11 September 2024: Sasseur REIT (SASSR SP), Trip.com Group Ltd (9961 HK), General Mills Inc (GIS US)

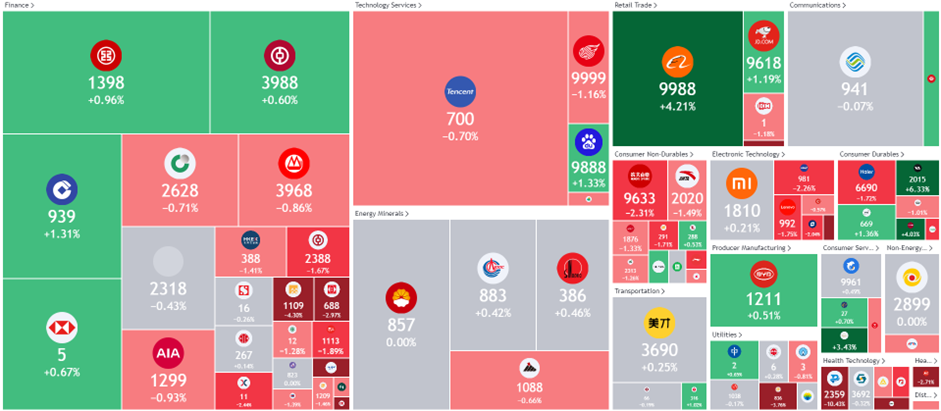

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

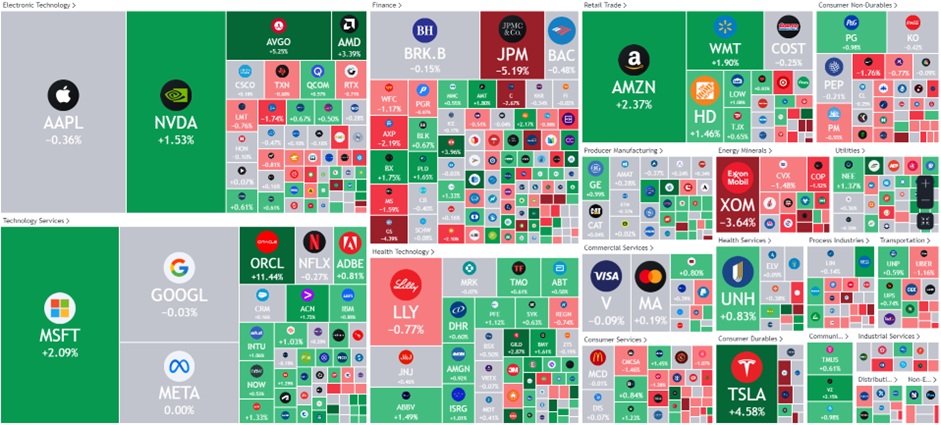

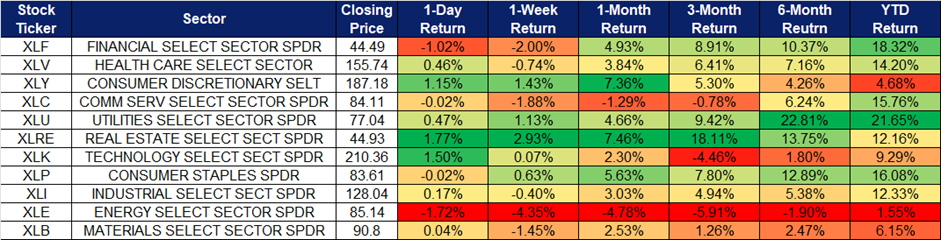

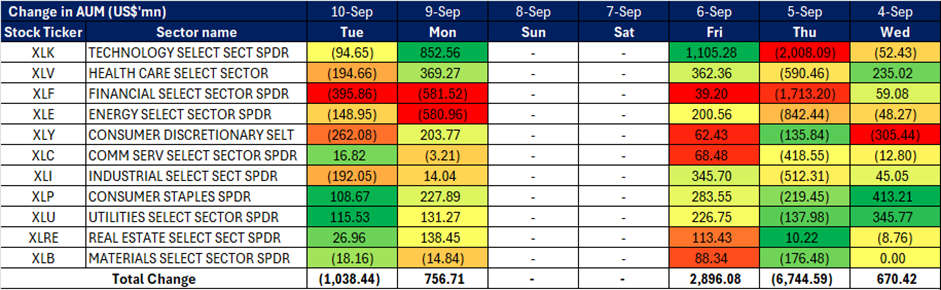

United States

Hong Kong

Sasseur REIT (SASSR SP): REIT-liable portfolio

- BUY Entry – 0.665 Target– 0.725 Stop Loss – 0.635

- Sasseur Real Estate Investment Trust operates as a real estate investment trust. The Company invests in a diversified portfolio of retail real estate assets. Sasseur Real Estate Investment Trust serves customers in Asia.

