16 August 2024: United Hampshire US REIT (UHU SP), Lenovo Group Ltd. (992 HK), Dell Technologies Inc (DELL US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

United Hampshire US REIT (UHU SP): Tailwinds from the potential soft-landing of the US economy

- BUY Entry – 0.430 Target– 0.460 Stop Loss – 0.415

- United Hampshire US REIT operates as a real estate investment trust. The Company owns and operates shopping, storage, grocery, and necessity-based retail properties.

- Optimism surrounding US Federal Interest rate cuts in 2H24. Following recent inflationary data in June, the market anticipates a potential 25 basis points rate cut in September 2024. These expected rate reductions are poised to benefit United Hampshire US REIT by lowering borrowing costs, enhancing financial flexibility, and potentially attracting higher investor interest. This favourable interest rate environment aligns with the REIT’s growth strategy, positioning it for increased profitability and value creation in the upcoming quarters.

- Organic growth to drive upside in profitability. United Hampshire US REIT expects organic growth to drive profitability, leveraging built-in rental escalation in the majority of long-term tenant contracts and shorter-term leases in prime self-storage properties. These factors contribute to potential revenue growth and enhanced operational performance.

- Better positioning for active management. If the Federal Reserve implements rate cuts, United Hampshire US REIT stands to benefit in the coming year, enabling proactive portfolio management through strategic acquisitions and divestments. This flexibility underscores the REIT’s capability to adapt to changing market conditions and optimize its asset base.

- 1H24 results review. Revenue for 1H24 increased by 2.4% YoY to US$36.8mn, compared to US$36.0mn in 1H23. Net profit declined by 25.4% YoY to US$9.67mn in 1H24, compared to US$12.96mn in 1H23, mainly due to high interest rates. It also divested a Freestanding Lowe’s and Freestanding Sam’s Club Property within Hudson Valley Plaza for a divestment consideration of US$36.5mn.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.60. Please read the full report here.

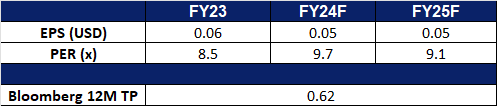

- Market Consensus.

(Source: Bloomberg)

SATS Ltd (SATS SP): Service improvement amidst air travel recovery

- BUY Entry – 3.10 Target– 3.35 Stop Loss – 2.98

- SATS Ltd. provides gateway services and food solutions. The Company specializes in airfreight, ramp and baggage handling; passenger services; aviation security services; aircraft cleaning; and cruise centre management. It also provides airline catering; institutional catering; aviation laundry; and food distribution and logistics. SATS has presence across Asia and the Middle East.

- Partnership to expand food solutions business. SATS is partnering with Mitsui & Co to expand its food and retail solutions businesses. They created a subsidiary, Food Solutions Sapphire Holdings, for joint investments. Mitsui will invest S$36.4mn for a 15% stake in this subsidiary, which includes four of SATS’ food solutions entities. The collaboration aims to enhance the food value chain by leveraging Mitsui’s global network and SATS’ expertise. They plan to grow the food solutions business in key Asian markets, focusing on product development, kitchen production, and logistics. The partnership is already showing results, especially in Japan, with plans to supply frozen meals to Muji Japan by early 2025. This collaboration is expected to drive long-term growth for SATS.

- Self-driving buses on trial. Changi Airport will trial a self-driving bus for transporting workers in its restricted area starting in the third quarter of 2024. The agreement on 17 July, involving Changi Airport Group (CAG), Singapore Airlines Engineering Company (SIAEC), and Sats Airport Services, aims to boost manpower productivity through automation. The two-year proof of concept will be in two phases: a nine-month controlled environment test followed by a live operational test. A safety driver will be on board throughout both phases. This trial is part of broader efforts, including previous trials of autonomous baggage vehicles, to improve operational efficiency and reduce congestion at Changi Airport. The project is co-funded by the Civil Aviation Authority of Singapore. Successful implementation could potentially benefit SATS, by reducing manpower for its airside operations.

- Air passenger traffic not slowing. According to the International Air Transport Association, in 2024, the airline industry has recovered from the COVID-19 crisis, with total traffic surpassing 2019 levels in February. Domestic travel returned to pre-COVID levels in spring 2023, while international routes have also recently recovered. Most regions are expected to exceed 2019 levels in 2024, with Asia Pacific leading growth at 17.2% YoY. Over the next 20 years, global passenger journeys are expected to increase by an average of 3.8% annually, resulting in over 4 billion additional journeys by 2043 compared to 2023. This yearly rise in global travel will contribute to SATS revenue growth in the coming years.

