26 December 2024: Wealth Product Ideas

- Focus on the domestic market of the United States. In the “return to America” trend, many companies continue to bring their manufacturing back to the United States for higher product quality, shorter delivery times, lower inventories, advanced technology, pro-business policies, and The potential advantage of being more responsive to changes in customer needs.

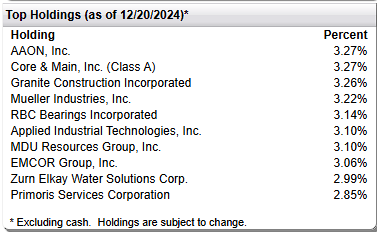

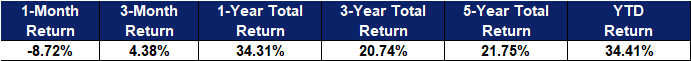

- Morningstar 5-star rating. This ETF has a 5-star rating from Morningstar. It mainly invests in small and medium-sized enterprises in industry and finance, avoiding companies unrelated to manufacturing and infrastructure. Companies that meet the investment criteria must have more than 75% of their revenue coming from the United States and 12-month profits. Expected to be positive.

- Concentrated shareholdings. The tracking index generally holds 30-60 stocks, but the proportion of each stock is relatively balanced. Each component stock accounts for at least 0.5% and the maximum does not exceed 4%.

Fund Name (Ticker) | First Trust RBA American Industrial Renaissance ETF (AIRR US) |

Description | The Richard Bernstein Advisors American Industrial Renaissance® Index is designed to measure the performance of small and mid-cap U.S. companies in the industrial and community banking sectors. |

Asset Class | Equity |

30-Day Average Volume (as of 23 Dec) | 628,393 |

Net Assets of Fund (as of 23 Dec) | $2.89bn |

12-Month Yield | 0.181% |

P/E Ratio (as of 23 Dec) | 23.5 |

P/B Ratio (as of 23 Dec) | 2.79 |

Expense Ratio (Annual) | 0.70% |

Top Holdings

(as of 20 December 2024)

(Source: Bloomberg)

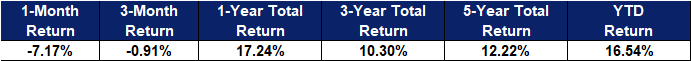

- Low expense ratio. The ETF expense ratio is 0.1%, which is cost-effective and helps investors reduce investment costs.

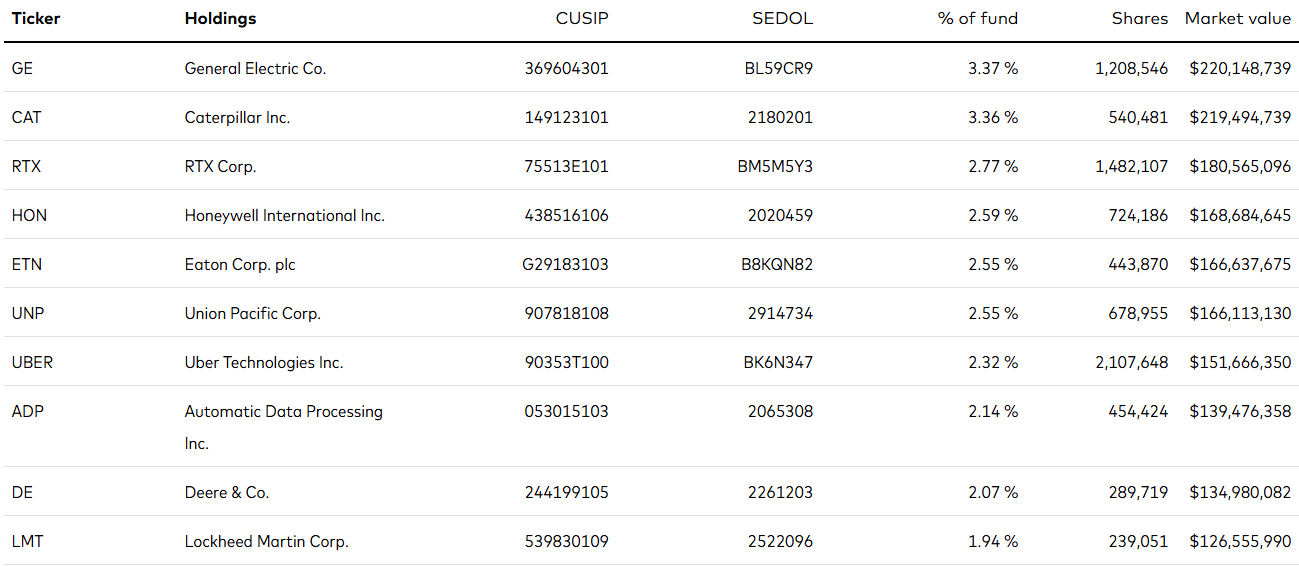

- Diversified investment strategies. This ETF tracks the MSCI US Investable Market Industrials 25/50 Index, which covers multiple sub-sectors of the industrial sector. It invests in large, medium and small companies in the US industrial industry. The investment is relatively diversified, reducing the risk of a single company. The ETF holds The number of shares is 399, with the top ten holding approximately 25.66%

- Covers related industries in the industrial field. It mainly invests in industries related to the US industrial field, including aerospace/defense, transportation, business services and machine tool manufacturers. It is suitable for investors who want to invest in specific areas but do not want to directly select a single stock.

Fund Name (Ticker) | Vanguard Industrials ETF (VIS US) |

Description | The fund seeks to track the performance of a benchmark index that measures the investment return of stocks in the industrials sector. |

Asset Class | Equity |

30-Day Average Volume (as of 23 Dec) | 80,705 |

Net Assets of Fund (as of 23 Dec) | $5.65bn |

12-Month Yield | 1.216% |

P/E Ratio (as of 23 Dec) | 32.1 |

P/B Ratio (as of 23 Dec) | 5.85 |

Expense Ratio (Annual) | 0.10% |

Top 10 Holdings

(as of 30 November 2024)

(Source: Bloomberg)