15 August 2024: Wealth Product Ideas

Maximizing Stability and Income

In the current volatile market, fixed income ETFs have emerged as a crucial investment option for those seeking stability and income.

Benefits of Fixed Income ETFs

- Stability: Fixed income ETFs provide a buffer against market volatility. They are less susceptible to swings compared to equities, making them ideal for conservative investors.

- Income Generation: These ETFs deliver regular income through interest payments, which can be especially attractive in uncertain economic times.

- Diversification: Investing in fixed income ETFs allows for broad exposure to various bonds, including government and corporate debt, reducing individual security risk.

- Liquidity: ETFs trade on exchanges like stocks, offering the flexibility to buy and sell throughout the trading day, which enhances liquidity.

- Low Costs: Many fixed income ETFs have low expense ratios, making them cost-effective for long-term investment strategies.

Fund Name (Ticker) | iShares U.S. Treasury Bond ETF (GOVT US) |

Description | The iShares U.S. Treasury Bond ETF seeks to track the investment results of an index compased of U.S. Treasury bonds. |

Asset Class | Fixed Income |

30-Day Average Volume (as of 12 Aug) | 5,844,130 |

Net Assets of Fund (as of 12 Aug) | $27,194,208,025 |

12-Month Yield (as of 12 Aug) | 2.94% |

Weighted Average Coupon (as of 12 Aug) | 2.57% |

Effective Duration (as of 12 Aug) | 5.96years |

Management Fees (Annual) | 0.05% |

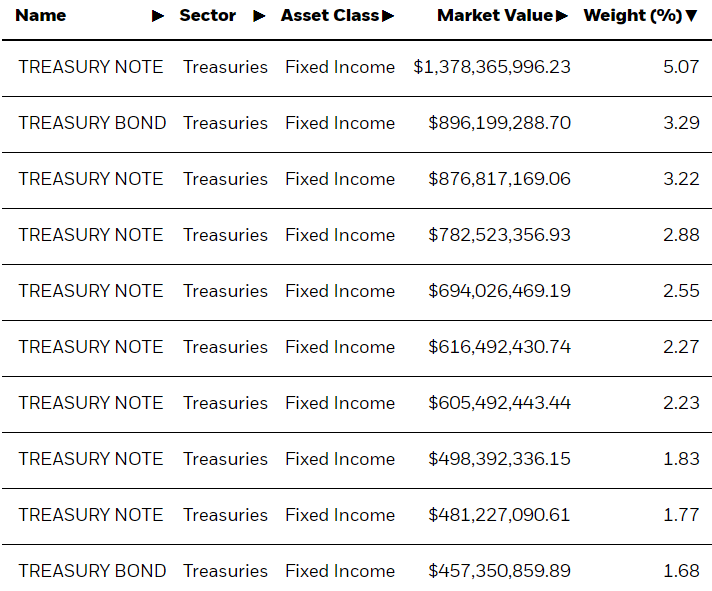

Holdings

(as of 12 August 2024)

(Source: Bloomberg)

Fund Name (Ticker) | iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD US) |

Description | The Global X Defence Tech ETF (SHLD) seeks to invest in companies positioned to benefit from the increased adoption and utilization of defence technology (“Defence Tech”). This includes companies that build and manage cybersecurity systems, utilize artificial intelligence and big data, and build advanced military systems and hardware such as robotics, fuel systems, and aircrafts for defence applications. |

Asset Class | Fixed Income |

30-Day Average Volume (as of 12 Aug) | 28,692,404 |

Net Assets of Fund (as of 13 Aug) | $33,141,432,087 |

12-Month Yield (as of 12 Aug) | 4.28% |

Weighted Average Coupon (as of 12 Aug) | 4.30% |

Effective Duration (as of 12 Aug) | 8.38years |

Management Fees (Annual) | 0.14% |

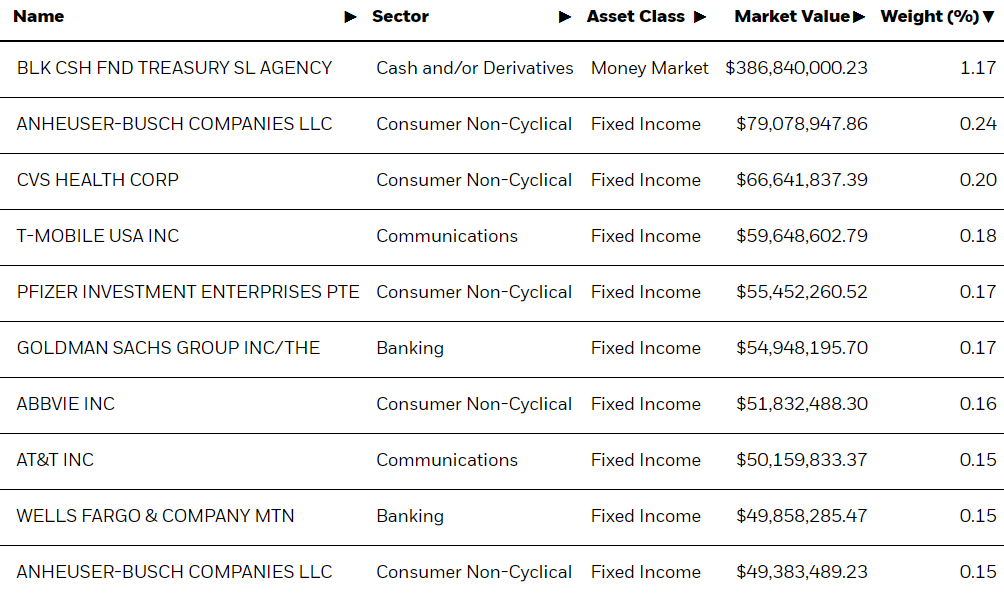

Holdings

(as of 12 August 2024)

(Source: Bloomberg)

(Source: Bloomberg)