9 January 2025: Investment Product Ideas

Rise of humanoids

- Recent advancements in technology and declining production costs are bringing mass production and widespread adoption of humanoid robots closer to reality.

- Drawing parallels from the evolution of the automotive industry and the rise of collaborative robots, humanoid robots are on the brink of mainstream adoption, driven by technological innovation, supply chain constraints, rising labor costs, and aging demographics.

- For investors seeking opportunities in the humanoid robotics space, the value chain offers a range of prospects — from robotic manufacturers and AI chipmakers to sensor developers and component suppliers. Additionally, cloud infrastructure providers and data management firms are positioned to benefit from the surge in data generated by humanoid deployments.

More Autonomous AI Technology

- At the CES 2025, Nvidia introduced new products including AI to better train robots and cars. The company introduced the Cosmos foundation models, which generate photo-realistic video which can be used to train robots and self-driving cars at a much lower cost than using conventional data. By creating so-called “synthetic” training data, the models help robots and cars understand the physical world similar to the way that large language models have helped chatbots generate responses in natural language. Furthermore, several companies such as Uber, Aurora and Continental have recently teamed up with Nvidia to scale autonomous driving and driverless trucks.

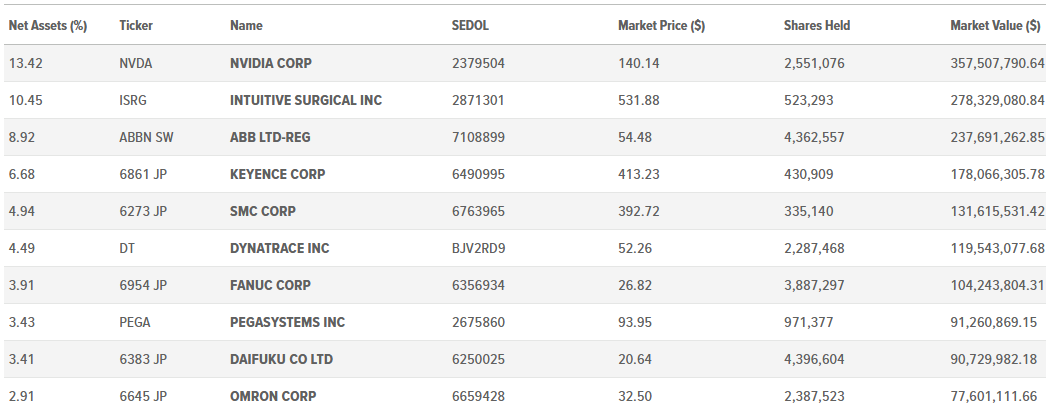

Fund Name (Ticker) | Robotics & Artificial Intelligence ETF (BOTZ US) |

Description | The Global X Robotics & Artificial Intelligence ETF (BOTZ) seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles. |

Asset Class | Equity |

30-Day Average Volume (as of 7 Jan) | 541,849 |

Net Assets of Fund (as of 7 Jan) | $2,654,777,100 |

12-Month Yield (as of 7 Jan) | 0.1323% |

P/E Ratio (as of 7 Jan) | 60.716 |

P/B Ratio (as of 7 Jan) | 4.231 |

Expense Ratio (Annual) | 0.68% |

Top Holdings

(as of 07 January 2025)

(Source: Bloomberg)

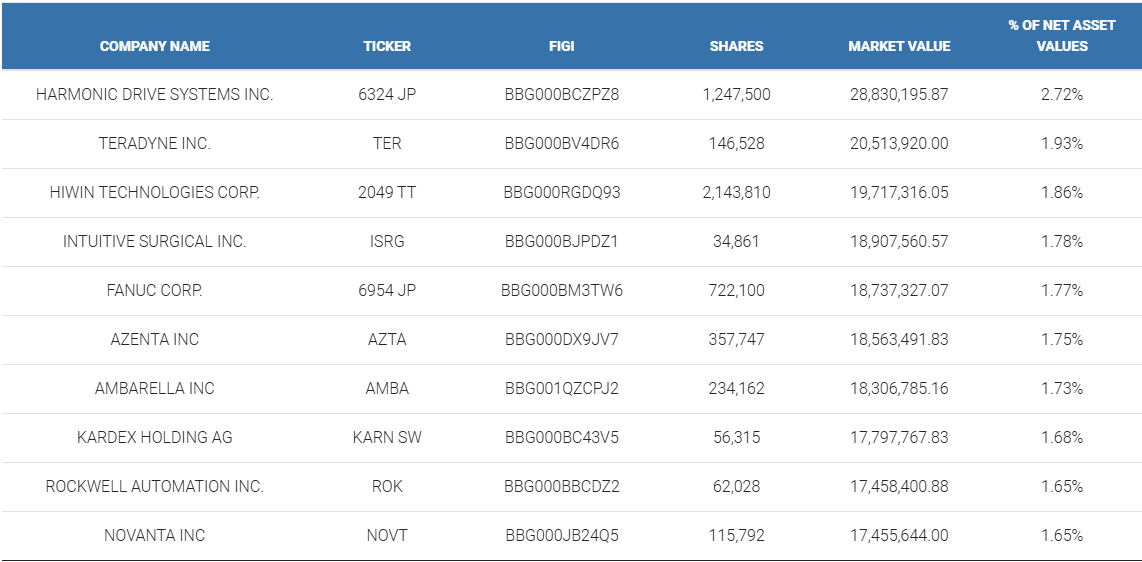

Fund Name (Ticker) | ROBO Global Robotics & Automation ETF (ROBO US) |

Description | Robo Global Robotics & Automation Index ETF is an exchange-traded fund incorporated in the USA. The ETF seeks to track the performance of the ROBO Global Robotics and Automation Index. The ETF weights the holdings using a multi factor methodology that primarily holds US based information technology and industrial companies. |

Asset Class | Equity |

30-Day Average Volume (as of 07 Jan) | 67,039 |

Net Assets of Fund (as of 06 Jan) | $1,060,609,858 |

12-Month Yield | 0.5384% |

P/E Ratio (as of 07 Jan) | 81.806 |

P/B Ratio (as of 07 Jan) | 2.503 |

Expense Ratio (Annual) | 0.95% |

Top 10 Holdings

(as of 06 January 2025)

(Source: Bloomberg)