12 June 2025: Investment Product Ideas

ETF ┃ 12 June 2025

iShares MSCI Europe Financials ETF (EUFN)

- Focus on the European Financial Market. The tracked index focuses on European financial stocks. This ETF is suitable for investors seeking concentrated exposure to the European financial sector.

- Attractive Valuation. European financial institutions span multiple countries and industries, including banking, insurance, asset management, and fintech. They are positioned both within the EU and in global markets, helping to diversify risk and enhance resilience. In addition, European financial stocks generally have lower P/E ratios than their U.S. peers, making European financial assets more attractive in global capital allocation.

- Benefiting from ECB’s Easing Policy. As the U.S. becomes a primary source of uncertainty, aside from the need for risk diversification, Europe’s cooling inflation and continued policy rate cuts have significantly lowered corporate funding costs, making the region a key market focus.

Fund Name (Ticker) | iShares MSCI Europe Financials ETF (EUFN) |

Description | The iShares MSCI Europe Financials ETF seeks to track the investment results of an index composed of developed market European equities in the financials sector. |

Asset Class | Equity |

30-Day Average Volume | 1,619,183 |

Net Assets of Fund (as of 10 June) | $3,872,927,913 |

12-Month Yield (as of 30 May) | 3.94% |

P/E Ratio (as of 9 June) | 11.77x |

P/B Ratio (as of 9 June) | 1.40x |

Expense Ratio (Annual) | 0.48% |

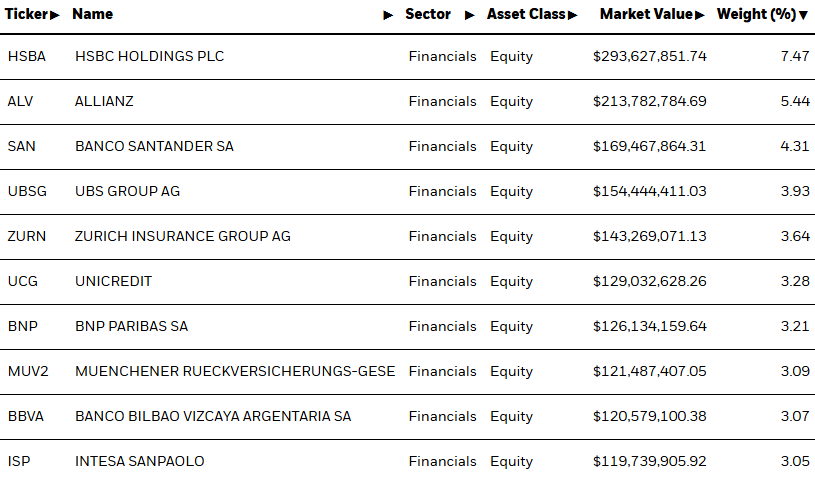

Top Holdings

(as of 9 June 2025)

(Source: Bloomberg)

