28 August 2024: Food Empire Holdings Ltd (FEH SP), Industrial and Commercial Bank of China Ltd (1398 HK), Sea Limited (SE US)

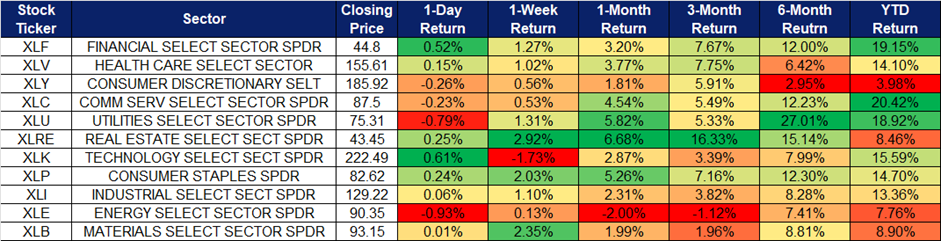

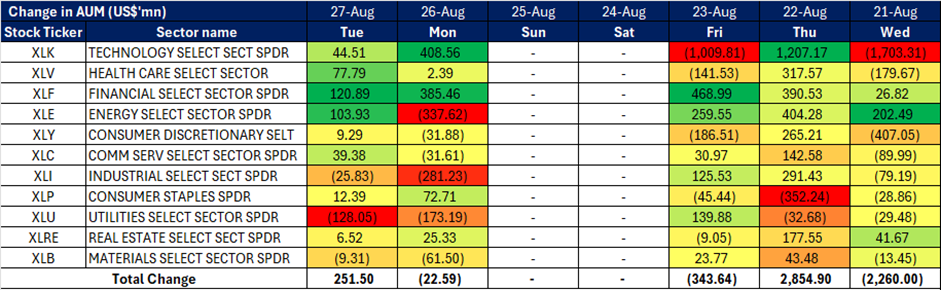

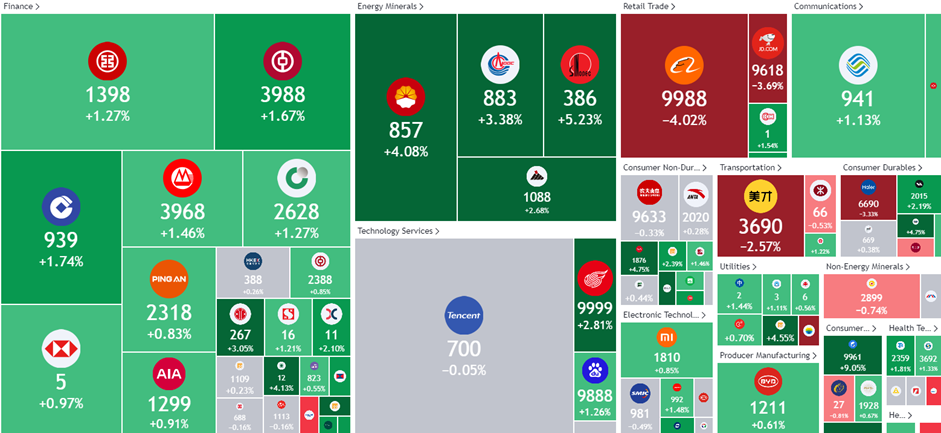

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

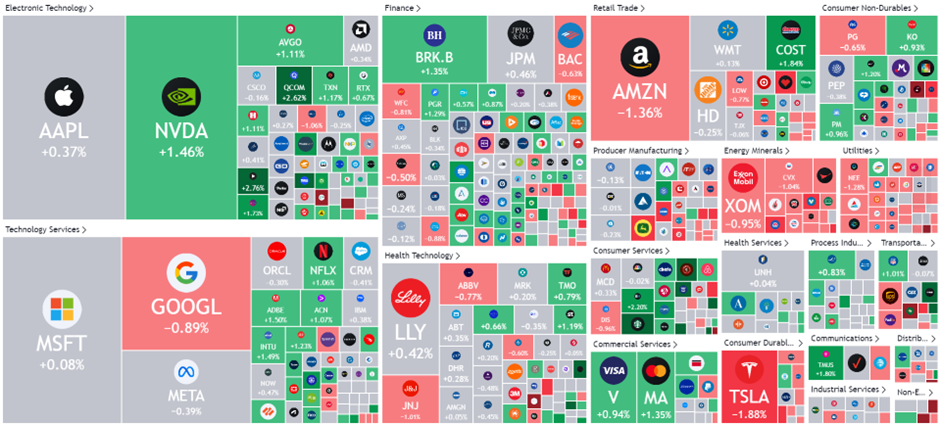

United States

Hong Kong

Food Empire Holdings Ltd (FEH SP): More capacity, more growth

- BUY Entry – 0.98 Target– 1.06 Stop Loss – 0.94

- Food Empire Holdings Limited operates as a food and beverage manufacturing and distribution company. The Company offers beverages and snacks including classic and flavoured coffee mixes and cappuccinos, chocolate drinks, fruit-flavoured and bubble teas, cereal blends, and crispy potato snacks. Food Empire Holdings serves customers worldwide.

- Continued strong growth in South-East Asia and South Asia. Food Empire Holdings saw a sustained increase in sales across its core markets in 1H24, showcasing a resilient consumer demand for the company’s products, which saw volume growth YoY, especially in the Southeast Asia and South Asia regions. The group continues to reap the benefits of its brand-building efforts in Vietnam, increasing its market share across the Vietnamese market. Demand for the group’s products in South Asia also remains strong amidst a coffee consumption boom in the region.

- Ramped up capacity in Malaysia. The group recently completed the expansion of its non-dairy creamer production facilities in Malaysia. Commercial production started on 1st April, boosting production of non-dairy creamer going forward. The plant will reach full production capacity over the next 24 to 36 months and will drive more growth for the group’s Southeast Asia region and translate into higher revenue for the group in the region.

