5 December 2024: Wealth Product Ideas

The Preferred Position: Capturing Yield & Stability in 2025

1. The Preferred Advantage: Current Market Sweet Spot

Market Leadership

- Record performance in 2024: 23% surge in Preferred Securities Index

- Outperformance driven by dual catalysts: falling rates and strong credit fundamentals

- Strategic positioning between fixed income and equities providing unique advantages

- Higher yields versus traditional investment-grade bonds (avg. 150-200bps premium)

- Priority claim on dividends and assets versus common equity

2. Macro Tailwinds Creating Sustained Opportunity

Rate Environment

- Fed pivot creating supportive backdrop (rates declined from 4.98% to 3.63%)

- Inflation moderation (CPI at 2.4%) supporting monetary easing trajectory

- Rate sensitivity becoming a positive driver of returns

- $2.8B institutional flows validating strategic timing

- Duration exposure offering potential capital appreciation

3. Strong Credit Fundamentals Underpinning Security

Credit & Quality Metrics

- Corporate balance sheets at historic strength levels

- High-yield spreads at 2.80, tightest since 2007

- Default rates down 47% to $15.7B from peak

- Bank stress tests confirming robust capital positions

- Investment-grade focus providing defensive characteristics

Fund Name (Ticker) |

|

Description |

|

Asset Class | Fixed income |

30-Day Average Volume (as of 3 Dec) | 753,698 |

Net Assets of Fund (as of 3 Dec) | $2,447,932,900 |

12-Month Yield (as of 3 Dec) | 6.34% |

P/E Ratio | N/A |

P/B Ratio | N/A |

Expense Ratio (Annual) | 0.23% |

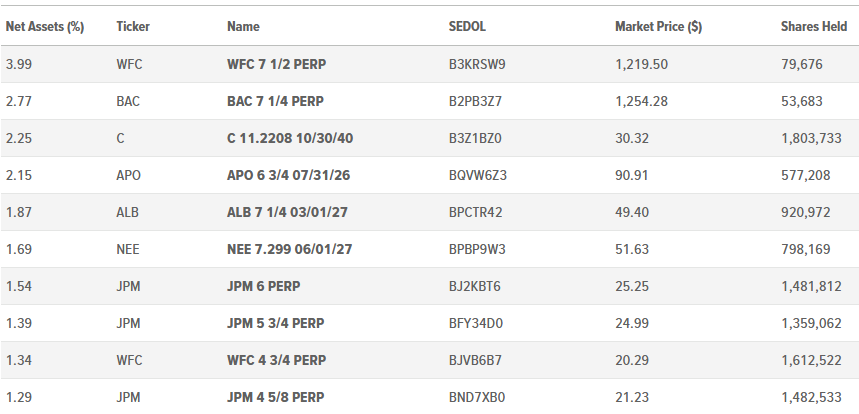

Top 10 Holdings

(as of 3 December 2024)

(Source: Bloomberg)

Fund Name (Ticker) |

|

Description |

|

Asset Class | Equity |

30-Day Average Volume (as of 2 Dec) | 4,330,263 |

Net Assets of Fund (as of 3 Dec) | $15,175,633,552 |

12-Month Yield (as of 31 Oct) | 6.16% |

P/E Ratio (as of 2 Dec) | 16.49 |

P/B Ratio (as of 2 Dec) | 1.49 |

Expense Ratio (Annual) | 0.46% |

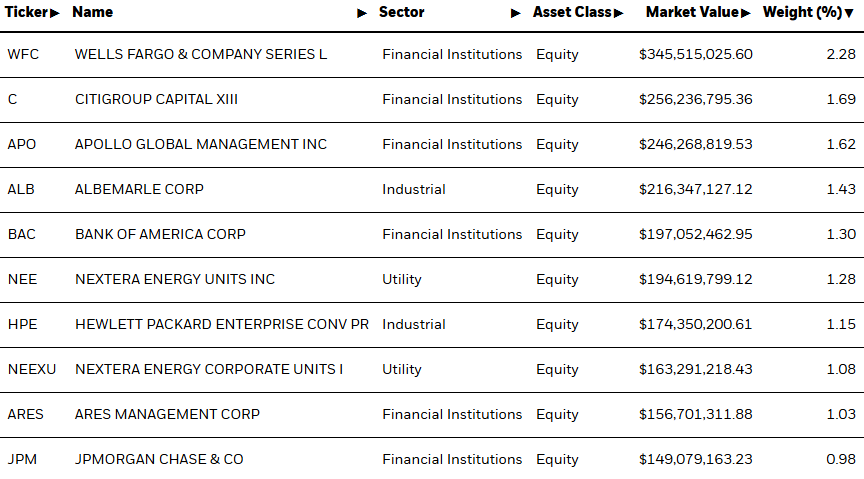

Top Holdings

(as of 2 December 2024)

(Source: Bloomberg)