18 July 2024: Wealth Product Ideas

Mitigating the Interest Rate Environments

- Tapering inflation rate. The June U.S. core inflation rate shows a 3.3% YoY rise, better than the market expectation of 3.4%. While this inflation rate is still above Fed’s inflation rate target of 2%, it has already shown signs of slowing down. This fuels better expectations towards rate cuts, with the market now expecting around 1-2 rate cuts by the end of 2024.

- Outlook of rate cut cycle. With the annual inflation rate at 3%, the lowest in three years, the market indicates a 93.3% probability that the US Federal Reserve will decrease interest rates by 25 basis points in September. This would result in a decrease from the current range of 5.25% to 5.50% to a range of 5% to 5.25% in September. The Fed Chairman noted that the Fed would not wait for inflation to decline to its target rate of 2% before it began cutting rates due to the lag effects of tightening.

- Upside potential in rate-decreasing periods. The Federal Reserve is considering the timing of rate cuts, which is expected to benefit bond prices. The value of a bond with higher maturity/duration will increase more as interest rates fall.

- Customize exposure to interest rate risk. The funds provide investors with more options to target the duration they seek accordingly.

- Seek to target different segments of the yield curve. Corporate bond ETFs offer exposure to corporate bonds that mature within specific maturity years or ranges, allowing investors to target different points on the yield curve.

Fund Name (Ticker) | iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD US) |

Description | The iShares iBoxx $ Investment Grade Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, investment-grade corporate bonds. |

Asset Class | Fixed Income |

30-Day Average Volume (as of 15 Jul) | 21,174,103 |

Net Assets of Fund (as of 16 Jul) | US$32,234,474,722 |

Average Yield to Maturity (as of 15 Jul) | 5.27% |

Effective Duration (as of 15 Jul) | 8.32 yrs |

Weighted Average Coupon (as of 15 Jul) | 4.30% |

Management Fees (Annual) | 0.14% |

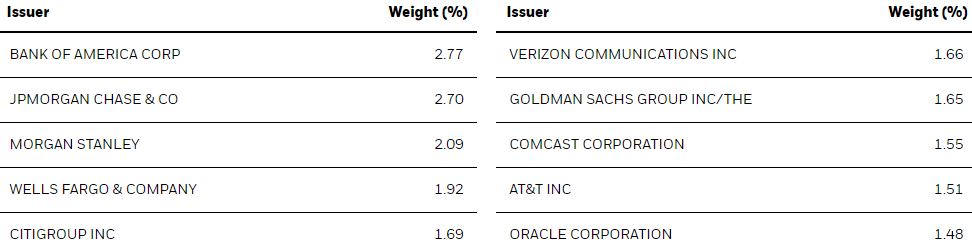

Top 10 Holdings

(as of 15 July 2024)

(Source: Bloomberg)

Fund Name (Ticker) | Vanguard Intermediate-Term Corporate Bond ETF (VCIT US) |

Description | Vanguard Intermediate-Term Corporate Bond ETF seeks to track the performance of a market-weighted corporate bond index with an intermediate-term dollar-weighted average maturity. The fund invests by sampling the index, meaning that it holds a range of securities that, in the aggregate, approximates the full index in terms of key risk factors and other characteristics. All of the fund’s investments will be selected through the sampling process and at least 80% of the fund’s assets will be invested in bonds included in the index. The fund maintains a dollar-weighted average maturity consistent with that of the index. |

Asset Class | Fixed Income |

25-Day Average Volume (as of 16 Jul) | 4,810,400.2 |

Net Assets of Fund (as of 30 Jun) | US$47.7 B |

Yield to Maturity (as of 30 Jun) | 5.40% |

Average Duration (as of 30 Jun) | 6.1 yrs |

Average Coupon (as of 30 Jun) | 4.20% |

Management Fees (Annual) | 0.04% |

Top 10 Holdings

(as of 30 June 2024)

(Source: Bloomberg)