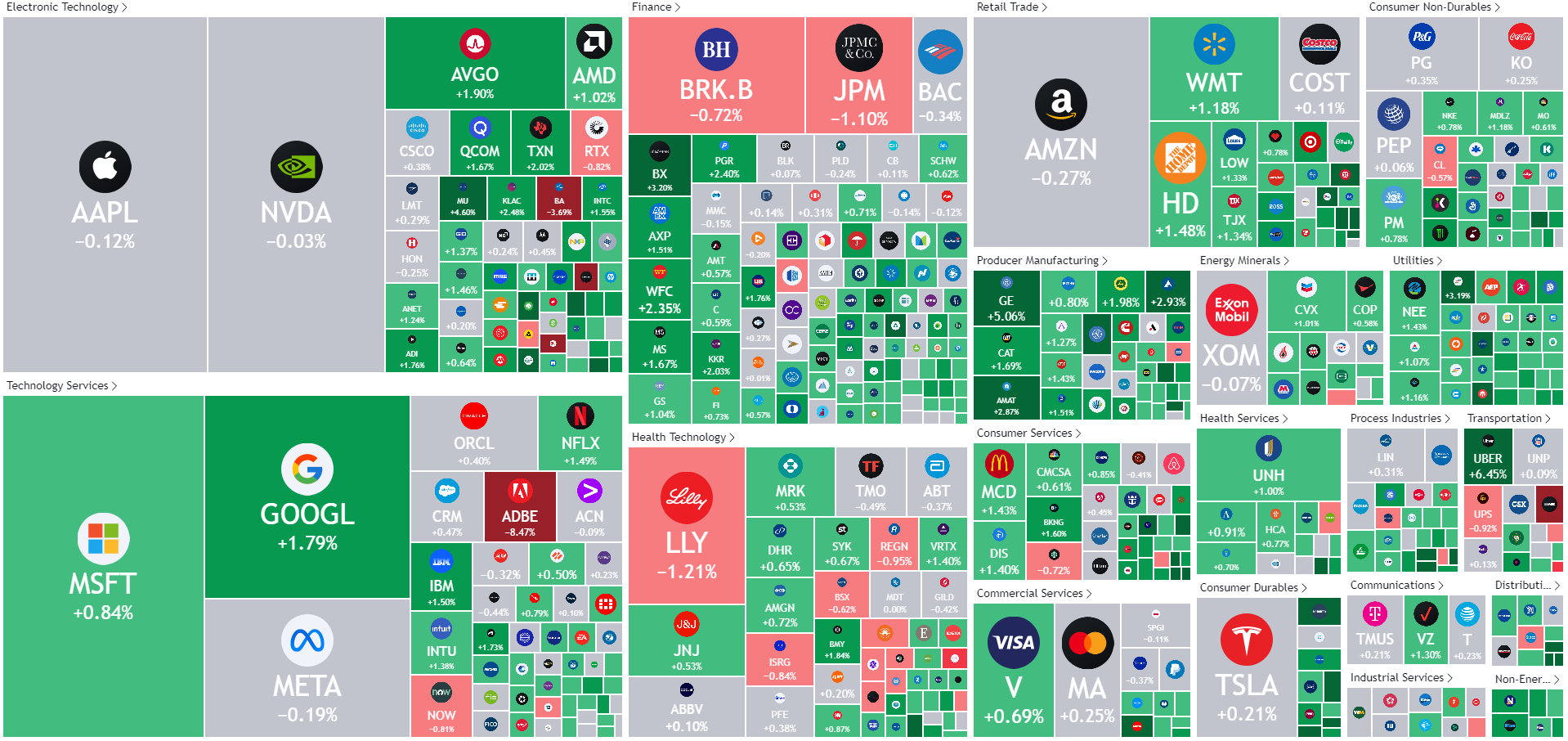

United States

Hong Kong

Singapore Airlines Ltd (SIA SP): Improved margins

- BUY Entry – 6.5 Target– 7.1 Stop Loss – 6.2

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

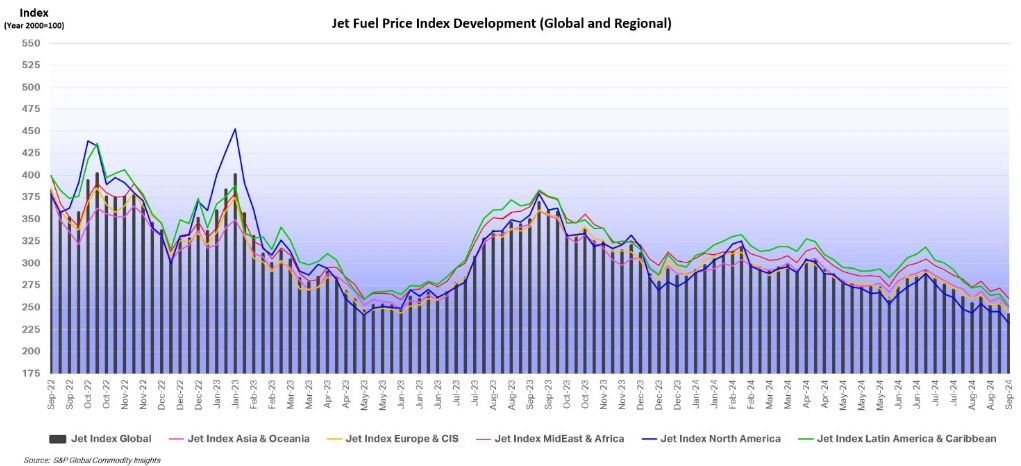

- Continued strong travel demand. According to the International Air Transport Association (IATA) in July 2024, global air passenger demand increased by 8%, reaching a record high, with capacity up 7.4% and a load factor of 86%. International travel grew by 10.1%, while domestic demand rose 4.8%, despite disruptions like the CrowdStrike IT outage. Asia-Pacific saw the highest demand growth at 19.1%, though some routes remain below pre-pandemic levels, while Europe and Latin America also posted strong gains. North America had the highest load factor at 89.4%. IATA highlighted the need to resolve supply chain issues to maintain accessibility and affordability in air travel. With declining jet fuel prices and sustained demand, Singapore Airlines will continue to benefit from improved margins.

Jet Fuel Price Trend

(Source: International Air Transport Association)

- Potential growth in Indian travel market. India has approved Singapore Airlines’ foreign direct investment into the merged Air India-Vistara entity, clearing the final hurdle for the merger. SIA will hold a 25.1% stake in the new carrier with an initial investment of ₹20.6 billion, expected to increase to ₹50.2 billion after completion. Vistara flights will be operated by Air India starting in November 2024. The merger, delayed from its original March target, is expected to close by the end of 2024, giving SIA a significant foothold in India’s rapidly growing travel market.

