28 March 2024: Wealth Product Ideas

Thematic Idea: Semiconductor Supercycle

Market Backdrop:

- Industry faced downturn in 2022-23, but poised for strong rebound

- Fueled by secular demand drivers across verticals

Key Bullish Drivers:

- Surging AI/ML chip demand across industries

- 5G infrastructure buildout

- Automotive/mobility semi needs (ADAS, autonomy)

- Proliferation of IoT devices

- Cloud data center expansions

Improving Supply/Demand:

- Chipmakers adding capacity to meet pent-up demand

- Supply constraints easing as new capacity comes online

Innovation Catalysts:

- Advancements in chip architectures and transistor density

- Specialized chips for AI, crypto, gaming, data centers

- Emerging computing like neuromorphic

Reasonable Valuations:

- Semi stocks at attractive forward multiples

- Bullish catalysts not fully priced in

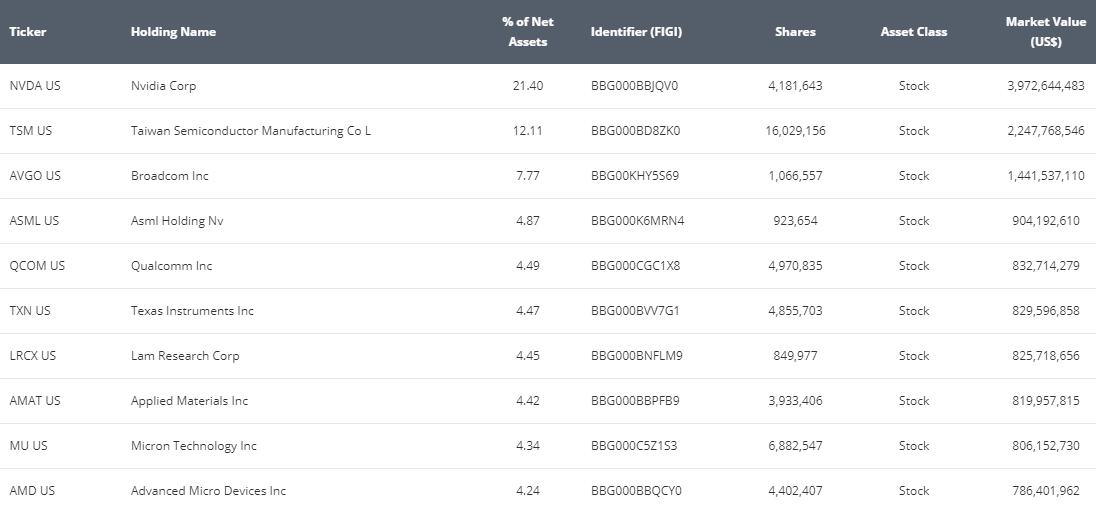

Fund Name (Ticker) | VanEck Semiconductor ETF (SMH US) |

Description | VanEck Semiconductor ETF (SMH®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Semiconductor 25 Index (MVSMHTR), which is intended to track the overall performance of companies involved in semiconductor production and equipment. |

Asset Class | Equity |

30-Day Average Volume (as of 26 Mar) | 9,606,521 |

Net Assets of Fund (as of 26 Mar) | USD18,380,000,000 |

12-Month Yield | NA |

P/E Ratio (as of 26 Mar) | 51.192 |

P/B Ratio (as of 26 Mar) | 7.159 |

Management Fees (Annual) | 0.35% |

Top 10 Holdings

(as of 25 March 2024)

(Source: Bloomberg)

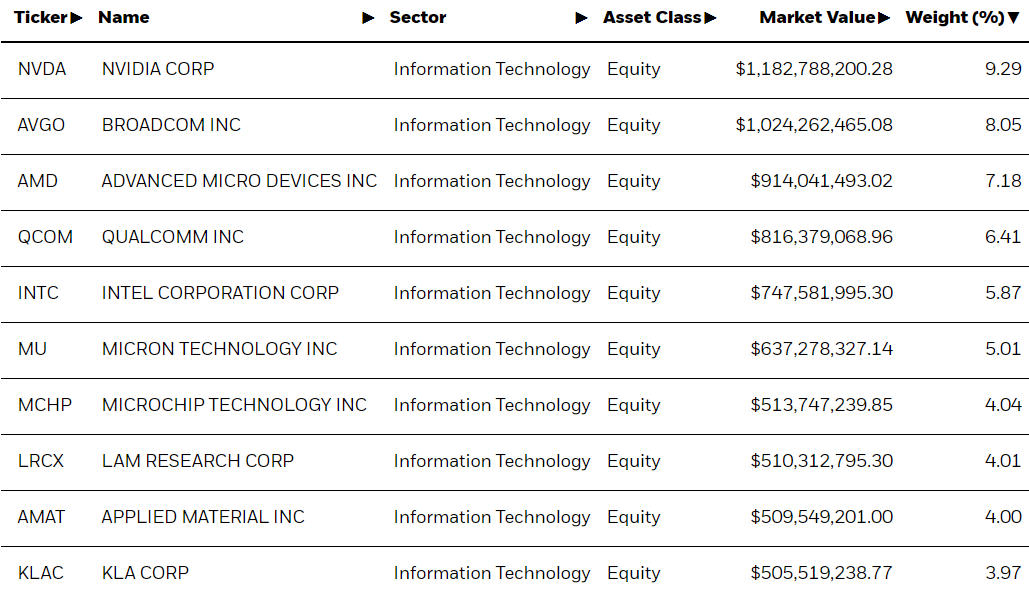

Fund Name (Ticker) | iShares Semiconductor ETF (SOXX US) |

Description | The iShares Semiconductor ETF seeks to track the investment results of an index composed of U.S.-listed equities in the semiconductor sector. |

Asset Class | Equity |

30-Day Average Volume (as of 26 Mar) | 3,297,316 |

Net Assets of Fund (as of 26 Mar) | US$12,638,636,843 |

12-Month Trailing Yield (as of 29 Feb) | 0.69 |

P/E Ratio (as of 25 Mar) | 33.59 |

P/B Ratio (as of 25 Mar) | 5.61 |

Management Fees (Annual) | 0.35% |

Top 10 Holdings

(as of 25 March 2024)

(Source: Bloomberg)