- Business restructuring. SATS recently announced the division of its airport ground handling services into separate units for Singapore and the Asia-Pacific region to stimulate company growth. The restructuring of its Gateway Services business resulted in the creation of two new units: the Singapore Hub and Gateway Services Asia-Pacific. The Singapore Hub will focus on enhancing aviation hub competitiveness in Singapore, while Gateway Services Asia-Pacific will aim to expand the group’s market share by managing operations in overseas airports.

- FY24 results review. Total revenue rose by 192.9% YoY to S$5.15bn in FY24, compared to S$1.76bn in FY23. Core PATMI rose by 331.3% to S$78.5mn in FY24, compared to S$18.2mn in FY23. Basic EPS was 3.8 Scents in FY24, compared to -2.2 Scents in FY23.

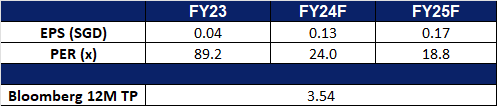

- Market Consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): PC shipment recovery on track

- BUY Entry – 9.90 Target 10.90 Stop Loss – 9.40

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Global PC recovery to continue in the second half of the year. An IDC report indicates that the traditional PC market experienced its second quarter of growth following eight consecutive quarters of decline. In Q2, worldwide shipments reached 64.9 million units, reflecting a 3.0% YoY growth. Additionally, Lenovo’s robust 1Q25 results bolster optimism for a gradual recovery in the computing industry, driven by global AI spending. The results highlight how increasing demand for servers, crucial for AI development, is revitalizing the computing hardware market after its post-Covid downturn. As we reach the four-year mark since the COVID-19 pandemic began in 2020, it’s also expected that the PC commercial refresh cycle will start. Additionally, with inventory levels returning to normal, average selling prices are anticipated to increase due to more advanced configurations and reduced discounting.

- Ramping up global AI spending. Major technology companies, including Microsoft, Alphabet, Meta, and Amazon, are projected to invest over $1tn in AI over the coming years, according to sources. In their recent earnings reports, these companies informed investors that they anticipate increased spending on AI infrastructure, particularly data centres, to secure their long-term positions in the AI sector and meet the growing computational demands. By investing in AI infrastructure now, these tech giants aim to ensure they have the necessary computing technology as AI continues to evolve. Lenovo’s AI PCs is likely to benefit from these AI investments.

- Expanding product portfolio in India. Lenovo has been expanding its product portfolio in India, recently launching the Yoga Slim 7x, its first AI-powered Copilot+ PC in the country. Additionally, Lenovo also introduced its latest gaming tablet, the Lenovo Legion Tab, in India. With more Lenovo’s offerings alongside the company’s Microsoft’s AI expertise, the increased number of product offerings is expected to attract more customers.

- 1Q25 earnings. The company’s revenue rose by 19.7% YoY to US$15.4bn in 1Q25, compared to US$12.9bn in 1Q24. The company’s net profit rose by 38.3% YoY to US$253mn in 1Q25, compared to US$183mn in 1Q24. Basic earnings per share rose to US1.99 cents in 1Q25, compared to US1.48 cents in 1Q24.

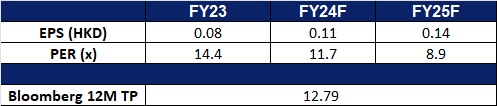

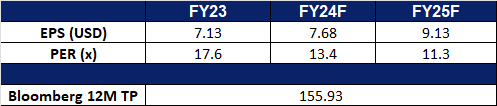

- Market consensus.

(Source: Bloomberg)

Goldwind Science & Technology Co Ltd. (2208 HK): Spurring investments into renewable energy

- RE-ITERATE BUY Entry – 3.90 Target 4.30 Stop Loss – 3.70

- Goldwind Science & Technology Co Ltd, formerly Xinjiang Goldwind Science & Technology Co Ltd, is a China-based company that provides overall solutions for wind turbines, wind power services and wind farm development. The Company operates its businesses through four segments. The Wind Turbine Manufacturing and Sales segment is mainly engaged in the research and development, manufacturing and sales of wind turbines and their parts. The Wind Power Service segment mainly provides wind power-related consultants, wind farm construction and maintenance and transportation services. The Wind Farm Development segment is mainly engaged in the development and operation of wind farms. Other segment is mainly engaged in financial leasing and water treatment development and operation business. The Company conducts its businesses both in the domestic market and overseas markets.