- 1Q25 results review. Total revenue for Q1 increased by 5.3% YoY to S$4,718mn from S$4,479mn in 1Q24. Passenger flown revenue grew 4.1% to S$3.8bn, supported by a 13.8% increase in passengers carried and strong load factors. Net profit saw a 38.4% YoY decline to S$452mn, due to weaker operating performance, a reduction in net interest income, lower surplus on disposal of aircrafts and spare engines, and a lower share of profit from its associated companies.

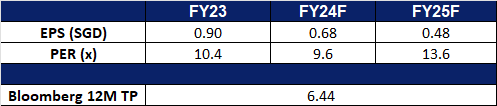

- Market Consensus.

(Source: Bloomberg)

Sasseur REIT (SASSR SP): REIT-liable portfolio

- RE-ITERATE BUY Entry – 0.665 Target– 0.725 Stop Loss – 0.635

- Sasseur Real Estate Investment Trust operates as a real estate investment trust. The Company invests in a diversified portfolio of retail real estate assets. Sasseur Real Estate Investment Trust serves customers in Asia.

- Stable 1H24 performance. Sasseur REIT reported a 5.1% YoY decline in distributable income per unit (DPU) to 3.153 Scts in 1H24. Despite this, EMA rental income remained stable, delivering RMB329.0mn, a 0.9% YoY growth, equivalent to S$62.3mn, a slight 0.4% YoY decline. This performance aligns with expectations, considering the changes in the treatment of upfront borrowing costs and 20% of the REIT Manager’s base fee to be paid in cash. The 3.9% YoY decline in outlet sales in RMB during 1H24 reflects the higher sales base from 1H23, driven by pent-up demand following China’s economic reopening.

- Shifting consumer dynamics in China. Amid growing consumer caution, outlet sales have seen a modest decline. Sasseur REIT has felt the impact of weaker consumer spending in China, with sales declining YoY, exacerbated by the strong 1H23 base. The slower-than-expected recovery in the Chinese economy has added to consumption uncertainty. However, proactive management efforts, including ongoing tenant mix enhancements, are helping to attract diverse audiences and support portfolio sales performance.

