6 February 2025: Investment Product Ideas

Navigating Economic Uncertainties

The potential imposition of tariffs by President Donald Trump on major trading partners like Mexico and Canada alongside the tariffs currently imposed on China has significant implications for the US bond market. The US bond market is signaling concerns about the dual risks of higher inflation and slower economic growth due to ongoing trade tensions. This has led to a flattening yield curve, rising inflation expectations, and increased stagflation risks. The Federal Reserve is likely to maintain a cautious stance, with the possibility of rate hikes if inflation accelerates. Meanwhile, investors are flocking to safe-haven assets, including long-dated bonds, as uncertainty over trade policy persists.

- Yield Curve Flattening

- Short-term yields rose due to expectations that tariffs could fuel inflation by raising import prices. This would likely keep the Federal Reserve from cutting interest rates, as higher inflation typically prompts tighter monetary policy.

- Long-term yields fell as investors are worried about ongoing trade friction which could slow economic growth, leading to a flattening of the yield curve (the gap between short- and long-term yields narrowed).

- Short-term yields rose due to expectations that tariffs could fuel inflation by raising import prices. This would likely keep the Federal Reserve from cutting interest rates, as higher inflation typically prompts tighter monetary policy.

- Inflation Expectations

- Tariffs could lead to higher import prices, which may rekindle inflationary pressures. This has been a concern since Trump’s election, and the Fed has paused its monetary easing in response. Markets are now pricing in the possibility that the Fed will hold rates steady or even hike them later in the year to combat inflation.

- Long-term inflation expectations could rise, particularly if tariffs are applied to essential goods like gasoline and food.

- Tariffs could lead to higher import prices, which may rekindle inflationary pressures. This has been a concern since Trump’s election, and the Fed has paused its monetary easing in response. Markets are now pricing in the possibility that the Fed will hold rates steady or even hike them later in the year to combat inflation.

- Fed Policy Outlook

- The Federal Reserve is likely to keep interest rates on hold in the near term as it assesses whether inflation or growth risks are more pressing. However, if inflation pressures intensify, the Fed may consider rate hikes later in the year, even if economic growth weakens.

- The Federal Reserve is likely to keep interest rates on hold in the near term as it assesses whether inflation or growth risks are more pressing. However, if inflation pressures intensify, the Fed may consider rate hikes later in the year, even if economic growth weakens.

- Market Sentiment and Safe-Haven Flows

- The uncertainty surrounding tariffs and their economic impact has led to a flight to safety, benefiting long-dated bonds, which typically perform well when growth prospects deteriorate.

- The uncertainty surrounding tariffs and their economic impact has led to a flight to safety, benefiting long-dated bonds, which typically perform well when growth prospects deteriorate.

iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD US)

Fund Highlights:

- Exposure to a broad range of U.S. investment grade corporate bonds

- Access to 1000+ high quality corporate bonds in a single fund

- Use to seek stability and pursue income

Fund Name (Ticker) | iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD US) |

Description | The iShares iBoxx $ Investment Grade Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, investment grade corporate bonds. |

Asset Class | Fixed Income |

30-Day Average Volume (as of 03 Feb) | 22,893,485 |

Net Assets of Fund (as 04 Feb) | $30,606,527,479 |

12-Month Yield (as of 03 Feb) | 4.43% |

Average Yield to Maturity (as of 03 Feb) | 5.42% |

Effective Duration (as of 03 Feb) | 8.13 yrs |

Expense Ratio (Annual) | 0.14% |

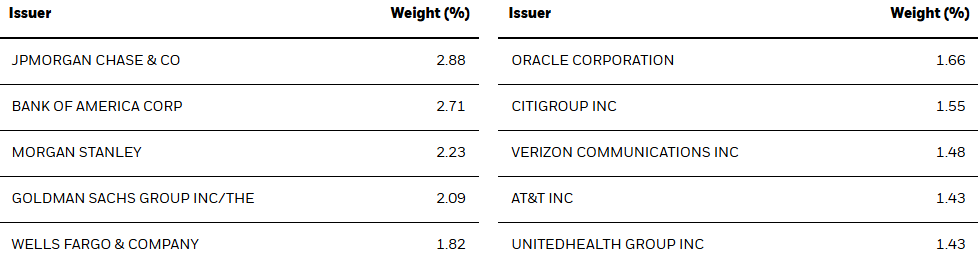

Top Holdings

(as of 03 February 2025)

(Source: Bloomberg)

VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC US)

Navigating the WTF Risks: War, Tariffs, and Fed’s Impact

- Emerging markets debt outperformed developed markets yet again in 2024. In 2025, war, tariffs, and Fed risks are top of mind to start the year.

- While we await U.S. policy clarity, China appears to be steadily moving toward increased spending, perhaps aggressively in the event of harsher U.S. tariffs.

Fund Highlights

- Seeks to replicate the J.P. Morgan GBI-EM Global Core Index

- Access to local bond markets in emerging economies

- Higher yields versus developed markets, with potential for currency appreciation

Fund Name (Ticker) | VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC US) |

Description | The VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the J.P. Morgan GBI-EM Global Core Index (GBIEMCOR), which is comprised of bonds issued by emerging market governments and denominated in the local currency of the issuer. |

Asset Class | Equity |

30-Day Average Volume (as of 04 Feb) | 1811910 |

Net Assets of Fund (as of 04 Feb) | $2,631,011,900 |

12-Month Yield (as of 04 Feb) | 6.39% |

Average Yield to Maturity (as of 04 Feb) | 7.15% |

Effective Duration (as of 04 Feb) | 5.10years |

Expense Ratio (Annual) | 0.30% |

Top 10 Holdings

(as of 03 February 2025)

(Source: Bloomberg)