- Stable 1H24 performance. Sasseur REIT reported a 5.1% YoY decline in distributable income per unit (DPU) to 3.153 Scts in 1H24. Despite this, EMA rental income remained stable, delivering RMB329.0mn, a 0.9% YoY growth, equivalent to S$62.3mn, a slight 0.4% YoY decline. This performance aligns with expectations, considering the changes in the treatment of upfront borrowing costs and 20% of the REIT Manager’s base fee to be paid in cash. The 3.9% YoY decline in outlet sales in RMB during 1H24 reflects the higher sales base from 1H23, driven by pent-up demand following China’s economic reopening.

- Shifting consumer dynamics in China. Amid growing consumer caution, outlet sales have seen a modest decline. Sasseur REIT has felt the impact of weaker consumer spending in China, with sales declining YoY, exacerbated by the strong 1H23 base. The slower-than-expected recovery in the Chinese economy has added to consumption uncertainty. However, proactive management efforts, including ongoing tenant mix enhancements, are helping to attract diverse audiences and support portfolio sales performance.

- 1H24 results review. EMA rental income for 1H24 increased by 0.9% YoY to RMB329.0mn from RMB326.0mn. However, unfavourable forex movements led to a slight 0.4% YoY decline in EMA rental income, totalling S$62.3mn. The combination of forex headwinds and declining outlet sales resulted in a 2.9% YoY drop in distributable income to S$42.7mn, with a corresponding decrease in 1H24 DPU to 3.153 Scts. RMB sales for 1H24 declined by 3.9% YoY, reflecting ongoing weakness in the outlet business.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.90. Please read the full report here.

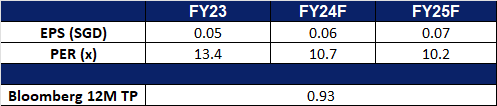

- Market Consensus.

(Source: Bloomberg)

First Resources (FR SP): Palm oil prices to rise

- RE-ITERATE BUY Entry – 1.46 Target– 1.60 Stop Loss – 1.39

- First Resources Limited produces crude palm oil. The Company is an upstream operator with primary business activities in the cultivation and harvesting of oil palms, and the processing of fresh fruit bunches into crude palm oil for local and export sales.

- Palm oil production to decline. Indonesia’s palm oil production outlook has worsened due to dry weather and aging trees, which could tighten global supply and keep prices high. Production is expected to be flat or decrease by up to 5% in 2024 compared to 2023. Earlier predictions of increased output have been revised downward by industry groups. Factors contributing to the decline include reduced rainfall in key regions and the aging of many plantations, particularly those managed by smallholders. The situation is exacerbated by similar issues in Malaysia, the world’s second-largest palm oil producer, leading to the lowest global palm oil reserves in three years. This combination of lower production and declining reserves is driving up palm oil prices. Malaysian palm oil futures surged over 1% on 30 August, reaching near MYR 4,000 per tonne, marking the second consecutive day of gains. This price increase benefits palm oil producers.

- Acquisition to drive inorganic growth. First Resources’ subsidiary, PT Karya Tama Bakti Mulia, won a S$162.9mn bid to acquire 17,600 hectares of plantation assets in Indonesia’s Riau Province. The assets, which include mills, plantations, and unplanted land, were purchased from PT Tri Bakti Sarimas through a public auction. The acquisition aligns with First Resources’ expansion strategy and aims to enhance its operational footprint, with expected operational synergies boosting overall performance. The purchase was funded internally and is not expected to significantly impact the company’s financials.

- 1H24 results review. Total revenue for 1H24 increased by 1.9% YoY to US$457.2mn from US$448.8mn, primarily due to the higher production volumes as compared to the same period last year, partially offset by a reduction in purchases of palm oil products from third parties for processing and sale. Net profit was US$103.9mn in 1H24, an increase of 45.4% YoY and profit from operations rose by 48.9% YoY to US$143.5mn, driven by higher production volumes and improved processing margins. Basic EPS rose in 1H24 to 6.67 UScents from 4.56 UScents in 1H23.