- 1H24 results review. EMA rental income for 1H24 increased by 0.9% YoY to RMB329.0mn from RMB326.0mn. However, unfavourable forex movements led to a slight 0.4% YoY decline in EMA rental income, totalling S$62.3mn. The combination of forex headwinds and declining outlet sales resulted in a 2.9% YoY drop in distributable income to S$42.7mn, with a corresponding decrease in 1H24 DPU to 3.153 Scts. RMB sales for 1H24 declined by 3.9% YoY, reflecting ongoing weakness in the outlet business.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.90. Please read the full report here.

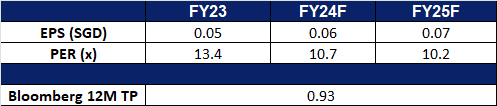

- Market Consensus.

(Source: Bloomberg)

Laopu Gold Co Ltd (6181 HK): Gold rush in China

- BUY Entry – 110 Target 120 Stop Loss – 105

- Laopu Gold Co., Ltd. produces and sells jewelry products. The Company produces pendants, bracelets, bracelets, collectibles, ornaments, and other products. Laopu Gold also operates import and export businesses.

- Gold demand to remain high. China’s central bank paused gold purchases for the fourth consecutive month in August, despite the value of its gold reserves rising to US$182.98bn, driven by a 21% surge in gold prices this year. This rise is fuelled by expectations of US rate cuts and increased safe-haven demand amid global geopolitical and economic uncertainties. While the People’s Bank of China (PBOC) was the largest gold buyer in 2023, its recent pause has tempered domestic investor demand. However, analysts anticipate the PBOC will eventually resume purchases to reduce its reliance on the US dollar as a reserve asset. In July, China’s net gold imports via Hong Kong increased by 17% from the previous month, with total imports rising by over 6%, signalling growing demand. Despite weak demand for gold jewellery due to economic uncertainty, Chinese banks have received new gold import quotas, reflecting expectations of rising demand. Interest in gold coins and bars remains steady, and with ongoing economic instability and concerns over currency depreciation, gold demand is expected to remain strong in the coming months.

- Gold jewellery still shining. Laopu Gold, renowned for its traditionally crafted gold jewellery, has strategically positioned itself as a luxury brand, with fixed pricing for its pieces rather than pricing by weight, earning it the nickname “Hermès of Gold.” Leveraging its first-mover advantage in the heritage gold jewellery industry, Laopu focuses on product innovation, design, and quality customer service. Laopu is well-placed to capitalize on the booming gold jewellery market in China, where culturally resonant designs are attracting younger buyers. The “guochao” (China chic) trend, which celebrates Chinese identity, combined with gold’s rising value as a safe-haven asset, presents a significant growth opportunity. Young consumers are increasingly valuing the purchasing experience, craftsmanship, and cultural stories behind their jewellery, reshaping the market and positioning Laopu to capture this growing demand.

- 1H24 earnings. Revenue rose by 148.3% YoY to RMB3,520.19mn in 1H24, compared to RMB1,417.51mn in 1H23. Net profit rose by 198.8% YoY to RMB587.81mn in 1H24, from RMB196.75mn in 1H23, due to expansion of brand awareness, including both online and offline channels; the continuing optimization, promotion and iteration of the Group’s products; customers’ preference for high-quality heritage gold products with significant cultural and product value resulting from the changes in consumer consumption attitudes and upgrading of consumption concepts; and six new boutiques and expanded one boutique which resulted in an increased revenue contribution. Basic and diluted earnings per share was RMB4.11 an increase from RMB1.44 in 1H23.

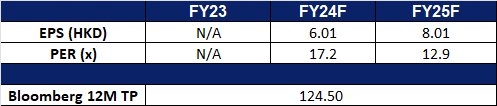

- Market consensus.

(Source: Bloomberg)

CGN Mining Co Ltd (1164 HK): Potential tight supply

- RE-ITERATE BUY Entry – 1.45 Target 1.60 Stop Loss – 1.36

- CGN Mining Co Ltd is a company mainly engaged in the trading of natural uranium. The Company operates its business through three segments. The Natural Uranium Trading segment is engaged in the trading of natural uranium. The Property Investment segment is engaged in leasing business. The Other Investments segment is engaged in investment activities.

- Potential restricted uranium supply. Russian President Putin said Moscow should consider limiting uranium, titanium, and nickel exports. Russia has approximately 44% of the world’s uranium enrichment capacity and provides 5.5% of the global supply. It owns about 8% of the global reserves. In May, the US passed the Prohibiting Russa Uranium Imports Act. Countries with nuclear energy, especially the Western ones have been sourcing reliable supplies. Russia’s potential uranium export restriction will lead to tight supplies, and prices will rebound accordingly.