- 1H24 results review. Total revenue for 1H24 increased by 13.6% YoY to US$225.2mn from US$198.2mn in 1H23, led by strong growth in its South-East Asia and South Asia market, which saw a growth of 34.8% and 36.0% respectively.

- We have fundamental coverage with a BUY recommendation and a TP of S$1.35. Please read the full report here.

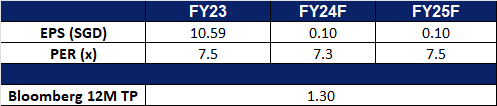

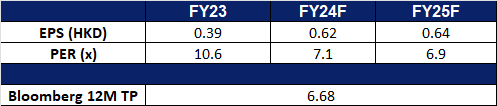

- Market Consensus.

(Source: Bloomberg)

Q&M Dental Group Ltd (QNM SP): Opening up more room for growth

- RE-ITERATE BUY Entry – 0.265 Target– 0.285 Stop Loss – 0.255

- Q & M Dental Group (Singapore) Limited operates dental clinics. The Company offers aesthetic, children’s and general dentistry; fits crowns, dentures and braces; and offers bleeding gum treatment, gum surgery and oral surgery; and treats snoring and teeth grinding.

- Looking at further expansion. Q & M Dental Group, in its financial results announcement, revealed plans to explore strategic growth opportunities in Singapore and other Asia- Pacific markets. This decision follows a year of business process streamlining that has led to improved profitability, suggesting the company is well-positioned for its next phase of growth.

- Improving profitability. The company experienced a significant increase in its net profit margin (NPM), which rose to 11.5% in the first half of 2024, up from 6.6% in the same period of 2023. Several expense categories remained flat or decreased year-over-year, highlighting the company’s successful efforts to streamline business processes and enhance operations organically. We anticipate this improved efficiency to persist throughout the remainder of the year.

