19 September 2024: Wealth Product Ideas

Laddering Treasury Exposures Can Help Mitigate Interest Rate and Reinvestment Risk

- Historically, the longer end of the yield curve has generally offered greater income potential in upward sloping yield curve environments but carry higher interest rate sensitivity. We believe some of the interest rate risk can be mitigated by laddering exposure to multiple maturities across multiple rungs, like the structure offered through the Global X Long-Term Treasury Ladder ETF (LLDR). A Treasury ladder helps mitigate interest rate risk by spreading the risk across multiple rungs. The staggered maturities of Treasury holdings help dampen the impact of interest rate volatility due to the periodic rolling of only one rung within the ladder at a time.

- The bond laddering process also helps address some concerns around reinvestment risk, which is the risk that cashflows from an investment cannot be reinvested at rates comparable to its current rate of return. Essentially, there is a risk that proceeds are reinvested at lower coupon rates, thereby generating a lower rate of return than the previous investment. Cash holdings are particularly exposed to reinvestment risk, given their direct exposure to short-term rates. However, a laddered portfolio of bonds can help mitigate reinvestment risk by holding a range of different maturities. By periodically reinvesting only a portion of the fund’s assets, the risk of having to reinvest at a less attractive rate is generally localized to the shortest portion of the portfolio. Should interest rates decline, only the maturities on the shortest rung of the ladder must be sold and reinvested at lower market rates.

