6 June 2024:Wealth Product Ideas

AI-Driven Nuclear Energy Demand

Investment Thesis: The rapid advancements in artificial intelligence are catalyzing a significant increase in demand for nuclear energy. As more powerful AI data centers come online, they require substantial and reliable electricity and water supplies. Nuclear power, being a low-carbon energy source that does not emit greenhouse gases, is well-positioned to meet this growing demand. Unlike intermittent renewable energy sources such as solar and wind, nuclear power can provide a stable, round-the-clock electricity supply, making it an ideal choice for the industry.

Key Insights:

- The global generative AI energy market is projected to reach $5.3bn by 2032.

- AI servers utilize chips that consume significantly more power compared to traditional servers, with electricity demand expected to grow at an annual rate of approximately 9% through 2030.

- To meet carbon neutrality standards, the demand for uranium is set to expand continuously.

- The global nuclear power market is forecast to reach 498.41GW by 2032.

|

Fund Name (Ticker) |

Global X Uranium ETF (URA US) |

|

Description |

The Global X Uranium ETF (URA) provides investors access to a broad range of companies involved in uranium mining and the production of nuclear components, including those in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 04 June) |

3,406,467 |

|

Net Assets of Fund (as of 04 June) |

US$3,502,164,100 |

|

12-Month Yield (as of 04 June) |

50.60% |

|

P/E Ratio (as of 03 June) |

29.67 |

|

P/B Ratio (as of 03 June) |

1.85 |

|

Management Fees (Annual) |

0.69% |

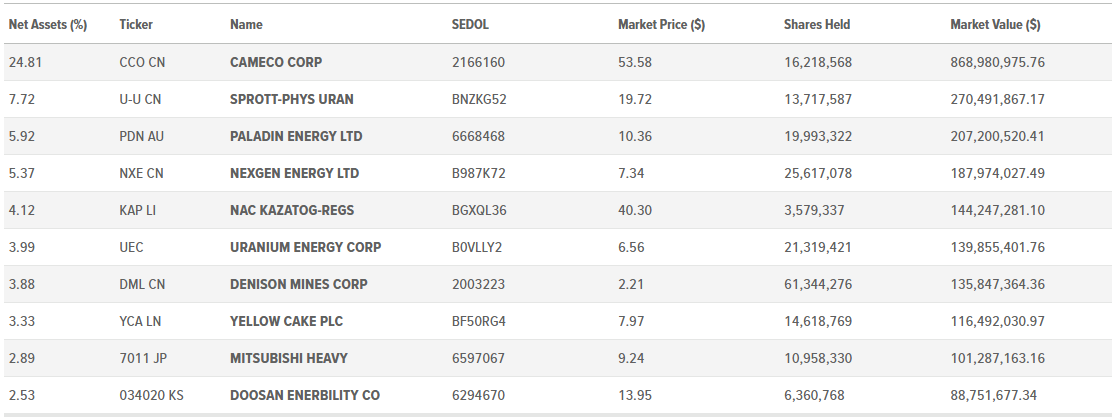

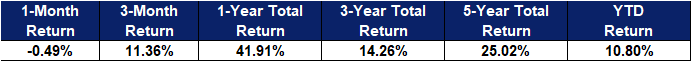

Top 10 Holdings

(as of 04 June 2024)

(Source: Bloomberg)

|

Fund Name (Ticker) |

Sprott Uranium Miners ETF (URNM US) |

|

Description |

The Sprott Uranium Miners ETF seeks to invest at least 80% of its total assets in securities of the North Shore Global Uranium Mining Index (URNMX). The Index is designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development and production of uranium, or holding physical uranium, owning uranium royalties or engaging in other non-mining activities that support the uranium mining industry. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 04 June) |

475,705 |

|

Net Assets of Fund (as of 04 June) |

US$1,817,586,203.55 |

|

12-Month Yield (as of 04 June) |

65.72% |

|

P/E Ratio |

NA |

|

P/B Ratio (as of 04 June) |

3.877 |

|

Management Fees (Annual) |

0.75% |

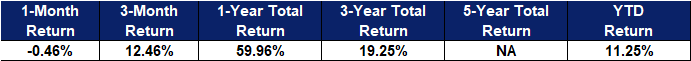

Top 10 Holdings

(as of 04 June 2024)

(Source: Bloomberg)