10 October 2024: Wealth Product Ideas

Strategic Importance of Low Beta ETFs

Low Beta ETFs represent a crucial component in modern portfolio construction, offering enhanced stability and risk mitigation in volatile market conditions. These funds typically comprise stocks with beta coefficients lower than 1.0, indicating reduced volatility relative to the broader market.

Key advantages include:

- Reduced Portfolio Volatility: By incorporating assets less reactive to market swings, investors can potentially smooth out returns over time.

- Downside Protection: During market downturns, low beta stocks tend to outperform, preserving capital more effectively.

- Diversification Benefits: Low correlation with high-beta assets enhances overall portfolio diversification.

Defensive sectors demonstrating consistently low correlation with the S&P 500:

- Consumer Staples: Leading with a beta of 0.63 over five years, showcasing remarkable stability.

- Healthcare: Benefiting from inelastic demand and consistent cash flows.

- Utilities: Regulated industries providing steady returns and low volatility.

-

Communication Services: Essential nature of services contributes to stability.

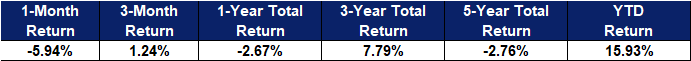

Fund Name (Ticker) | AGF US Market Neutral Anti Beta Fund (BTAL US) |

Description | BTAL’s objective is to provide a consistent negative beta exposure to the U.S. equity market. BTAL strives to achieve this objective by investing primarily in long positions in low beta U.S. equities and short positions in high beta U.S. equities on a dollar neutral basis, within sectors. |

Asset Class | Equity |

30-Day Average Volume (as of 8 Oct) | 832,882 |

Net Assets of Fund (as of 7 Oct) | $402,810,102.04 |

12-Month Yield (as of 8 Oct) | 5.2973% |

P/E Ratio (as of 30 Sep) | 22.61 |

P/B Ratio (as of 30 Sep) | 3.26 |

Expense Ratio (Annual) | 1.43% |

Top 10 Holdings

(as of 7 October 2024)

(Source: Bloomberg)

Seeking alpha from Taiwan beyond TSMC with convenient access tool

- Diversified basket of top 50 companies listed in Taiwan representing ~2/3 total market capitalization

- One of the best performing markets in Asia outperforming also S&P 500, Nasdaq and MSCI ACWI

- High tech manufacturing and financials oriented reflecting major economic contributors in Taiwan which has among the highest GDP per capita in Asia surpassing Japan and Korea

- Unique AI play given unrivalled global dominance in semiconductor ecosystem with ~90% market share in advanced chip space that is hard to replicate or replace

- Key beneficiary of recovery of semiconductor cycle and AI-driven hardware replacement cycle for next-gen smartphones and PCs equipped with AI orchestration capabilities

- Attractive dividend yield given strong domestic investor preference for high dividend yield and high dividend payout stocks

- Tax-efficient, convenient allocation tool for international investors to access market in Taiwan, available in both USD (accumulating) and HKD (distributing) share classes. NO US withholding tax, stamp duty or capital gains tax* and trades in the same timezone as underlying market

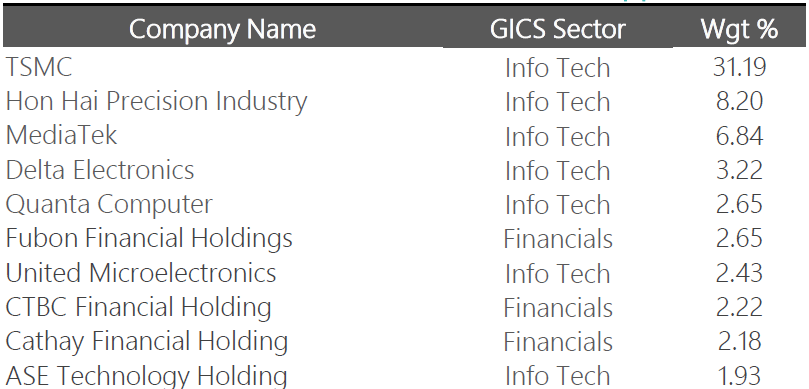

Fund Name (Ticker) | Premia FTSE TWSE Taiwan 50 ETF (3453 HK) |

Description | The investment objective of the ETF is to provide investment results that, before fees and expenses, closely correspond to the performance of the FTSE TWSE Taiwan 50 30% Capped Index USD (NTR) (“Index”). There can be no assurance that the ETF will achieve its investment objective. |

Asset Class | Equity |

Listing Date | 9th October 2024 |

Net Assets of Fund | N.A. |

P/E Ratio | N.A. |

P/B Ratio | N.A. |

Expense Ratio (Annual) | 0.28% |

Top 10 Holdings

(as of 30 August 2024)

(Source: Bloomberg)