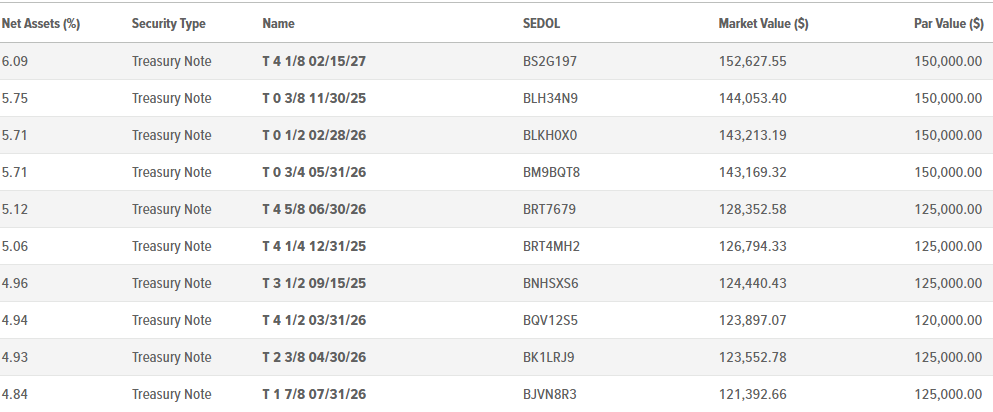

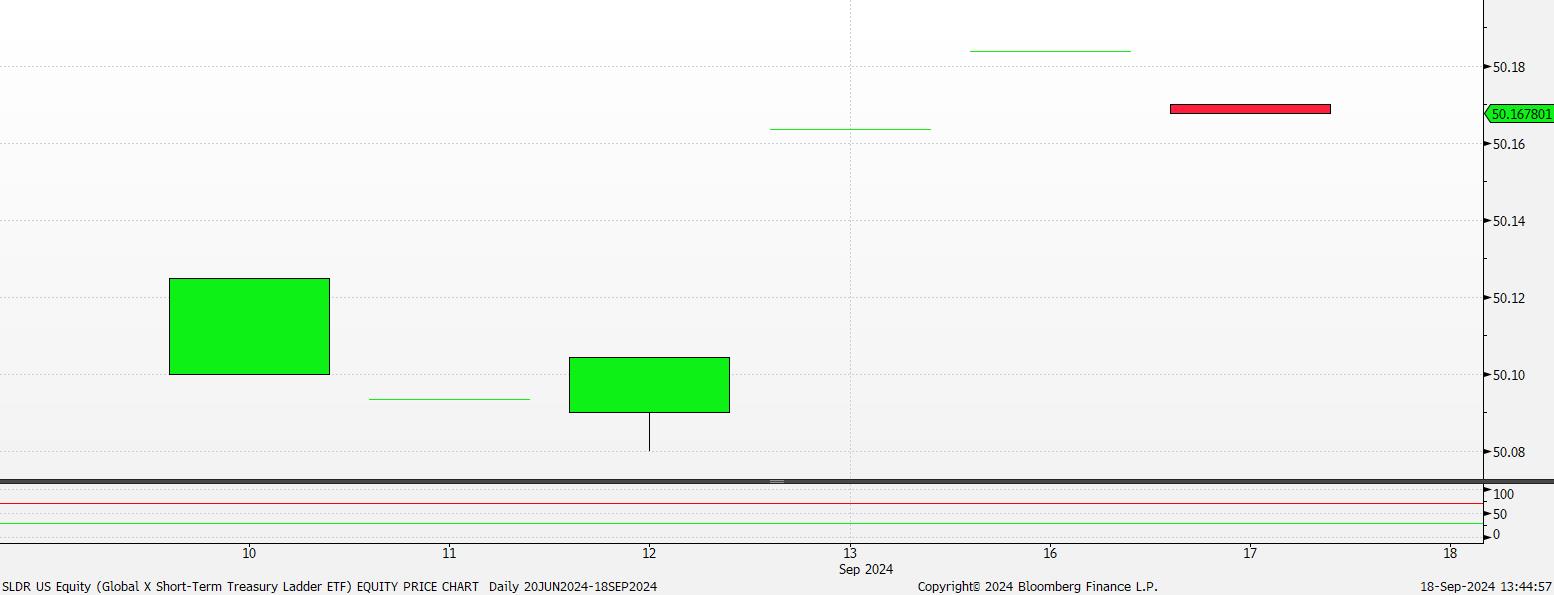

Fund Name (Ticker) | Short-Term Treasury Ladder ETF (SLDR US) |

Description | The Global X Short-Term Treasury Ladder ETF (SLDR) invests in a basket of Treasury notes issued by the U.S. government that have a remaining maturity of at least 1 year but less than 3 years. SLDR will primarily invest in Treasury notes, making it an attractive option for investors seeking to potentially minimize credit and interest rate risks. |

Asset Class | Treasury |

Net Assets of Fund (as of 17 Sep) | $2,510,000 |

Macaulay Duration (as of 16 Sep) | 1.4 years |

Modified Duration (as of 16 Sep) | 1.38% |

Expense Ratio (Annual) | 0.12% |

Top 10 Holdings

(as of 17 September 2024)

(Source: Bloomberg)

(Source: Bloomberg)