- 1H24 results review. Total revenue for 1H24 increased by 1.9% YoY to S$88.8mn from S$87.1mn in 1H23, driven mainly by a higher revenue contribution from the Group’s primary healthcare business in Singapore, partially offset by lower revenue contribution from the group’s medical laboratory business and dental distribution business. net interest income and non-interest income rose 3% and 15% YoY respectively. PATMI rose 83.7% YoY to S$9.80mn in 1H24, compared with S$5.33mnn in 1H23. Diluted EPS rose to 1.04 Scents in 1H24, compared to 0.56 Scents in 1H23. The Group announced an interim dividend of 0.40 Scents per share for 1H24, to be paid on 2 September 2024, representing a 150% increase YoY and a dividend payout ratio of 39%.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.35. Please read the full report here.

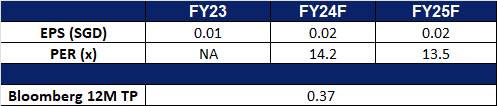

- Market Consensus.

(Source: Bloomberg)

Industrial and Commercial Bank of China Ltd (1398 HK): More potential value in banks

- BUY Entry – 4.70 Target 5.10 Stop Loss – 4.50

- Industrial and Commercial Bank of China Ltd is a China-based company principally engaged in the provision of banking and related financial services. The Bank mainly operates three segments, including Corporate Banking segment, Personal Banking segment and Treasury segment. The Corporate Banking segment provides loan, trade financing, deposit, corporate finance, custody and other related financial products and services to enterprises, government agencies and financial institutions. The Personal Banking segment provides loan, deposit, bank card, personal finance and other related financial products and services to individual customers. Treasury segment includes money markets business, securities investment business, self and valet foreign exchange trading and derivative financial instruments business. The Company conducts its businesses within domestic and overseas markets.

- In search of high dividend yielding assets. Chinese banks have quickly become favourites in the market as investors are drawn to their substantial dividend payouts and strong state backing, positioning them as likely winners in a country where bond yields have plunged to near-record lows. The surge in demand for bank shares is largely driven by a broader scramble for high-dividend assets amid a year of economic uncertainty and a murky investment outlook. Optimists believe further gains are on the horizon, fueled by increasing interest from risk-averse funds and the continued support of the state for the market.

- Spurring economic growth. Chinese banks have kept their benchmark lending rates unchanged for August, as profit margins remain under pressure and policymakers prioritize the stability of financial institutions. The one-year loan prime rate (LPR) stays at 3.35%, while the five-year rate, which influences long-term credit such as mortgages, remains at 3.85%. This decision follows a 10-basis point reduction in the LPRs last month by commercial lenders, after the central bank lowered a key short-term policy rate for the first time in nearly a year in response to disappointing economic growth in the second quarter. Recent data from the National Bureau of Statistics of China (NBS) indicates that the economy may be experiencing modest growth in the third quarter. Although the July LPR reduction could further pressure banks’ profitability, the potential for increased loan volumes driven by improved business confidence could benefit banks in the long run.

- Partnership with Dubai Chambers. Dubai Chambers recently signed a Memorandum of Understanding (MoU) with the Dubai (DIFC) Branch of the Industrial and Commercial Bank of China Limited to strengthen cooperation and enhance support for companies and businesspeople in Dubai and China. The agreement outlines a framework for broad collaboration, where Dubai Chambers will assist the bank’s customers in establishing their businesses in Dubai. Additionally, both parties will work together to advance the interests of the business communities in Dubai and China, fostering collaboration between companies to boost bilateral trade and investment in both markets.

- 1Q24 earnings. Revenue fell by 3.80% YoY to RMB210.2bn in 1Q24, compared to RMB218.5bn in 1Q23. Net profit fell by 2.78% YoY to RMB87.6bn in 1Q24, compared to RMB90.2bn in 1Q23. Basic EPS fell 4.0% YoY to RMB0.24 in 1Q24, compared to RMB0.25 in 1Q23.

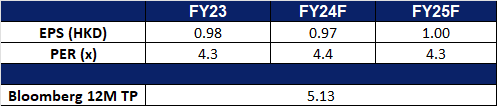

- Market consensus.

