19 June 2025: Investment Product Ideas

ETF ┃ 19 June 2025

Amplify Cybersecurity ETF (HACK)

- Focus on Cybersecurity Sector. The index tracked by this ETF focuses on the cybersecurity sector, covering hardware, software, and services. With the growing adoption of AI, IoT, and cloud computing, cybersecurity demand continues to rise, shifting emphasis from post breach response to proactive prevention. This has accelerated innovation across the cybersecurity industry. The ETF is well-suited for long-term investors optimistic about the sector’s structural growth.

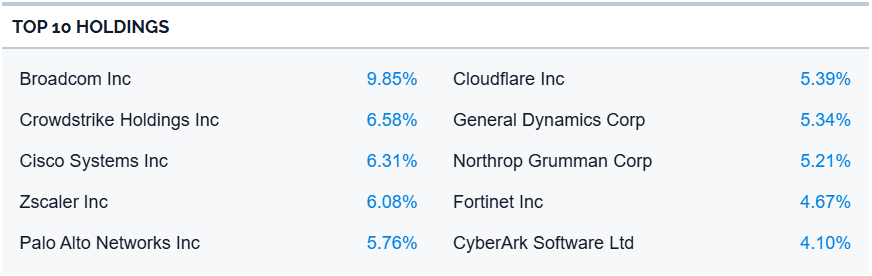

- Concentrated and Representative Holdings. Over 70% of the ETF’s portfolio consists of large-cap stocks, with the top 10 holdings accounting for approximately 58%, including Broadcom, CrowdStrike Holdings, and Cisco Systems.

- First-Ever Cybersecurity ETF. Launched in 2014, this is the first ETF dedicated to the cybersecurity sector, with assets exceeding $2 billion. It offers investors efficient exposure to companies operating within the cybersecurity industry.

Fund Name (Ticker) | Amplify Cybersecurity ETF (HACK) |

Description | HACK seeks investment results that generally correlate (before fees and expenses) to the total return performance of the Nasdaq ISE Cyber Security™ Select Index. HACK tracks a portfolio of companies actively involved in providing cybersecurity solutions that include hardware, software, and services. |

Asset Class | Equity |

30-Day Average Volume (as of 17 June) | 125,299 |

Net Assets of Fund (as of 17 June) | $2,259,331,484 |

12-Month Yield (as of 17 June) | 0.12% |

P/E Ratio (as of 17 June) | 100.49x |

P/B Ratio (as of 17 June) | 7.65x |

Expense Ratio (Annual) | 0.60% |

Top Holdings

(as of 18 June 2025)

(Source: Bloomberg)

First Trust NASDAQ Cybersecurity ETF (CIBR)

- Focus on Cybersecurity Sector. The index tracked by this ETF focuses on the cybersecurity sector, covering hardware, software, and services. With the growing adoption of AI, IoT, and cloud computing, cybersecurity demand continues to rise, shifting emphasis from post breach response to proactive prevention. This has accelerated innovation across the cybersecurity industry. The ETF is well-suited for long-term investors optimistic about the sector’s structural growth.

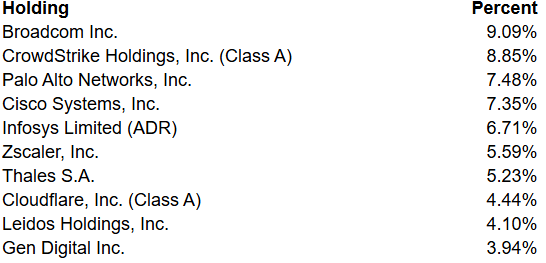

- Concentrated and Representative Holdings. Majority of the ETF’s portfolio consists of large-cap stocks, with the top 10 holdings accounting for approximately 62%, including Broadcom, CrowdStrike Holdings, and Cisco Systems.

