31 August 2023: Wealth Product Ideas

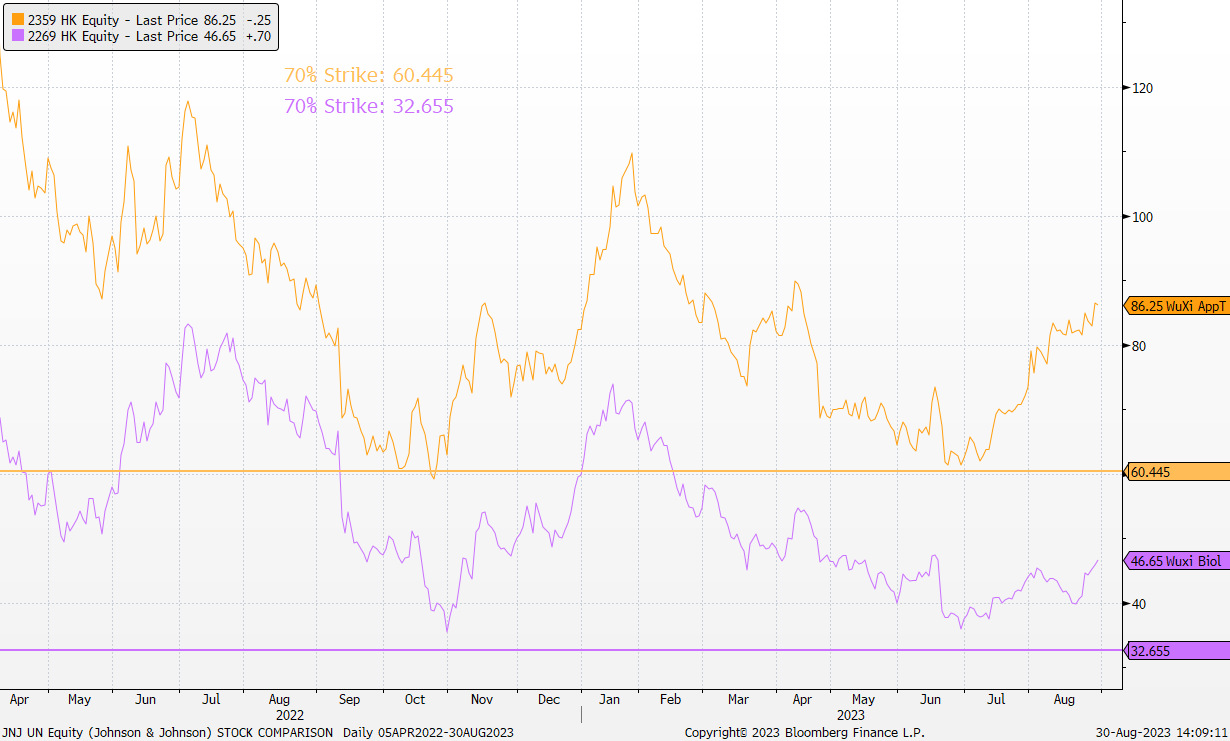

FCN Theme 1 – Chinese CRO

- The Chinese Contract Research Organization (CRO) sector is showing signs of recovery in China’s healthcare industry after a two-year correction.

- The defensiveness of the sector is attributed to China’s domestic policy headwinds, such as anti-corruption measures.

- Leading players in the CRO sector are expected to experience a rebound in overseas R&D outsourcing demand within the next year.

- The sector offers attractive valuations, with negative factors already reflected in the pricing.

- WuXi AppTec (2359 HK) is identified as the top pick in the Chinese CRO space, with a positive outlook for overseas business-focused players like WuXi Bio (2269 HK).

- WuXi AppTec is favored due to its defensiveness in the China healthcare sector, unaffected by healthcare anti-corruption measures.

- The company has an attractive valuation with a favorable price-to-earnings ratio (PE) and potential earnings growth of over 20% year-over-year.

- WuXi AppTec has secured a significant order for the commercial manufacture of a blockbuster drug and stands to benefit from a potential global biotech funding recovery in the next 12 months.

