11 January 2024: Wealth Product Ideas

Product: Inverse Floater (Issuer-Callable Structured Product)

- An Inverse Floater is a type of financial instrument that is structured to benefit from a decrease in interest rates.

- Typically, these instruments become more attractive in an economic climate where the central bank, such as the Federal Reserve, is expected to halt or reverse the trend of increasing interest rates.

- Inverse Floaters are often seen as conservative investments, especially in scenarios where interest rates are projected to fall. They also provide a measure of protection for the investor’s capital should the interest rate predictions prove inaccurate.

- However, as with any investment, Inverse Floaters carry inherent risks. These include the credit risk associated with the issuer’s ability to meet payment obligations and liquidity risk, which may pose challenges for investors seeking to exit their positions prior to maturity.

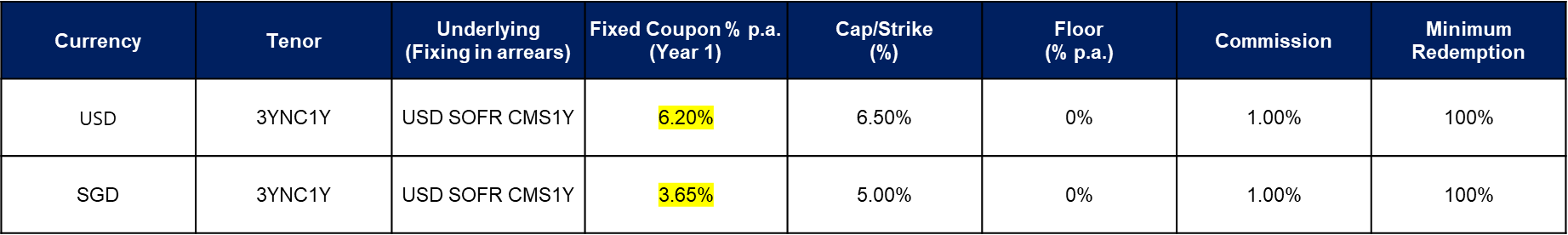

Inverse Floater Quotes

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

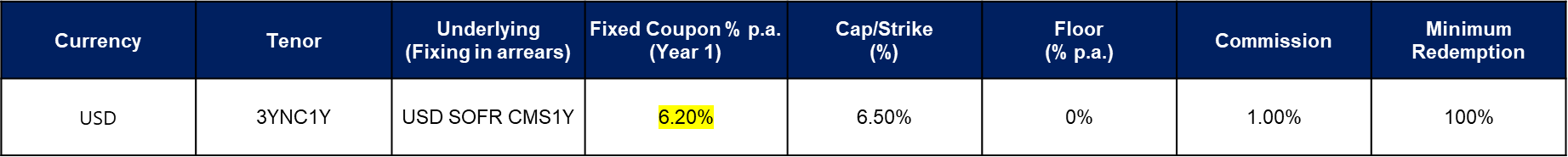

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

Payoff Scenario:

- First-year fixed coupon: The inverse floater provides a fixed coupon rate in the first year.

- Subsequent years’ coupon: From the second year onwards, the coupon payment is the difference between the strike rate and the benchmark rate (taking into account the cap and floor) on a specified observation date. If the benchmark rate (USD SOFR CMS1Y) decreases, the coupon payment increases.

- Interest Rate Cap and Floor: The coupon payments are designed with a maximum limit (the cap) and a minimum limit (the floor) to protect the investor. The “cap” sets an upper limit on the coupon, while the “floor” sets a lower limit that protects investors from the possibility of negative coupons, regardless of any increases in the benchmark interest rates.

- Call Provision: After the first year, the issuer reserves the right to opt for early redemption of the investment at any point in time. In the instance where the issuer exercises this right, investors will receive their principal and pro-rated interest (if any).

- Minimum Redemption: Upon maturity, the investor will receive a payment that will be at least equal to their initial principal (provided the issuer remains solvent and does not default).