22 May 2025: Investment Product Ideas

iShares MSCI United Kingdom ETF (EWU US)

- Broad Exposure to the UK Market. The underlying index focuses on the largest market-cap companies listed on the London Stock Exchange, enabling the ETF to offer broad exposure to the UK equity market.

- Global Operating Perspective. Comprising companies across multiple sectors, this ETF includes many globally recognized firms such as HSBC Holdings, AstraZeneca, and Shell, each with significant business operations and influence in global markets.

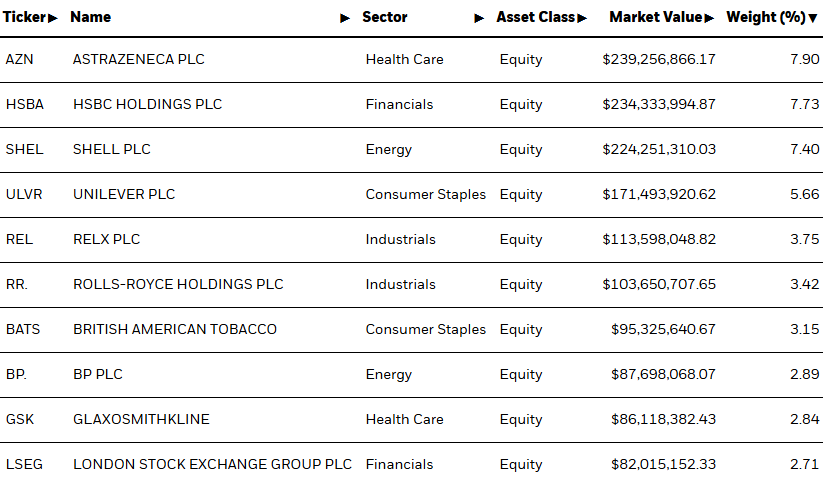

- Focus on Mid- and Large-Cap Stocks. The portfolio holds around 74 stocks, spanning key sectors such as Financials, Energy, and Consumer-related industries. The top 10 holdings account for approximately 47% of total assets, making it suitable for investors seeking exposure to leading companies across various sectors of the UK economy.

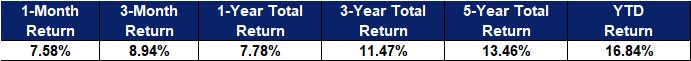

Fund Name (Ticker) | iShares MSCI United Kingdom ETF (EWU US) |

Description | The iShares MSCI United Kingdom ETF seeks to track the investment results of an index composed of U.K. equities. |

Asset Class | Equity |

30-Day Average Volume (as of 19 May) | 1,766,546 |

Net Assets of Fund (as of 20 May) | $3,062,543,280 |

12-Month Yield (as of 30 Apr) | 3.68% |

P/E Ratio (as of 19 May) | 17.23x |

P/B Ratio (as of 19 May) | 1.90x |

Expense Ratio (Annual) | 0.50% |

Top Holdings

(as of 19 May 2025)

(Source: Bloomberg)

IShares Core FTSE 100 ETF (CUKX.LN)

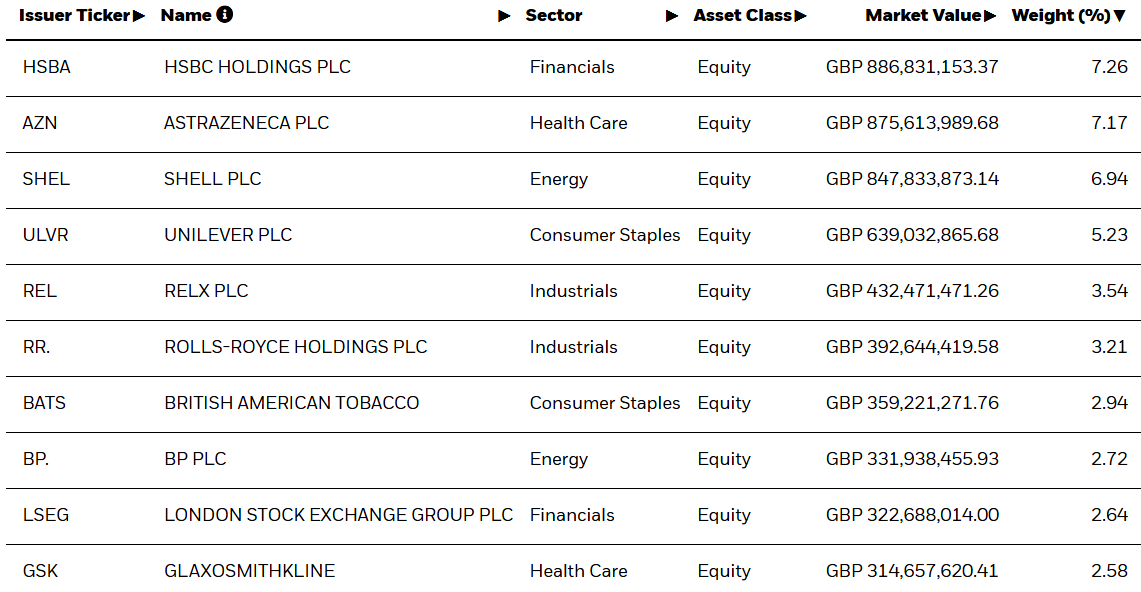

- Targeting the UK’s 100 Largest Listed Companies. The underlying index primarily covers the 100 largest companies by market capitalization listed on the London Stock Exchange. These holdings are typically financially sound, stable blue-chip stocks, allowing the ETF to provide broad exposure to major UK corporates and reflect the overall performance of the UK equity market.

- Automatic Dividend Reinvestment. This is an accumulating ETF, with dividends automatically reinvested, making it well-suited for long-term investors.

- Low Expense Ratio. With an expense ratio of 0.07%, this ETF ranks among the lowest in its category. A low fee structure helps investors reduce long-term costs, thereby enhancing net returns over time.

Fund Name (Ticker) | iShares Core FTSE 100 ETF (CUKX LN) |

Description | The Fund seeks to track the performance of an index composed of the 100 largest UK companies. |

Asset Class | Equity |

30-Day Average Volume (as of 20 May) | 30545 |

Net Assets of Fund (as of 20 May) | GBP 12,330,240,384 |

12-Month Yield (as of 19 May) | 3.44% |

P/E Ratio (as of 19 May) | 16.99x |

P/B Ratio (as of 19 May) | 1.91x |

Expense Ratio (Annual) | 0.07% |

Top Holdings

(as of 19 May 2025)

(Source: Bloomberg)