(Source: Bloomberg)

Aluminum Corp of China Ltd (2600 HK): Tight supply for the rest of 2024

- RE-ITERATE BUY Entry – 4.70 Target 5.10 Stop Loss – 4.50

- Aluminum Corporation of China Ltd is a China-based company primarily engaged in the production and sale of primary aluminum and aluminum products. The Company conducts its business primarily through five segments. The Alumina segment is engaged in the mining and purchase of bauxite, the production and sale of alumina and alumina bauxite. The Primary Aluminum segment is engaged in the smelting of alumina, the production and sale of primary aluminum, carbon products, aluminum alloy and other aluminum products. The Energy segment is engaged in coal mining, electricity generation by thermal power, wind power and solar power, new energy related equipment manufacturing business. The Trading segment is engaged in the trading of alumina, primary aluminum, aluminum fabrication products, other non-ferrous metal products and coal products. The Corporate and Other Operating segment is engaged in the management of corporate, research and development activities and others.

- Tight Alumina supply. The supply of alumina has been tightening due to various factors. China’s increasing production output of aluminum has amplified the demand for alumina, the intermediate product. Additionally, the cost of raw materials for aluminum production has risen, with China’s alumina futures reaching a near three-month high. Production cuts at alumina refineries operated by Alcoa and Rio Tinto in Australia have further exacerbated supply constraints. Inventories of alumina have been significantly depleted, driven by improved profitability in primary aluminum production. This tight supply of alumina is likely to keep aluminum and alumina prices elevated, benefitting Aluminum Corp of China.

- Surging Aluminum price. Aluminum futures have been on a steady rise, reaching above $2,480 per tonne and a six-week high in August, primarily due to increased fund buying. This surge is seen as a correction to the significant drop in prices last month. Furthermore, China’s unexpected increase in aluminum imports in July, despite strong domestic production, has added pressure to the market. The rising cost of alumina, a crucial raw material, has also contributed to the price rally. Supply constraints caused by production cuts in Australian refineries have led to a significant drawdown in alumina inventories, further supporting the price increase.

Aluminum price

(Source: Bloomberg)

- Potential Acquisition. The company is considering acquiring a significant stake in Indophil Resources Phils., which owns the Tampakan copper-gold project in Mindanao, Philippines. Covering approximately 10,000 hectares in South Cotabato, the Tampakan project is estimated to contain 15mn metric tons of copper and 17.6mn ounces of gold, with a projected mine life of over 40 years. Expected to become the largest mine in the Philippines when it begins operations in 2026, this potential $2 billion investment aligns with Chinalco’s strategy to expand its global mining presence. Chinalco, China’s largest state-owned aluminium producer, has a history of investing in international mining projects, including those in Guinea and Peru.

- 1Q24 earnings. Revenue fell by 26.1% YoY to RMB49.0bn in 1Q24, compared to RMB66.3bn in 1Q23. Net profit rose by 23.0% YoY to RMB2.23bn in 1Q24, compared to RMB1.81bn in 1Q23. Basic EPS rose 23.8% YoY to RMB0.130 in 1Q24, compared to RMB0.105 in 1Q23.

- Market consensus.

(Source: Bloomberg)

Sea Limited (SE US): Growth on track

- BUY Entry – 80 Target – 90 Stop Loss – 75

- Sea Limited offers information technology services. The Company provides online personal computer and mobile digital content, e-commerce, and payment platforms. Sea serves customers worldwide.

- Southeast Asia’s leading e-commerce platform. Shopee anticipates a significant 25% increase in Gross Merchandise Value (GMV) this year, surpassing its initial mid-teens projection. This growth is fuelled by a strategic adjustment: increased commission fees for merchants in key markets. Despite this change, Shopee’s strong market position remains unchallenged due to its expansive user base and robust logistics infrastructure. This combination positions Shopee as a valuable partner for merchants seeking to tap into the region’s growing online marketplace.

- Gaming business continue to expand. The company’s flagship title “Free Fire” attracting over 100 million daily active users in the second quarter. This achievement solidified “Free Fire’s” position as the world’s most downloaded mobile game during the period. To bolster its gaming portfolio, the company has partnered with Tencent and Electronic Arts to launch “Need for Speed: Mobile” in Taiwan, Hong Kong, and Macau later this year. This strategic move positions the company for sustained growth in the competitive gaming market.

