22 February 2024: Wealth Product Ideas

Anticipated Interest Rate Cuts

- Market projections after the FOMC meeting show a trend toward rate cuts later this year

- For your consideration today, we have two principal-protected structured products available, on the condition that the investor does not redeem early: 1.) Linear Zero Coupon Callable and 2.) Callable Fixed Rate Notes.

- Lock in higher rates for at least 1 year. If not called after 1 year, continue to enjoy higher yields. If called, get back principal for reinvestment.

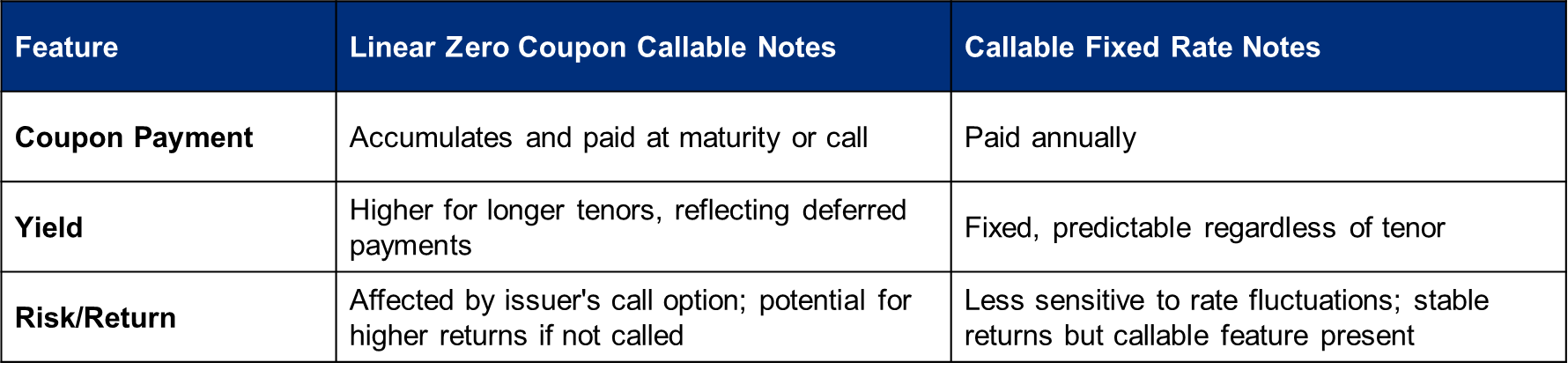

Key Features and Differences:

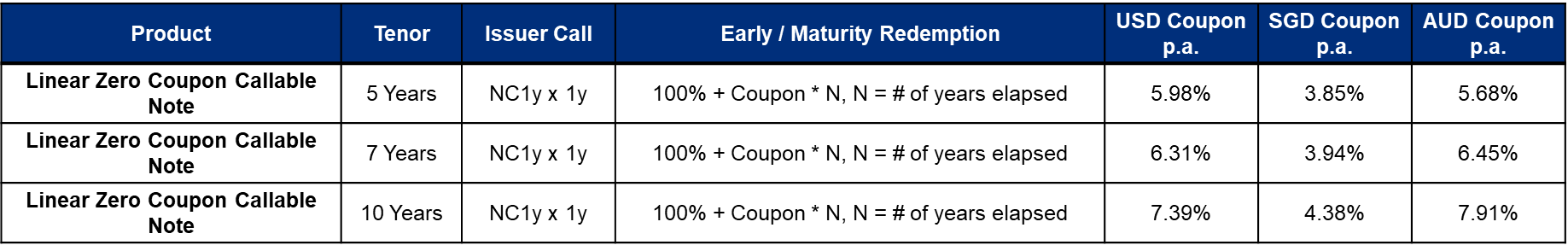

Linear Zero Coupon Callable Quotes

Note: Pricing provided is indicative only. For updated pricing, please contact us directly. Investing in complex structured products carries inherent risks. Ensure you fully understand the terms, conditions, and potential risks before making any investment decisions.

Return Scenarios

Held to Maturity

- Investor receives the full face value (100%) plus accumulated coupon interest for the entire tenor of the note.

- Total return will be the principal plus the coupon rate multiplied by the number of years until maturity.

- The longer the tenor, the greater the total return due to the higher coupon rates for longer durations.

Called Early by Issuer (Post Non-Callable Period)

- Investor receives 100% of the principal plus the accrued coupon interest for the number of years the note was held prior to the call.

- An early call typically benefits the issuer, especially if the interest rates have fallen, allowing them to refinance at a lower rate.

General Considerations

- The non-callable period (NC1y x 1y) ensures that the investor will hold the note for at least one year without the risk of it being called.

- Potential return decreases if the issuer calls the note early, after the non-callable period. Given the callable nature of the notes,

- investors must be prepared for varying return scenarios and should consider their investment horizon and the likelihood of the issuer exercising the call option when evaluating the suitability of these products for their portfolio.

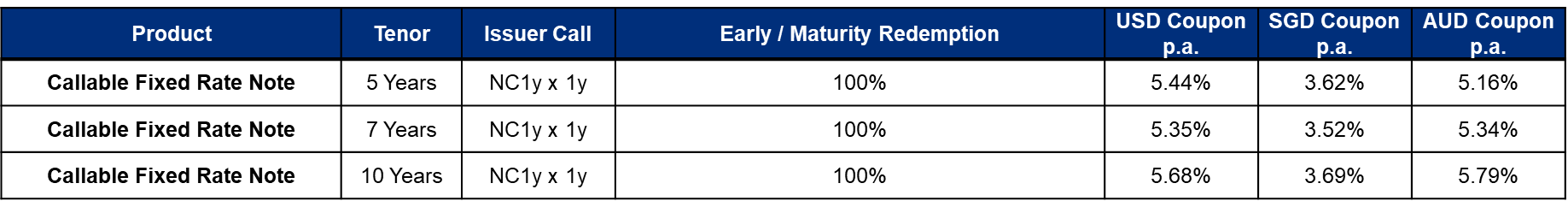

Note: Pricing provided is indicative only. For updated pricing, please contact us directly. Investing in complex structured products carries inherent risks. Ensure you fully understand the terms, conditions, and potential risks before making any investment decisions.

Return Scenarios

Held to Maturity

- Investor receives annual interest payments at the stated coupon rate for the currency and tenor of the note.

- At maturity, the investor receives 100% of the principal back in addition to the final year’s coupon payment.

Called Early by Issuer (Post Non-Callable Period)

- Investor receives 100% of the principal if the note is called by the issuer after the non-callable period.

- All coupon payments that were due annually up to the call date will have been paid.

- An early call may occur if it’s advantageous for the issuer (e.g., if interest rates have declined), and the investor will no longer receive future coupon payments after the call.

General Considerations

- Investors benefit from predictable returns with annual coupon payments, which can provide a steady income stream.

- Non-callable period (NC1y x 1y) offers certainty for at least one year.

- Callable features give the issuer the right, but not the obligation, to redeem the notes early, which may impact the overall yield if the notes are called before maturity. Given the callable nature of the notes, investors must be prepared for varying return scenarios and should consider their investment horizon and the likelihood of the issuer exercising the call option when evaluating the suitability of these products for their portfolio.