23 August 2024: Q&M Dental Group Ltd (QNM SP), Aluminum Corp of China Ltd (2600 HK), Take-Two Interactive Software Inc (TTWO US)

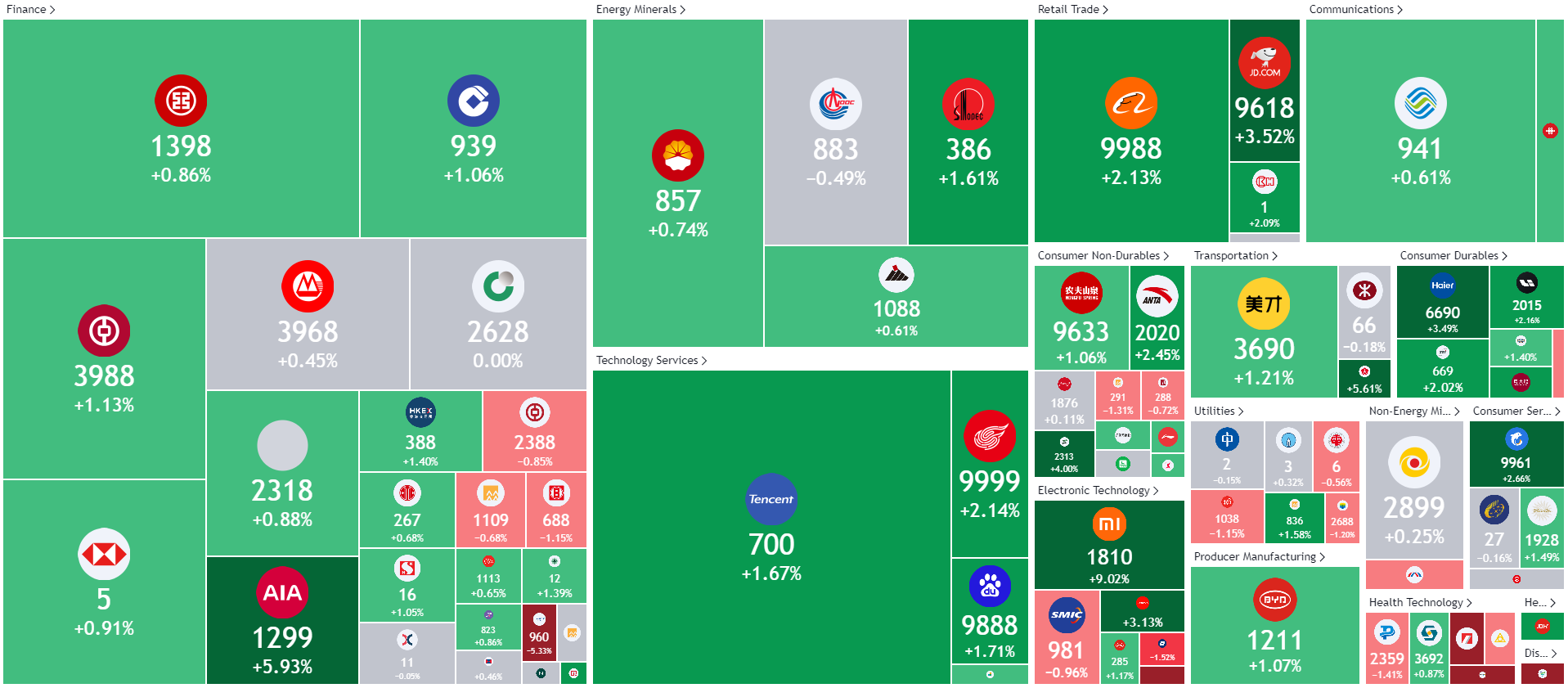

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

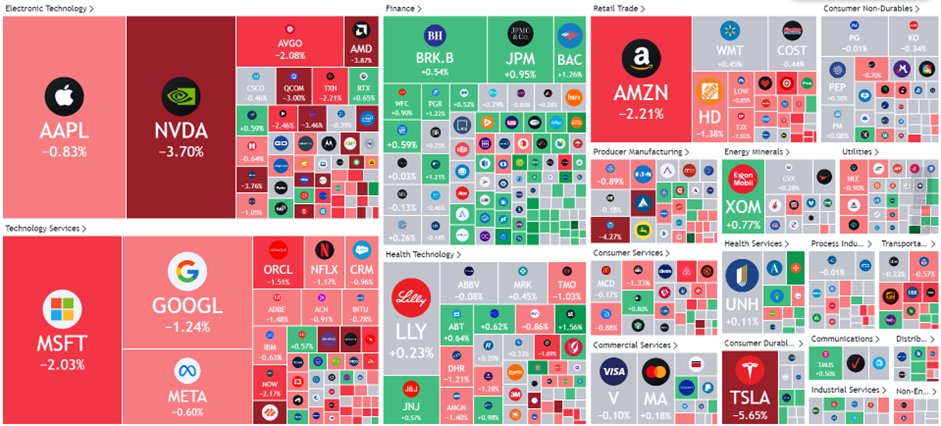

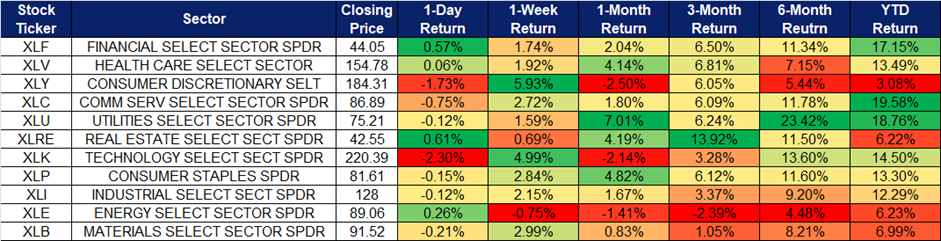

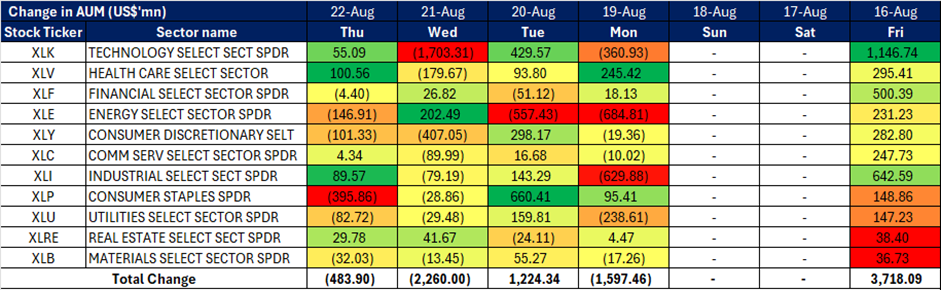

United States

Hong Kong

Q&M Dental Group Ltd (QNM SP): Opening up more room for growth

- BUY Entry – 0.265 Target– 0.285 Stop Loss – 0.255

- Q & M Dental Group (Singapore) Limited operates dental clinics. The Company offers aesthetic, children’s and general dentistry; fits crowns, dentures and braces; and offers bleeding gum treatment, gum surgery and oral surgery; and treats snoring and teeth grinding.

- Looking at further expansion. Q & M Dental Group, in its financial results announcement, revealed plans to explore strategic growth opportunities in Singapore and other Asia- Pacific markets. This decision follows a year of business process streamlining that has led to improved profitability, suggesting the company is well-positioned for its next phase of growth.

- Improving profitability. The company experienced a significant increase in its net profit margin (NPM), which rose to 11.5% in the first half of 2024, up from 6.6% in the same period of 2023. Several expense categories remained flat or decreased year-over-year, highlighting the company’s successful efforts to streamline business processes and enhance operations organically. We anticipate this improved efficiency to persist throughout the remainder of the year.

