5 September 2024: Wealth Product Ideas

Dollar Index focused ETFs : UUP and UDN

Theme Overview:

- These ETFs focus on the fluctuations of the Dollar Index, a measure of the US dollar’s value against a basket of six major currencies.

- The theme is driven by US macroeconomic conditions and expectations surrounding the Federal Reserve’s monetary policy.

Key Drivers:

a) Short-term:

- The Dollar Index can be used as a hedge against risky assets, such as equities, during market corrections. When investors become risk-averse, they often seek safe-haven assets like the US dollar, causing its value to appreciate.

b) Long-term:

- The US dollar’s value is closely tied to interest rates. When the Federal Reserve lowers interest rates to stimulate the economy, it becomes less attractive to hold US dollars, causing the Dollar Index to depreciate.

Note:

- The specific timing and magnitude of these fluctuations can be influenced by various factors, including global economic conditions, geopolitical events, and market sentiment.

Fund Name (Ticker) | Invesco DB US Dollar Index Bullish Fund (UUP US) |

Description | The Invesco DB US Dollar Index Bullish (Fund) seeks to track changes, whether positive or negative, in the level of the Deutsche Bank Long USD Currency Portfolio Index – Excess ReturnTM (DB Long USD Currency Portfolio Index ER or Index) plus the interest income from the Fund’s holdings of primarily US Treasury securities and money market income less the Fund’s expenses. The Fund is designed for investors who want a cost effective and convenient way to track the value of the U.S. dollar relative to a basket of the six major world currencies – the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc (collectively, the “Basket Currencies”). The Index is a rules-based index composed solely of long U.S. Dollar Index futures contracts that trade on the ICE futures exchange (USDX® futures contracts). The USDX® futures contract is designed to replicate the performance of being long the U.S. dollar against the Basket Currencies. |

Asset Class | Currency |

30-Day Average Volume (as of 3 Sep) | 1,147,576 |

Net Assets of Fund (as of 3 Sep) | $390,900,000 |

12-Month Yield (as of 3 Sep) | 6.1636% |

Expense Ratio (Annual) | 0.78% |

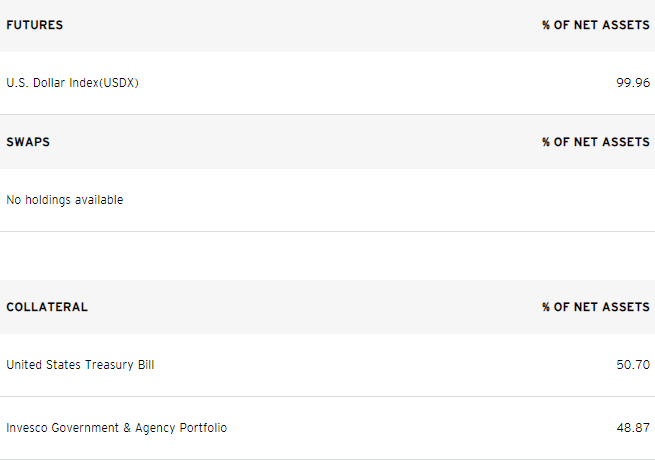

Holdings

(as of 30 August 2024)

(Source: Bloomberg)

(Source: Bloomberg)

Fund Name (Ticker) | Invesco DB US Dollar Index Bearish Fund (UDN US) |

Description | The Invesco DB US Dollar Index Bearish (Fund) seeks to track changes, whether positive or negative, in the level of the Deutsche Bank Short USD Currency Portfolio Index – Excess Return™ (DB Short USD Currency Portfolio Index ER or Index) plus the interest income from the Fund’s holdings of primarily US Treasury securities and money market income less the Fund’s expenses. The Fund is designed for investors who want a cost effective and convenient way to track the value of the U.S. dollar relative to a basket of the six major world currencies – the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc (collectively, the “Basket Currencies”). The Index is a rules-based index composed solely of short U.S. Dollar Index futures contracts that trade on the ICE futures exchange (USDX® futures contracts). The USDX® futures contract is designed to replicate the performance of being short the U.S. dollar against the Basket Currencies. |

Asset Class | Currency |

30-Day Average Volume (as of 3 Sep) | 58,409 |

Net Assets of Fund (as of 3 Sep) | $55,200,000 |

12-Month Yield (as of 3 Sep) | 5.1324 % |

Management Fees (Annual) | 0.78% |

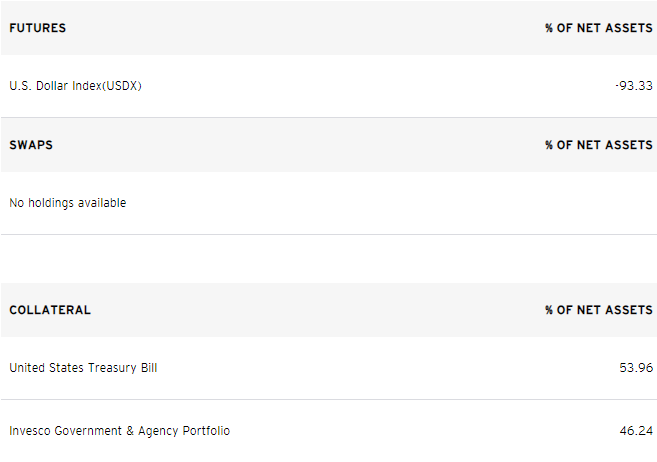

Holdings

(as of 30 August 2024)

(Source: Bloomberg)