Fund Name (Ticker) | First Trust NASDAQ Cybersecurity ETF (CIBR) |

Description | The First Trust Nasdaq Cybersecurity ETF is an exchange-traded fund. The Fund seeks investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of an equity index called the Nasdaq CTA Cybersecurity™ Index. |

Asset Class | Equity |

30-Day Average Volume (as of 16 June) | 893,586 |

Net Assets of Fund (as of 16 June) | $9,661,270,200 |

12-Month Yield (as of 30 May) | 0.23% |

P/E Ratio (as of 30 May) | 30.69x |

P/B Ratio (as of 30 May) | 7.32x |

Expense Ratio (Annual) | 0.59% |

Top Holdings

(as of 16 June 2025)

(Source: Bloomberg)

ETF 推荐 ┃ 2025年6月19日

Amplify网络安全ETF (HACK)

- 聚焦网络安全行业。 该ETF追踪专注于网络安全行业的指数,涵盖硬件、软件和服务等领域。在人工智能、物联网和云计算普及的背景下,网络安全需求持续增长,关注点也从事后补救转向事前预防,促进网络安全技术产业加速创新。该ETF适合看好网络安全产业长期发展的投资者。

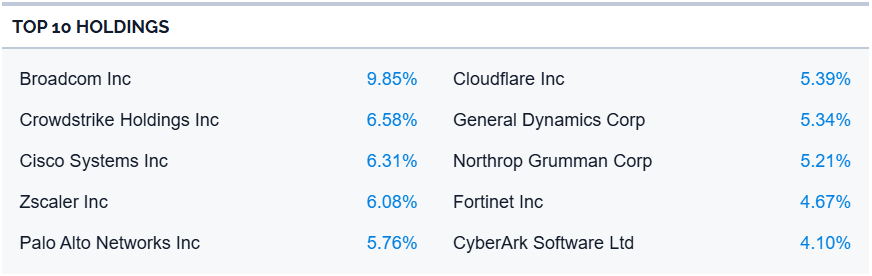

- 持股集中且具代表性。 投资组合中超过70%为大型公司股票,前十大持股比重约58%,包括博通、Crowdstrike控股、思科系统等公司。

- 第一档网络安全ETF。 该ETF成立于2014年,是第一档网络安全ETF,资产规模超过20亿美元,为投资者提供高效投资于网络安全行业中的公司的机会。

|

名称(代码) |

Amplify网络安全ETF (HACK) |

|

描述 |

该ETF追踪“ISE Cyber Security Select Index”,旨在追踪指数成分股并达到与指数相对应的投资表现。 |

|

资产类别 |

股票 |

|

30日平均成交量(截至6月17日) |

125,299 |

|

净资产规模(截至6月17日) |

$2,259,331,484 |

|

12个月收益率(截至6月17日) |

0.12% |

|

市盈率(截至6月17日) |

100.49x |

|

市净率(截至6月17日) |

7.65x |

|

费用比率(年) |

0.60% |

持股情况

(截止6月18日)

(Source: Bloomberg)

First Trust NASDAQ网络安全ETF (CIBR)

- 聚焦网络安全行业。 该ETF追踪专注于网络安全行业的指数,涵盖硬件、软件和服务等领域。在人工智能、物联网和云计算普及的背景下,网络安全需求持续增长,关注点也从事后补救转向事前预防,促进网络安全技术产业加速创新。该ETF适合看好网络安全产业长期发展的投资者。

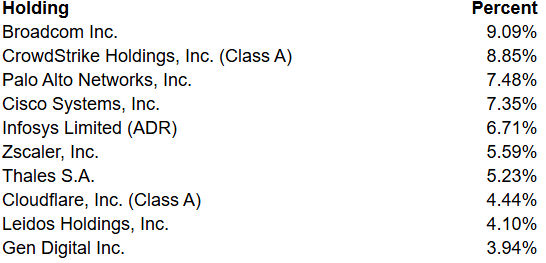

- 持股集中且具代表性。 该ETF的投资组合主要由大盘股组成,前十大持股约占62%,包括博通、CrowdStrike控股和思科系统等。

|

名称(代码) |

First Trust NASDAQ网络安全ETF (CIBR) |

|

描述 |

First Trust Nasdaq网络安全ETF是一只交易所交易基金。该基金寻求与名为Nasdaq CTA Cybersecurity™指数的股票指数的价格和收益(在基金费用和支出之前)大致相符的投资结果。 |

|

资产类别 |

股票 |

|

30日平均成交量(截至6月17日) |

893,586 |

|

净资产规模(截至6月17日) |

$9,661,270,200 |

|

12个月收益率(截至6月17日) |

0.23% |

|

市盈率(截至6月17日) |

30.69x |

|

市净率(截至6月17日) |

7.32x |

|

费用比率(年) |

0.59% |

持股情况

(截止6月16日)

(Source: Bloomberg)