- 1H24 results review. Total revenue for 1H24 increased by 1.9% YoY to S$88.8mn from S$87.1mn in 1H23, driven mainly by a higher revenue contribution from the Group’s primary healthcare business in Singapore, partially offset by lower revenue contribution from the group’s medical laboratory business and dental distribution business. net interest income and non-interest income rose 3% and 15% YoY respectively. PATMI rose 83.7% YoY to S$9.80mn in 1H24, compared with S$5.33mnn in 1H23. Diluted EPS rose to 1.04 Scents in 1H24, compared to 0.56 Scents in 1H23. The Group announced an interim dividend of 0.40 Scents per share for 1H24, to be paid on 2 September 2024, representing a 150% increase YoY and a dividend payout ratio of 39%.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.35. Please read the full report here.

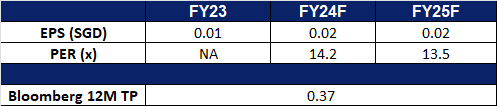

- Market Consensus.

(Source: Bloomberg)

Oversea-Chinese Banking Corp Ltd (OCBC SP): Rate cuts to stimulate loan growth

- RE-ITERATE BUY Entry – 14.2 Target– 15.4 Stop Loss – 13.6

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other fin

- Optimism surrounding US Federal Interest rate cuts in 2H24. Following recent inflationary data, the market anticipates a potential 25 basis points rate cut in September 2024. While this could reduce borrowing costs and enhance financial flexibility for customers, it could also put pressure on the bank’s net interest margins. Lower rates generally narrow the spread between the interest earned on loans and the interest paid on deposits, potentially reducing profitability from interest income. However, the overall lower borrowing costs could stimulate loan demand and economic activity, which may help offset the impact on margins and support OCBC’s broader growth strategy.

- Diversifying loan portfolio. After launching a program aimed at accelerating the growth of women-led SMEs in April, OCBC saw a significant increase in loans to female-owned businesses, with a growth of over 30% in the two months following the launch. This outpaced the loan growth for male-owned businesses, which increased by over 20% during the same period. The program, now called Women Unlimited, includes expanded access to SME sustainable finance and offers up to S$100,000 in financing for women-founded startups within their first two years. It also provides educational workshops, networking opportunities, and plans to expand regionally to Malaysia and Hong Kong. This initiative strengthens OCBC’s market position by fostering growth among women-led SMEs, diversifying its loan portfolio, and enhancing customer loyalty through targeted support and expanded services.

OCBC share price and USD/SGD comparison

(Source: Bloomberg)

- Promising second quarter results. OCBC reported a 14% YoY increase in second-quarter net profit, reaching S$1.94bn, exceeding expectations. The profit growth was driven by increased income and reduced allowances. OCBC remains confident in the ASEAN economy and is on track to meet its 2024 targets, including maintaining a net interest margin (NIM) between 2.2% and 2.25%. The bank declared a 10% higher interim dividend of S$0.44 per share and saw a 17% rise in wealth management fees. Despite a slight decline in NIM to 2.2%, return on equity improved to 14.2%.

- 1H24 results review. Total income for 1H24 increased by 7% YoY to S$7.26bn, net interest income and non-interest income rose 3% and 15% YoY respectively. Net profit increase by 9% YoY to S$3.93bn in 1H24, compared to S$3.59bn in 1H23, mainly due to record total income and lower allowances. The Board declared an interim dividend of S$0.44, up 10% or S$0.04 from a year ago, representing a payout ratio of 50% of the Group’s 1H24 net profit.

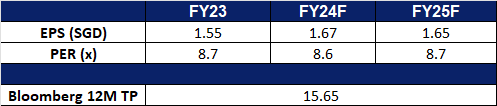

- Market Consensus.