- New Renewable Energy Consumption Benchmarks. China’s National Development and Reform Commission (NDRC) and National Energy Administration (NEA) have jointly released updated requirements for the percentage of energy that provinces must source from renewable generators in 2024 and 2025. These requirements are part of China’s renewable energy consumption guarantee mechanism, mandating a significant increase in the share of renewable energy in several provinces. The document also outlines tentative renewable energy consumption targets for 2025. Current data reveals that six provinces experienced increases exceeding 6 percentage points in their renewable energy consumption mandate between 2023 and 2024. China remains on track to achieve its renewable energy goals, aiming for renewable energy, including hydropower, to account for 40 percent of total national energy consumption by 2030. This benchmarks are likely to spur on more investment into renewable energy as well.

- Increasing use of renewable energy in China. China’s renewable energy utilization has reached or exceeded advanced international levels, demonstrating rapid progress in sustainable energy. The country has maintained strong momentum in renewable energy adoption, with a utilization rate of 97.6%, surpassing 95% for six consecutive years since 2018. Last year, newly installed renewable energy capacity rose to 290 million kW, 2.4 times that of 2022, accounting for 79% of the total new power generation capacity nationwide, making it the primary source of new power generation. This surge in capacity has spurred significant investments in solar, wind, and hydropower projects across the country. These efforts are part of China’s broader strategy to peak carbon emissions before 2030 and achieve carbon neutrality before 2060. Goldwind is likely to benefit from the increased investment and spending in renewable energy.

- Expanding presence. Goldwind Science & Technology recently acquired its first overseas wind turbine manufacturing plant in Brazil. In May, the company finalized an agreement with General Electric to acquire the Camacari assembly plant in Bahia state. The plant is set to begin mass production of wind turbines by the end of 2024, creating over 1,000 jobs in the region. Goldwind highlighted that this investment will enhance local supply chains and capitalize on the region’s abundant wind resources.

- 1Q24 earnings. The company’s operating revenue rose to RMB6.98bn in 1Q24, +25.42% YoY, compared to RMB5.56bn in 1Q23. The company’s net profit fell by 73.06% YoY to RMB332mn, compared to RMB1.23bn in 1Q23. Basic earnings per share fell to RMB0.0726 in 1Q24, compared to RMB0.286 in 1Q23.

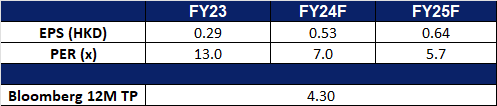

- Market consensus.

(Source: Bloomberg)

Dell Technologies Inc (DELL US): Tailwinds from PC upgrade cycle & AI wave

- BUY STOP Entry – 105 Target – 130 Stop Loss – 93

- Dell Technologies Inc. provides computer products. The Company offers laptops, desktops, tablets, workstations, servers, monitors, printers, gateways, software, storage, and networking products. Dell Technologies serves customers worldwide.

- Global PC recovery to continue in the second half of the year. An IDC report indicates that the traditional PC market experienced its second quarter of growth following eight consecutive quarters of decline. In Q2, worldwide shipments reached 64.9 million units, reflecting a 3.0% YoY growth. When excluding China, worldwide shipments grew by more than 5% YoY. AI PCs are predicted to drive demand from the commercial market in the short term. As we reach the four-year mark since the COVID-19 pandemic began in 2020, it’s expected that the PC commercial refresh cycle will start. Additionally, with inventory levels returning to normal, average selling prices are anticipated to increase due to more advanced configurations and reduced discounting. Therefore, the report expects that the PC recovery will persist.

- Partnership to run the new platform. Dell Technologies and Nutanix have expanded their long-term partnership to offer a competitive alternative to VMware, particularly targeting customers unhappy with changes under Broadcom’s ownership. This collaboration integrates Nutanix’s software with Dell’s PowerEdge servers and PowerFlex storage, aiming to capture market share from discontented VMware users. The new Dell XC Plus appliance, a turnkey hyperconverged infrastructure (HCI) solution, is central to this strategy, offering simplified management and scalability for hybrid cloud environments. The partnership, which is set to expand further, could intensify competition in the HCI market and allow Dell to gain a competitive advantage in the computing space.

