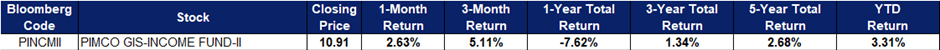

31 January 2023: Wealth Product Ideas

| Fund Name (Ticker) | PIMCO GIS Income Fund (IE00B8JDQ960) |

| Description | PIMCO GIS Income Fund is a portfolio that is actively managed and utilizes a broad range of fixed-income securities that seek to produce an attractive level of income while maintaining a relatively low-risk profile with a secondary goal of capital appreciation. Since its inception, the Fund has had a stellar track record and is rated four stars by Morningstar. The Fund pays 5% p.a. dividend yield currently (monthly payout). |

| Asset Class | Fixed Income |

| Inception Date | 30/11/2012 |

| 30-Day Average Volume | N.A. |

| Net Assets of Fund (as of 31 Dec) | US$58.0B |

| 12-Month Trailing Yield | 5.01% |

| P/E Ratio | N.A |

| P/B Ratio | N.A. |

| Management Fees | 0.55% |

Top 10 Holdings

Investment Thesis

1. Attractive yields:

- The significant sell-off in bond yields and widening of spreads provide access to attractive yields that we haven’t seen in many years, driving higher return potential for today’s investors.

- The PIMCO GIS Income Fund has a YTM of 7.37% (as of end-Dec 2022), which provides an additional buffer against further increases in rates or spreads.

- Even if the Fed lowers interest rates in due course, investors can benefit from the potential price appreciation within the portfolio (bond prices and yields move in the opposite direction).

2. Attractive risk-reward proposition:

- The PIMCO GIS Income Fund offers a compelling proposition of yield and quality.

- With a credit rating of single A+, the PIMCO Income Fund is higher in quality than the IG or HY index, while providing an attractive yield of 7.37%. This means that investors do not have to take on additional risk for yield.

- Following past periods of peak yields, the fund has also had strong returns 1,3,5 years after. As a result, now is an attractive point for new clients to invest to lock in yields or existing clients to average down their cost.

3. Diversification across various sectors: High quality and balanced portfolio that can be resilient in different market environments

- The PIMCO GIS Income Fund is a highly diversified fund investing across the entire fixed income markets.

- As we approach the later stage of the economic cycle, being up in quality and diversified is crucial to protect against a market selloff or risk-off environment.

- As a result of being diversified, the fund is able to source its yield from various sources and not rely on any single sector for yield/income.

- BUY Entry –9.50 Target – 10.90 Stop Loss – 8.80

- Major Crypto Rebounded

- BTC is on the charge in 2023, clocking a gain of 26% in January 2023.

- The biggest cryptocurrency has recently recovered all its losses since the collapse of FTX, breaking back above the $20,000 level and putting it on course for its best month since October 2021.

- Bitcoin’s network fundamentals also give investors a cause for optimism with greater mining difficulty on the network.

- Investors are turning towards risk mode towards cryptocurrencies.

Source: Bloomberg