(Source: Bloomberg)

Aluminum Corp of China Ltd (2600 HK): Tight supply for the rest of 2024

- BUY Entry – 4.70 Target 5.10 Stop Loss – 4.50

- Aluminum Corporation of China Ltd is a China-based company primarily engaged in the production and sale of primary aluminum and aluminum products. The Company conducts its business primarily through five segments. The Alumina segment is engaged in the mining and purchase of bauxite, the production and sale of alumina and alumina bauxite. The Primary Aluminum segment is engaged in the smelting of alumina, the production and sale of primary aluminum, carbon products, aluminum alloy and other aluminum products. The Energy segment is engaged in coal mining, electricity generation by thermal power, wind power and solar power, new energy related equipment manufacturing business. The Trading segment is engaged in the trading of alumina, primary aluminum, aluminum fabrication products, other non-ferrous metal products and coal products. The Corporate and Other Operating segment is engaged in the management of corporate, research and development activities and others.

- Tight Alumina supply. The supply of alumina has been tightening due to various factors. China’s increasing production output of aluminum has amplified the demand for alumina, the intermediate product. Additionally, the cost of raw materials for aluminum production has risen, with China’s alumina futures reaching a near three-month high. Production cuts at alumina refineries operated by Alcoa and Rio Tinto in Australia have further exacerbated supply constraints. Inventories of alumina have been significantly depleted, driven by improved profitability in primary aluminum production. This tight supply of alumina is likely to keep aluminum and alumina prices elevated, benefitting Aluminum Corp of China.

- Surging Aluminum price. Aluminum futures have been on a steady rise, reaching above $2,480 per tonne and a six-week high in August, primarily due to increased fund buying. This surge is seen as a correction to the significant drop in prices last month. Furthermore, China’s unexpected increase in aluminum imports in July, despite strong domestic production, has added pressure to the market. The rising cost of alumina, a crucial raw material, has also contributed to the price rally. Supply constraints caused by production cuts in Australian refineries have led to a significant drawdown in alumina inventories, further supporting the price increase.

Aluminum price

(Source: Bloomberg)

- Potential Acquisition. The company is considering acquiring a significant stake in Indophil Resources Phils., which owns the Tampakan copper-gold project in Mindanao, Philippines. Covering approximately 10,000 hectares in South Cotabato, the Tampakan project is estimated to contain 15mn metric tons of copper and 17.6mn ounces of gold, with a projected mine life of over 40 years. Expected to become the largest mine in the Philippines when it begins operations in 2026, this potential $2 billion investment aligns with Chinalco’s strategy to expand its global mining presence. Chinalco, China’s largest state-owned aluminium producer, has a history of investing in international mining projects, including those in Guinea and Peru.

- 1Q24 earnings. Revenue fell by 26.1% YoY to RMB49.0bn in 1Q24, compared to RMB66.3bn in 1Q23. Net profit rose by 23.0% YoY to RMB2.23bn in 1Q24, compared to RMB1.81bn in 1Q23. Basic EPS rose 23.8% YoY to RMB0.130 in 1Q24, compared to RMB0.105 in 1Q23.

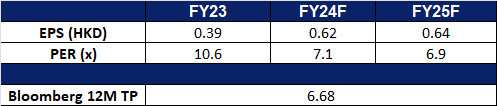

- Market consensus.

(Source: Bloomberg)

Tencent Holdings Ltd. (700 HK): Overwhelming launch of new game

- RE-ITERATE BUY Entry – 366 Target – 400 Stop Loss – 347

- Tencent Holdings Ltd is an investment holding company primarily engaged in the provision of value-added services (VAS), online advertising services, as well as FinTech and business services. The Company primarily operates through four segments. The VAS segment is mainly engaged in the provision of online games, video account live broadcast services, paid video membership services and other social network services. The Online Advertising segment is mainly engaged in media advertising, social and other advertising businesses. The FinTech and Business Services segment mainly provides commercial payment, FinTech and cloud services. The Others segment is principally engaged in the investment, production and distribution of films and television program for third parties, copyrights licensing, merchandise sales and various other activities.