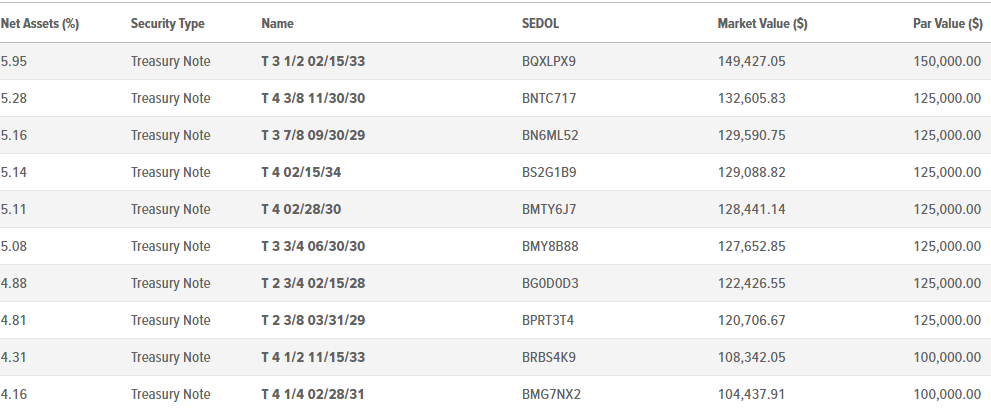

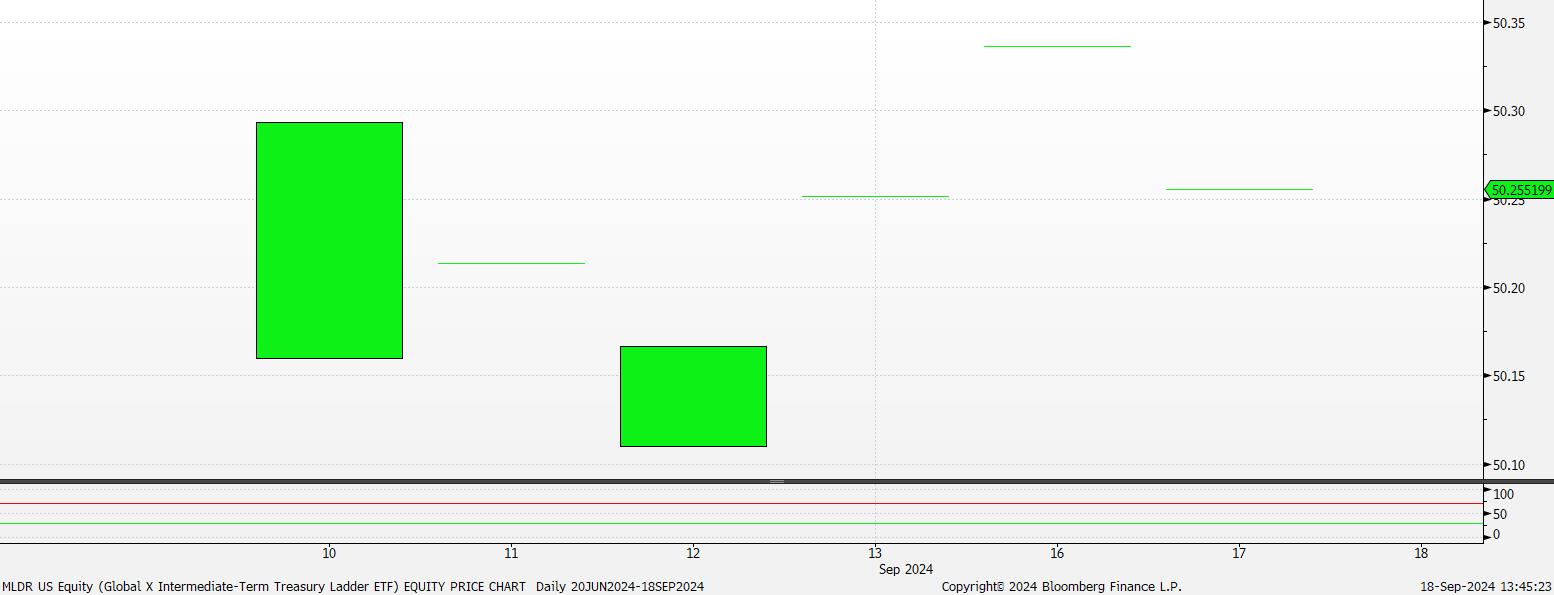

Fund Name (Ticker) | Intermediate-Term Treasury Ladder ETF (MLDR US) |

Description | The Global X Intermediate-Term Treasury Ladder ETF (MLDR) invests in a basket of Treasury notes and bonds issued by the U.S. government that have a remaining maturity of at least 3 years but less than 10 years. MLDR will primarily invest in Treasury notes and bonds, making it an attractive option for investors seeking to potentially minimize credit risk but target intermediate-term duration exposure. |

Asset Class | Treasury |

Net Assets of Fund (as of 17 Sep) | $2,510,000 |

Macaulay Duration (as of 16 Sep) | 5.4 years |

Modified Duration (as of 16 Sep) | 5.29% |

Expense Ratio (Annual) | 0.12% |

Top 10 Holdings

(as of 17 September 2024)

(Source: Bloomberg)

