12 September 2024: Wealth Product Ideas

Resilient Portfolios Through Healthcare Investments

Key Drivers for Healthcare Industry Investment:

- Healthcare stocks show relative resilience during market downturns.

- The sector has demonstrated strong performance after past Fed interest rate cuts.

- Long-term healthcare expenditure and costs continue to rise in the US.

- Aging population and increasing medical needs contribute to the sector’s growth.

- The US presidential election may have less impact on healthcare stocks this year compared to previous elections.

- US national health expenditure is projected to grow at a compound annual growth rate of 4.4% until 2026.

Fund Name (Ticker) | iShares Global Healthcare ETF (IXJ US) |

Description | The iShares Global Healthcare ETF seeks to track the investment results of an index composed of global equities in the healthcare sector. |

Asset Class | Equity |

30-Day Average Volume (as of 9 Sep) | 112,791 |

Net Assets of Fund (as of 10 Sep) | $4,315,096,002 |

12-Month Yield (as of 31 Aug) | 1.21% |

P/E Ratio (as of 9 Sep) | 32.20 |

P/B Ratio (as of 9 Sep) | 4.75 |

Expense Ratio (Annual) | 0.41% |

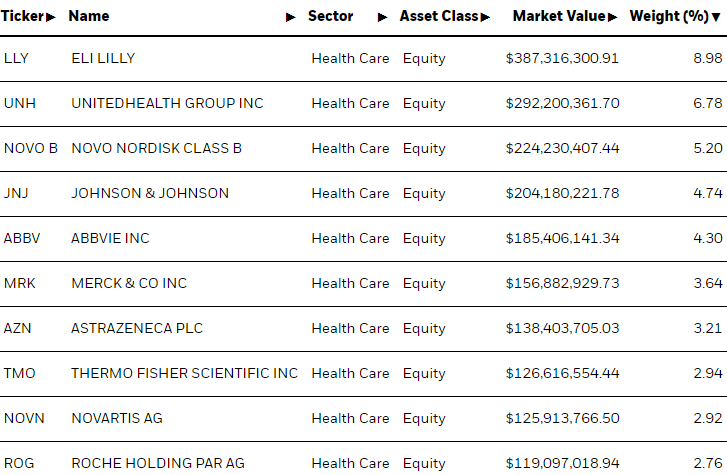

Top 10 Holdings

(as of 9 September 2024)

(Source: Bloomberg)

(Source: Bloomberg)

Fund Name (Ticker) | iShares U.S. Healthcare ETF (IYH US) |

Description | The iShares U.S. Healthcare ETF seeks to track the investment results of an index composed of U.S. equities in the healthcare sector. |

Asset Class | Equity |

30-Day Average Volume (as of 9 Sep) | 303,223 |

Net Assets of Fund (as of 10 Sep) | $3,656,754,102 |

12-Month Yield (as of 31 Jul) | 1.12 % |

P/E Ratio (as of 9 Sep) | 33.18 |

P/B Ratio (as of 9 Sep) | 5.27 |

Management Fees (Annual) | 0.39% |

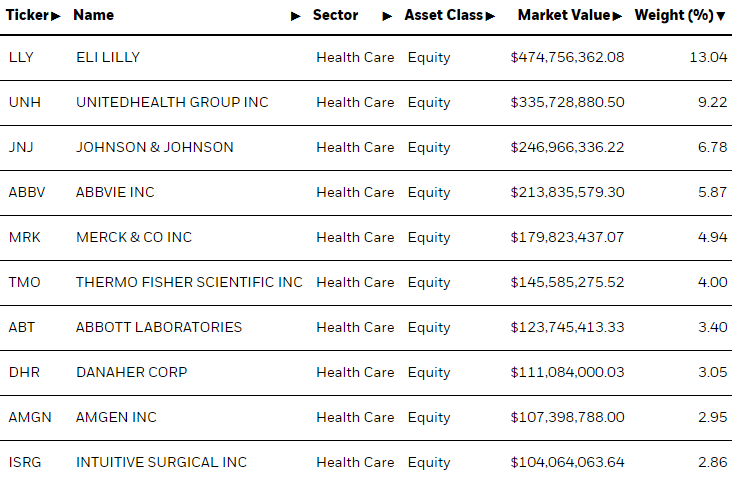

Top 10 Holdings

(as of 9 September 2024)

(Source: Bloomberg)