9 November 2023: Wealth Product Ideas

Trade Idea: Tapping AI’s Potential

- AI has become a key focus in recent tech earnings, leading to differing stock reactions.

- Microsoft and Amazon experienced a rally, driven by optimism about their AI progress and monetization.

- Alphabet and Meta, however, face more uncertainty despite Alphabet’s strong core ad sales.

- Microsoft’s Azure cloud revenue growth was significantly boosted by AI demand.

- Amazon’s AWS also experienced a growth inflection, demonstrating their leadership in utilizing AI.

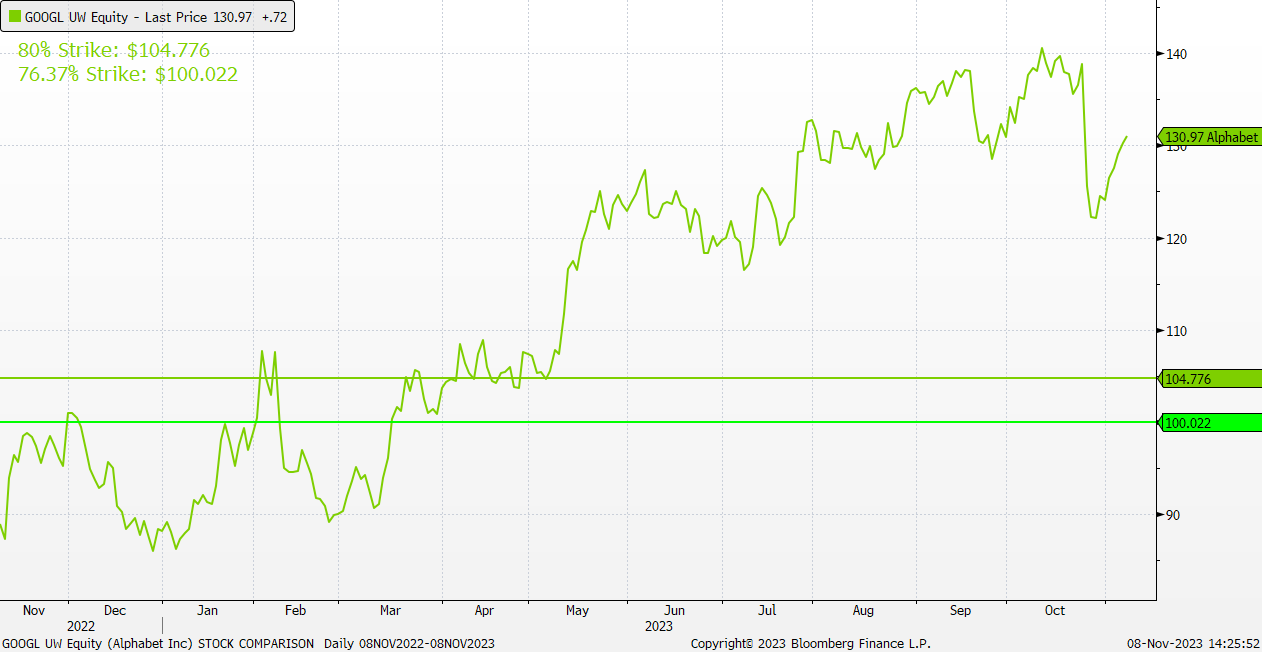

- Alphabet’s Google Cloud fell short of expectations, indicating a potential lag in AI monetization, though its ad strength showed no loss of share.

- Meta is currently investing heavily in its AI initiatives.

- Looking forward, AI will continue to be a critical theme. The pace of development may differ, but these tech giants are strategically focused on harnessing AI’s potential.

- The solid 3Q2023 fundamentals highlight their resilience amid economic uncertainty.

- The increasing importance of AI and the sustained strengths of these tech leaders support the idea of investing in this theme via structured notes (FCNs).

- Investors have the opportunity to capitalize on AI’s long-term potential while limiting downside risks.

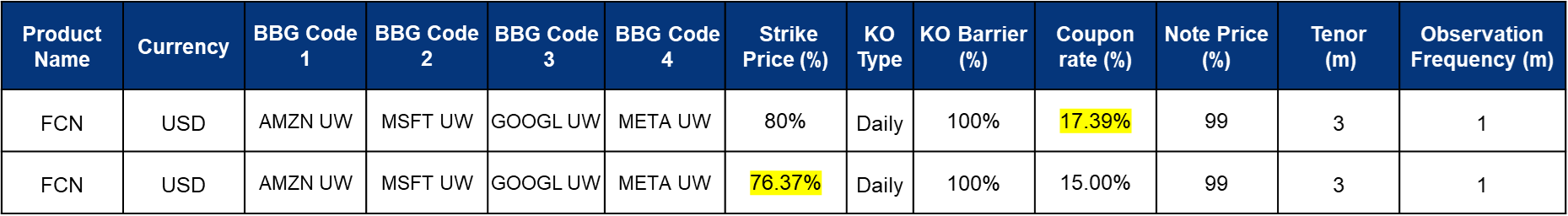

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

Payout Scenarios:

Investors receive corresponding interest payments every month and;

- KO Early Redemption: Principal + KO returns (KO event occurs only when the closing price of all underlying securities is higher than the knock-out price)

-

Maturity Redemption: If no KO event occurs, the payout will be:

- If the final price of all underlying is higher than or equal to the strike price, investors will receive 100% cash return on their principal, along with the final interest.

- If the final price of one or more underlying is lower than the strike price, investors will receive 100% of their principal in the form of shares of the worst-performing stock and will also receive the final interest.