- 2Q24 earnings review. Revenue grew by 22.9% YoY to US$3.81bn, beating estimates by US$90mn. GAAP EPS was US$0.14 missing estimates by US$0.05.

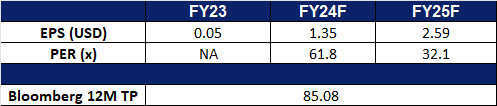

- Market consensus.

(Source: Bloomberg)

Take-Two Interactive Software Inc (TTWO US): Gamers unite!

Take-Two Interactive Software Inc (TTWO US): Gamers unite!

- RE-ITERATE BUY Entry – 160 Target – 180 Stop Loss – 150

- Take-Two Interactive Software, Inc. develops, markets, distributes, and publishes interactive entertainment software games and accessories. The Company’s products are for console systems, handheld gaming systems and personal computers and are delivered through physical retail, digital download, online, and cloud streaming services.

- Multiple high-profile releases scheduled for 2025. Take-Two Interactive is preparing for a significant 2025, with major releases like Grand Theft Auto VI, Mafia 4, Borderlands 4, and other high-profile games, which are expected to drive substantial revenue growth. Despite some earlier setbacks, such as a potential delay for GTA 6, the company remains optimistic about its financial outlook for the next two fiscal years. Take-Two also plans to release WWE 2K25, Civilization 5, NBA 2K26, and Judas, alongside a remake bundle of Max Payne 1 & 2 funded by Rockstar Games. Take-Two’s acquisition of Zynga contributed to record high bookings last fiscal year and the company is poised for further revenue success in the current fiscal year, with GTA 6 expected to be a major highlight in 2025.