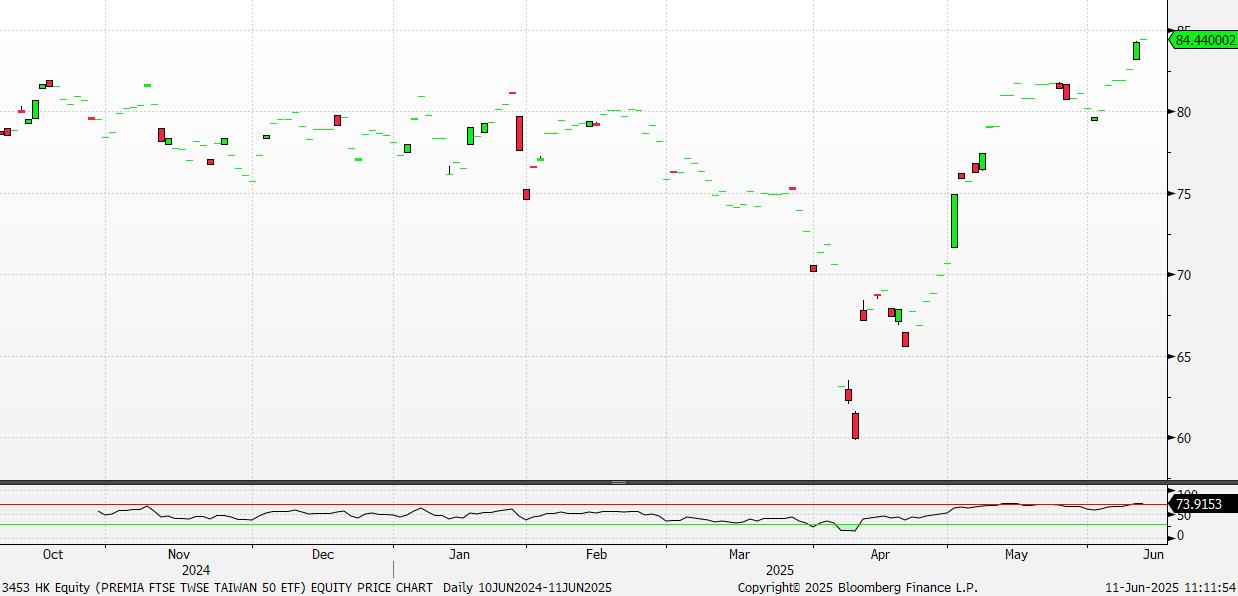

Premia FTSE TWSE Taiwan 50 ETF (3453 HK)

Seeking alpha from Taiwan beyond TSMC with convenient access tool

- Diversified basket of top 50 companies listed in Taiwan representing ~2/3 total market capitalization

- One of the best performing markets in Asia and with low correlation to US/ China/ global markets

- High tech manufacturing and financials oriented reflecting major economic contributors in Taiwan which has among the highest GDP per capita in Asia surpassing Japan and Korea

- Unique AI play given unrivalled global dominance in semiconductor ecosystem with ~90% market share in advanced chip space that is hard to replicate or replace

- Key beneficiary of recovery of semiconductor cycle and AI-driven hardware replacement cycle for next-gen smartphones and PCs equipped with AI orchestration capabilities

- Attractive dividend yield given strong domestic investor preference for high dividend yield and high dividend payout stocks

- Tax-efficient, convenient allocation tool for international investors to access market in Taiwan, available in both USD (accumulating) and HKD (distributing) share classes. NO US withholding tax, stamp duty or capital gains tax* and trades in the same timezone as underlying market

Fund Name (Ticker) | Premia FTSE TWSE Taiwan 50 ETF (3453 HK) |

Description | PREMIA FTSE TWSE TAIWAN 50 ETF is an ETF incorporated in Hong Kong. The aim to provide investment results that, before fees and expenses, closely correspond to the performance of the index. The Fund is primarily use a physical representative sampling strategy by investing 50% to 100% of its NAV in index securities. |

Asset Class | Equity |

30-Day Average Volume (as of 10 June) | 4,945 |

Net Assets of Fund (as of 10 June) | US$27.84mn |

12-Month Yield (as of 10 June) | 0.1895% |

P/E Ratio (as of 10 June) | 17.414 |

P/B Ratio (as of 10 June) | 2.633 |

Expense Ratio (Annual) | 0.280% |

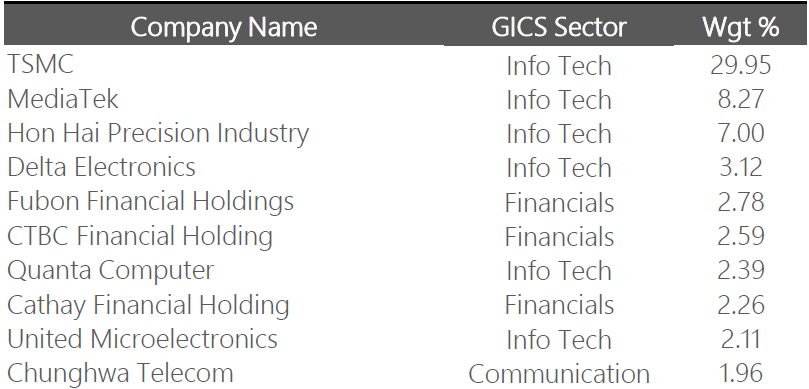

Top Holdings

(as of 31 March 2025)

(Source: Bloomberg)