29 August 2024: Wealth Product Ideas

Investment Opportunity for Aerospace and Defense

Theme Overview:

- These ETFs focus on companies involved in the production, research, and development of defense equipment, aircraft, and related technologies.

- The theme is driven by global geopolitical tensions and increased defense spending worldwide.

Key Drivers:

a) Ongoing Conflicts:

- The Russia-Ukraine war continues with no end in sight.

- The Israel-Hamas conflict has been ongoing for over a year.

- Tensions between Israel and Iran are escalating, with potential for direct confrontation.

b) Increased Defense Spending:

- Russia’s defense spending is projected to grow by 29% in 2024, reaching $140 billion.

- Ukraine’s defense spending grew by 51% in 2023, reaching $64.8 billion.

- Many NATO countries are increasing their defense budgets to meet the 2% of GDP target.

c) Technological Advancements:

- Increased focus on cybersecurity, AI in defense, and advanced weapon systems.

- Growing demand for space-based defense capabilities.

Potential Risks:

- Peace negotiations or de-escalation of conflicts could reduce defense spending.

- Budget constraints in some countries might limit defense expenditure growth.

Fund Name (Ticker) | Invesco Aerospace & Defense ETF (PPA US) |

Description | The Invesco Aerospace & Defense ETF (Fund) is based on the SPADE™ Defense Index (Index). The Fund will normally invest at least 90% of its total assets in common stocks that comprise the Index. The Index is designed to identify a group of companies involved in the development, manufacturing, operations and support of US defense, homeland security and aerospace operations. The Fund and the Index are rebalanced and reconstituted quarterly. |

Asset Class | Equity |

30-Day Average Volume (as of 27 Aug) | 157,987 |

Net Assets of Fund (as of 27 Aug) | $3,753,200,000 |

12-Month Yield (as of 27 Aug) | 0.57% |

P/E Ratio (as of 30 Jun) | 28.03 |

P/B Ratio (as of 30 Jun) | 4.64 |

Expense Ratio (Annual) | 0.58% |

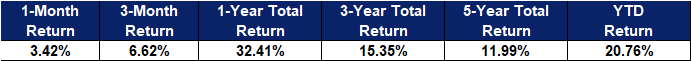

Top 10 Holdings

(as of 26 August 2024)

(Source: Bloomberg)

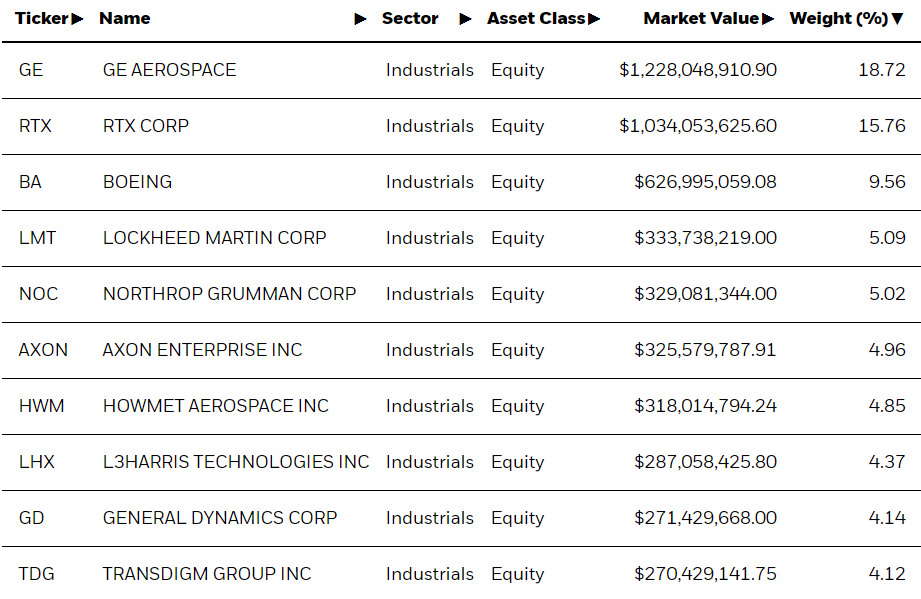

(Source: Bloomberg)

Fund Name (Ticker) | iShares U.S. Aerospace & Defense ETF (ITA US) |

Description | The iShares U.S. Aerospace & Defense ETF seeks to track the investment results of an index composed of U.S. equities in the aerospace and defense sector. |

Asset Class | Equity |

30-Day Average Volume (as of 26 Aug) | 335,909 |

Net Assets of Fund (as of 27 Aug) | $6,576,270,889 |

12-Month Yield (as of 31 Jul) | 0.8445% |

P/E Ratio (as of 26 Aug) | 32.44 |

P/B Ratio (as of 26 Aug) | 4.37 |

Management Fees (Annual) | 0.40% |

Top 10 Holdings

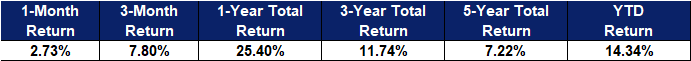

(as of 26 August 2024)

(Source: Bloomberg)