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

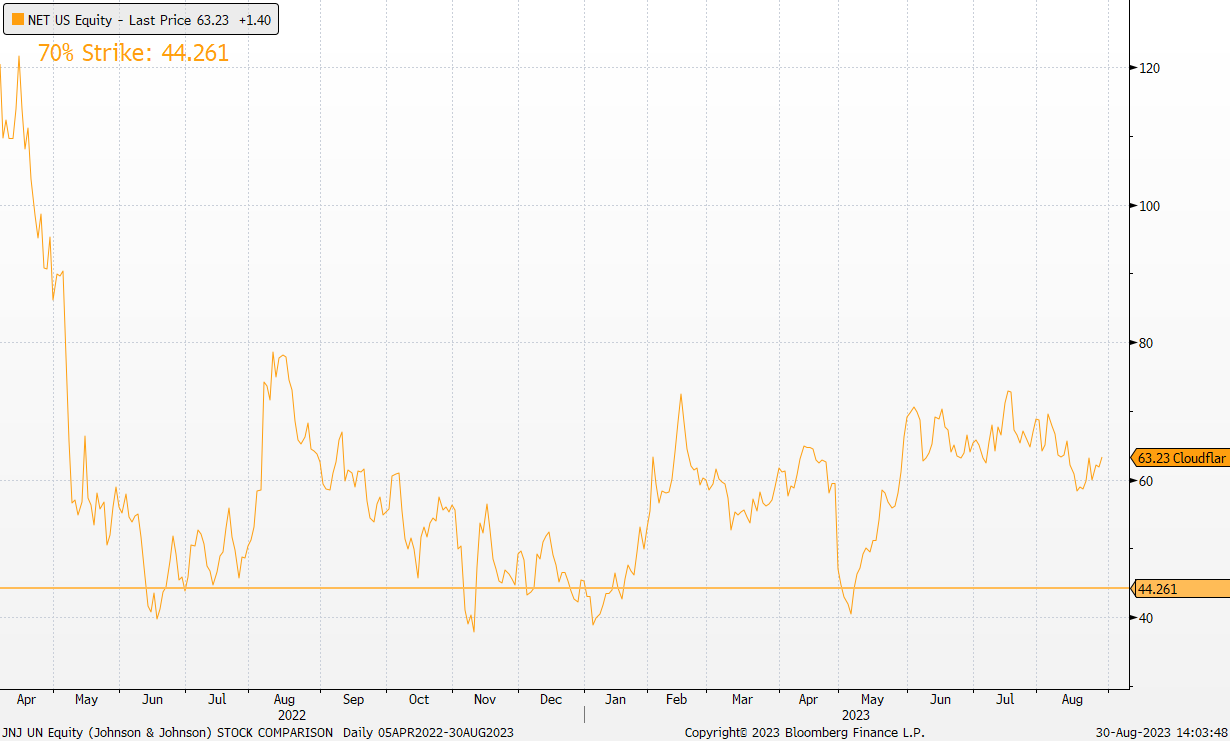

FCN Theme 2 – Cloudflare

- Cloudflare (NET UN) presents investment potential despite volatile sentiment in a challenging macro environment.

- Management is addressing past execution issues and reporting strong improvements in sales cycles, instilling confidence in future growth.

- The stock’s current valuation suggests it is pricing in expected acceleration in growth.

- NET delivered solid 32% year-over-year revenue growth, slightly surpassing guidance, indicating positive performance.

- Despite a deceleration in growth compared to previous years, NET achieved robust customer growth, overcoming challenges in customer acquisition.

- Management’s guidance for up to 30% year-over-year growth in the third quarter and increased revenue expectations for the full year highlight positive growth prospects.

- The company’s attractive positioning as a leading vendor in the mission-critical space of enabling a faster internet allows for continuous expansion and increased market potential.

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

Payout Scenarios:

Investors receive corresponding interest payments every month and;

- KO Early Redemption: Principal + KO returns (KO event occurs only when the closing price of all underlying securities is higher than the knock-out price)

-

Maturity Redemption: If no KO event occurs, the payout will be:

- If the final price of all underlying is higher than or equal to the strike price, investors will receive 100% cash return on their principal, along with the final interest.

- If the final price of one or more underlying is lower than the strike price, investors will receive 100% of their principal in the form of shares of the worst-performing stock and will also receive the final interest.

(Source: Bloomberg)

(Source: Bloomberg)