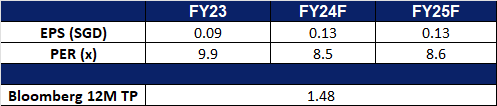

- Market Consensus.

(Source: Bloomberg)

Trip.com Group Ltd (9961 HK): Favourable seasonality

- RE-ITERATE BUY Entry – 365 Target 405 Stop Loss – 345

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Favourable Seasonality ahead. Upcoming holidays in China is expected to provided a boost to both domestic and international travel in China. China will enjoy 2 upcoming holidays, the Mid Autumn festival which runs 3 days between 15 September, 2024 and 17 September, 2024, as well as the China National Day Holiday which runs 7 days between 1 October 2024 to 7 October 2024. Last year, the Mid-Autumn Festival and China National Day holidays saw13.78 million international tourists visiting the country over the period. This upcoming holiday season is bound to see an increase in travel demand in China.

- New Asia Live Streaming Centre. Trip.com Group recently launched its new Asia Live Streaming Centre at its Bangkok office, marking a significant expansion of the company’s content marketing strategies. This hub is set to transform how partners and consumers engage by producing daily live content that highlights Thailand’s tourism offerings, providing travel inspiration and exclusive deals directly to eager travelers. The Asia Live Streaming Centre will also function as the group’s regional hub, collaborating with hotels, local attractions, and businesses in Thailand to feature a variety of travel products and promotions. The content will emphasize high-quality offerings, including those showcased on Trip.Best, Trip.com’s ranking list that helps global travelers choose the best experiences a destination has to offer.

- Extending partnership. Trip.com Group recently announced a partnership with Ryanair, enabling Trip.com to include Ryanair’s low-fare flights in its dynamic product offerings. This collaboration is a significant advantage for Trip.com customers, providing access to Ryanair’s budget-friendly fares, a vast selection of over 235 destinations, and excellent service. Travelers will soon be able to book Ryanair flights directly through Trip.com in the coming weeks.

- 1H24 earnings. Revenue rose by 20.6% YoY to RMB24.7bn in 1H24, compared to RMB20.5bn in 1H23. Net profit rose by 10.0% YoY to RMB8.151bn in 1H24, compared to RMB4.01bn in 1H23. Basic EPS increased to RMB12.46 in 1H24, compared to RMB6.14 in 1H23.

- Market consensus.

(Source: Bloomberg)

Alibaba Group Holding Ltd (9988 HK): Turning around

- BUY Entry – 78 Target 86 Stop Loss – 74

- Alibaba Group Holding Ltd provides technology infrastructure and marketing platforms. The Company operates through seven segments. China Commerce segment includes China retail commerce businesses such as Taobao, Tmall and Freshippo, among others, and wholesale business. International Commerce segment includes international retail and wholesale commerce businesses such as Lazada and AliExpress. Local Consumer Services segment includes location-based businesses such as Ele.me, Amap, Fliggy and others. Cainiao segment includes domestic and international one-stop-shop logistics services and supply chain management solutions. Cloud segment provides public and hybrid cloud services like Alibaba Cloud and DingTalk for domestic and foreign enterprises. Digital Media and Entertainment segment includes Youku, Quark and Alibaba Pictures, other content and distribution platforms and online games business. Innovation Initiatives and Others segment include Damo Academy, Tmall Genie and others.

- Added to Stock Connect program. Alibaba Group and other companies will be included in China’s Stock Connect cross-border investment scheme, linking the Shanghai, Shenzhen, and Hong Kong stock exchanges, starting from 10 September. This follows Alibaba’s upgrade to a primary listing in Hong Kong on 28 August, aimed at attracting more mainland Chinese investment. The dual primary listing, approved by shareholders, does not involve issuing new shares or raising funds. This move is part of China’s broader efforts to boost Hong Kong’s role as a global financial hub, as announced by regulators in April. The addition of Alibaba to Stock Connect will allow mainland Chinese investors to directly purchase Alibaba’s Hong Kong-listed shares, which is expected to accelerate capital outflows.