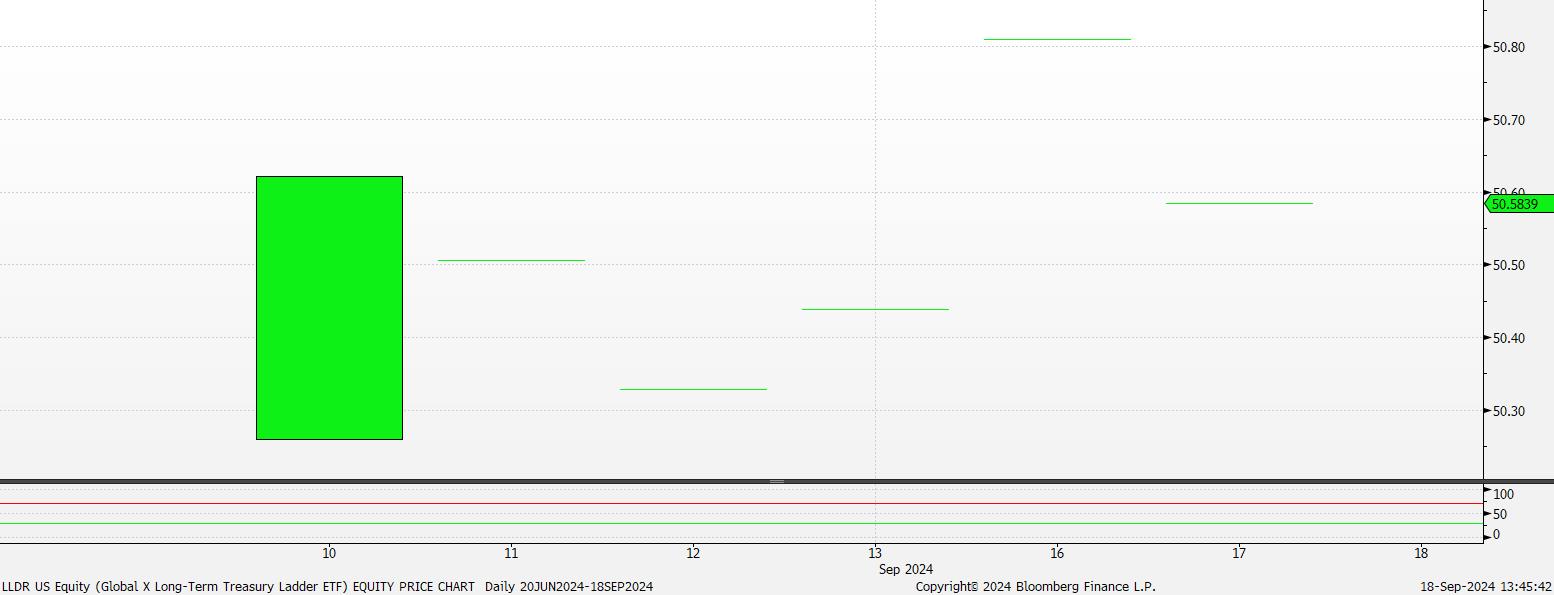

Fund Name (Ticker) | Long-Term Treasury Ladder ETF (LLDR US) |

Description | The Global X Long-Term Treasury Ladder ETF (LLDR) invests in a basket of Treasury bonds issued by the U.S. government that have a remaining maturity of at least 10 years but less than 30 years. LLDR will primarily invest in Treasury bonds, making it an attractive option for investors seeking to potentially minimize credit risk but target greater duration exposure. |

Asset Class | Treasury |

Net Assets of Fund (as of 17 Sep) | $2,530,000 |

Macaulay Duration (as of 16 Sep) | 14.4 Years |

Modified Duration (as of 16 Sep) | 14.13% |

Management Fees (Annual) | 0.12% |

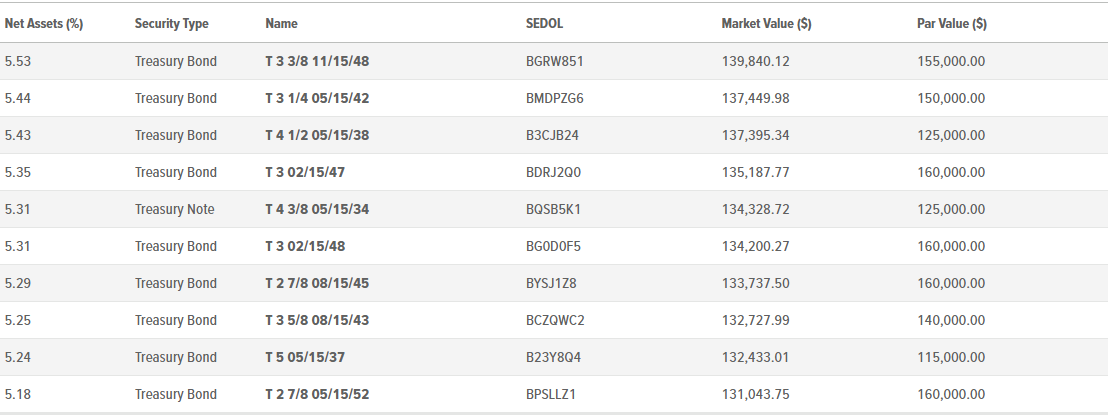

Top 10 Holdings

(as of 17 September 2024)

(Source: Bloomberg)