- Lowering costs. Dell Technologies is cutting jobs as part of a reorganization focused on streamlining its sales teams and prioritizing investments in AI products and services. The company is creating a new AI-focused group and adjusting its approach to data center sales. Despite growing investor interest in Dell’s AI capabilities, there is concern over the long-term payoff of such investments. The company, which had already cut 13,000 jobs earlier in 2023, aims to become leaner through the cutting of jobs. Dell remains optimistic about future growth, particularly with AI-optimized PCs, despite challenges in its traditional PC market.

- 1Q24 earnings review. Revenue grew by 6.2% YoY to US$22.2B, beating estimates by US$550M. Non-GAAP EPS was US$1.27, beating estimates by US$0.02.

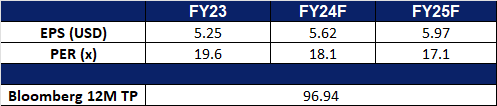

- Market consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): A hidden AI-themed stock is catching up

Palantir Technologies Inc (PLTR US): A hidden AI-themed stock is catching up

- RE-ITERATE BUY Entry – 28 Target – 34 Stop Loss – 25

- Palantir Technologies Inc. develops software to analyze information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- Growth and risk-off attributions. The company is one of the AI application concept stocks, and its platform has gained more use from business customers in the past two years. At the same time, the US Department of Defense is the company’s largest public business customer, and the company’s platform provides artificial intelligence training for the US Navy and Army. Therefore, under the economic pro-cycle, the increase of software expenditure is beneficial to the business growth of the company’s commercial sector; When the economic downturn cycle or high geopolitical risks, the U.S. defense spending, especially artificial intelligence, continues to grow, providing protection for the company’s public sector revenue growth.

- The first quarterly results meet the rule of 40. The Rule of 40 is a metric used to measure the overall performance of a SaaS company, which is considered good performance if the combined revenue growth rate and EBITDA Margin are at or above 40%. Palantir Technologies exceeded this indicator for the first time in the latest quarter. As a result, the company’s fundamentals are sound.

- 2Q24 earnings review. Revenue grew by 27.2% YoY to US$678.13M, beating estimates by US$25.71M. Non-GAAP EPS was US$0.09, beating estimates by US$0.01. The company expected 3Q24 revenue to be between $697M to $701M vs consensus of $680.2M and adjusted income from operations of between $233M to $237M. It also raise FY24 revenue guidance to be between $2.742B to $2.750B vs consensus of $2.7B.

- Market consensus.

(Source: Bloomberg)

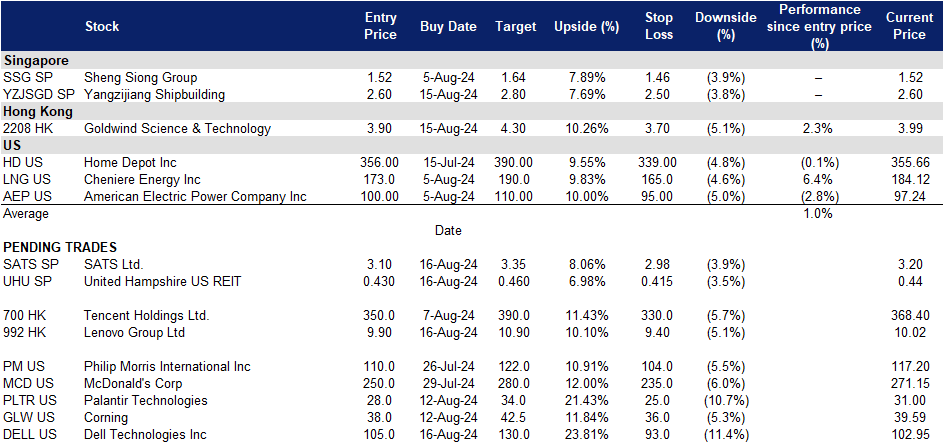

Trading Dashboard Update: Add Goldwind Science & Technology (2208 HK) at HK$3.9 and Yangzijiang Shipbuilding (YZJSGD SP) at S$2.60. Cut loss on Dongfang Electric Corp Ltd (1072 HK) at HK$9.7.