- Exports surge. In August, China’s exports grew 8.7% YoY, the fastest pace in nearly 1.5 years, driven by manufacturers rushing to fulfil orders ahead of expected tariffs. However, imports increased by only 0.5%, missing forecasts, reflecting weak domestic demand. This mixed performance highlights Beijing’s ongoing challenge to balance export-led growth with domestic demand, especially in the face of global economic uncertainties and geopolitical tensions. While the export growth has boosted investor sentiment and reflects strong global demand, China’s trade is increasingly constrained by rising tensions with the US, EU, and Southeast Asia. Additionally, weak imports, particularly of commodities, suggest that domestic economic challenges persist.

- Market expansion plans. Alibaba’s Taobao and Tmall Group (TTG) has expanded its operations with the establishment of a new company, Hangzhou Taobao and Tmall Digital Technology Co. This new venture will engage in various businesses, including import, export, household product sales, and technology services. Furthermore, TTG has recently integrated AI tools to enhance its merchant services and has begun to accept payments from Tencent’s WeChat app on Taobao and Tmall platforms. This strategic partnership with WeChat, boasting over 1.3 billion users (mostly in China), could be instrumental in expanding Alibaba’s reach in less developed regions, particularly since Alipay is not as widely used there. This move comes amidst easing regulatory scrutiny on Alibaba and reflects TTG’s efforts to diversify its business lines and compete more effectively in the Chinese e-commerce market.

- 1Q25 earnings. Revenue rose by 4.0% YoY to RMB243.24bn (US$33.47bn) in 1Q25, compared to RMB234.16bn in 1Q24. Net income fell by 27.0% YoY to RMB24.02bn (US$3.31bn) in 1Q25, from RMB33.00bn in 1Q24, due to a decrease in income from operations and the increase in impairment of investments partially offset by the mark-to-market changes from equity investments. Non-GAAP diluted earnings per ADS was RMB16.44 (US$2.26), a decrease of 5% YoY from RMB17.37 in 1Q24.

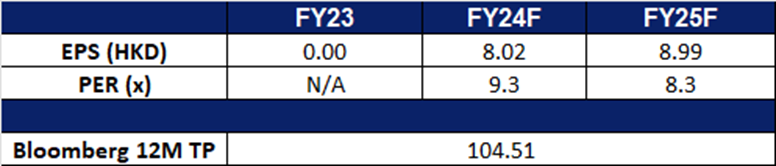

Market consensus.

(Source: Bloomberg)

General Mills Inc (GIS US): Risk-off in demand

- BUY Entry – 74.0 Target – 81.0 Stop Loss – 70.5

- General Mills, Inc. operates as a food company. The Company manufactures and markets branded processed consumer foods sold through retail stores. General Mills serves customers worldwide.

- Signs of slowdown in the US economy. Recent US macroeconomic data have performed poorly, and concerns about a soft landing or even recession remain. Trading recession sentiment has increased, and the discretionary consumer sector has benefited and continues to hit record highs. In addition, due to the decline in residents’ consumption power, the demand for packaged food is greater during the downturn of the economic cycle than during the upturn, which will help the company’s product sales growth.

- Tailwinds of falling inflation and interest rate cuts. Raw material prices are expected to continue to fall next year, and as the labor market begins to slow down, labor costs will decline, which will increase the company’s gross profit and operating profit. During an interest rate cut cycle, a company’s debt costs will fall. So the overall fundamentals will improve.

- 4Q24 earnings review. Revenue fell by 6.4% YoY to US$4.71bn, missing estimates by US$150M. Non-GAAP EPS was US$1.01, beating estimates by US$0.02.

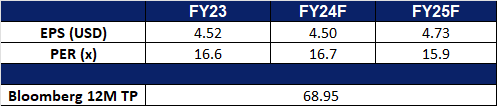

- Market consensus.

(Source: Bloomberg)

Campbell Soup Co (CPB US): Quick meal fix

Campbell Soup Co (CPB US): Quick meal fix

- RE-ITERATE BUY Entry – 50.0 Target – 55.0 Stop Loss – 47.5

- Campbell Soup Company, with its subsidiaries, manufactures and markets branded convenience food products. The Company’s core divisions include soups and sauces, biscuits and confectionery, and foodservice. Campbell’s distributes its products worldwide.

