25 July 2024: Wealth Product Ideas

Benefitting from Bitcoin Volatility

- High volatility of Bitcoin. The ETF is expected to take advantage of rising demand to profit from the volatile trading of cryptocurrencies. The introduction of several Bitcoin ETFs recently has also led to a higher inflow of funds into Bitcoin, as investors are now able to invest in Bitcoin and further diversify their portfolio without physically owning it. Bitcoin has been the most erratic among major global assets in the last ten years, with volatility as high as 38.3% in 2023. According to Coinshare, crypto investment products saw total inflows for July surpassing $3bn, implying high volatility towards crypto investment products. The ongoing presidential election has also led to an increase in the volatility of Bitcoin as well, with Trump recently positioning him as a crypto-friendly candidate.

- Hedging against Bitcoin Upside. The ETF creates opportunities for investors to gain from downside movements in bitcoin. Bitcoin has risen over US$60,000 recently in 2024, back up from the previous high in 2021. This level acts as a level of resistance for Bitcoin, and investors would be able to hedge themselves against Bitcoin’s price movement along this level of resistance.

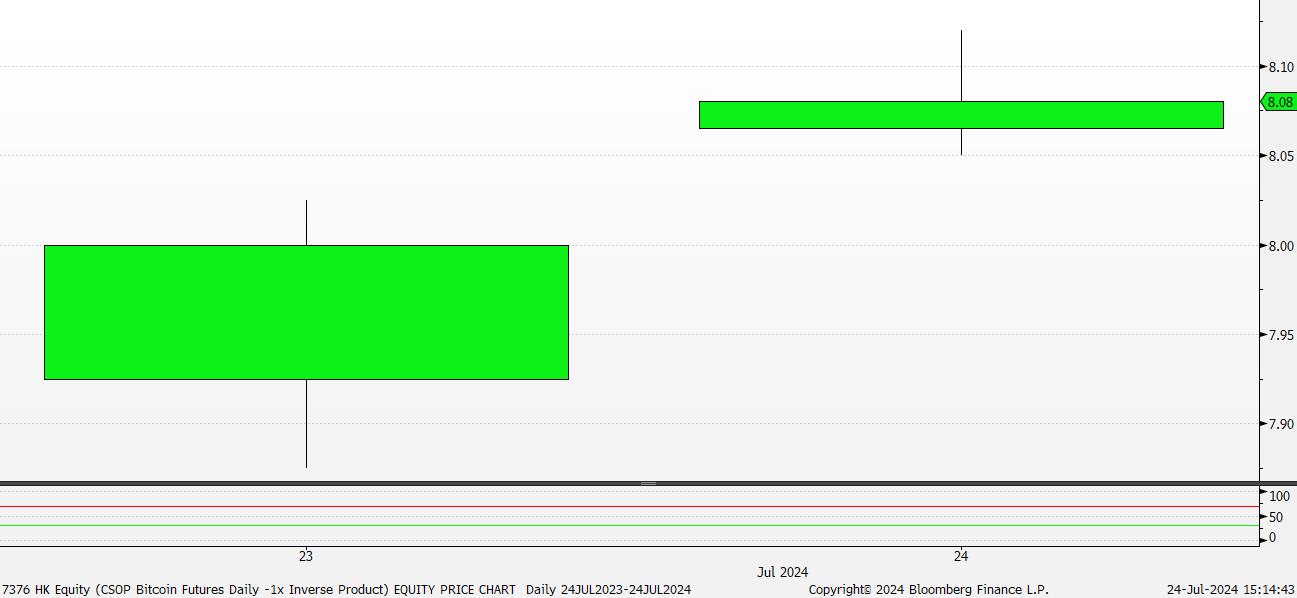

Fund Name (Ticker) | CSOP Bitcoin Futures Daily (-1x) Inverse Product (7376 HK) |

Description | The investment objective of the Product is to provide investment results that, before fees and expenses, closely correspond to the inverse (-1x) of the Daily performance of the Index. The Product does not invest directly in bitcoin. The Product does not seek to achieve its stated investment objective over a period of time greater than one day. |

Asset Class | Futures |

Fund Inception | 23 July 2024 |

Net Assets of Fund (as of 23 Jul) | US$31,207,528 |

NAV | US$1.04 |

Shares Outstanding | 30,000,000 |

Management Fees (Annual) | 1.99% |

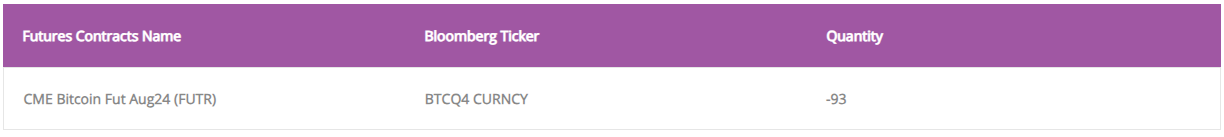

Holdings

(as of 23 July 2024)

(Source: Bloomberg)

Debut of the second-largest cryptocurrency – US spot Ethereum ETFs

- Correlation with bitcoin. BTC and ETH, being the 2 largest cryptocurrencies by market capitalization, account for approximately 71% of the sector’s market cap. BTC and ETH prices have exhibited a high correlation, with BTC occasionally leading the surge/dip, offering investors a brief window for manoeuvring in the market.