- Launch of new game makes gaming history. A Chinese-made game backed by Tencent Holdings Ltd., Black Myth: Wukong, became the fourth most-played title on Steam within hours of its launch yesterday. This rapid ascent saw the action-adventure game surpass 1.3mn concurrent players, outpacing the debut records of highly anticipated titles like Cyberpunk 2077 and Elden Ring, according to SteamDB. This strong initial performance signals potential recovery in China’s $40bn gaming industry, which has been under intense regulatory scrutiny in recent years.

- Policy Support for AI development. Since the beginning of the year, the Chinese government has implemented various policies to boost and regulate the development of the artificial intelligence (AI) sector. Recently, they announced new guidelines specifying seven key areas for developing the AI standard system in the country, including standards for key technologies, intelligent products and services, and industry applications. According to these guidelines, China aims to formulate over 50 national and industrial standards for AI by 2026 and develop a comprehensive standard system to ensure the sector’s high-quality development. Tencent is poised to benefit significantly from these AI-focused policies.

- Further approval of games. China’s gaming industry continues its rebound with the approval of 105 new video game titles in July 2024, maintaining the steady flow of approvals seen throughout the year. Notable titles in this latest batch include Tencent’s Arena Breakout: Infinite and Mihoyo’s Xingbu Gudi. This follows the approval of 115 titles in January 2024, the largest batch in 18 months, which has significantly boosted market confidence. Since the government resumed approving new game licenses in 2023, China’s gaming market has been on the mend, growing nearly 14% last year to reach almost 303 billion yuan, with the number of gamers hitting a record 668 million. The continued approval of new games and the recovery of the gaming market are expected to further drive sales for companies in the industry.

- 1H24 results review. Revenue increased 7.2% YoY to RMB320.6bn in 1H24, compared with RMB299.2bn in 1H23. Net profit rose 72.1% to RMB89.5bn in 1H24, compared to RMB52.0bn in 1H23. Basic earnings per share was RMB9.59 in 1H24, compared to RMB5.49 in 1H23.

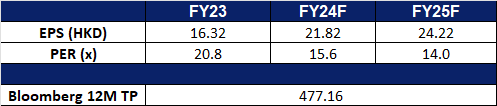

- Market consensus.

(Source: Bloomberg)

Take-Two Interactive Software Inc (TTWO US): Gamers unite!

- BUY Entry – 160 Target – 180 Stop Loss – 150

- Take-Two Interactive Software, Inc. develops, markets, distributes, and publishes interactive entertainment software games and accessories. The Company’s products are for console systems, handheld gaming systems and personal computers and are delivered through physical retail, digital download, online, and cloud streaming services.

- Multiple high-profile releases scheduled for 2025. Take-Two Interactive is preparing for a significant 2025, with major releases like Grand Theft Auto VI, Mafia 4, Borderlands 4, and other high-profile games, which are expected to drive substantial revenue growth. Despite some earlier setbacks, such as a potential delay for GTA 6, the company remains optimistic about its financial outlook for the next two fiscal years. Take-Two also plans to release WWE 2K25, Civilization 5, NBA 2K26, and Judas, alongside a remake bundle of Max Payne 1 & 2 funded by Rockstar Games. Take-Two’s acquisition of Zynga contributed to record high bookings last fiscal year and the company is poised for further revenue success in the current fiscal year, with GTA 6 expected to be a major highlight in 2025.