- Exhibits consumption defensive attributes. Its business has steadily operated and expanded over the past few years, showing resilience across economic cycles. This stability is bolstered by robust sales growth as more budget-conscious consumers seek value. Despite inflation easing for four consecutive months, rising 2.9% 2.9% in July, consumers continue to feel the effects of higher prices. According to the US Bureau of Labor Statistics, the “food away from home” index increased by 0.2% in July, following 0.4% gains in the prior two months, with dining out costs rising 4.1% YoY. Grocery prices rose 0.1% for the month and 1.1% YoY. While rate cuts are expected, inflation pressures have led many consumers to shift towards preparing meals at home, benefiting Campbell’s meals and beverages segment this quarter. As consumer sentiment strengthens, the company will be well-positioned for significant future growth.

- Expected improvement in profit margins. In FY25, a projected decline in raw material prices is anticipated to contribute to a rise in Campbell’s gross margin. Additionally, the easing labour market, with job openings falling to 7.673 million and the unemployment rate rising to 4.3%, could lead to reduced wage pressures. This may result in lower operating costs and further improve operating margins.

- Strategic branding plan. Campbell Soup Company completed the acquisition of Sovos Brands on 12 March 2024, adding a premium brand to its meals and beverages segment. Net sales in the fourth quarter increased by 11% to US$2.3bn, driven by the benefit from the Sovos Brands acquisition. The integration has progressed faster than expected, with the deal expected to boost earnings per share by the second year, excluding one-time costs. On 26 August 2024, Campbell sold its Pop Secret popcorn business, which generated US$120mn in fiscal 2024 sales. This sale is expected to reduce its fiscal 2025 earnings slightly. The company aims to accelerate growth in its Snacks division and other leading brands, forecasting net sales to rise 9% to 11% in fiscal 2025, driven by steady demand for its soups and ready-to-eat products.

- 4Q24 earnings review. Net sales grew by 11.1% YoY to US$2.3bn, missing estimates by US$10M. Non-GAAP EPS was US$0.63, beating estimates by US$0.01. It delivered an annual dividend yield of 2.87%. For FY25, Campbell expects net sales growth of 9% to 11% vs estimated growth of 8.96%, reflecting contributions from Sovos Brands and the loss of net sales from the divesture of Pop Secret.

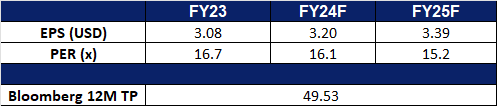

- Market consensus.

(Source: Bloomberg)

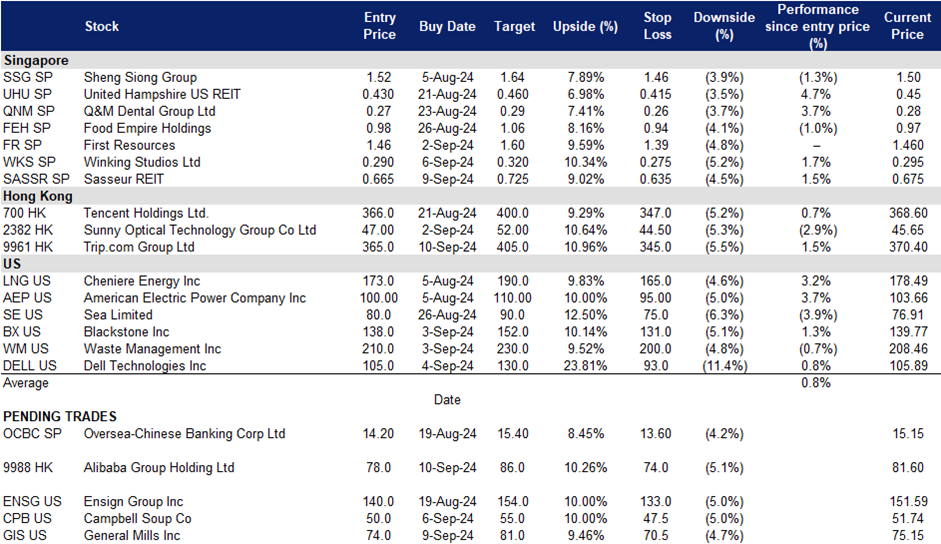

Trading Dashboard Update: Add Sasseur REIT (SASSR SP) at S$0.665 and Trip.com Group Ltd (9961 HK) at HK$365. Cut loss on Take-Two Interactive Software Inc (TTWO US) at US$150 and Aluminium Corp of China Ltd (2600 HK) at HK$4.50.