3 July 2025: Investment Product Ideas

ETF ┃ 3 July 2025

Global X Uranium ETF (URA)

- Focused Exposure to Uranium and Nuclear Energy Sector. The tracked index concentrates on global companies involved in the uranium and nuclear energy value chain, including uranium mining, exploration, investment, and nuclear equipment and technology. This ETF is suitable for investors with a constructive outlook on the future of nuclear energy.

- Concentrated Holdings. This ETF is heavily weighted toward North America, with Canadian companies accounting for 40% of the portfolio. It holds approximately 48 stocks in total Cameco is the largest holding, with a weighting of about 23% while the top 10 holdings represent more than 66% of the portfolio.

- Energy Demand. With global energy demand on the rise, nuclear energy is gaining prominence as an efficient and low carbon alternative. As a result, uranium’s role is becoming increasingly critical. Uranium mining and production are expected to hold a strategic position in the future energy landscape.

|

Fund Name (Ticker) |

Global X Uranium ETF (URA) |

|

Description |

The Global X Uranium ETF (URA) provides investors access to a broad range of companies involved in uranium mining and the production of nuclear components, including those in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 1 July) |

4,261,670 |

|

Net Assets of Fund (as of 1 July) |

$3.75 billion |

|

12-Month Yield (as of 1 July) |

1.981% |

|

P/E Ratio (as of 1 July) |

48.60x |

|

P/B Ratio (as of 1 July) |

2.90x |

|

Expense Ratio (Annual) |

0.69% |

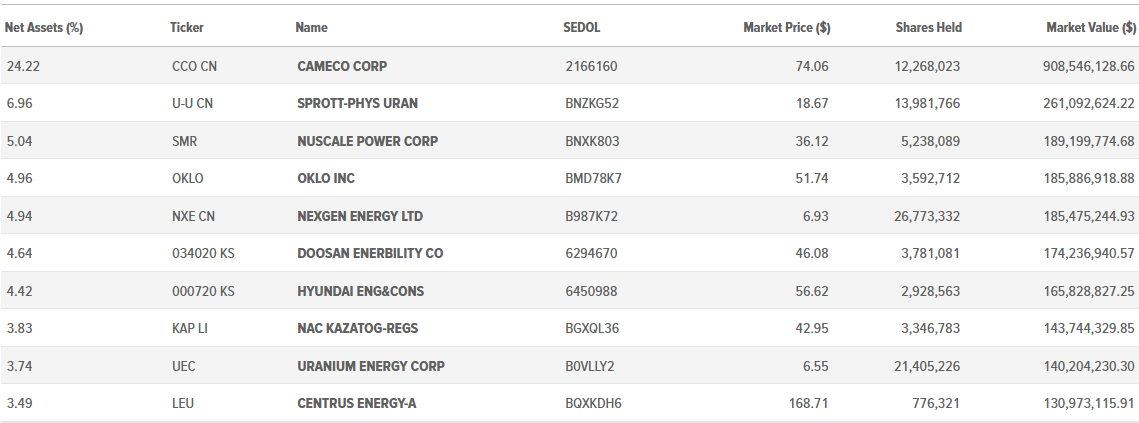

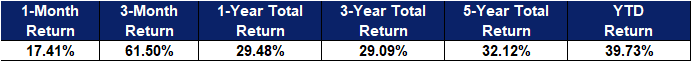

Top Holdings

(as of 1 July 2025)

(Source: Bloomberg)

Sprott Uranium Miners ETF (URNM)

- Focused Exposure to Uranium and Nuclear Energy Sector. The tracked index concentrates on global companies involved in the uranium and nuclear energy value chain, including uranium mining, exploration, investment, and nuclear equipment and technology. This ETF is suitable for investors with a constructive outlook on the future of nuclear energy.

- Concentrated Holdings. This ETF is heavily weighted toward North America, with Canadian companies accounting for 45% of the portfolio. It holds approximately 35 stocks in total Cameco is the largest holding, with a weighting of about 17% while the top 10 holdings represent more than 75% of the portfolio.

- Energy Demand. With global energy demand on the rise, nuclear energy is gaining prominence as an efficient and low carbon alternative. As a result, uranium’s role is becoming increasingly critical. Uranium mining and production are expected to hold a strategic position in the future energy landscape.

|

Fund Name (Ticker) |

Sprott Uranium Miners ETF (URNM) |

|

Description |

Sprott Uranium Miners ETF (NYSE Arca: URNM) seeks to invest at least 80% of its total assets in securities of the North Shore Global Uranium Mining Index (URNMX). The Index is designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development and production of uranium, or holding physical uranium, owning uranium royalties or engaging in other non-mining activities that support the uranium mining industry. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 1 July) |

826,311 |

|

Net Assets of Fund (as of 1 July) |

$1,725,597,057.23 |

|

12-Month Yield (as of 1 July) |

2.734% |

|

P/E Ratio |

N/A |

|

P/B Ratio (as of 1 July) |

3.239x |

|

Expense Ratio (Annual) |

0.75% |

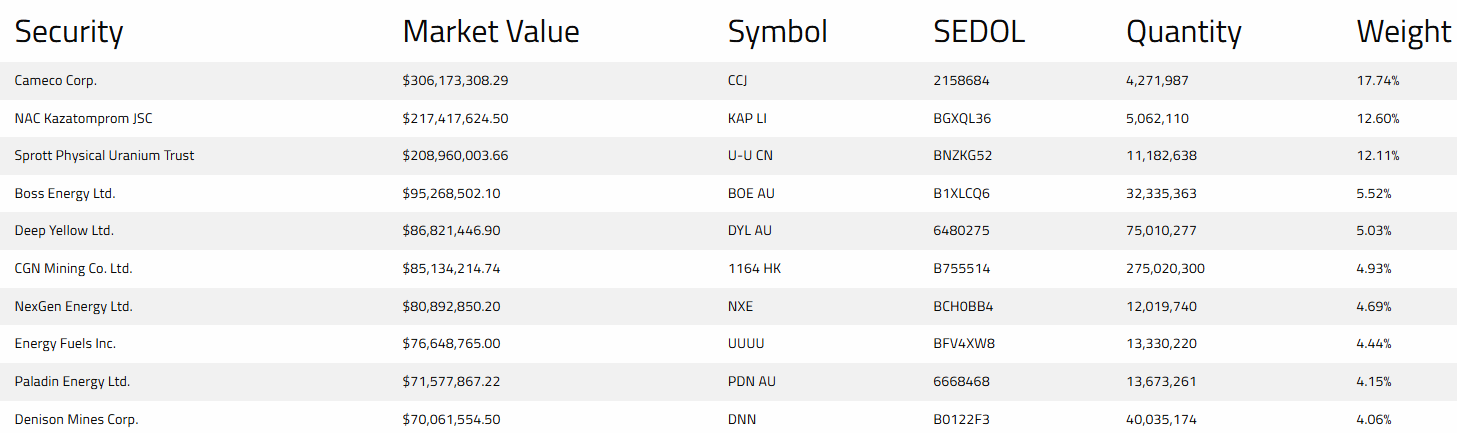

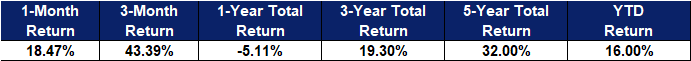

Top Holdings

(as of 1 July 2025)

(Source: Bloomberg)