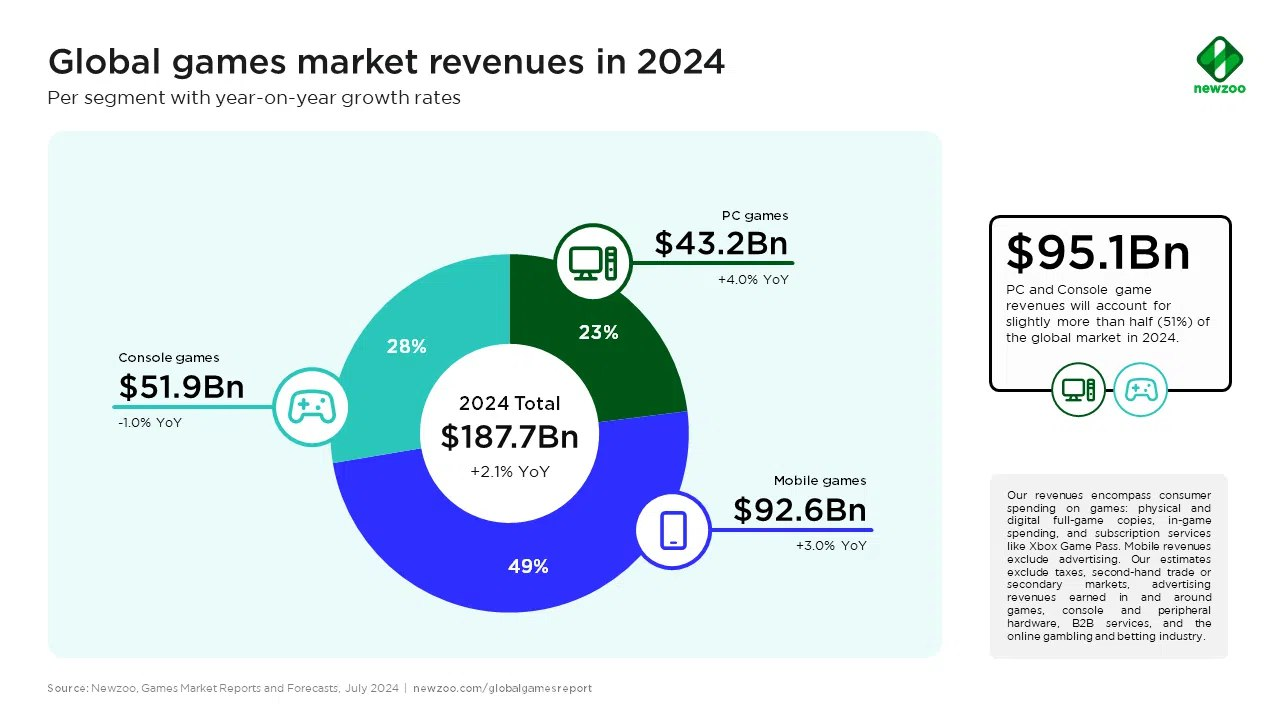

- Exhibits growth in gaming. According to Newzoo, the global gaming market is expected to grow by 2.1% YoY, reaching US$187.7bn. This growth, though modest, reflects ongoing trends such as declining average global playtime and the dominance of big studios. PC gaming revenue is projected to outpace mobile and console segments in 2024, with mobile gaming accounting for 49% of total revenue. The US and China are expected to dominate regional revenues while emerging markets like Latin America and the Middle East & Africa will see the highest growth rates. By 2027, the market is forecasted to reach US$213.3bn. This growth in the gaming industry will be highly beneficial for Take-Two, given that its new game releases are primarily in the PC and console segments, and its acquired company Zynga’s popular games are in the mobile segment, allowing it to benefit from the continued growth in mobile gaming.

Global games market revenue in 2024 per segment

(Source: Newzoo)

- 1Q25 earnings review. Revenue grew by 4.7% YoY to US$1.34bn, beating estimates by US$90mn. GAAP EPS was -US$1.52 missing estimates by US$0.15. It forecasted lower-than-expected bookings for Q2 due to decreased spending on live-service titles. Take-Two has about 40 titles in development through FY27 and reported no impact on its projects from the ongoing video game performers’ strike.

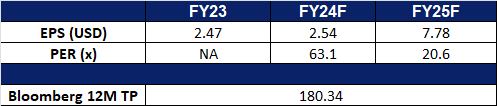

- Market consensus.

(Source: Bloomberg)

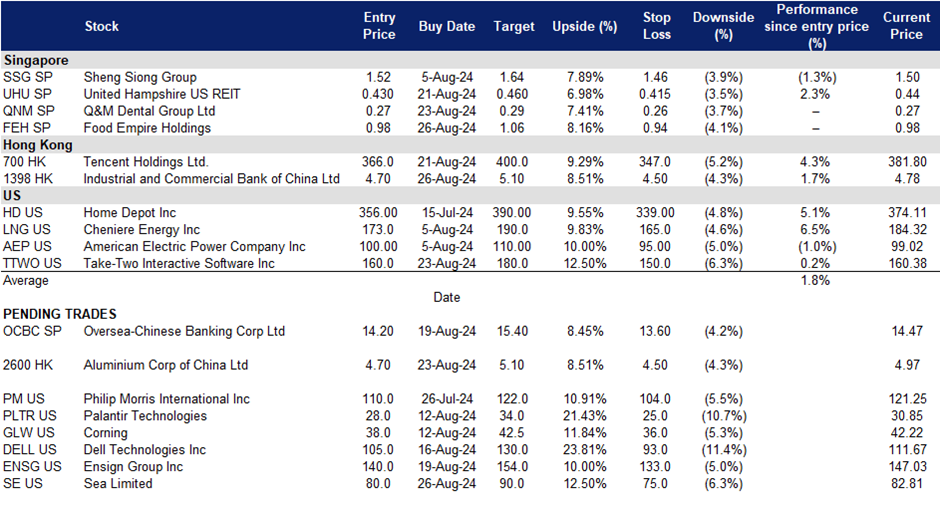

Trading Dashboard Update: Take profit on Goldwind Science & Technology (2208 HK) at HK$4.30. Add Food Empire Holdings (FEH SP) at S$0.98 and Industrial and Commercial Bank of China Ltd ((1398 HK) at HK$4.70.