- 1H24 operation update. In 1H24, the total equity source of the Group was 39,000tU and equity production was 624tU. The group was interested in 49% of the equity interest of Semizbay-U, which mainly owns and operates the Semizbay Mine and the Irkol Mine in Kazakhstan. The planned uranium extracted was 471tU with actual extraction of 477tU and the completion rate of planned production was 101% in the first half of the year; among which, actual uranium extracted from the Semizbay Mine and the Irkol Mine was 182tU and 295tU, respectively. The average production costs of the Semizbay Mine and the Irkol Mine were US$31.93/lbU3O8 and US$23.83/lbU3O8, respectively. The group was interested in 49% of the equity interest of Ortalyk, which mainly owns and operates the Central Mynkuduk Deposit and the Zhalpak Deposit in Kazakhstan. The planned uranium production was 905tU with actual production of 858tU and the completion rate of planned production was 95% in the first half of the year; among which, actual uranium extracted from the Central Mynkuduk Deposit and Zhalpak Deposit was 792tU and 66tU, respectively.

- 1H24 earnings. Revenue grew by 38.8% to HK$4.07bn. Gross loss was HK$56.4mn compared to HK$186.7mn profit in 1H23. Net profit attributable to the shareholders of the company declined by 37.0% to HK$113.1mn.

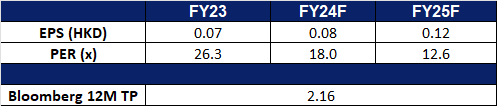

- Market consensus.

(Source: Bloomberg)

Universal Display (OLED US): OLED gadgets in demand

- BUY Entry – 207 Target – 231 Stop Loss – 195

- Universal Display Corporation is a member of the United States Display Consortium. The Consortium is a cooperative industry and government effort aimed at developing an infrastructure to support a North American flat panel display infrastructure. The Company and its partners are developing high-resolution, full color, light weight Organic Light Emitting Diode (OLED) technology.

- Demand for notebook and tablet OLED products is growing. OLED adoption is rapidly expanding in mobile PCs. Omdia forecasts a 37% compound annual growth rate in demand for OLED panels in laptops and tablets from 2023 to 2031. This surge reflects a growing number of brands investing in high-end notebooks with OLED displays. Market penetration is accelerating shipments of OLED screen tablets and laptops are projected to reach 12 million and 5 million units, respectively, in 2024. By 2027, these figures are expected to increase to 21 million and 28 million units.

- Strong cash position. As of the second quarter of 2024, the company held US$530.5mn in cash and equivalents, significantly exceeding its total debt of US$24.7mn. This robust cash position demonstrates the company’s strong financial health and ability to generate cash. Free cash flow in the second quarter reached US$57.89mn, approaching the historical peak of US$66.38mn.

- 2Q24 earnings review. Revenue rose by 8.1% YoY to US$158.5mn, missing estimates by US$1.44M. GAAP EPS was US$1.10, missing estimates by US$0.05.

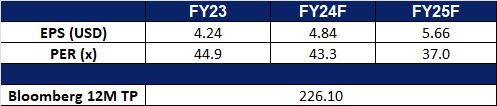

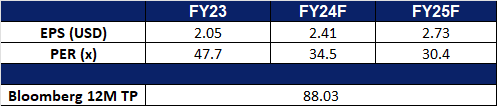

- Market consensus.

(Source: Bloomberg)

Boston Scientific Corp (BSX US): A growing stock in a defensive sector

Boston Scientific Corp (BSX US): A growing stock in a defensive sector

- RE-ITERATE BUY Entry – 82 Target – 90 Stop Loss – 78

- Boston Scientific Corporation develops, manufactures, and markets minimally invasive medical devices. The Company’s products are used in interventional cardiology, cardiac rhythm management, peripheral interventions, electrophysiology, neurovascular intervention, endoscopy, urology, gynecology, and neuromodulation.

- Exhibits both defensive and growth attributes. Boston Scientific Corp demonstrated remarkable resilience during market downturns supported by strong long-term growth prospects in the healthcare sector. The aging US population and increasing medical needs are driving higher demand for healthcare services and products. The Centers for Medicare & Medicaid Services (CMS) projects national health expenditure growth of 5.6% to outpace GDP growth of 4.3%, rising from 17.3% of GDP in 2022 to 19.7% by 2032. This sustained demand highlights the healthcare sector’s enduring role in economic growth.

