08 August 2024: Wealth Product Ideas

Increased infrastructure activities

- The U.S. inflation continues to cool down, with the CPI annual rate falling to 3.0% in June. This trend suggests that the start of an interest rate cut cycle is approaching. Federal Reserve Chairman Powell has hinted at upcoming rate cuts, stating that the Fed won’t wait for inflation to reach the 2% target before cutting rates.

- Lower cost of capital. Infrastructure projects are often capital-intensive. As a lower interest rate can reduce the cost of financing infrastructure projects, higher expectations towards a lower interest rates environment are likely to drive infrastructure activity.

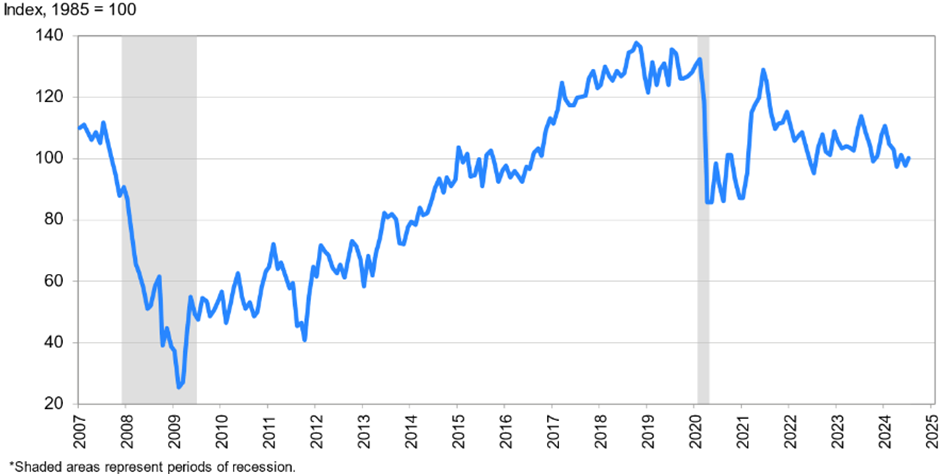

- Improving consumer sentiment. The U.S. consumer confidence index rose to 100.3 in July, compared to a downwardly revised 97.8 in June. This boosts consumer spending outlook in the future, increasing consumer spending as well as increasing demand for housing and properties, benefitting infrastructure ETFs.

United States Consumer Confidence Index

(Source: The Conference Board, NEBR)

- Business Sentiment. Business investment increased in 2Q24, with spending on equipment surging at an 11.6% rate, up from just 1.6% in the first quarter. While spending on intellectual property products continued to grow, the pace slowed from the brisk rate seen in the January-March quarter. These improved business sentiments are likely to positively impact infrastructure activity as well.

Fund Name (Ticker) | Global X US Infrastructure Development ETF (PAVE US) |

Description | The Global X U.S. Infrastructure Development ETF (PAVE) seeks to invest in companies that stand to benefit from a potential increase in infrastructure activity in the United States, including those involved in the production of raw materials, heavy equipment, engineering, and construction. |

Asset Class | Equity |

30-Day Average Volume (as of 30 Jul) | 1,381,522 |

Net Assets of Fund (as of 30 Jul) | US$7.50bn |

12-Month Yield (as of 30 Jul) | 0.6382% |

P/E Ratio (as of 30 Jul) | 20.831 |

P/B Ratio (as of 30 Jul) | 3.257 |

Management Fees (Annual) | 0.47% |

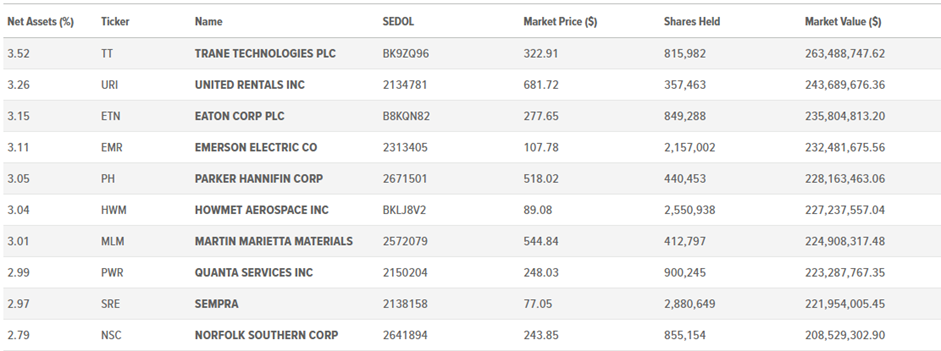

Holdings

(as of 06 August 2024)

(Source: Bloomberg)

Defence Sector Revival: Benefitting from escalating tensions

- Escalating tensions in the Middle East and the ongoing Russia-Ukraine conflict are increasing the attractiveness of defence-related equities, benefiting defence ETFs.

- The US is increasing its military presence in the Middle East to de-escalate regional tensions following the assassination of Hamas leader Ismail Haniyeh and Hezbollah commander Fuad Shukr. These events have heightened fears of a broader conflict, with Iran, Hamas, and Hezbollah vowing revenge. President Biden and his national security team are closely monitoring the situation. The US has deployed additional fighter jets and Navy warships, emphasizing its support for Israel’s security. Despite hopes for Iran to de-escalate, the US is preparing for all scenarios. This move comes as regional violence persists, with continued diplomatic efforts to prevent further escalation.

- Countries involved in and surrounding such conflicts may decide to enhance their defensive capabilities for self-defence, leading to increased sales for defence-related companies.

Fund Name (Ticker) | Global X Defence Tech ETF (SHLD US) |

Description | The Global X Defence Tech ETF (SHLD) seeks to invest in companies positioned to benefit from the increased adoption and utilization of defence technology (“Defence Tech”). This includes companies that build and manage cybersecurity systems, utilize artificial intelligence and big data, and build advanced military systems and hardware such as robotics, fuel systems, and aircrafts for defence applications. |

Asset Class | Equity |

30-Day Average Volume (as of 30 Jul) | 168,630 |

Net Assets of Fund (as of 30 Jul) | US$380,650,000 |

12-Month Yield (as of 30 Jul) | 0.385 % |

P/E Ratio (as of 30 Jul) | 19.87 |

P/B Ratio (as of 30 Jul) | 3.00 |

Management Fees (Annual) | 0.50% |

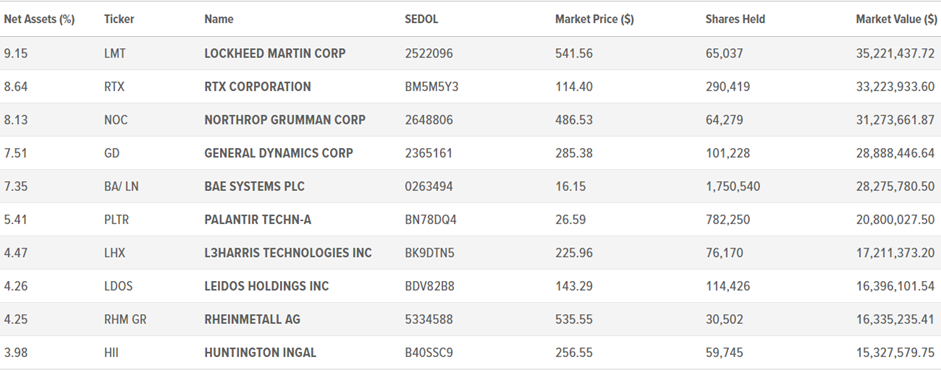

Holdings

(as of 6 August 2024)

(Source: Bloomberg)