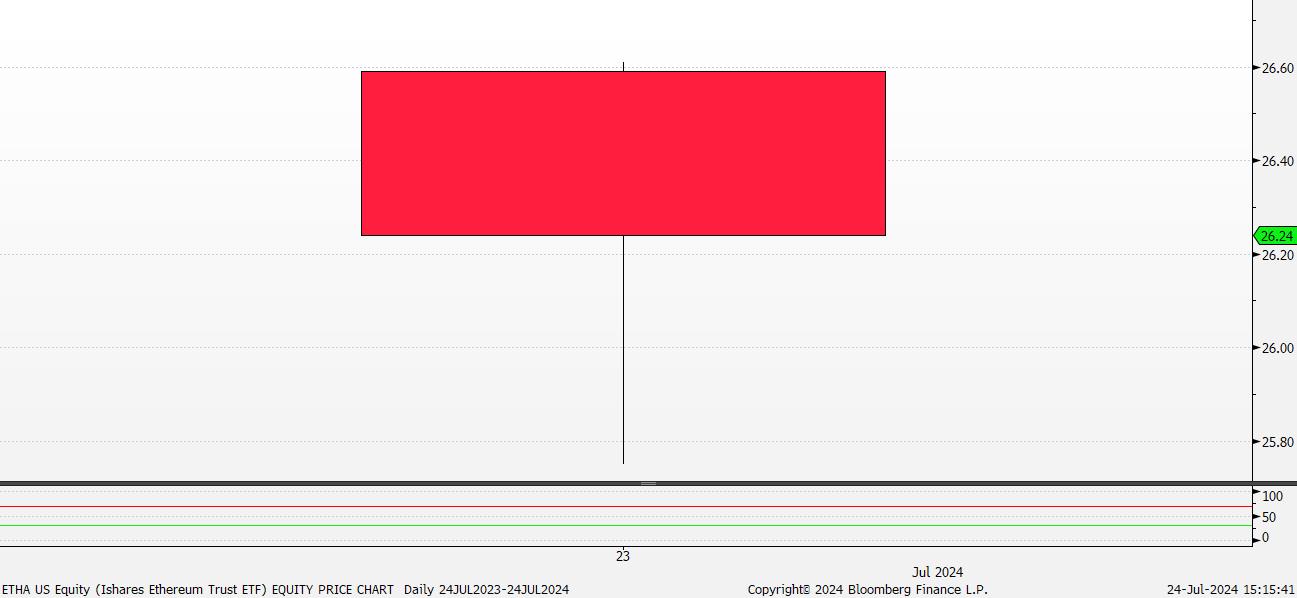

- Enhancing the cryptocurrency market’s legitimacy. Despite being roughly one-third of Bitcoins’ market capitalisation, on 23 July 2024, the eight new US exchange-traded funds (ETFs) tied to ether had a strong debut, with US$1.07bn in shares traded. Trading volumes were lower than the US$4.6bn traded in bitcoin ETFs during their January launch. The price of ether declined, affecting the new ETFs’ prices. The ETFs aim to classify ether as a commodity, enhancing the market’s legitimacy and stability, though the SEC has not officially labelled it as such.

- Push for digital assets. The introduction of ether ETFs will further boost market stability and reduce the volatility of cryptocurrency, improving the development of the crypto market. Ether ETF fees range from 0.19% to 2.5%, comparable to bitcoin ETF fees but with fewer waivers. Demand for these products will indicate investor interest in digital assets beyond Bitcoin. However, the SEC’s exclusion of the staking mechanism in the ether ETFs is a concern for some investors.

Fund Name (Ticker) | iShares Ethereum Trust ETF (ETHA US) |

Description | The iShares Ethereum Trust ETF seeks to reflect generally the performance of the price of ether. |

Asset Class | Commodity |

Fund Inception | 24 June 2024 |

Net Assets of Fund (as of 23 Jul) | US$10,535,521 |

NAV (as of 23 Jul) | US$26.34 |

Shares Outstanding (as of 23 Jul) | 400,000 |

Management Fees* (Annual) | 0.25% |

* BlackRock will waive a portion of the Sponsor’s Fee for the first 12 months commencing on July 23, 2024, so that the fee will be 0.12% of the net asset value of the Trust for the first $2.5 billion of the Trust’s assets. If the fund exceeds $2.5 billion of the Trust’s assets prior to the end of the 12-month period, the Sponsor’s Fee charged on assets over $2.5 billion will be 0.25%. All investors will incur the same Sponsor’s Fee which is the weighted average of those fee rates. After the 12-month waiver period is over, the Sponsor’s Fee will be 0.25%.

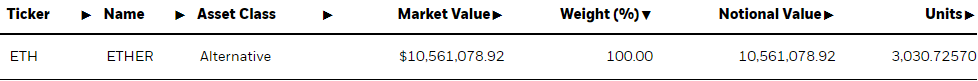

Holdings

(as of 22 July 2024)

(Source: Bloomberg)