- Tailwinds of falling inflation and interest rate cuts. Revenue is expected to grow at an average rate of 10% for the next 3 years from FY25 to FY27, with a 14.25% growth rate expected for FY24. The slowing labour market will lead to a decline in labour costs, which will increase the Boston Scientific’s gross profit and operating profit. As a result of an interest rate cut cycle, the company’s debt costs will fall, reducing its overall interest burden and leading to an improvement in fundamentals. Additionally, as the economy and consumer confidence gradually improve, there will be an increase in demand for medical procedures that require the use of medical devices manufactured by Boston Scientific.

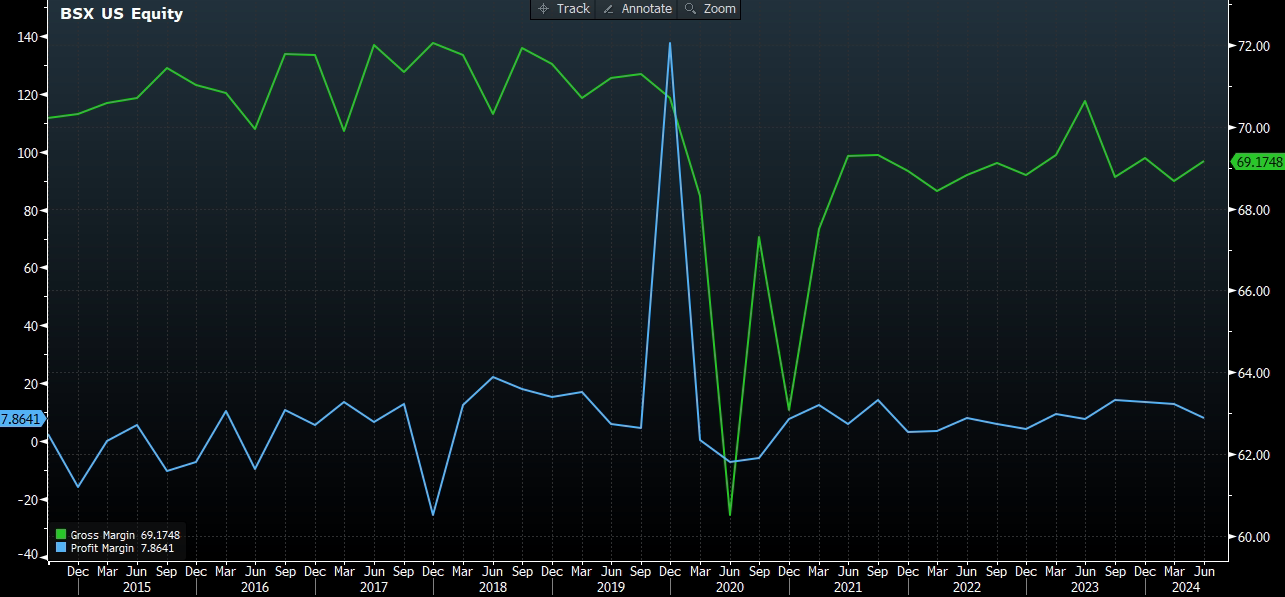

Gross Margin vs Net Profit Margin

(Source: Bloomberg)

- Promising acquisitions. Boston Scientific is making strategic acquisitions to strengthen its business. It plans to acquire Axonics, a maker of devices for urinary and bowel dysfunction, for US$3.7bn, with completion now delayed to the second half of 2024. This acquisition is expected to significantly boost Boston’s urology segment, which contributes about 14% of its sales. Regulatory delays from the FTC may prolong the process. Additionally, in June, Boston Scientific also announced the acquisition of Silk Road Medical for US$1.16bn, expanding its stroke prevention portfolio with Silk Road’s TCAR technology. Both deals are set to close in 2024, with no major impact on earnings expected until 2025.

- 2Q24 earnings review. Revenue rose by 14.8% YoY to US$4.12bn, beating estimates by US$100M. Non-GAAP EPS was US$0.62, beating estimates by US$0.04. For Q3, it expects net sales growth to be between 13% to 15% vs estimated growth of 12.09% YoY and adjusted EPS to be $0.57 to $0.59 vs $0.57 consensus. For FY24, it expects net sales growth to be in the range of 13.5% to 14.5% vs estimated growth of 12.38% YoY and adjusted EPS to be $2.38 to $2.42 vs $2.33 consensus.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on United Hampshire US REIT (UHU SP) at S$0.46. Add CGN Mining Co Ltd (1164 HK) at HK$1.45.