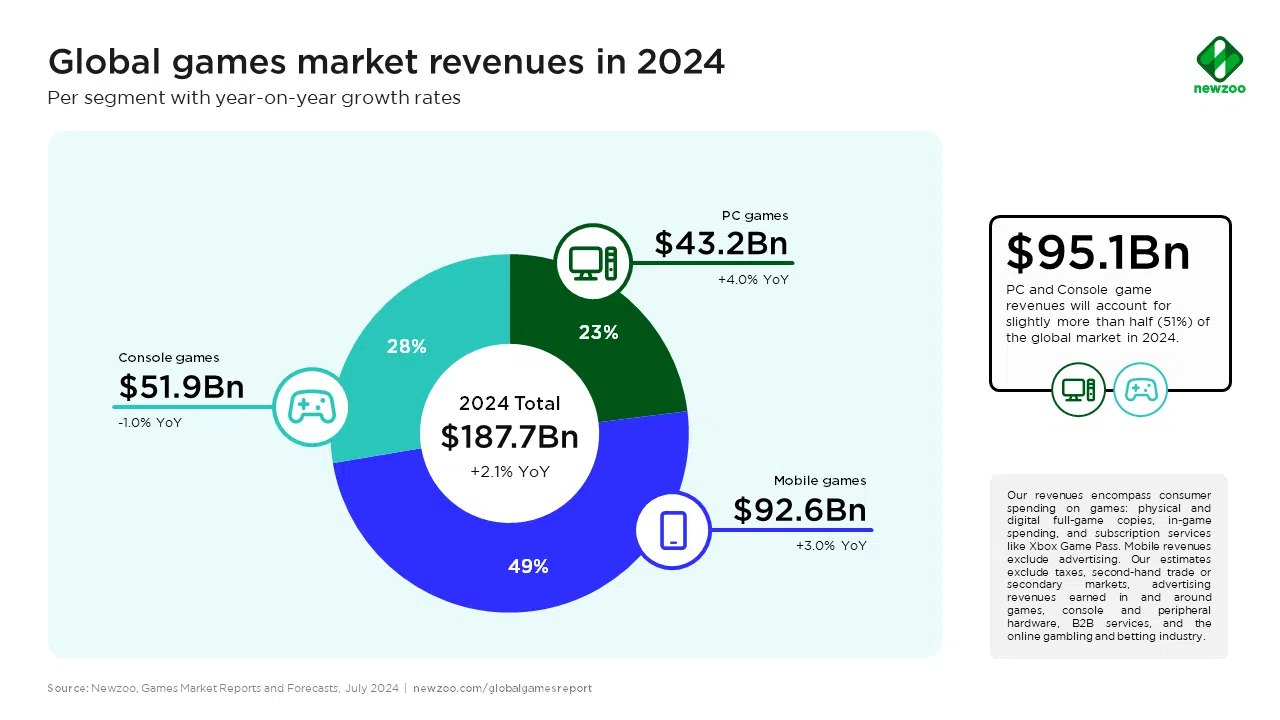

- Exhibits growth in gaming. According to Newzoo, the global gaming market is expected to grow by 2.1% YoY, reaching US$187.7bn. This growth, though modest, reflects ongoing trends such as declining average global playtime and the dominance of big studios. PC gaming revenue is projected to outpace mobile and console segments in 2024, with mobile gaming accounting for 49% of total revenue. The US and China are expected to dominate regional revenues while emerging markets like Latin America and the Middle East & Africa will see the highest growth rates. By 2027, the market is forecasted to reach US$213.3bn. This growth in the gaming industry will be highly beneficial for Take-Two, given that its new game releases are primarily in the PC and console segments, and its acquired company Zynga’s popular games are in the mobile segment, allowing it to benefit from the continued growth in mobile gaming.

Global games market revenue in 2024 per segment

(Source: Newzoo)

- 1Q25 earnings review. Revenue grew by 4.7% YoY to US$1.34bn, beating estimates by US$90mn. GAAP EPS was -US$1.52 missing estimates by US$0.15. It forecasted lower-than-expected bookings for Q2 due to decreased spending on live-service titles. Take-Two has about 40 titles in development through FY27 and reported no impact on its projects from the ongoing video game performers’ strike.

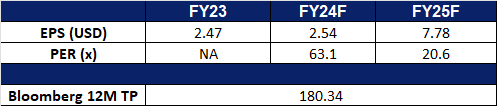

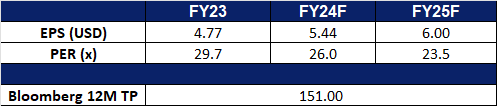

- Market consensus.

