11 July 2024: Wealth Product Ideas

AI Infrastructure Theme

- Investing opportunity. The generative AI boom goes beyond chat assistants to the wider integration of large language models. This will require data centres and digital infrastructure capable of managing AI workloads. New data centre construction is increasing and existing data centres are being retrofitted with AI hardware. Stakeholders are addressing power sourcing, potentially with alternative energies. Investments in cell towers and AI devices are expected to grow as well, providing numerous opportunities for investors to gain exposure to the AI paradigm shift.

- AI demand spurs U.S. data centre construction. In the US, primary data centre markets are expected to exceed 3,500 MW in construction activity in 2024, the highest level on record. In 2023, primary markets across the US witnessed a nearly 25% YoY increase in data centre supply, reaching 5,174 MW. In Europe, a record 273 MW of new capacity is expected to be built this year. Vacancy rates for existing colocation-based data centres have reached record lows, dropping to 3.7% by the end of 2023 in primary US markets. Rental rates for data centre capacity in primary US markets are expected to increase by 13% YoY in 2024, underscoring the growing demand amid a capacity crunch.

- Opportunities for growth. New AI data centres require specialized hardware, boosting companies like Nvidia, which sold $66bn in GPUs last year. Spending on data centre accelerators is projected to grow 30% annually to $165bn by 2030. Broadcom also expects its AI segment revenues to grow over 50% YoY to $11bn in 2024, while Intel and AMD have launched new products, including data center CPU chips, which are expected to be used widely for AI inferencing applications.

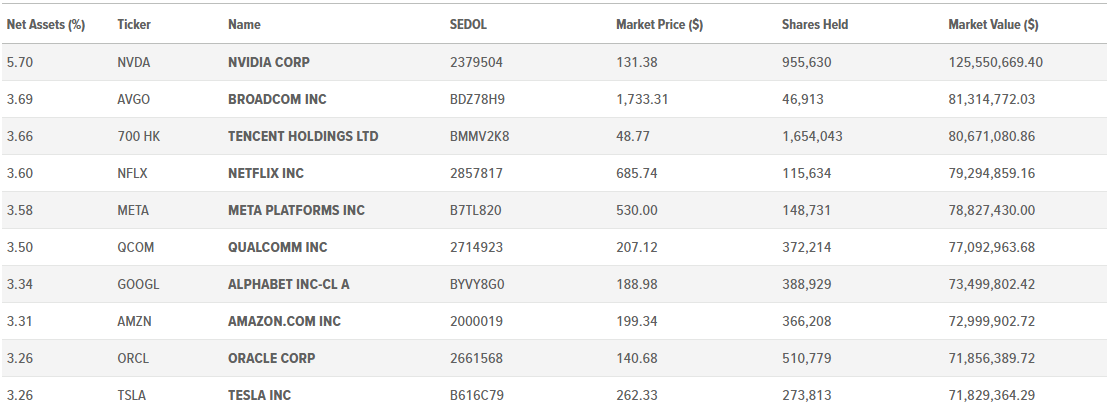

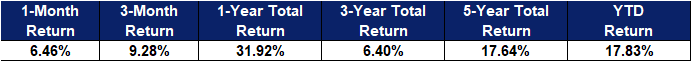

Fund Name (Ticker) | Global X Artificial Intelligence & Technology ETF (AIQ US) |

Description | The Global X Artificial Intelligence & Technology ETF (AIQ) seeks to invest in companies that potentially stand to benefit from the further development and utilization of artificial intelligence (AI) technology in their products and services, as well as in companies that provide hardware facilitating the use of AI for the analysis of big data. |

Asset Class | Equity |

30-Day Average Volume (as of 9 Jul) | 583,721 |

Net Assets of Fund (as of 9 Jul) | US$2.20bn |

12-Month Trailing Yield (as of 30 Jun) | 27.80% |

P/E Ratio (as of 8 Jul) | 27.05 |

P/B Ratio (as of 8 Jul) | 4.18 |

Management Fees (Annual) | 0.68% |

Top 10 Holdings

(as of 9 July 2024)

(Source: Bloomberg)

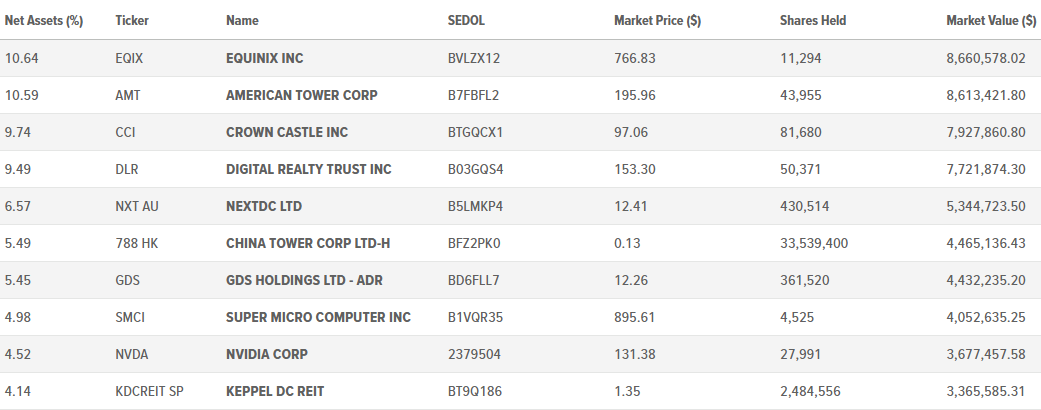

Fund Name (Ticker) | Data Center & Digital Infrastructure ETF (DTCR US) |

Description | The Global X Data Center & Digital Infrastructure ETF (DTCR) seeks to invest in companies that operate data centers and other digital infrastructure supporting the growth of communication networks. |

Asset Class | Equity |

30-Day Average Volume (as of 9 Jul) | 49,654 |

Net Assets of Fund (as of 9 Jul) | US$81.36M |

12-Month Trailing Yield (as of 9 Jul) | 2.18% |

P/E Ratio (as of 8 Jul) | 20.61 |

P/B Ratio (as of 8 Jul) | 2.66 |

Management Fees (Annual) | 0.50% |

Top 10 Holdings

(as of 09 July 2024)

(Source: Bloomberg)