12 January 2023: Wealth Product Ideas

| Fund Name (Ticker) | Invesco Golden Dragon China ETF (PGJ) |

| Description | The Invesco Golden Dragon China ETF (Fund) is based on the NASDAQ Golden Dragon China Index (Index). The Fund generally will invest at least 90% of its total assets in equity securities of companies deriving a majority of their revenues from the People’s Republic of China and that comprise the Index. The Index is composed of US exchange-listed companies that are headquartered or incorporated in the People’s Republic of China. The Fund and the Index are rebalanced and reconstituted quarterly. |

| Asset Class | Equity |

| 30-Day Average Volume (as of 10 Jan) | 97,541 |

| Net Assets of Fund (as of 10 Jan) | $252,777,840 |

| 12-Month Trailing Yield (as of 10 Jan) | -13.0% |

| P/E Ratio (as of 31 Dec) | 27.56 |

| P/B Ratio (as of 31 Dec) | 1.75 |

| Management Fees | 0.50% |

Top 10 Holdings

(as of 9 Jan, 2023)

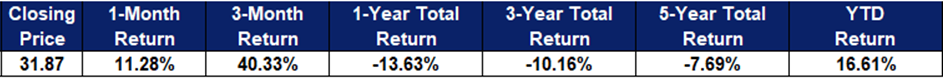

- BUY Entry –30.0 Target – 38.0 Stop Loss – 26.0

- 2023 is the year of economic revitalisation for China. The new batch of administration will be focusing on economic recovery.

- China has lifted COVID restrictions by the end of 2022, and meanwhile, the authority released quite a few supportive policies for several key sectors hit by lockdowns and crackdowns. Expanding domestic consumption is the main theme in 2023.

- Platform economies, real estate, gaming, and tourism sectors will have re-ratings of their valuations.

- Turnaround is the investment theme for this ETF.

Source: Bloomberg

| Fund Name (Ticker) | iShares MSCI Global Metals & Mining Producers ETF (PICK) |

| Description | The iShares MSCI Global Metals & Mining Producers ETF seeks to track the investment results of an index composed of global equities of companies primarily engaged in mining, extraction or production of diversified metals, excluding gold and silver. |

| Asset Class | Equity |

| 30-Day Average Volume (as of 9 Jan) | 220,105 |

| Net Assets of Fund (as of 10 Jan) | $1,488,750,140 |

| 12-Month Trailing Yield (as of 30 Nov) | 8.31% |

| P/E Ratio (as of 10 Jan) | 6.035 |

| P/B Ratio (as of 10 Jan) | 1.665 |

| Management Fees | 0.39% |

Top 10 Holdings

(as of 9 Jan 2023)

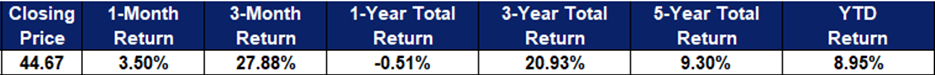

- BUY Entry – 40.0 Target – 48.0 Stop Loss – 36.0

- US dollar index peaked

- US inflation growth decreased and the market expectations of peak inflation were reinforced.

- US labour market starts cooling down

- Rate hikes are expected to slow down.

- The authorities are focused on economic recovery after the 20th National Congress of the Chinese Communist Party

- Abandoned Zero-Covid policy

- Several measures were released to bail out the property market

- Ongoing infrastructure expansion to drive demand for basic metals

Source: Bloomberg