(Source: Bloomberg)

Ensign Group Inc (ENSG US): Capitalising on an aging population

Ensign Group Inc (ENSG US): Capitalising on an aging population

- RE-ITERATE BUY Entry – 140 Target – 154 Stop Loss – 133

- The Ensign Group, Inc. operates facilities offering nursing and rehabilitative care services in multiple states. The Company provides a broad spectrum of nursing and assisted living, physical, occupational and speech therapies, and other rehabilitative and healthcare services for both long-term residents and short-stay rehabilitation patients.

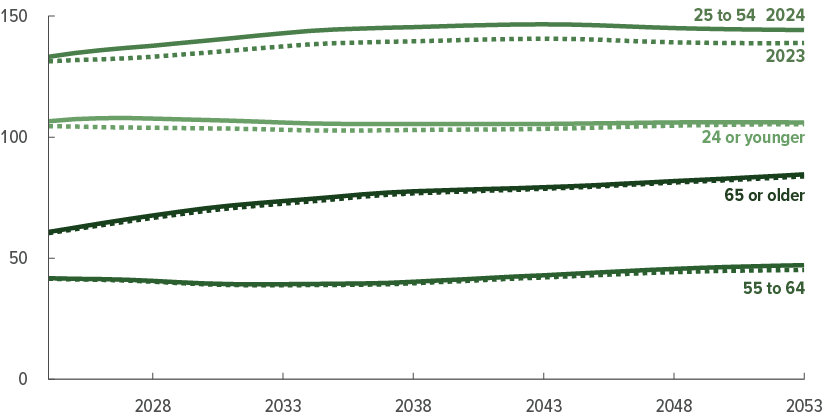

- Exhibits both defensive and growth attributes. Its business has steadily expanded over the past few years, demonstrating resilience across economic cycles. This defensive posture is complemented by robust growth prospects driven by the rapidly aging US population. According to the Population Reference Bureau, the number of Americans aged 65 and older will surge from 58 million in 2022 to 82 million by 2050. Concurrently, the shortfall in elderly care services will skyrocket from 6 million to 13 million over the same period. This burgeoning demand for nursing care positions the company favourably for significant future growth.

US demographic outlook – 2024 to 2054

Source: CBO

- 2Q24 earnings review. Revenue grew by 12.5% YoY to US$1.04B. Non-GAAP EPS was US$1.32.

- Market consensus.

(Source: Bloomberg)

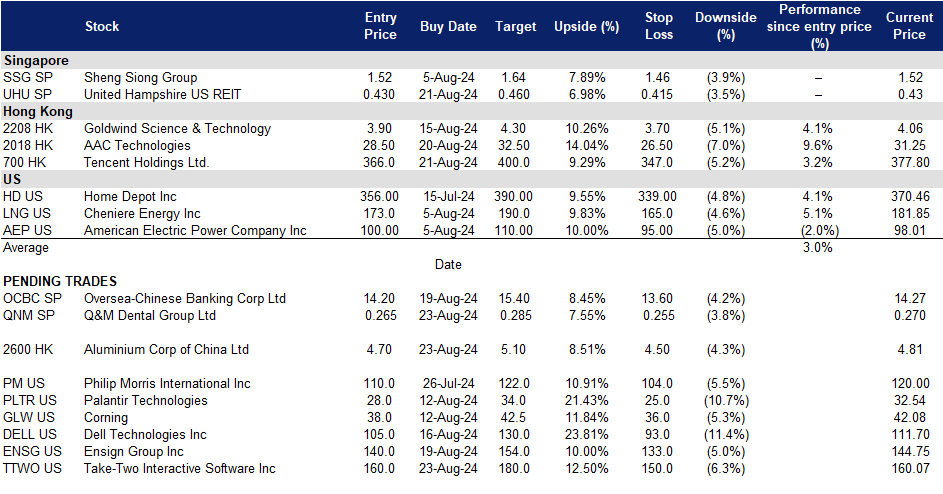

Trading Dashboard Update: Add Tencent Holdings Ltd (700 HK) at HK$366 and United Hampshire US REIT (UHU SP) at US$0.43.