22 August 2024: Wealth Product Ideas

Rate cut expectations. The US Federal Reserve decided to keep interest rates unchanged in July, in line with expectations, and it highlighted that a September cut could be on the table if inflation moves down in line with expectations. Policymakers noted that there has been some further progress toward the 2% inflation goal although it remains somewhat elevated. The market also expects a rate cut to occur as early as September due to cooling inflation and a slowdown in the labour market, with a total of 2-3 25-bps rate cuts by the end of 2024. If the sentiment regarding potential rate cuts continues to improve, it could prematurely boost consumer demand and spending in the upcoming months, enabling consumers to allocate more funds to discretionary items like weight loss drugs for self-fulfilment.

Defensive play. The healthcare sector serves as a recession-resistant sector as people continue to seek medical treatment and essential healthcare products amidst economic downturns. Investing in the healthcare sector would provide investors with a hedge against a recession should one occur.

Fund Name (Ticker) | VanEck Pharmaceutical ETF (PPH US) |

Description | VanEck Pharmaceutical ETF (PPH®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Pharmaceutical 25 Index (MVPPHTR), which is intended to track the overall performance of companies involved in pharmaceuticals, including pharmaceutical research and development as well production, marketing and sales of pharmaceuticals. |

Asset Class | Equity |

30-Day Average Volume (as of 20 Aug) | 135,013 |

Net Assets of Fund (as of 20 Aug) | $669,963,500 |

12-Month Yield (as of 20 Aug) | 1.58% |

P/E Ratio (as of 20 Aug) | 122.9 |

P/B Ratio (as of 20 Aug) | 5.435 |

Management Fees (Annual) | 0.36% |

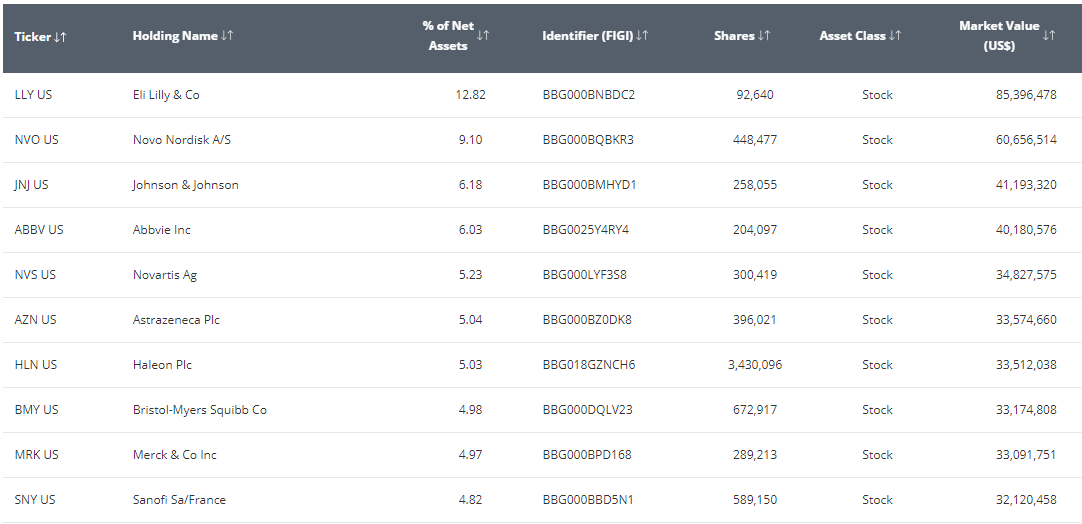

Holdings

(as of 19 August 2024)

(Source: Bloomberg)

Fund Name (Ticker) | iShares U.S. Pharmaceuticals ETF (IHE US) |

Description | The iShares U.S. Pharmaceuticals ETF seeks to track the investment results of an index composed of U.S. equities in the pharmaceuticals sector. |

Asset Class | Equity |

30-Day Average Volume (as of 19 Aug) | 41,880 |

Net Assets of Fund (as of 20 Aug) | $685,617,534 |

12-Month Yield (as of 20 Aug) | 1.41% |

P/E Ratio (as of 19 Aug) | 21.00 |

P/B Ratio (as of 19 Aug) | 3.28 |

Management Fees (Annual) | 0.39% |

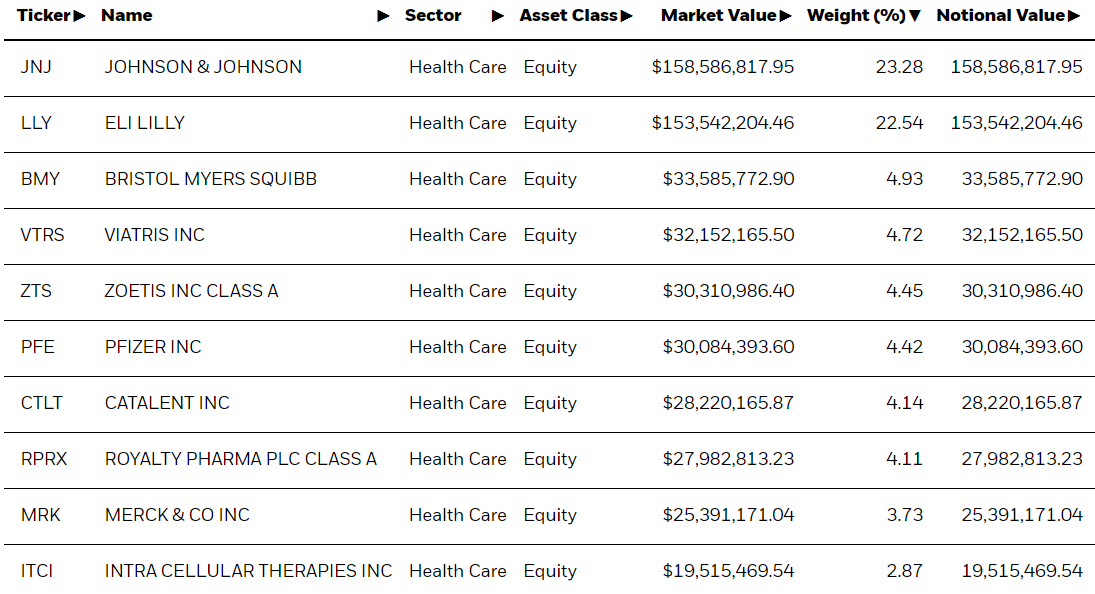

Holdings

(as of 19 August 2024)

(Source: Bloomberg)